|

市场调查报告书

商品编码

1441610

液化天然气燃料库:市场占有率分析、产业趋势与统计、成长预测(2024-2029)LNG Bunkering - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

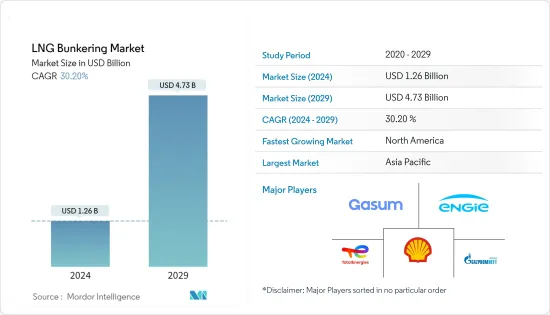

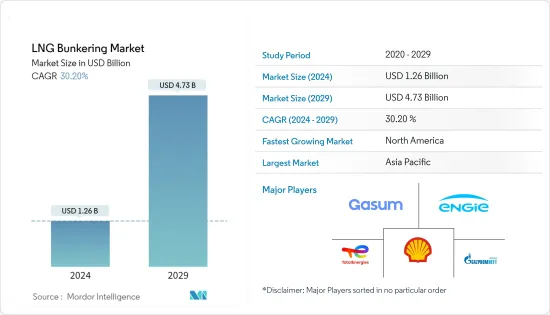

液化天然气燃料库市场规模预计到 2024 年为 12.6 亿美元,预计到 2029 年将达到 47.3 亿美元,预测期内(2024-2029 年)复合年增长率为 30.20%。

在COVID-19感染疾病期间,由于临时进出口禁令,市场低迷。然而,由于航运对液化天然气作为船用燃料的需求不断增加,市场从 2021 年下半年的收益下降中恢復过来。在市场成长方面,限制传统燃料硫含量的标准和提高效率正在推动对液化天然气燃料库基础设施的需求。各地船舶逐渐开始采用液化天然气作为推进燃料。此外,减少传统燃料中的硫含量可能成本高且不经济。

主要亮点

- 在预测期内,油轮船队可能会显着成长。

- 与传统船用燃料相比,液化天然气作为船用燃料具有巨大的优势,从延长合规期到减少温室气体排放。随着IMO法规的实施,船舶将改用硫含量较低的燃料,使液化天然气成为理想的选择,并为燃料库市场带来机会。

- 大部分需求来自美国和加拿大,其中北美预计将主导市场。

液化天然气(LNG)燃料库市场趋势

油轮船队显着成长

- 油轮船队包括小型油轮、中型油轮、中程1号(MR1)、中程2号(MR2)、大型油轮1号(LR1)、大型油轮2号(LR2)、超大型原油装运船隻( VLCC)和超大型油轮. 包括油轮。大型原油装运船隻(ULCC) 的油轮容量各不相同。

- 油轮船队用于储存或运输大量气体/液体。它们用于储存和运输石油、天然气、化学品和其他产品,如植物油、淡水、酒和糖蜜。

- 2020年,国际海事组织对全球燃油硫含量实施新的0.5%上限,低于先前的3.5%,以限制海上活动产生的温室气体排放。液化天然气作为船用燃料比其他类型的船用燃料具有显着优势,包括减少高达 80% 的氮氧化物排放并消除硫氧化物颗粒物,而最新的引擎技术可最大程度减少 23% 的温室气体排放。运作具竞争力的设计的液化天然气船舶将确保比传统设计更长期的合规性。这些因素导致越来越多地采用液化天然气作为船用燃料,并增加油轮运输液化天然气。

- 截至年终,液化天然气船队总数为642艘,总作业量为9,340万立方公尺。 2020年,製造商又交付了47艘船舶,并订购了40艘新油轮。到2020年,订单量将达到147台、2,270万立方公尺。

- 因此,对燃料中硫含量的监管预计将使液化天然气成为未来几年海上活动的首选燃料,从而导致油轮运输液化天然气船用燃料的增加。

北美市场占据主导地位

- 在预测期内,北美地区可能会主导液化天然气燃料库市场,其中大部分需求来自美国和加拿大。

- 推动液化天然气燃料库市场的主要因素是航运业对液化天然气减少碳排放的需求不断增加。此外,液化天然气是一种更好的替代燃料,各国政府正在推动液化天然气适应工作。

- 2020年,国际海事组织实施了降低船用燃料硫含量的措施,以遏制海上活动产生的温室气体排放。由于这一因素,IMO后的液化天然气很可能成为船用燃料的经济替代品,美国液化天然气燃料库市场预计在未来几年将成长。

- 2022年1月,美国造船公司芬坎蒂尼湾造船公司开始建造美国最大的液化天然气燃料库驳船。该LNG燃料库驳船由一艘长126.8公尺的船舶组成,可容纳12,000立方公尺的LNG。计划预计完工日期为2023年。

- 此外,2021年9月,稳定解决方案与德克萨斯州伊莎贝尔港物流海上码头和路易斯安那州卡梅伦教区港口码头区签署了一份谅解备忘录(MoU),以开发船舶液化天然气加註服务。

- 同样,2021年4月,惠生海工订单Pilot LNG位于加拿大加尔维斯顿液化天然气加註港计划的前端工程开发(FEED)合同,计划于2024年开始运营。

- 加拿大政府致力于大幅减少温室气体排放,且该国拥有丰富的天然气供应。燃烧天然气产生的温室气体排放较少,使液化天然气成为加拿大航运业的绝佳替代船用燃料。

- 儘管液化天然气船舶的初始安装成本较高,但营运成本低于运行带有洗涤器的旧船舶。因此,北美地区可能在预测期内主导整个液化天然气燃料库市场。

液化天然气(LNG)燃料库产业概述

液化燃料库市场适度整合。主要企业包括壳牌公司、Gazprom Neft PJSC、TotalEnergies SE、Gasum Oy 和 Engie SA。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章 简介

- 调查范围

- 市场定义

- 调查先决条件

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 2027年之前的市场规模与需求预测(百万美元)

- 最新趋势和发展

- 政府政策法规

- 市场动态

- 促进因素

- 抑制因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌意强度

第五章市场区隔

- 最终用户

- 油轮船队

- 货柜船队

- 散货和杂货船队

- 渡轮和 OSV

- 其他最终用户

- 地区

- 北美洲

- 欧洲

- 亚太地区

- 中东和非洲

- 南美洲

第六章 竞争形势

- 併购、合资、合作与协议

- 主要企业采取的策略

- 公司简介

- Shell PLC

- ENN Energy Holdings Ltd

- Korea Gas Corporation

- Harvey Gulf International Marine LLC

- Gasum Oy

- Engie SA

- Gazprom Neft PJSC

- TotalEnergies SE

- Naturgy Energy Group SA

第七章市场机会与未来趋势

The LNG Bunkering Market size is estimated at USD 1.26 billion in 2024, and is expected to reach USD 4.73 billion by 2029, growing at a CAGR of 30.20% during the forecast period (2024-2029).

During the COVID-19 pandemic, the market experienced a decline due to temporary bans on export and import. However, the market recovered from the declining revenues in the second half of 2021, owing to the rising demand for LNG as bunker fuel from maritime transport. In terms of market growth, the norms to restrict the sulfur content in conventional fuels and the increased efficiency are driving the demand for LNG bunkering infrastructure. The ships across various regions are slowly starting to adopt LNG as a fuel for propulsion. Moreover, reducing the sulfur content from conventional fuel requires high costs, which is likely to hamper its economic viability.

Key Highlights

- The tanker fleet segment is likely to witness significant growth during the forecast period.

- LNG as a bunker fuel presents immense benefits over conventional bunker fuel, ranging from increased length of compliance to reduced GHG emissions. With the IMO regulations in place, maritime vessels will be switching to less sulfur content fuel, making LNG an ideal choice and leading to opportunities in the bunkering market.

- North America is expected to dominate the market, with most of the demand coming from the United States and Canada.

Liquefied Natural Gas (LNG) Bunkering Market Trends

Tanker Fleet to Witness Significant Growth

- Tanker fleets include small tanker, intermediate tanker, medium-range 1 (MR1), medium-range 2 (MR2), large range 1 (LR1), large range 2 (LR2), very large crude carrier (VLCC), and ultra-large crude carrier (ULCC), which differ based on tanker capacity.

- Tanker fleets are used to store or transport gases/liquids in bulk amounts. These are used to store and carry oil, gas, chemicals, and other products, like vegetable oil, freshwater, wine, molasses, etc.

- In 2020, the International Maritime Organization enforced a new 0.5% global sulfur cap on fuel content, lowering from the earlier 3.5% to limit the greenhouse gas emissions from the marine activities. LNG as a bunker fuel presents significant advantages over other kinds of bunker fuels, such as reducing NOx emissions by up to 80% and eliminating SOx particulate matter, leading to a reduction in GHG emissions by up to 23% with modern engine technology. Vessels that run on LNG on a competitive design ensure longer compliance than conventional designs. These factors have led to increasing adoption of LNG as a bunker fuel and increasing transport of LNG through tankers.

- At the end of 2020, the total LNG tanker fleet consisted of 642 vessels with a total operational capacity of 93.4 million cubic meters. In 2020, 47 more vessels were delivered by the manufacturers and 40 new orders for tankers. The order book consisted of 147 units of 22.7 million cubic meters by 2020.

- Thus, with the regulations related to sulfur content in the fuel, LNG is projected to become a reliant fuel for maritime activity in the coming years, leading to the increased transportation of LNG bunker fuel through tankers.

North America to Dominate the Market

- The North American region is likely to dominate the LNG bunkering market during the forecast period, with most demand coming from the United States and Canada.

- The key factor driving the LNG bunkering market is the increased LNG demand to reduce the carbon footprint in the shipping industry. Furthermore, LNG is a better alternative fuel, and the governments have been taking initiatives for LNG adaptation.

- In 2020, the International Maritime Organization implemented the reduced sulfur content in bunker fuels to contain the GHG emission from maritime activity. Due to this factor, the US LNG bunkering market is expected to witness growth in the coming years, as LNG is likely to be an economical alternative for marine fuel after IMO's regulation.

- In January 2022, the US shipbuilder Fincantieri Bay Shipbuilding commenced the construction of the largest LNG bunkering barge in the United States. The LNG bunkering barge will consist of a 126.8 m vessel, which will have the capacity for 12,000 m3 of LNG. The expected completion date of the project is 2023.

- Furthermore, in September 2021, Stabilis Solutions Inc. signed a memorandum of understanding (MoU) with Port Isabel Logistical Offshore Terminal in Texas and Louisiana's Cameron Parish Port, Harbor & Terminal District to develop LNG refueling services for ships.

- Similarly, in April 2021, Wison Offshore & Marine (Wison) was awarded the Front-End Engineering Development (FEED) contract for Pilot LNG's Galveston LNG Bunker Port project in Canada, with operations slated to begin in 2024.

- The Canadian government made commitments to significantly reduce greenhouse gas emissions, and the country has an abundant supply of natural gas. Natural gas on combustion produces less greenhouse gas emissions, making LNG a better alternative marine fuel for the Canadian shipping industry.

- Although the initial installation cost of LNG-based vessels is high, the operational cost is lower compared to running old ships with installed scrubbers. Therefore, the North American region is likely to dominate the overall LNG bunkering market during the forecast period.

Liquefied Natural Gas (LNG) Bunkering Industry Overview

The LNG bunkering market is moderately consolidated. The major companies include Shell PLC, Gazprom Neft PJSC, TotalEnergies SE, Gasum Oy, and Engie SA.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD million, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 End User

- 5.1.1 Tanker Fleet

- 5.1.2 Container Fleet

- 5.1.3 Bulk and General Cargo Fleet

- 5.1.4 Ferries and OSV

- 5.1.5 Other End Users

- 5.2 Geography

- 5.2.1 North America

- 5.2.2 Europe

- 5.2.3 Asia-Pacific

- 5.2.4 Middle-East and Africa

- 5.2.5 South America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Shell PLC

- 6.3.2 ENN Energy Holdings Ltd

- 6.3.3 Korea Gas Corporation

- 6.3.4 Harvey Gulf International Marine LLC

- 6.3.5 Gasum Oy

- 6.3.6 Engie SA

- 6.3.7 Gazprom Neft PJSC

- 6.3.8 TotalEnergies SE

- 6.3.9 Naturgy Energy Group SA