|

市场调查报告书

商品编码

1690859

电动汽车电池管理系统:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Electric Vehicle Battery Management System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

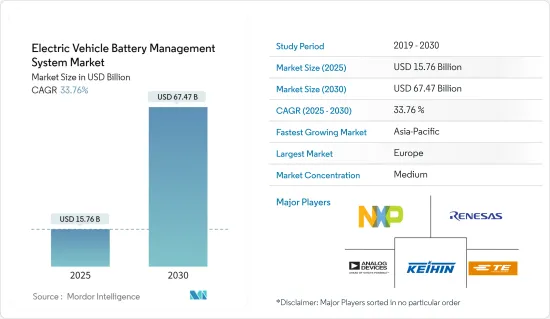

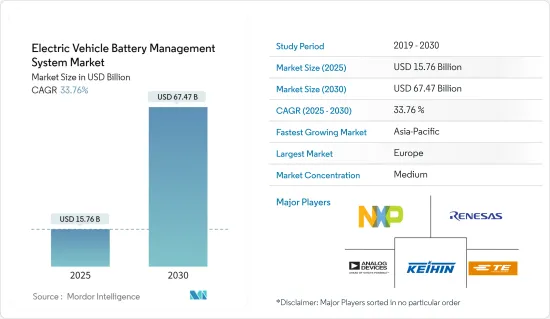

电动车电池管理系统市场规模预计在 2025 年为 157.6 亿美元,预计到 2030 年将达到 674.7 亿美元,预测期内(2025-2030 年)的复合年增长率为 33.76%。

儘管新冠疫情对全球汽车产业产生了负面影响,但2020年全球电动车销量仍呈现显着成长。这主要得益于政府补贴、电动车充电基础设施的扩建以及燃料价格的上涨。预计 2021 年将出现类似的成长趋势,并将在整个预测期内持续下去。疫情扰乱了全球供应链,导致BMS组件和系统的生产和交付出现延迟和短缺。同时,疫情加速了电动车的普及,推动了对 BMS 技术的需求。整体而言,疫情对BMS产业的长期影响可能是正面的。

从中期来看,对永续交通和清洁能源的需求不断增长,推动了对电池式电动车的需求。消费者面临的限制因素包括车辆行驶里程、较高的初始价格、有限的车型供应以及缺乏知识等,正在透过促销活动和政府法规予以解决。这些变数影响电动车的需求并推动电池管理系统市场的发展。

由于电动车的普及,全球整体对电池管理系统 (BMS) 的需求预计将快速增长。然而,由于亚太地区工业化和都市化的快速发展,以及中国和印度等国家对电动车的需求不断增加,预计 BMS 市场将由亚太地区主导。预计北美和欧洲等其他地区的 BMS 市场也将显着成长。

电动车需求的不断增长将推动电池化学和材料技术的进步,需要更先进、更有效率的BMS来确保电池的安全和性能。

电动车电池管理系统市场趋势

电动车领域预计将占据市场主导地位

世界各国政府都在积极实施鼓励使用电动车的政策。中国、印度、法国和英国已宣布计划在 2040 年前逐步淘汰汽油和柴油汽车。随着电动车需求的增加,对电池管理系统的需求也预计将逐步增加。

电动车正在全球逐渐普及,因此货运公司也将现有车辆改装为电力驱动车辆。OEM正在重新定义他们的电动车蓝图。这可能会对目标市场的成长产生正面影响。例如

- 2022 年 12 月,专注于为商用车队市场製造电动轻型皮卡的公司 Lordstown Motors 宣布,将在 CES 上 Mobility in Harmony (MIH) 联盟西厅 5274 号展位展示其全尺寸 BEV 皮卡 Endurance。

- 2022年12月,洛杉矶世界机场(LAWA)宣布其首辆 Nikola Tre 大型电池电动车到来,标誌着该机场向全电动汽车过渡的重要一步。

电动车的成长趋势预计也将推动未来市场的成长。比亚迪、Proterra、塔塔和沃尔沃等知名公司正尝试在全部区域实现产品在地化,以减少对其他参与者和进口产品的依赖。例如

- 2022 年 12 月,沃尔沃汽车马来西亚 (VCM) 推出了 C40 Recharge,这是该公司继 XC40 Recharge Pure Electric 之后的第二款 BEV 车型。 C40 是剪切机南工厂生产的本地组装(CKD) 车型,将享受政府的 CKD EV 激励措施,直至 2025 年 12 月 31 日。

- 2022 年 12 月,丰田马达欧洲公司 (TME) 推出了丰田 bZ 紧凑型 SUV 概念车,这是一款由法国丰田欧洲设计与开发中心 (ED2) 在欧洲设计的全电池电动车。

监管机构正在实施严格的规定以减少燃料排放并提高道路安全。此外,预测期内,消费者对碳排放和能源永续运输的倾向可能会成为市场渗透的潜在机会。

预计欧洲将占很大市场份额

在电动车推广计画方面,德国目前正在实施符合更严格排放标准的策略。联邦政府的气候保护计画旨在主要透过交通创新实现 2030 年的气候目标,其中重点在于电动车。为了推广清洁汽车,该国推出了购买补贴、所有权税和公司汽车税等奖励和投资。

减轻重量是电动车和产品设计的首要任务。很少有公司设计整合两个或多个部件以减轻重量的紧凑型模组。例如

海拉于 2021 年 4 月推出了 Power Pack 48 Volt。它将电力电子和电池管理整合在一个产品中,每公里可节省 5-6 克二氧化碳。该解决方案由海拉与中国电池製造商共同开发,并计划于 2024 年在上海投入大量生产。

各国政府也推出了更多支持性政策来支持该行业的发展,包括投资基础设施、采取广泛措施鼓励人们使用现代低排放和零排放气体汽车,以及提供长期购买激励措施来帮助电动车占据更大的市场份额。预计这将在预测期内增强电动车电池管理系统的市场前景。

- 2023 年 1 月中国汽车製造商比亚迪将于本季开始在英国销售汽车,英国电动车的市场占有率正在持续成长。该汽车製造商由沃伦·巴菲特的伯克希尔哈撒韦公司支持,它表示其在英国拥有四家经销商合作伙伴:Pendragon、Arnold Clark、Lookers 和 LSH。

- 2021年6月,义法半导体宣布与Arrival合作,提供Arrival的汽车半导体技术和产品,包括汽车微控制器以及电源和电池管理设备。 Arrival 已选择 ST 作为将连网电动车推向市场的关键合作伙伴之一。 Arrival 已采用 ST 的安全汽车微控制器作为其模组化 ECU 平台,以及其他 ST 技术,包括智慧电源和电池管理设备。

为了减轻车辆重量,各公司正在开发配备电池管理系统的新型电池模组。例如

2021年6月,Leclanche SA宣布开发出名为M3的新一代锂离子电池模组。它包含一个功能安全的从属电池管理系统 (BMS) 单元,该单元与功能安全的主电池管理系统单元通讯。

考虑到这些因素,预计在预测期内对电动车电池管理系统的需求将保持处于正向状态。

电动汽车电池管理系统产业概况

电动车电池管理系统市场由瑞萨电子株式会社、恩智浦半导体公司、京滨株式会社、泰科电子、ADI 公司等主要企业主导。此外,该市场对新参与企业非常有吸引力,在市场上运营的公司专注于引进先进技术以获得竞争优势。例如

- 2022 年 5 月,博格华纳公司宣布已赢得一家未公开的国际汽车製造商的合同,为该公司供应电池管理系统 (BMS)。博格华纳的BMS技术提升了电池组的效能、安全性和使用寿命。

- 2022 年 1 月,FPT Industrial 推出了两款配备根据客户需求量身定制的电池管理系统的电轴和电池组。该公司展出了专为 Nikola Tre 设计的整合式电桥。双马达轴适用于总重量不超过 44 吨的车辆,可确保高性能和高效率,每个马达的最大功率为 420kW,最大扭力为 900Nm。

- 2021 年 10 月,Ballard Power Systems 和 Forsee Power 宣布已签署一份谅解备忘录,建立战略伙伴关係关係,开发完全整合的燃料电池和电池解决方案,该解决方案针对大规模氢动力应用的性能、成本和可安装性进行了优化。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场驱动因素

- 市场限制

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场区隔

- 按组件

- 积体电路

- 截止 FET 和 FET 驱动器

- 温度感测器

- 电量计/电流测量装置

- 微型计算机

- 其他组件

- 依推进类型

- 纯电动车

- 油电混合车

- 按车型

- 搭乘用车

- 商用车

- 按地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 俄罗斯

- 西班牙

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 其他中东和非洲地区

- 北美洲

第六章 竞争格局

- 供应商市场占有率

- 公司简介

- Infineon Technologies AG

- Silicon Laboratories

- NXP Semiconductors

- Vitesco Technologies

- TE Connectivity

- Renesas Electronics Corporation

- Keihin Corporation

- Texas Instruments Incorporated

- Analog Devices Inc.

- Visteon Corporation

第七章 市场机会与未来趋势

The Electric Vehicle Battery Management System Market size is estimated at USD 15.76 billion in 2025, and is expected to reach USD 67.47 billion by 2030, at a CAGR of 33.76% during the forecast period (2025-2030).

Despite the negative COVID-19 impact on the global automotive industry, electric vehicle sales for the year 2020 witnessed significant growth worldwide. This was primarily attributed to government subsidies, expanding electric vehicle charging infrastructure, and a rise in fuel prices. The same growth trend was witnessed for 2021 and will likely continue during the forecast period. The pandemic has disrupted global supply chains, causing delays and shortages in the production and delivery of BMS components and systems. On the other hand, the pandemic has also accelerated the adoption of electric vehicles, which has driven the demand for BMS technology. Overall, the long-term impact of the pandemic on the BMS industry is likely to be positive.

Over the medium term, rising demand for sustainable transportation and cleaner energy has engaged the demand for battery electric vehicles. Consumer constraints such as vehicle range, greater upfront prices, limited model availability, and lack of knowledge are being solved by promotional activities and government legislation. These variables will have an impact on the demand for electric vehicles, which will drive the battery management system market.

The demand for battery management systems (BMS) is expected to grow rapidly across the globe, driven by the increasing adoption of electric vehicles. However, Asia Pacific is expected to lead the market for BMS due to the rapid industrialization and urbanization in the region, as well as the increasing demand for electric vehicles in countries such as China and India. Other regions, such as North America and Europe, are also expected to experience significant growth in the BMS market.

The growing demand for electric vehicles will lead to technological advancements in battery chemistry and materials, which will require more sophisticated and efficient BMS to ensure the safety and performance of batteries.

Battery Management System for Electric Vehicle Market Trends

Battery Electric Vehicle Segment Anticipated to Dominate the Market

Governments around the world have been proactive in enacting policies to encourage the adoption of electric vehicles. China, India, France, and the United Kingdom have announced plans to phase out petrol and diesel vehicles before 2040 completely. As the demand for EVs increases, the demand for battery management systems will also increase gradually.

Electric mobility is gradually growing around the world, owing to which the goods transportation companies are also converting their existing fleets into electric propulsion-based vehicles. OEM is redefining its roadmap for electric vehicles. This will positively impact the target market growth. For instance,

- In December 2022, Lordstown Motors Corp., which focuses on building electric light-duty pickup trucks for the commercial fleet market, announced that the Endurance full-size BEV pickup truck will be on display at CES in the West Hall Booth 5274 of the Mobility in Harmony (MIH) Consortium.

- In December 2022, Los Angeles World Airports (LAWA) announced the arrival of its first Nikola Tre heavy-duty battery-electric vehicle, a significant step forward in the airport's transition to a fully electric fleet.

The increase in the trend of electric vehicles is also expected to drive market growth in the future. Prominent companies such as BYD, Proterra, Tata, Volvo, and others are trying to localize their products across the regions they operate to reduce the dependence on other players and imports. For instance,

- In December 2022, Volvo Car Malaysia (VCM) unveiled the C40 Recharge, the company's second BEV model after the XC40 Recharge Pure Electric. The C40, as a locally assembled (CKD) model from Volvo's Shah Alam plant, will also benefit from the government's CKD EV incentives until December 31, 2025.

- In December 2022, Toyota Motor Europe (TMEs unveiled the Toyota bZ Compact SUV Concept, a full-battery-electric vehicle designed in Europe by Toyota European Design and Development (ED2) in France.

Regulatory bodies have laid down stringent regulations about bringing down fuel emissions and increasing road safety. Furthermore, Consumer inclination toward carbon emission and energy-sustainable transportation will provide potential opportunities for target market penetration over the forecast period.

Europe Expected to Hold Significant Share in the Market

In terms of pro-electric plans, Germany is now implementing strategies to meet stricter emission standards. The federal government's climate protection program, which aims to meet its 2030 climate targets primarily through transportation innovation, places a premium on electric mobility. To promote clean cars, the country is introducing incentives and investments such as a purchase grant, ownership tax, and company car tax.

Weight reduction is a top priority in the design of electric vehicles and products. Few companies are designing compact modules integrating two or more components to save weight. For example,

Hella's introduced the PowerPack 48 Volt in April 2021, which combines power electronics and battery management in one product and saves 5 to 6 grams of CO2 per kilometer driven. This solution, which HELLA is developing in collaboration with a Chinese cell manufacturer, is set to enter series production in Shanghai in 2024.

The government is also aiding the industry growth with more supportive policies: investment in infrastructure; broader measures to encourage uptake of the latest, low and zero-emission cars; and long-term purchase incentives to help the country grow its share in the EV market. This is expected to bolster the market prospects for battery management systems for EVs during the forecast period.

- In January 2023, BYD, a Chinese automaker, began selling vehicles in the United Kingdom this quarter, where electric vehicles are gaining market share. According to the automaker, backed by Warren Buffett's Berkshire Hathaway, it has appointed four UK dealer partners in Pendragon, Arnold Clark, Lookers, and LSH.BYD's first model will be the Atto 3 SUV, and more dealer partners and pricing will be announced in the coming weeks.

- In June 2021, STMicroelectronics announced its collaboration with Arrival to provide semiconductor technologies and products for Arrival's vehicles, including automotive microcontrollers and power and battery-management devices. Arrival has chosen ST as one of its key partners in bringing its connected Evs to market. Arrival has selected ST's secure automotive microcontrollers for their modular ECU platform, as well as other ST technologies, including smart-power and battery-management devices.

Although companies are developing new battery modules with a battery management system to reduce the weight of the vehicles. For instance,

In June 2021, Leclanche SA announced that it had developed a new generation of lithium-ion battery modules called M3; it is fitted with a functionally safe slave battery management system (BMS) unit which communicates with a functionally safe master battery management system unit.

Considering these factors demand for Electric Vehicle Battery Management Systems is anticipated to remain on the positive side of the graph during the forecast period.

Battery Management System for Electric Vehicle Industry Overview

The Electric Vehicle Battery Management System Market is dominated by several key players such as Renesas Electronics Corporation, NXP Semiconductors, Keihin Corporation, TE Connectivity, Analog Devices Inc., and others. Moreover, the market tends to be highly attractive for new players, and companies operating in the market have been focusing on launching advanced technologies to gain a competitive advantage. For instance,

- In May 2022, BorgWarner Inc. announced that the company had got a deal from an undisclosed international vehicle manufacturer to supply its Battery Management System (BMS). Model years beginning in the middle of 2023 will be the first to come with the new BorgWarner BMS technology, which improves the performance, security, and lifespan of battery packs.

- In January 2022, FPT Industrial announced presenting two e-axles and a battery pack with a Battery Management System customized to meet customer needs. It displayed an integrated e-Axle designed for the Nikola Tre. A dual-electric motor axle for GVW vehicles up to 44 tons guarantees high performance and efficiency with a maximum power of 420 kW and a maximum torque of 900 Nm for each motor.

- In October 2021, Ballard Power Systems and Forsee Power announced signing a memorandum of understanding (MOU) for a strategic partnership to develop fully integrated fuel cell and battery solutions optimized for performance, cost, and installation for heavy-duty hydrogen mobility applications.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value USD Million)

- 5.1 By Components

- 5.1.1 Integrated Circuits

- 5.1.2 Cutoff FETs and FET Driver

- 5.1.3 Temperature Sensor

- 5.1.4 Fuel Gauge/Current Measurement Devices

- 5.1.5 Microcontroller

- 5.1.6 Other Components

- 5.2 By Propulsion Type

- 5.2.1 Battery Electric Vehicles

- 5.2.2 Hybrid Electric Vehicles

- 5.3 By Vehicle Type

- 5.3.1 Passenger Car

- 5.3.2 Commercial Vehicles

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Russia

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Infineon Technologies AG

- 6.2.2 Silicon Laboratories

- 6.2.3 NXP Semiconductors

- 6.2.4 Vitesco Technologies

- 6.2.5 TE Connectivity

- 6.2.6 Renesas Electronics Corporation

- 6.2.7 Keihin Corporation

- 6.2.8 Texas Instruments Incorporated

- 6.2.9 Analog Devices Inc.

- 6.2.10 Visteon Corporation