|

市场调查报告书

商品编码

1436067

日本电力市场:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Japan Power - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

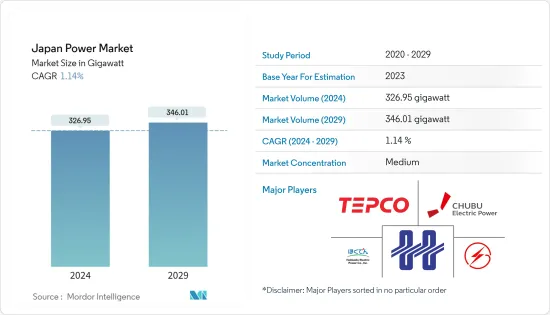

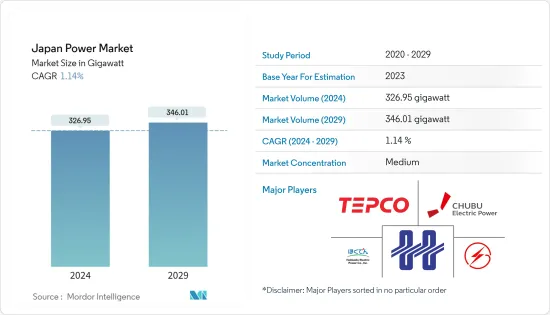

日本电力市场规模预计到 2024 年为 326.95 吉瓦,预计到 2029 年将达到 346.01 吉瓦,在预测期内(2024-2029 年)复合年增长率为 1.14%。

市场受到 COVID-19 的负面影响。目前市场处于大流行前的水平。

主要亮点

- 从中期来看,可再生能源计划的成长预计将推动日本电力市场的发展。

- 另一方面,预计相对停滞的电力需求将阻碍预测期内的市场成长。

- 减少污染(每千瓦)的高效新技术,如超临界燃煤发电厂和燃煤发电厂,预计将取代老化的电厂,并可能为日本电力市场带来若干机会。

日本电力市场趋势

火力发电预计将主导市场。

- 日本的火力发电厂主要使用天然气作为燃料。该国是仅次于中国的第二大液化天然气(LNG)进口国,大部分液化天然气用于发电。 2021年,该国进口了全球液化天然气进口总量的1,013亿立方公尺(bcm),相当于液化天然气进口量的约19.6%。

- 2011年海啸之后,日本不得不关闭大部分核能发电厂,转而采用天然气作为主要能源产出来源来填补空缺。在过去的十年中,天然气已成为该国的重要能源来源。

- 日本火力发电产业以液化天然气发电为主,占总发电量的近49.5%。根据经济产业省(METI)统计,截至2021年,日本共有69座发电厂,平均装置容量为1.1GW。其次是燃煤发电厂,有近95座,占总装置容量的32.2%。

- 但随着疫情消退、需求復苏以及俄罗斯和乌克兰之间的衝突持续影响经济,全球能源价格正在迅速上涨。这导致日本因能源价格飙升而需求激增,转向煤炭和天然气以维持能源安全。

可再生能源市场的成长可能会推动市场

- 日本是主导可再生能源产业发展以减少对进口石化燃料依赖的国家之一。太阳能发电是对日本可再生能源成长做出重大贡献的关键领域之一。 2021年,太阳能装置容量约为7419吉瓦。

- 由于政府在该国实施清洁能源措施的政策、较低的太阳能能源产出成本以及较低的能源储存价格,日本太阳能市场预计在未来几年将成长。

- 该国有几个可再生能源计划可能会取代旧的火力发电厂。此外,可再生技术的引入预计将减少该国进口燃料的支出,从而为其他开发工程节省收入。

日本电力业概况

日本电力市场适度分散。市场主要企业(排名不分先后)包括北海道电力、东北电力、东京电力、中部电力、北陆电力等。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 调查先决条件

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- GW 发电容量及预测至 2028 年

- 全球发电量(TWh)及 2028 年预测

- 日本可再生能源结构,2021 年

- 最新趋势和发展

- 政府政策法规

- 市场动态

- 促进因素

- 抑制因素

- 供应链分析

- PESTLE分析

第五章市场区隔

- 发电源

- 热

- 水力发电

- 核能

- 可再生

- 输电和配电 (T&D)

第六章 竞争形势

- 併购、合资、合作与协议

- 主要企业采取的策略

- 公司简介

- Hokkaido Electric Power Company

- Tohoku Electric Power Company

- Tokyo Electric Power Company

- Chubu Electric Power Company

- Hokuriku Electric Power Company

- Kansai Electric Power Company

- Chugoku Electric Power Company

- Shikoku Electric Power Company

- Kyushu Electric Power Company

- Okinawa Electric Power Company

第七章市场机会与未来趋势

The Japan Power Market size is estimated at 326.95 gigawatt in 2024, and is expected to reach 346.01 gigawatt by 2029, growing at a CAGR of 1.14% during the forecast period (2024-2029).

The market was negatively impacted by COVID-19. Presently the market has now reached pre-pandemic levels.

Key Highlights

- Over the medium period, the growth in renewable energy projects is expected to drive the Japanese power market.

- On the other hand, the relatively stagnant electricity demand is expected to hinder market growth during the forecast period.

- New and efficient technologies like supercritical and ultra-supercritical coal power plants, which reduce the amount of pollution (per KW), are expected to replace the aging power plants and will likely create several opportunities for the Japanese power market in the future.

Japan Power Market Trends

Thermal Power Generating Source is Expected to Dominate the Market

- Thermal power plants in Japan are mostly powered by natural gas. The country is the largest importer of liquefied natural gas (LNG) after China and uses a major portion of the LNG to produce electricity. In 2021, the country imported 101.3 billion cubic meters (bcm) of the total imported LNG in the world, which is approximately 19.6% of the LNG imported.

- After the 2011 tsunami, Japan had to close down most of its nuclear power plants, which made Japan use natural gas as a significant source of energy generation to fill the void. In the past decade, natural gas has emerged as a significant source of energy in the country.

- The Japanese thermal power sector is dominated by LNG-fired plants, which account for nearly 49.5% of the total power capacity. According to the Ministry of Economy, Trade, and Industry (METI) statistics, as of 2021, Japan has 69 plants with an average installed capacity of 1.1 GW. This is followed by coal-fired power plants, which account for nearly 95 plants and 32.2% of the total installed capacity.

- However, since the pandemic has subsided and demand has recovered, and the Russia-Ukraine conflict continues to have economic effects, global energy prices have spiked rapidly. This has created a huge demand spike in Japan, which has been dealing with high energy prices, as a result of which the country has been shifting to coal and natural gas to maintain energy security.

Growth in Renewable Energy Market is Likely to Drive the Market

- Japan is one of the countries leading the development of the renewable energy sector to reduce its dependency upon imported fossil fuels. Solar is one of the leading segments that has contributed significantly to renewable energy growth in Japan. In 2021, solar energy had an installed capacity of around 74.19 GW.

- The solar energy market in Japan is poised for growth in the coming years on account of the government's policy to implement clean energy measures in the country, the declining cost of solar energy generation, and reduced energy storage prices.

- The country has several renewable energy projects that are likely to replace old thermal power plants. Moreover, the adoption of renewable technologies is expected to reduce the country's expenses on imported fuel, thus saving its revenue for other developmental work.

- Yatsubo Solar Power Plant, Ikeda Solar Power Plant, and Miyagi Osato Solar Park are a few upcoming prominent projects that are likely to expand the country's renewable sector.

Japan Power Industry Overview

The Japan power market is moderately fragmented. The key players in the market (not in a particular order) include Hokkaido Electric Power Company, Tohoku Electric Power Company, Tokyo Electric Power Company, Chubu Electric Power Company, and Hokuriku Electric Power Company, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Installed Power Generation Capacity and Forecast in GW, till 2028

- 4.3 Electricity Generation and Forecast in TWh, Global, till 2028

- 4.4 Renewable Energy Mix, Japan, 2021

- 4.5 Recent Trends and Developments

- 4.6 Government Policies and Regulations

- 4.7 Market Dynamics

- 4.7.1 Drivers

- 4.7.2 Restraints

- 4.8 Supply Chain Analysis

- 4.9 PESTLE Analysis

5 MARKET SEGMENTATION

- 5.1 Power Generation Source

- 5.1.1 Thermal

- 5.1.2 Hydroelectric

- 5.1.3 Nuclear

- 5.1.4 Renewable

- 5.2 Power Transmission and Distribution (T&D)

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Hokkaido Electric Power Company

- 6.3.2 Tohoku Electric Power Company

- 6.3.3 Tokyo Electric Power Company

- 6.3.4 Chubu Electric Power Company

- 6.3.5 Hokuriku Electric Power Company

- 6.3.6 Kansai Electric Power Company

- 6.3.7 Chugoku Electric Power Company

- 6.3.8 Shikoku Electric Power Company

- 6.3.9 Kyushu Electric Power Company

- 6.3.10 Okinawa Electric Power Company