|

市场调查报告书

商品编码

1438458

半导体设备:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Semiconductor Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

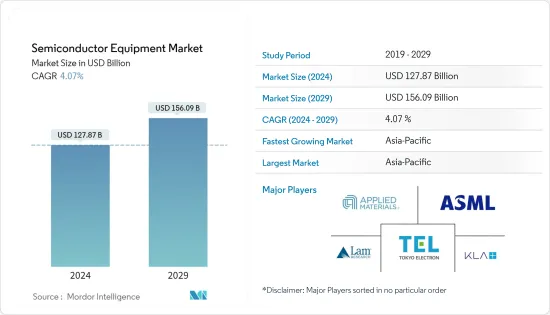

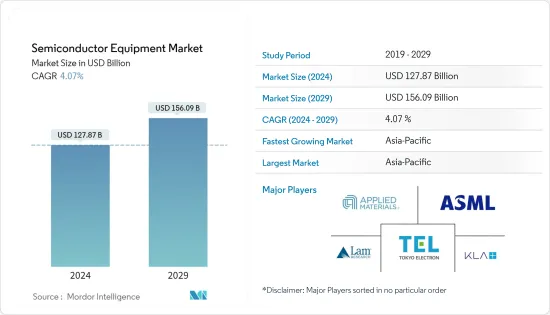

2024年半导体设备市场规模预估为1,278.7亿美元,预估至2029年将达到1,560.9亿美元,在预测期间(2024-2029年)复合年增长率为4.07%成长。

全球半导体产业受到智慧型手机和先进消费性电器产品等其他设备的同步成长以及汽车产业的成长所推动。

主要亮点

- 这些产业受到无线技术(5G)和人工智慧等技术转型的推动。推动市场发展的因素有很多,包括对高性能、低成本半导体的需求稳定成长,这些因素在短期、中期和长期内产生不同的影响。

- 5G的推出预计将成为推动市场的关键因素之一。 5G 的扩展将导致无线产业的扩展,从而实现扩增实境、关键任务服务、固定无线存取和物联网等创新。

- 此外,随着半导体产业的逐步变化,如节点和晶圆尺寸的小型化,超大规模整合技术对更大晶圆尺寸的需求带动了半导体设备的成长。此外,与晶圆小型化相关的成本上升和检测挑战正促使晶圆厂製造商将製程监视器从裸晶圆转移到大批量晶圆。

- 全球300毫米硅片需求强劲,近年来200毫米硅片需求也快速成长。据SEMI称,200毫米晶圆厂正准备从2017年到2022年在全球每月新增超过60万片晶圆。预计此类趋势将进一步成为所研究市场成长的催化剂。

- 2020 年上半年,冠状病毒感染疾病(COVID-19) 大流行扰乱了全球(尤其是中国)的半导体供应链和生产流程。主要原因是劳动力短缺,导致多家半导体公司停止营运。这给依赖半导体的最终产品公司带来了危机。

半导体设备市场趋势

消费性电子产品需求不断成长

- 消费性电器产品是成长最快的领域,对市场扩张做出了重大贡献。智慧型手机的成长预计将随着人口的成长而继续成长,使其成为该市场的关键驱动力。由于平板电脑、智慧型手机、笔记型电脑和穿戴式装置等产品的需求增加,消费性电器产品产品正在推动该产业的发展。随着半导体技术的进步,机器学习等新的市场领域正迅速巩固。

- 由于汽车、医疗设备、智慧型装置、智慧家庭和穿戴式装置等产品的不断改进,半导体整合已成为一种普遍现象。此外,消费者对小型设备的需求正在推动将半导体整合到单一晶片上的趋势不断增长。由于半导体可以组装到单一晶片上,因此用于半导体製造的机械正在获得发展势头。

- 年终,行动用户数约为82亿人。预计到年终,这一数字将达到近 91 亿。同时,行动宽频用户份额可能从 84% 上升至 93%。到预测期结束时,独立行动客户数量预计将从年终的61 亿增加到 67 亿。

- 智慧型手机相关合约数量仍在增加。截至年终,合约数量为63亿份,占所有行动电话合约的近77%。到 2027 年,这一数字预计将增至 78 亿,即所有行动用户的 87%。

- 半导体设备市场是由对更快、更有效的记忆体解决方案的需求所推动的。这些半导体变得越来越复杂并且能够处理密集的记忆体操作。总体而言,由于对 IP解决方案供应商的依赖增加,市场上出现了大量投资。

预计亚太地区将占据主要市场占有率

- 半导体设备集中在少数国家,这些设备的销售在几个主要国家之外非常有限或根本不存在。作为成熟半导体技术的重要生产国,中国已取得显着成长。同时,中国政府继续将半导体产业视为经济成长和技术领先的驱动力。预计到 2030 年,全球新增产能将增加 40% 左右。

- 此外,领先的自动化测试设备供应商泰瑞达 (Teradyne) 将于 2022 年 4 月向领先的微控制器单元 (MCU) 和安全积体电路 (IC) 供应商 Nations Technologies 交付第 7,000 个 J750出货测试平台。 。中国晶片製造商。

- 越来越多地采用智慧电子设备来改善製造机会,以及电子产品更大程度地整合到各种应用中,是推动日本半导体设备成长的关键因素。此外,物联网、人工智慧和连接连网型设备融入各种最终用户产业预计将推动该国的半导体设备市场。

- 国际贸易组织 SEMI 表示,汽车和高效能运算设备中使用的晶片的强劲需求预计将使台湾今年成为全球前端晶片製造设备上最大的支出国。台湾晶圆厂设备支出预计每年增长 52%,达到 340 亿美元。

- 韩国和其他地方的主要晶圆代工厂厂正在增加投资和鼓励,以扩大其在各自国家行业的影响力。此外,产业通商资源部宣布,到2030年,晶片出口额预计将翻倍,达到2,000亿美元。此外,政府还计划建造一条延伸至首尔以南数十公里的「K半导体带」。将晶片设计师、製造商和供应商聚集在一起。这些工厂将增强韩国在全球半导体行业的竞争力,将主要半导体公司及其供应商丛集,在全球晶片短缺的情况下实现关键半导体材料和设备的本地化供应。

半导体设备产业概况

半导体设备市场竞争对手之间的竞争强度适中。企业专业化是由在小型企业产业竞争所需的大量研发和资本投资所推动的。主要参与者包括应用材料公司、ASML 控股半导体公司和 KLA 公司。该市场的最新发展包括:

- 2022 年 5 月:SCREEN Holdings 加大力度减少半导体产业对环境的影响。然而,随着对半导体装置的依赖增加,製造过程造成的环境影响已成为半导体产业通用关注的问题。考虑到这项挑战,SCREEN SPE 同意参与由世界主导的创新者 IMEC 领导的永续半导体技术和系统调查计画。该计划旨在帮助半导体产业减少其整体环境影响。

- 2022 年 2 月:台湾全球半导体代晶圆代工厂联电 (UMC) 宣布计划在新加坡建造一座新的先进製造工厂。新工厂将建在位于白沙 (Pasir Ris) 的现有 Fab12i 工厂旁。规划计划总投资50亿美元。新晶圆製造厂的月产能将达到30,000片晶圆,预计2024年终开始生产。联华电子表示,该工厂将成为新加坡最先进的半导体晶圆代工厂之一,将生产 22 奈米和 28 奈米晶片。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 竞争公司之间的敌意强度

- 替代品的威胁

- 评估 COVID-19 对产业的影响

第五章市场动态

- 市场驱动因素

- 消费性电子产品需求不断成长

- 人工智慧、物联网和连网型设备在各行业中激增

- 市场限制因素

- 技术的动态本质要求製造设备发生一些变化

第六章市场区隔

- 依设备类型

- 前端装置

- 微影製程设备

- 蚀刻设备

- 沉淀设备

- 测量/检测设备

- 材料去除/清洗设备

- 光阻剂加工设备

- 其他设备类型

- 后端设备

- 测验设备

- 组装/包装设备

- 前端装置

- 按供应链进入

- IDM

- OSAT

- 铸造厂

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 中国

- 日本

- 台湾

- 韩国

- 世界其他地区

第七章 竞争形势

- 公司简介

- Applied Materials Inc.

- ASML Holding Semiconductor Company

- Tokyo Electron Limited

- Lam Research Corporation

- KLA Corporation

- Veeco Instruments Inc.

- Screen Holdings Co. Ltd

- Teradyne Inc.

- Hitachi High-Technologies Corporation

第八章投资分析

第九章市场机会与未来趋势

The Semiconductor Equipment Market size is estimated at USD 127.87 billion in 2024, and is expected to reach USD 156.09 billion by 2029, growing at a CAGR of 4.07% during the forecast period (2024-2029).

The global semiconductor industry is driven by the simultaneous growth of smartphones and other devices, such as advanced consumer electronics, and the growth of the automotive industry.

Key Highlights

- These industries are driven by technology transitions such as wireless technologies (5G) and artificial intelligence. Several factors, including a steady rise in the demand for high-performance and low-cost semiconductors, drive the market with varying impacts over the short, medium, and long term.

- The deployment of 5G is expected to be one of the key factors driving the market. This is because the expansion of 5G would lead to the expansion of the wireless industry and enable innovations like augmented reality, mission-critical services, fixed wireless access, and the Internet of Things.

- Furthermore, with the gradual transitions in the semiconductor industry, such as the miniaturization of nodes and wafer sizes, the demand for increasing the wafer sizes for ultra-large-scale integration technologies has fostered the growth of semiconductor equipment. Moreover, fab manufacturers are shifting process monitors from bare wafers to production wafers due to the higher cost and inspection challenges faced by wafer miniaturization.

- The global demand for 300 mm silicon wafers is strong, and the demand for 200 mm has also seen a surge in recent years. According to SEMI, 200 mm fabs are gearing up to add over 600,000 wafers per month across the world during 2017-2022. Such trends are further expected to act as catalysts for the growth of the market studied.

- The COVID-19 pandemic disrupted the supply chains and production processes of semiconductors worldwide, especially in China, during the first half of 2020. The primary reason was a labor shortage, during which several semiconductor companies suspended operations. This created a crunch for end-product companies that depend on semiconductors.

Semiconductor Equipment Market Trends

Increasing Demand for Consumer Electronic Devices

- Consumer electronics is the fastest-growing segment and contributes significantly to market expansion. The growth of smartphones, which is predicted to increase with population growth, is the key driving force for this market. Consumer electronics drive the industry due to the increased demand for products such as tablets, smartphones, laptop computers, and wearable gadgets. As semiconductor technology advances, new market areas, such as machine learning, are rapidly being integrated.

- Due to ongoing improvements in items, including cars, medical equipment, smart devices, smart homes, and wearables, semiconductor integration has become a widespread phenomenon. Additionally, the trend of combining semiconductors into a single chip is expanding due to the consumers' desire for small-sized devices. The machinery used to manufacture semiconductors is gaining momentum since it makes it possible to assemble semiconductors on a single chip.

- There were approximately 8.2 billion mobile subscriptions by the end of 2021. This is anticipated to reach nearly 9.1 billion by the end of 2027. The percentage of mobile broadband subscriptions may rise from 84% to 93% at the same time. By the end of the forecast period, there are expected to be 6.7 billion unique mobile customers, up from 6.1 billion at the end of 2021.

- Smartphone-related subscriptions are still increasing. There were 6.3 billion at the end of 2021, making up nearly 77% of all mobile phone subscriptions. By 2027, this is anticipated to increase to 7.8 billion, or 87% of all mobile subscribers.

- The semiconductor equipment market is driven by the demand for quicker and more effective memory solutions. These semiconductors are becoming more complicated and can handle intensive memory operations. Overall, the market is seeing significant investments due to the increased reliance on IP solution providers.

Asia-Pacific Expected to Hold Significant Market Share

- The semiconductor equipment is highly concentrated in a few countries, and sales of this equipment are very limited or non-existent outside some major countries. China has grown significantly as an essential producer of mature semiconductor technologies. On the other hand, the Chinese government continues to prioritize the semiconductor industry as a driver of economic growth and technological leadership. It is expected to add roughly 40% of the new global capacity by 2030.

- Further, in April 2022, Teradyne Inc., a leading supplier of automated test equipment, announced the shipment of the 7,000th unit of its J750 semiconductor test platform to Nations Technologies, a leading microcontroller unit (MCU) and security integrated circuit (IC) chip maker in China.

- The growing adoption of smart electronic devices that improve manufacturing opportunities and the significant integration of electronics into various applications are the key factors driving the growth of semiconductor equipment in Japan. Moreover, the incorporation of IoT, artificial intelligence, and connected devices into various end-user industries are expected to drive the semiconductor equipment market in the Country.

- Due to the robust demand for chips used in vehicles and high-performance computing devices, Taiwan is expected to become the world's largest spender on front-end chip manufacturing equipment this year, according to the international trade group SEMI. Taiwanese fab equipment spending is expected to rise by 52% yearly to USD 34 billion.

- South Korea and other major hubs for foundries are increasingly investing and incentivizing to expand the industry presence of their respective countries. In addition, the Ministry of Trade, Industry, and Energy announced that chip exports are expected to double to USD 200 billion by 2030. Furthermore, the government seeks to build a "K-Semiconductor belt" that stretches dozens of kilometers south of Seoul and brings together chip designers, manufacturers, and suppliers. These plants aim to sharpen South Korea's competitive edge in the global semiconductor industry and localize major semiconductor materials and equipment supplies with key semiconductor companies and their suppliers working in clusters amid a global chip shortage.

Semiconductor Equipment Industry Overview

The intensity of competitive rivalry is moderately high in the semiconductor equipment market. Firm specialization is driven by the high R&D investments and capital expenditures required to compete in the SME industry. Some key players are Applied Materials Inc., ASML Holding Semiconductor Company, and KLA Corporation. A few recent developments in this market are:

- May 2022: SCREEN Holdings increased its efforts to reduce the environmental impact of the semiconductor industry. However, as reliance on semiconductor devices has grown, the environmental impact created by the manufacturing processes has become a shared concern for the semiconductor industry. With this challenge in mind, SCREEN SPE agreed to join the Sustainable Semiconductor Technologies and Systems research program led by IMEC, a world-leading innovator. The program is designed to help the semiconductor industry reduce its overall environmental impact.

- February 2022: United Microelectronics Corporation (UMC), a Taiwanese global semiconductor foundry, announced its plans to build a new advanced manufacturing facility in Singapore. The new facility would be built next to its existing plant, known as Fab12i, in Pasir Ris. The total investment for the planned project was USD 5 billion. The new wafer fab facility would have a monthly capacity of 30,000 wafers, with production expected to start in late 2024. According to UMC, it would also be one of the most advanced semiconductor foundries in Singapore and will produce 22 nm and 28 nm chips.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitutes Products

- 4.3 Assessment of Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Consumer Electronic Devices

- 5.1.2 Proliferation of AI, IoT, And Connected Devices Across Industry Verticals

- 5.2 Market Restraints

- 5.2.1 Dynamic Nature of Technologies Requires Several Changes in Manufacturing Equipment

6 MARKET SEGMENTATION

- 6.1 By Equipment Type

- 6.1.1 Front-end Equipment

- 6.1.1.1 Lithography Equipment

- 6.1.1.2 Etch Equipment

- 6.1.1.3 Deposition Equipment

- 6.1.1.4 Metrology/Inspection Equipment

- 6.1.1.5 Material Removal/Cleaning Equipment

- 6.1.1.6 Photoresist Processing Equipment

- 6.1.1.7 Other Equipment Types

- 6.1.2 Back-end Equipment

- 6.1.2.1 Test Equipment

- 6.1.2.2 Assembly and Packaging Equipment

- 6.1.1 Front-end Equipment

- 6.2 By Supply Chain Participants

- 6.2.1 IDM

- 6.2.2 OSAT

- 6.2.3 Foundry

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 Taiwan

- 6.3.3.4 Korea

- 6.3.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Applied Materials Inc.

- 7.1.2 ASML Holding Semiconductor Company

- 7.1.3 Tokyo Electron Limited

- 7.1.4 Lam Research Corporation

- 7.1.5 KLA Corporation

- 7.1.6 Veeco Instruments Inc.

- 7.1.7 Screen Holdings Co. Ltd

- 7.1.8 Teradyne Inc.

- 7.1.9 Hitachi High -Technologies Corporation