|

市场调查报告书

商品编码

1645159

NFT 游戏 -市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)NFT Gaming - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

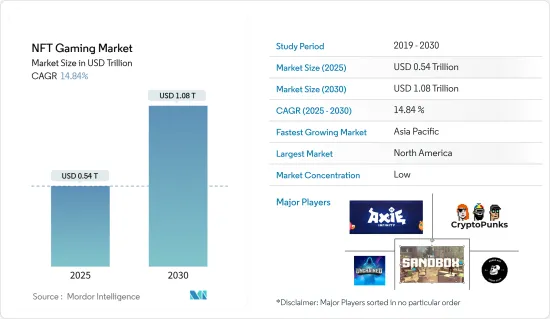

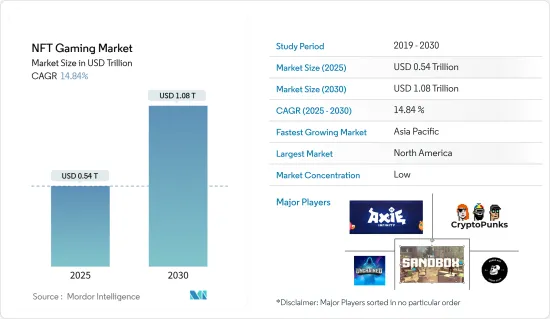

2025 年 NFT 游戏市场规模预估为 5,400 亿美元,预计到 2030 年将达到 1.08 兆美元,预测期内(2025-2030 年)的复合年增长率为 14.84%。

此外,非同质化代币(NFT)或数位资产将反映游戏内容并促进游戏中的区块链技术。支撑 NFT 的区块链网路允许参与企业所有权并提供稀缺性、互通性和不变性,同时使这些代币独特、稀有且不可分割。

关键亮点

- 有很多优点:该令牌有几个优点。例如,在典型的游戏中,参与企业购买装甲升级所能获得的唯一好处就是改善该特定游戏的游戏玩法。但在支援 NFT 的游戏生态系统中,同样的盔甲可以被代币化,将游戏内购买转化为可转让资产,可以在相关游戏中授予奖励或兑换成现金或其他数位资产。

- 此外,收藏游戏利用数位资产的稀缺性和稀有性来增加参与企业的参与度,并激励他们在游戏中投入时间和金钱。这是透过各种游戏元素实现的,包括随机奖品、仅在有限时间内提供的商品以及达到某些里程碑或目标的奖励。

- 在区块链游戏中,B2C交易和B2B交易都存在。然而,大多数游戏仅强调针对B2C交易的有效使用者介面。为了获得最佳的 B2C 用户体验,游戏介面需要支援即时交易和钱包,这可能会阻碍市场成长。

- 儘管 NFT 越来越受欢迎,但它们仍然面临着包括版权问题、智慧财产权问题、环境影响和安全风险在内的挑战。目前尚不清楚 NFT 是否会获得主流采用或仍只是一个小众市场。

- COVID-19 疫情对 NFT 产生了正面影响。由于封锁和其他社会隔离措施让人们留在家里,对线上游戏的需求增加了。疫情期间,区块链游戏的接受度不断提高,这可以归因于其新颖的游戏机制和商业化战略。资料来源:https://www.mordorintelligence.com/industry-reports/global-nft-gaming-market

NFT 游戏市场趋势

随着元宇宙活动的兴起,市场需求预计将成长

- 随着元宇宙概念的传播,选择也随之增加。 Pioneer 越来越强调自下而上的策略,游戏诞生于 NFT 生态系统,而不是不同游戏之间的 NFT互通性。例子包括 CryptoKitties 和跨平台 Bored Apes 之间的竞赛。

- 此外,如果可以实现跨平台迁移,设计师将需要为参与企业提供经验和平衡方面的协助。 NFT 并不能一致地定义游戏商品的真正效用,而仅仅是所有权的象征。例如,一把剑的 NFT 可以轻鬆更改,使得它在一个游戏中具有相当强大的力量,但在另一个游戏中却具有压倒性的强大力量。

- 图形介面本身也存在问题。有许多可用于开发游戏 3D 图形资产的设计程序,例如 Unreal 和 Unity。这些项目使用与特定渲染引擎绑定的专有资料格式。但让它们协同工作却很复杂。

- 据思科系统公司称,线上游戏领域的消费者资料流量预计将从 2017 年的 1 EB 增长到 2020 年的每月约 7 Exabyte。 2017 年至 2022 年期间,该子区隔的复合年增长率将达到 59%。

- 企业家们推出解决方案来满足日益增长的需求,使元宇宙成为其中可行的一部分。例如,MetaverseGo 在 2022 年 6 月表示将推出一款应用程序,让访问基于 NFT 的游戏变得更加容易。这些游戏通常要求参与企业完成需要花费时间和精力去理解的操作,例如创建加密货币钱包。您只需要一个行动电话号码,应用程式就会为您处理其中一些任务。

- 此外,2023 年 1 月,主要企业之一 NFT Technologies Inc. 与 Web3 工作室 Run It Wild 和 Sandbox(Animoca Brands 的子公司和领先的去中心化游戏虚拟世界)合作。 Sandbox 宣布将透过增加新合作伙伴来扩大其生态系统。

北美占有最大市场占有率

- 预计预测期内北美将经历显着成长。该地区的成长得益于 Splinterlands、Uplandme Inc.、Mythical Inc. 和 ROKO GAME STUDIOS 等行业巨头的存在,以及大量精通技术的人士。此外,区块链技术和加密货币通常受到北美法规结构的支持。

- 随着非同质化代币(NFT)的兴起,许多区块链游戏开发商正在建立自己的 NFT 市场,以允许参与企业购买、出售和交易游戏内资产。因此,游戏玩家现在可以在次市场上将其游戏内资产收益,为该地区的区块链游戏创作者提供新的收入来源。

- 随着云端游戏的发展,虚拟伺服器(储存所有游戏的地方)执行渲染游戏场景、处理游戏逻辑、编码视讯和串流影片等计算。已有多家公司提供此类商业云端游戏服务,包括 Onlive、G-Cluster、StreamMyGame、Gaikai 和 T5-Labs。传统游戏市场可能会面临来自该行业的竞争。

- 非同质化代币(NFT)等独特的数位资产储存在区块链上,可以安全公开地买卖,用于收藏类游戏。因此,有兴趣拥有或收集稀有或独特数位资产的参与企业将拥有一个引人注目的价值提案,从而推动全部区域的市场扩张。

NFT 游戏产业概况

全球 NFT 游戏市场竞争激烈,参与企业众多。目前,只有少数主要竞争对手占大部分市场占有率。然而,区块链和云端运算的广泛应用正在增加该行业的需求。一些公司透过赢得新契约和进入新市场来扩大其市场份额。

- 2023 年 5 月 - Sandbox 与总部位于新加坡的 Web3Start-UpsAffyn 合作,该公司创建了融合了扩增实境和地理定位功能的游戏和元宇宙。两家公司将共同推动可互通的元宇宙体验,建构以社群为中心的突破性、可互通的开放元宇宙,汇集来自世界各地的创作者和合作者,建构融合虚拟世界和现实世界的长期生态系统。

- 2022 年 6 月—以 NFT 为中心的游戏平台 Cryptoys 在由 Andreessen Horowitz、OnChain Studios 及其母公司主导的A 轮资金筹措中筹集了 2,300 万美元。 Cryptoys 计划利用这笔资金建立一个基于 NFT 的游戏世界,玩游戏并赚钱,并允许用户与收藏玩具互动。 Cryptoys 还计划专注于新的动画系列。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 游戏中的 NFT :模式转移

- 市场概况

- 预计采用趋势-根据游戏转换率,每个阶段的百分比范围很广

- 第一代 – NFT

- 第二代-NFT+P2E

- 第三代-NFT+P2E+高品质/渲染

- 第四代-NFT + P2E + AAA 游戏 + 传统游戏模式的转变

- 市场驱动因素

- NFT 带来了分销的根本性变化,从以出版商为中心的模式(零和博弈)转变为去中心化的模式,DAO 社群、参与企业、出版商和游戏玩家生态系统均能从中受益。

- 向元宇宙和对加密产业日益增长的认识将进一步推动采用。

- 由邻近市场现有公司提供资金筹措支持的强大生态系统

- 市场问题

- 监管不确定性仍然是主要问题

- 相对缺乏对基于 NFT 的模型的好处以及使用基于区块链的模型所带来的环境挑战的认识

- 产业生态系统分析

5. 游戏 NFT - 产业人口统计

- 目前游戏中 NFT 的潜在市场和记录的活跃钱包(2020-2021 年)

- 按地区分類的需求分布(北美、欧洲、亚太地区、亚太其他地区)

- 游戏类型需求:行动电话、主机、下载/盒装

第六章 P2E游戏市场现状

- P2E 游戏的当前潜在市场及其在整个游戏产业中的相对份额

- 关键市场影响者与推动者

- Gamefi 在促进 P2E 采用方面的作用

第七章 竞争格局

- 游戏产业 NFT 总量(含游戏内交易量)

- 公司简介

- Axie Infinity

- Gods Unchained

- CryptoPunks

- Bored Ape Yacht Club

- The Sandbox

第八章 GAMEFI 2.0-下一代IT及其特征

- GameFi 将进行最佳化,以实现更好的社交互动、元宇宙归因整合,并降低所有主要相关人员的进入门槛。

- 市场展望

第九章 投资分析-游戏厂商的区块链

The NFT Gaming Market size is estimated at USD 0.54 trillion in 2025, and is expected to reach USD 1.08 trillion by 2030, at a CAGR of 14.84% during the forecast period (2025-2030).

Additionally, non-fungible tokens (NFTs) and digital assets reflect in-game content and power blockchain technology in gaming. The blockchain networks that support NFTs enable player ownership and prove scarcity, interoperability, and immutability, while these tokens are one-of-a-kind, uncommon, and indivisible.

Key Highlights

- It offers many advantages. It has several advantages. For instance, in a typical game, the only advantage a player receives from purchasing an armor upgrade is better gameplay inside the confines of that specific game. However, in a gaming ecosystem that uses (NFTs), the same armor can be tokenized to convert in-game purchases into transferable assets that may bestow benefits across connected games or be traded for cash or other digitall assets.

- Additionally, collectible games use the rarity and scarcity of digital assets to increase player engagement and motivate them to invest their time and money in the game. This is accomplished through various gameplay elements, including randomized awards, goods only available for a limited time, and rewards for reaching certain milestones or objectives.

- In blockchain gaming, both B2C and B2B transactions exist. However, most games only emphasize an effective user interface for business-to-consumer transactions. For the best possible B2C user experience, the gaming interface must support instant trades and a wallet, which might hamper the market growth.

- Although NFTs are becoming more and more popular, they continue to face challenges that include copyright issues, intellectual property concerns, the impact on the environment and security risks. Whether they will succeed in gaining mainstream acceptance or retain a niche market is unclear.

- The COVID-19 pandemic has positively impacted the NFT In the gaming sector, NFT. Lockdowns and other social isolation measures caused people to stay home, increasing demand for online gaming. A rise in acceptance of blockchain-based games during the pandemic can be attributed to their new gameplay mechanics and monetization strategies.

NFT Gaming Market Trends

Increasing Move Towards Metaverse is Expected to Increase the Demand of the Market

- There are now more options because of the growing "metaverse" notion. Pioneers increasingly see a bottom-up strategy where games emerge from NFT ecosystems rather than NFT interoperability between different games. For example, consider races amongst CryptoKitties or platform-jumping Bored Apes.

- Additionally, cross-platform transferability would cause designers to need help with player experience and balance. An NFT hardly defines the real utility of game goods consistently; it is merely a symbol of possession. For instance, an NFT of a sword might easily be changed from being reasonably powerful in one game to utterly overwhelming in another.

- The graphical interface itself has difficulties as well. Many design programs, such as Unreal or Unity, can be used to develop 3D graphic assets for games. These items use exclusive data formats that are connected to certain rendering engines. However, getting them to cooperate can be complicated.

- According to Cisco Systems, in 2020, consumer data traffic in the online gaming segment is expected to be about 7 exabytes per month, an increase from 1 EB in 2017. The 2017-2022 CAGR of this subsegment amounts to 59 percent.

- Entrepreneurs have launched solutions in response to the rising demand, making the metaverse an attainable factor. For instance, MetaverseGo stated in June 2022 that it would publish an app to facilitate access to NFT-based games. These games frequently demand players to complete actions that take some time and effort to understand, such as creating a cryptocurrency wallet. With just a mobile number, the app can do some of these tasks for the user.

- Furthermore, in January 2023, NFT Technologies Inc., one of the leading technology companies, partnered with web3 studio Run It Wild and Sandbox, one of the leading decentralized gaming virtual worlds, a subsidiary of Animoca Brands. The Sandbox announced efforts to expand its ecosystem by onboarding new partners.

North America to hold largest Market share

- Over the forecast period, North America is anticipated to have significant expansion. The region's growth can be ascribed to major industry companies like Splinterlands, Uplandme Inc., Mythical Inc., and ROKO GAME STUDIOS and the presence of a sizable community of technologically savvy people. Additionally, blockchain technology and cryptocurrencies are usually supported by the regulatory framework in North America.

- Many blockchain game developers are creating their own NFT marketplaces so that players can buy, sell, and trade in-game assets as non-fungible tokens (NFTs) become more popular. As a result, gamers can now monetize their in-game assets on a secondary market, and blockchain game creators in the area also have a new source of income.

- In addition to the growth of cloud gaming, the virtual server (where all of the games are kept) performs computations such as game scene rendering, game logic processing, video encoding, and video streaming. Several players, including Onlive, G-Cluster, StreamMyGame, Gaikai, and T5-Labs, already provide these commercial cloud gaming services. The traditional gaming market is potentially facing competition from this industry.

- Unique digital assets, like Non-fungible Tokens (NFTs), which are kept on a blockchain and can be bought or sold securely and openly, are used in collectible games. As a result, players interested in owning and collecting rare or unique digital assets have a compelling value proposition that fuels market expansion throughout the region.

NFT Gaming Industry Overview

The global NFT gaming market is highly competitive and consists of major players. Few of the big competitors now control the majority of the market in terms of market share. However, the industry is experiencing increased demand due to the widespread implementation of blockchain and cloud computing. By winning new contracts and entering new markets, several corporations are expanding their market share.

- May 2023 - The Sandbox has partnered with Affyn, a Singapore-based Web3 startup creating games and metaverses with built-in augmented reality and geolocation features. Together, these two organizations will improve the interoperable metaverse experiences and create a groundbreaking, community-focused interoperable and open metaverse that will bring together the world's creators and collaborators to build long-term ecosystems that merge the virtual and real worlds.

- June 2022 - Cryptoys, an NFT-centric gaming platform, in a Series A fundraising round headed by Andreessen Horowitz, OnChain Studios and its parent business, raised USD 23 million. The business plans to utilize the money to create an NFT-based gaming world that will have play-and-earn games and let users interact with collector toys. Cryptoys will also be putting in effort on a fresh animated series.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 NFT IN GAMING - A PARADIGM SHIFT

- 4.1 Market Overview

- 4.2 Anticipated Adoption Trends - A Broader Percentage for Each Stage to be Attributed Based on Switch to Gaming

- 4.2.1 First Gen - NFT

- 4.2.2 Second Gen - NFT + P2E

- 4.2.3 Third Gen - NFT + P2E + Higher quality/rendering

- 4.2.4 Fourth Gen - NFT + P2E + AAA Titles + Shift from traditional gaming modes

- 4.3 Market Drivers

- 4.3.1 NFT has Led to a Fundamental Change in Distribution from a Publisher-oriented Model (Zero-Sum) to a Distributed Model Where DAO Community, Players, Publishers and Gamer Ecosystem Stand to Benefit from the Returns.

- 4.3.2 The Move Towards Metaverse Coupled with Increased Awareness on the Crypto Industry will Further Drive Adoption

- 4.3.3 Robust Ecosystem Backed by Funding from Incumbents from Adjacent Markets

- 4.4 Market Challenges

- 4.4.1 Regulatory Uncertainty Remains a Key Concern

- 4.4.2 Relative Lack of Awareness on the Benefits of NFT-Based Models and Environmental Challenges due to use of Blockchain-based Models

- 4.5 Industry Ecosystem Analysis

5 GAMING NFT - INDUSTRY DEMOGRAPHICS

- 5.1 Current Addressable Market for NFT in Gaming & Number of Active Wallets Recorded (2020-2021)

- 5.2 Breakdown of the Demand by Region - North America, Europe, Asia-Pacific, and Rest of the World

- 5.3 Breakdown of the Demand by Gaming Type - Mobile, Console and Download/Box

6 PLAY-TO-EARN GAMING MARKET LANDSCAPE

- 6.1 Current Addressable Market for P2E Gaming and its Relative Share in the Overall Gaming Industry

- 6.2 Key Market Influencers and Enablers

- 6.3 Role of Gamefi in Driving P2E Adoption

7 COMPETITIVE LANDSCAPE

- 7.1 Overall NFT (including in-game transaction volume) in the Gaming industry

- 7.2 Company Profiles

- 7.2.1 Axie Infinity

- 7.2.2 Gods Unchained

- 7.2.3 CryptoPunks

- 7.2.4 Bored Ape Yacht Club

- 7.2.5 The Sandbox

8 GAMEFI 2.0 - THE NEXT ITERATION and its ATTRIBUTES

- 8.1 GameFi to be Optimized on the Basis of Better Social Interactions, Integration of Metaverse Attributes, Lower Barriers to Entry for all the Key Parties

- 8.2 Market Outlook