|

市场调查报告书

商品编码

1438332

休閒车 - 市场占有率分析、产业趋势与统计、成长预测(2024 - 2029)Recreational Vehicle - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

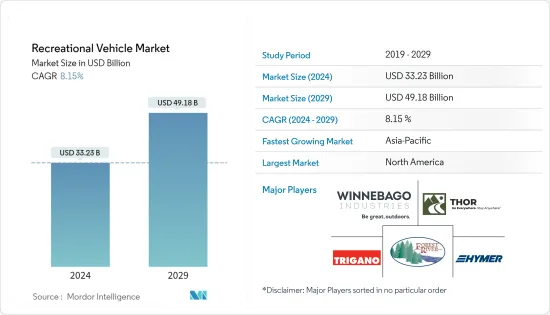

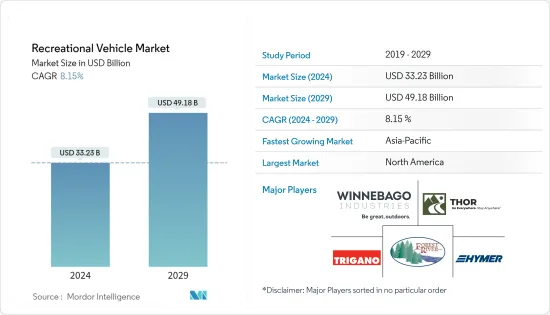

房车市场规模预计到 2024 年为 332.3 亿美元,预计到 2029 年将达到 491.8 亿美元,在预测期内(2024-2029 年)CAGR为 8.15%。

COVID-19 危机极大地影响了世界各地的旅游业。这使得2020年上半年房车市场的销售脱轨了几个月。然而,市场復苏缓慢以及消费者更喜欢住在大篷车而不是酒店,可以刺激市场在预测期内的增长。新兴经济体租赁服务的大幅成长预计也将在短期内推动市场成为焦点。

活跃露营者数量的不断增加正在推动对房车的需求。房车的商业用途正在增加。点对点租赁服务的成长预计将提高千禧世代的受欢迎程度,他们越来越多地寻求租赁服务。此外,作为远离工作生活的公路旅行需求的不断增长可能会促进市场成长。封锁后,全球休閒车的使用量显着成长,尤其是在北美和欧洲。

北美可能主导市场。此外,在区域休閒公园和露营地数量迅速增长的推动下,它可能会在预测期内扩大。美国境内有超过 13,000 个私营露营地和 1,600 个公共露营地,个人可以使用房车体验露营活动。

由于休閒活动的日益普及,全球休閒车市场预计将快速成长,特别是在北美和欧洲。预计亚太地区在预测期内将显着成长。由于这些车辆提供了可靠且个人化的出行方式,因此在新冠肺炎 (COVID-19) 疫情期间被认为是最安全的出行选择。

房车 (RV) 市场趋势

房车细分市场可望引领市场

房车市场预计在预测期内复合CAGR最高。该国露营地数量的增加表明人们越来越偏爱房车休閒旅行。此外,在美国、德国等国家也被广泛使用,不仅用于度假旅行,还用于尾随、带宠物旅行、商务以及户外运动和其他休閒活动的首选交通方式。

儘管发生了大流行,但过去五年中房车的新註册数量仍比大篷车的数量大幅增加。例如,2019 年,德国登记了约 55,000 辆新房车,2020 年增加到超过 78,000 辆。2021 年房车数量持续增长,该国登记了超过 82,000 辆房车。相反,2020 年和 2021 年新註册的大篷车数量下降了 13%。

在房车中,C 型房车比 A 型或 B 型房车具有更好的燃油效率。它们通常被称为迷你房车,以缩小版和较低的价格提供大型房车的便利设施。这些房车的价格从大约 40,000 美元到 200,000 美元不等。此外,製造商正在添加多个滑出装置以增加居住空间,并正在设计具有更大底盘版本的各种平面图。

预计 A 类机动车辆将继续在收入中占据主导地位,到 2021 年将占全球休閒车市场份额的约 50%。线上租赁网站和应用程式的成长进一步简化了租赁流程,刺激了精通技术的需求千禧世代人口。

北美在 2021 年的商业销售中也占据主导地位,并且很可能在预测期内占据主导地位。美国是世界上最大的商用房车市场,其中租赁机构主要占据主导地位。

北美将见证显着成长

北美休閒车市场是全球最大的。房车在美国人中非常受欢迎,超过 11% 的家庭拥有它。美国有超过 100 万个家庭全职居住在房车。它允许旅行成本降低 20-60%,这推动了房车在千禧世代中的流行。房车市场为美国经济贡献了 1,140 亿美元,僱用了超过 60 万名员工。

未来几年,美国将推动北美休閒车市场的收入成长。加拿大休閒车市场在未来几年也可能呈现显着成长。预计到预测期结束时,它将占据北美休閒车市场 10% 以上的份额。

另一方面,到2024年底,美国可能会占据该区域市场80%以上的份额。就CAGR而言,加拿大在北美休閒车市场比美国更有利可图。然而,由于个人可支配收入水准的不断提高和税收的放鬆,美国是一个更具吸引力的市场。

例如,与2020年相比,2021年美国房车出货量激增。2021年房车出货量超过60万辆,比2020年增加近30%。

拥有多种设施(包括钓鱼、激流漂流和健行)的露营地的激增以及自然风景,提供了巨大的市场机会。豪华房车度假村提供专门的体育设施,包括高尔夫球场、网球场、健康水疗中心和美食餐厅,这对市场收入有正面影响。

房车 (RV) 产业概览

全球市场的主要参与者包括 Thor Industries、Forest River Inc.、Winnebago Industries、Trigano SA 和 Hymer GmbH & Co. KG。其他重要参与者包括 Airstream、Crossroads RV、Highland Ridge、Skyline Corporation、DRV Luxury Suites、Cruiser RV、Dutchmen RV、Fleetwood Corporation、Grand Design RV、Kropf Industries、GMC Motorhome、Keystone RV 和 Pleasure-Way Industries。

房车市场竞争激烈,存在多家销售产品的製造商,这些製造商透过产品功能直接竞争。在该地区运营的公司正在采用併购策略以及伙伴关係和协作来增加其市场份额。例如,

- 2022 年 1 月,福特和 Erwin Hymer Group (EHG) 宣布了一项框架协议,将基于 Ford Transit 和 Ford Transit Custom 提供可供客户使用的休閒车和房车。

- 2021年12月,阿波罗旅游休閒与旅游控股有限公司宣布两家实体合併。此次合併将使 Apollo Tourism & Leisure 股东拥有合併后集团 25% 的股份。这将扩大阿波罗的全球休閒车网络,包括休閒车的服务、销售、租赁和製造。

额外的好处:

- Excel 格式的市场估算 (ME) 表

- 3 个月的分析师支持

目录

第 1 章:简介

- 研究假设

- 研究范围

第 2 章:研究方法

第 3 章:执行摘要

第 4 章:市场动态

- 市场驱动因素

- 市场限制

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者的议价能力

- 新进入者的威胁

- 替代产品的威胁

- 竞争激烈程度

第 5 章:市场细分

- 按类型

- 牵引式房车

- 旅行拖车

- 第五轮拖车

- 折迭露营拖车

- 卡车露营车

- 房车

- A型

- B型

- C型

- 牵引式房车

- 按应用

- 国内的

- 商业的

- 按地理

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 英国

- 德国

- 法国

- 西班牙

- 欧洲其他地区

- 亚太

- 中国

- 印度

- 日本

- 韩国

- 亚太地区其他地区

- 世界其他地区

- 南美洲

- 中东和非洲

- 北美洲

第 6 章:竞争格局

- 供应商市占率

- 公司简介

- Thor Industries Inc.

- Forest River Inc.

- Winnebago Industries Inc.

- REV Group

- NeXus RV

- Tiffin Motorhomes Inc.

- Triple E Recreational Vehicles

- Dethleffs GmbH & Co. KG

- Burstner GmbH & Co. KG

- The Swift Group

- Rapido Motorhomes

第 7 章:市场机会与未来趋势

The Recreational Vehicle Market size is estimated at USD 33.23 billion in 2024, and is expected to reach USD 49.18 billion by 2029, growing at a CAGR of 8.15% during the forecast period (2024-2029).

The COVID-19 crisis tremendously affected the tourism industry across the world. This derailed the sales of recreational vehicles in the market for a few months in the first half of the year 2020. However, the market's slow recovery and consumers' preference to stay in caravans than hotels can stimulate the market's growth during the forecast period. The high proliferation of rental services in emerging economies is also expected to drive the market in focus for the short term.

The growing number of active campers is contributing to the demand for RVs. The commercial usage of RVs is on the rise. Growth in peer-to-peer rental services is expected to increase popularity among millennials, which are increasingly seeking rental services. Furthermore, the increasing demand for road trips as a getaway from work-life may boost the market growth. The post-lockdown has witnessed significant growth in the use of recreational vehicles across the globe, especially in North America and Europe.

North America is likely to dominate the market. Moreover, it may expand during the forecast period, propelled by a rapidly growing number of regional recreational parks and camping grounds. More than 13,000 privately-owned and 1,600 public campgrounds within the United States enable individuals to experience camping activities with their recreational vehicles.

Because of the increase in the popularity of recreational activities, the global recreational vehicle market is expected to witness rapid growth, especially in North America and Europe. The Asia-Pacific region is expected to witness significant growth during the forecast period. As these vehicles provide a reliable and personal way to travel, it is considered the safest travel alternative because of the COVID-19 pandemic.

Recreational Vehicle (RV) Market Trends

Motorhomes Segment Expected to Lead the Market

The motorhomes segment of the market is anticipated to register the highest CAGR during the forecast period. The increase in the number of campgrounds in the country illustrates the increasing preference for recreational travel with motorhomes. Additionally, they are widely used in the countries like the United States and Germany, not only for vacation traveling but also for tailgating, traveling with pets, business, and as a preferred mode of transportation for outdoor sports and other leisure activities.

Despite the pandemic, Motorhomes have witnessed a significant rise in the number of new registrations over Caravans over the past five years. For instance, in 2019, in Germany, about 55,000 units of new motorhomes were registered, which increased to more than 78,000 units in 2020. The growing number of motorhomes continued in 2021, too, as over 82,000 units were registered in the country. On the contrary, verses 2020 and 2021 saw a 13% dip in new registrations of caravans.

Among the motorhomes, the Type C motorhomes provide better fuel efficiency than the type A or B motorhomes. They are often referred to as mini-motorhomes, which provide the amenities of a larger motorhome in a scaled-down version and at a lower price. The price of these motorhomes ranges from approximately USD 40,000 and goes up to USD 200,000. Moreover, manufacturers are adding multiple slide-outs to increase the living space and are designing a large variety of floor plans with larger chassis versions.

Type A motorized vehicles are expected to continue to dominate in revenue, contributing approximately 50% of the global recreational vehicle market share in 2021. The growth in online rental websites and applications has further eased the renting process, boosting the demand in the tech-savvy millennial population.

North America also dominated the commercial sales in 2021, which will likely dominate during the forecast period. The United States is the largest commercial RV market in the world, which rental agencies primarily dominate.

North America to Witness Significant Growth

The North American recreational vehicle market is the largest across the globe. RV is highly popular among Americans, and over 11% of households own it. Over 1 million households in the United States live full-time in RVs. It allows traveling at 20-60% less cost, which drives the popularity of RV among millennials. The recreational vehicle market contributes an overall USD 114 billion to the US economy, employing over 600,000 people.

Over the next few years, the United States will drive revenue growth in the North American recreational vehicles market. The Canadian recreational vehicles market may also exhibit significant growth in the years to come. It is expected to hold more than a 10% share of the North American recreational vehicles market until the end of the forecast period.

On the other hand, the United States will likely occupy more than 80% of this regional market until the end of 2024. In terms of CAGR, Canada is more lucrative than the United States in the North American recreational vehicles market. However, the United States is a more attractive market, owing to growing personal disposable income levels and tax relaxation.

For instance, the United States witnessed a surge in the shipments of recreational vehicles in 2021 when compared to 2020. In 2021, more than 600,000 units of shipments of recreational vehicles were observed, which is nearly 30% higher than the figures in 2020.

The proliferation of campgrounds with multiple facilities, including fishing, white water rafting, and hiking, along with natural scenic landscapes, provides robust market opportunities. Luxury RV resorts offer specialized sports facilities, including golf courses, tennis courts, health spas, and gourmet restaurants, which positively influence the market revenue.

Recreational Vehicle (RV) Industry Overview

Key players operating in the global market include Thor Industries, Forest River Inc., Winnebago Industries, Trigano SA, and Hymer GmbH & Co. KG. Other significant players include Airstream, Crossroads RV, Highland Ridge, Skyline Corporation, DRV Luxury Suites, Cruiser RV, Dutchmen RV, Fleetwood Corporation, Grand Design RV, Kropf Industries, GMC Motorhome, Keystone RV, and Pleasure-Way Industries.

The Recreational Vehicle Market is intensely competitive with the presence of several manufacturers selling products that compete directly through product features. Companies operating in the are adopting merger & acquisition strategies coupled with partnerships and collaborations to increase their market share. For instance,

- In January 2022, Ford and Erwin Hymer Group (EHG) announced a framework agreement to deliver customer-ready recreational vehicles and motorhomes based on Ford Transit and Ford Transit Custom.

- In December 2021, Apollo Tourism & Leisure and Tourism Holdings Limited announced the merger of the two entities. The merger will result in Apollo Tourism & Leisure shareholders owning 25% of the combined group. This will expand Apollo's global recreational vehicle networks that include RVs' service, sales, rental, and manufacturing.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Towable RVs

- 5.1.1.1 Travel Trailers

- 5.1.1.2 Fifth Wheel Trailers

- 5.1.1.3 Folding Camp Trailers

- 5.1.1.4 Truck Campers

- 5.1.2 Motorhomes

- 5.1.2.1 Type A

- 5.1.2.2 Type B

- 5.1.2.3 Type C

- 5.1.1 Towable RVs

- 5.2 By Application

- 5.2.1 Domestic

- 5.2.2 Commercial

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United states

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 Germany

- 5.3.2.3 France

- 5.3.2.4 Spain

- 5.3.2.5 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia Pacific

- 5.3.4 Rest of the World

- 5.3.4.1 South America

- 5.3.4.2 Middle-East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles*

- 6.2.1 Thor Industries Inc.

- 6.2.2 Forest River Inc.

- 6.2.3 Winnebago Industries Inc.

- 6.2.4 REV Group

- 6.2.5 NeXus RV

- 6.2.6 Tiffin Motorhomes Inc.

- 6.2.7 Triple E Recreational Vehicles

- 6.2.8 Dethleffs GmbH & Co. KG

- 6.2.9 Burstner GmbH & Co. KG

- 6.2.10 The Swift Group

- 6.2.11 Rapido Motorhomes