|

市场调查报告书

商品编码

1440260

铝零件重力铸造:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Aluminum Parts Gravity Die Casting - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

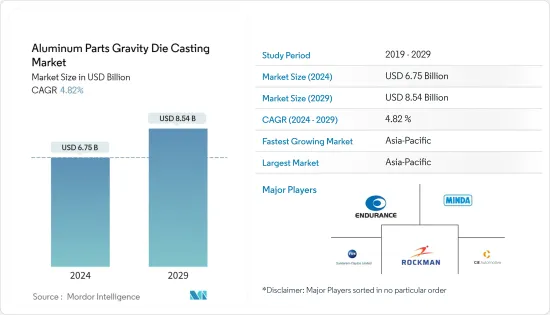

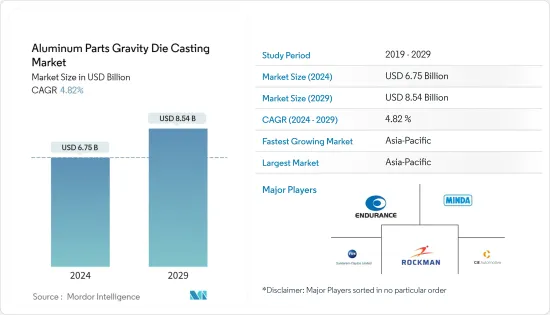

铝零件重力铸造市场规模预计到 2024 年为 67.5 亿美元,预计到 2029 年将达到 85.4 亿美元,在预测期内(2024-2029 年)增长 4.82%,复合年增长率为

2020年COVID-19爆发时,整个汽车产业供应链受到了显着影响。OEM正在努力维持业务。然而,随着封锁和限制的放鬆,汽车产业和铝零件重力铸造市场恢復了势头。

该市场主要由压铸行业供应链的复杂性、汽车市场的扩张、压铸件在工业机械中的普及不断提高、建筑行业的增长以及铝铸件在汽车工业中的采用所推动。电气和电子领域。马苏。

重力压铸是最古老的压铸方法之一。这种压铸工艺用于生产尺寸精确、轮廓清晰、表面光滑或有纹理的金属零件。重力铸造的主要优点是生产速度快。

CAFE 标准和 EPA 旨在减少车辆排放气体和提高燃油效率的政策正在推动汽车製造商透过采用轻质金属来减轻车辆重量。此后,采用压铸件作为减重策略,对汽车领域的前市场起到了重要的推动作用。

铝件重力铸造市场趋势

严格的 EPA 法规和咖啡馆标准可能会推动市场需求

欧洲和北美汽车法律规范为创建汽车行业的永续环境做出了贡献。最新的法规结构Euro 6 于 2011 年推出并于 2014 年 9 月生效,它改变了对于确定该地区汽车市场方向非常重要的监管标准。自2013年以来,EC(欧盟委员会)与EEA/EMEP合作,保存了在欧洲註册的每辆新车的排放性能标准记录。

排放法规将汽车製造商团结在一起。货运公司和车队所有者正在迅速采取行动,实施更多有望降低平均排放率的技术。因此,减轻车辆重量以降低排放气体水准的需求极大地促进了压铸件在车辆中的采用。

汽车製造商不断寻找提高车辆零件效率的方法,以提高车辆燃油效率并减少碳排放。使用高效且成本优化的铝压铸件的轻量化结构在实现这一目标方面发挥关键作用。 Nemak 等公司正在关注「轻量化」趋势,并将电动车产品(采用 HPDC 製程製造)引入汽车产业。上述环境政策预计将增加市场需求。

亚太地区预计将占据主要市场份额

由于印度、中国等主要经济体的存在、主要企业的积极参与以及多项政府倡议,亚太地区是全球最大的汽车市场,预计将进一步促进铝重力的发展。压铸市场。中国是世界主要铝及铝製品出口国之一。 2022年,中国铝出口量与前一年同期比较%,达到100万吨,从2021年12月的仅39.69亿吨,达到2022年12月的57,349万吨。

由于全球对中国产品的高需求,亚太地区也正在感染疾病(COVID-19) 大流行的影响中迅速恢復。随着製造能力的增加,铝零件重力铸造市场的需求预计在预测期内将成长。

2022年,Vedanta(1,696,960吨)、Hindalco(969,180吨)和Nalco(343,460吨)是三大铝生产公司。印度是世界第二大铸造业,生产铸造金属。印度的铸造厂可以生产符合国际标准的重力铸造产品,用途广泛。

政府对「印度製造」的关注、汽车工业的发展和严格的排放标准正在推动市场的成长。 2022-23 年小客车(PV)出口总量为 662,891 辆,而 2021-22 年为 577,875 辆。现代、起亚、马鲁蒂铃木和大众等公司正在向非洲销售印度製造的汽车,而不是在该地区设立工厂,因为印度的製造成本较低且零件供应商较多。我们正在向该地区出口。所有这些因素都有助于预测期内亚太铝零件重力铸造市场的整体发展。

铝件重力铸造产业概况

铝零件重力铸造市场本质上是分散的,有大量大型/国际参与者以及跨越多个国家的中小型参与者。

主要企业也透过各种合併、扩张、联盟、合资和收购进行全球扩张。这些主要企业将收益集中在研发上,以设计更好的生产流程和合金。这项策略可以帮助为全球汽车和工业领域生产高品质的压铸零件。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章 简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场驱动因素

- 重视汽车和航太的轻量材料

- 市场限制因素

- 设计弹性有限

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代产品的威胁

- 竞争公司之间的敌意强度

第五章市场区隔(市场规模、金额)

- 目的

- 车

- 零件

- 传动部件

- 引擎零件

- 煞车零件

- 其他零件

- 车辆类型

- 小客车

- 商用车

- 其他车辆

- 电气和电子

- 工业用途

- 其他用途

- 车

- 地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 南非

- 土耳其

- 中东和非洲其他地区

- 北美洲

第六章 竞争形势

- 供应商市场占有率

- 公司简介

- Rockman Industries

- Endurance Technologies Limited

- Minda Corporation Limited

- Hitachi Metals Ltd

- MAN Group Co.

- MRT Castings Ltd

- Harrison Castings Limited

- Vostermans Companies

- CIE Automotive

- Sundaram Clayton Ltd

- GWP Manufacturing Services AG

第七章市场机会与未来趋势

- 电动车的采用率增加

- 改良的模具设计、电脑辅助模拟和製程控制系统

The Aluminum Parts Gravity Die Casting Market size is estimated at USD 6.75 billion in 2024, and is expected to reach USD 8.54 billion by 2029, growing at a CAGR of 4.82% during the forecast period (2024-2029).

During the COVID-19 outbreak in 2020, the entire supply chain of the automotive industry was significantly impacted. The OEMs struggled to keep their operations going. However, as the lockdowns and restrictions were relaxed, the automotive industry and the aluminum parts gravity die-casting market regained their momentum.

The market is largely driven by supply chain complexities in the die-casting industry, the expanding automotive market, increasing penetration of die-casting parts in industrial machinery, the growing constructional sector, and employing aluminum castings in the electrical and electronics sector.

Gravity die casting is one of the oldest methods of die casting. This die-casting process is used for producing accurately dimensioned, sharply defined, and smooth or textured-surface metal parts. The main advantage of gravity die casting is its high speed of production.

The CAFE standards and EPA policies to cut down automobile emissions and increase fuel efficiency are driving the automakers to reduce the weight of automobiles by employing lightweight metals. Subsequently, employing die-cast parts as a weight reduction strategy is acting as a major driver for the former market in the automotive segment.

Aluminum Parts Gravity Die Casting Market Trends

Stringent EPA Regulations and Cafe Standards are Likely to Drive Demand in the Market

The automobile regulatory frameworks in Europe and North America have been instrumental in creating a sustainable environment in the automobile industry. The latest regulatory framework, Euro 6, which was introduced in 2011 and came into effect from September 2014 onward, changed the regulatory standards that have been crucial in determining the dynamics of the automotive market in the region. Since 2013, the EC (European Commission), along with EEA/EMEP, has been maintaining the record of emission performance standards for each new vehicle registered in Europe.

The emission regulations bind the automotive manufacturers together. Freight companies and fleet owners are rapidly moving toward incorporating more technologies that are expected to reduce the average emission rate. Thereby, a need to reduce vehicle weight to lowering emission levels has greatly encouraged the employment of die-cast parts in vehicles.

Automobile manufacturers are always looking for ways to make vehicle components more efficient to improve the fuel efficiency of vehicles and reduce carbon emissions. Lightweight construction, using efficient and cost-optimized aluminum die-casted parts, plays a key role in achieving this goal. Companies like Nemak are focusing on the 'lightweight' trend and introducing electric vehicle products (manufactured by using the HPDC process) into the automotive industry. Such aforementioned environmental policies are expected to drive the demand in the market.

The Asia-Pacific Region is Expected to Hold a Significant Share in the Market

Asia-Pacific is the largest automotive market in the world due to the presence of key economies like India, China, etc., and active engagements of key players and several government initiatives, which are expected to further contribute to the development of the aluminum gravity die-casting market. China is the world's leading exporter of aluminum and aluminum products. In 2022, China's exports of aluminum increased by 741.4% year on year to 1 million mt and reached 57,349 mt in December 2022 compared to only 3,969 mt in December 2021.

The Asia-Pacific region has also recovered quickly from the impact of the COVID-19 pandemic due to the high demand for Chinese products across the world. With growing manufacturing capabilities, the demand in the aluminum parts gravity die-casting market is expected to grow during the forecast period.

In 2022, Vedanta (1,696,960 mt), Hindalco (969,180 mt), and Nalco (343,460 mt) were the three prominent companies in aluminum production. India stands as the second-largest foundry industry that produces castings in the world. Foundries in India are capable of producing gravity die-casting products that serve a wide range of applications conforming to international standards.

The government's focus on 'Make in India', developing the automotive industry, and the stringent emission norms is driving the market growth. In FY 2022-23, total passenger vehicle (PV) exports stood at 6,62,891 units in compare to 5,77,875 units in 2021-22. Companies such as Hyundai, Kia, Maruti Suzuki, and Volkswagen are exporting Indian-made cars to the African region instead of setting up their factories there because of low-cost manufacturing and availability of parts suppliers in India. All these factors contribute to the overall development of the Asia-Pacific aluminum parts gravity die casting market during the forecast period.

Aluminum Parts Gravity Die Casting Industry Overview

The market for aluminum parts gravity die casting is fragmented in nature, with the presence of many regional small-medium scale players across several countries, as well as large-scale/international players.

Key players have also expanded their operations globally through various mergers, expansions, partnerships, joint ventures, and acquisitions. These key players are focusing their revenues on R&D to come up with better production processes and alloys. This strategy may assist in the production of premium-quality die-cast parts for the global automotive and industrial sectors.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Emphasis on Lightweight Materials in Automobile and Aerospace sector

- 4.2 Market Restraints

- 4.2.1 Limited Design Flexibility

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value USD Billion)

- 5.1 Application

- 5.1.1 Automotive

- 5.1.1.1 Parts and Components

- 5.1.1.1.1 Transmission Parts

- 5.1.1.1.2 Engine Parts

- 5.1.1.1.3 Brake Parts

- 5.1.1.1.4 Other Parts and Components

- 5.1.1.2 Vehicle Type

- 5.1.1.2.1 Passenger Cars

- 5.1.1.2.2 Commercial Vehicles

- 5.1.1.2.3 Other Vehicles

- 5.1.2 Electrical and Electronics

- 5.1.3 Industrial Applications

- 5.1.4 Other Applications

- 5.1.1 Automotive

- 5.2 Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.1.3 Rest of North America

- 5.2.2 Europe

- 5.2.2.1 Germany

- 5.2.2.2 United Kingdom

- 5.2.2.3 France

- 5.2.2.4 Italy

- 5.2.2.5 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 China

- 5.2.3.2 Japan

- 5.2.3.3 India

- 5.2.3.4 South Korea

- 5.2.3.5 Rest of Asia-Pacific

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Rest of South America

- 5.2.5 Middle-East and Africa

- 5.2.5.1 South Africa

- 5.2.5.2 Turkey

- 5.2.5.3 Rest of Middle-East and Africa

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Rockman Industries

- 6.2.2 Endurance Technologies Limited

- 6.2.3 Minda Corporation Limited

- 6.2.4 Hitachi Metals Ltd

- 6.2.5 MAN Group Co.

- 6.2.6 MRT Castings Ltd

- 6.2.7 Harrison Castings Limited

- 6.2.8 Vostermans Companies

- 6.2.9 CIE Automotive

- 6.2.10 Sundaram Clayton Ltd

- 6.2.11 GWP Manufacturing Services AG

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Adoption of Electric Vehicles

- 7.2 Improved Tooling Design, Computer-aided Simulation, and Process Control Systems