|

市场调查报告书

商品编码

1444797

穿戴式感测器 - 市场占有率分析、产业趋势与统计、成长预测(2024 - 2029)Wearable Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

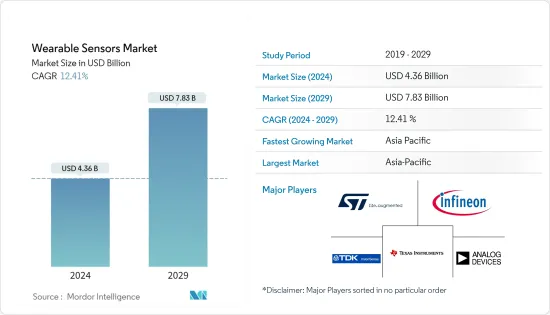

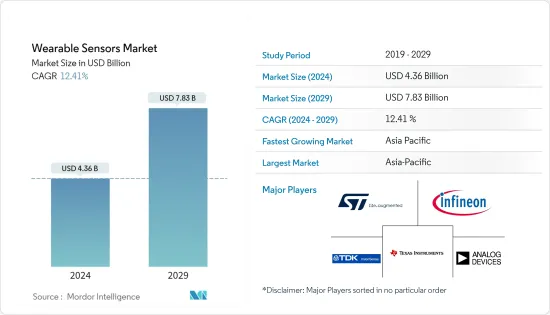

2024年穿戴式感测器市场规模估计为43.6亿美元,预计到2029年将达到78.3亿美元,在预测期内(2024-2029年)CAGR为12.41%。

电子产业的蓬勃发展主要得益于数位化,这推动了对广泛用于自我健康监测应用的可穿戴技术设备的需求。

主要亮点

- 由于消费者对追踪即时运动感测活动(例如计步和步行距离)越来越感兴趣,可穿戴感测器对于穿戴式装置至关重要。使用者可以使用透过分析产生的资料提供的具体结果来定义他们的健身和健康目标。穿戴式科技完全依赖感测器来监控消费者的健康和资料,并帮助做出有意义的决策。随着感测器技术的不断发展,穿戴式装置变得更加智慧并受到消费者的欢迎。

- 消费性电子产品的支出也刺激了穿戴式装置的成长。此外,不断增长的人口、日益城市化和生活方式的改变提高了人们的健康和安全意识。这是刺激健身追踪器、耳戴式耳机和智慧手錶等穿戴式装置成长的主要因素。

- 随着感测器和相关组件的不断小型化,智慧型穿戴装置中先进功能感测器的成长、电池尺寸的改进和效率是推动穿戴式运动感测器市场的关键驱动力。

- 随着消费者对智慧型穿戴装置的兴趣日益浓厚,装置的价格也随着组件成本的上涨而飙升,限制了市场的采用。智慧手錶和健身追踪器的低成本部分引起了消费者的极大关注。然而,随着科技的普及,鞋类、眼镜和紧身衣产品等其他设备价格高昂,采用率较低。目前大多数穿戴式科技的价格都很高,这对市场的采用产生了负面影响。

- COVID-19 大流行对穿戴式感测器市场产生了有利影响,并凸显了利用数位基础设施进行远端患者监测的必要性。由于目前的病毒测试和疫苗需要一段时间才能开发,因此穿戴式感测器可以帮助疾病检测并追踪个人和人群的健康状况。

穿戴式感测器市场趋势

运动和健身领域将占据主要市场份额

- 对健康监测器和健身追踪器的需求不断增长是推动全球穿戴式感测器出货量成长的关键因素。在全球范围内,随着消费者越来越意识到这些设备提供的功能(例如健康和健身的远端监控),对基于感测器的设备的需求正在增加。据思科系统公司称,到 2022 年,北美地区使用可穿戴设备进行的 5G 连接数量最多。北美和亚洲的可穿戴设备合计占 2022 年全球可穿戴 5G 连接数量的 70% 左右。

- 可穿戴性能设备已广泛供一般大众和运动队使用。技术的进步使个人耐力运动员、运动团队和医生能够监测功能性运动、工作负荷和生物识别标记,以提高表现。成长的增加正在推动市场。

- 技术组织在为运动团队开发和宣传穿戴式装置方面取得了重大进展。 Zephyr Technology、Viperpod、Smartlife、miCoach 和 Catapult 等公司正在重塑体育教练的决策方式、体育活动的进行方式以及职业运动员的表现、健康和安全。这些技术也正迅速从专业运动领域进入大众市场。

- 2022 年 6 月,Garmin Ltd 推出了 Forerunner 955 Solar,这是该公司首款具有太阳能充电功能的专用跑步智慧手錶。 Forerunner 955 Solar 配备 Power Glass 太阳能充电镜头,在智慧手錶模式下可为运动员提供长达 20 天的电池续航时间1,在 GPS 模式下为运动员提供长达 49 小时的电池续航时间2。这款智慧手錶配备常亮全彩显示屏,在阳光直射下也易于阅读。响应灵敏的触控屏,加上传统的 5 按钮设计,可以快速存取标准健康功能、更轻鬆的地图控制等。

- 此外,2021 年 9 月,Whoop 为针对运动员的健身穿戴装置筹集了 2 亿美元。 F 轮融资使 Whoop 的总投资达到近 4.05 亿美元。在软银愿景基金 2 的帮助下,该轮融资的估值为 36 亿美元。其他投资者包括 IVP、Cavu Venture Partners、GP Bullhound、Accomplice、NextView Ventures 和 Animal Capital。他们都是前支持者名单的一部分,其中包括国家橄榄球联盟球员协会、杰克·多尔西和一些专业运动员。

亚太地区成长最快

- 多年来,中国一直是晶片行业的重要参与者,目前正在成为晶片小型化领域的领导者。中国晶片小型化的关键驱动力之一是奈米技术等先进製造技术的发展,这些技术能够生产更小、更有效率的晶片。这导致更小、更有效率的晶片产量激增,这对于开发穿戴式感测器至关重要。此外,中国政府还推出了多项措施来促进数位医疗保健和医疗技术的发展,其中包括穿戴式感测器。

- 随着日本近年来数位化程度的不断提高,预计日本穿戴式感测器市场将出现显着成长。这一趋势是由多种因素推动的,包括政府促进数位技术采用的措施、数位原生消费者数量的不断增加,以及提高各行业生产力和效率的需要。

- 印度穿戴式感测器市场正在快速成长,其推动因素包括数位科技的日益普及、人们对健康和健身的日益关注以及对穿戴式装置优势的认识不断提高。

- 过去几年,由于人们对健身和健康的兴趣日益增长、人口老化以及科技和医疗保健的进步,亚太其他地区对穿戴式感测器的需求稳步增长。

- 根据《东协邮报》报道,疗养院不足以满足不断增长的老年人口的需求。这些疗养院提供的服务也不足,影响了生活品质并造成居民的孤立。房地产开发商在为城市居民建造住房时也在考虑老龄化社会的问题,从而为可穿戴感测器提供了一个尚未开发的潜在市场。

穿戴式感测器产业概述

穿戴式感测器市场竞争激烈,主要参与者包括义法半导体、德州仪器、英飞凌科技股份公司、ADI 公司和 InvenSense 公司(TDK 公司)。市场参与者正在采取合作伙伴关係、协作、创新和收购等策略来增强其产品供应并获得可持续的竞争优势。

- 2022 年 12 月 - Analog Devices Inc. 与俄勒冈健康与科学大学 (OHSU) 合作开发一款智慧手錶,可检测关键心理健康指标,以帮助解决青少年日益严重的心理健康危机。根据第一个独特的项目的合作,OHSU 将利用 ADI 的创新技术和产品来应对日益严重的全球精神健康危机,从而拯救、改善和丰富人类的生活。

- 2022 年12 月- 松下工业推出了其着名的Grid-Eye 感测器系列的新成员,该系列具有90° 镜头,可提供更广阔的视野(FoV),并减少覆盖给定区域所需的感测器数量,使人们能够计数和追踪应用程式。 Grid-Eye 90° 将改进用于追踪和统计个人移动的系统以及其他应用程式。注重隐私的设计师对 Grid-Eye 系列的 64 像素解析度表示讚赏。

额外的好处:

- Excel 格式的市场估算 (ME) 表

- 3 个月的分析师支持

目录

第 1 章:简介

- 研究假设和市场定义

- 研究范围

第 2 章:研究方法

第 3 章:执行摘要

第 4 章:市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 竞争激烈程度

- 替代品的威胁

- COVID-19 对产业影响的评估

第 5 章:市场动态

- 市场驱动因素

- 提高健康和健身意识

- 智慧穿戴装置的成长趋势

- 市场挑战

- 与小工具相关的更高成本

第 6 章:市场细分

- 按类型

- 化学和气体

- 压力

- 影像/光学

- 运动

- 其他类型的感测器

- 按应用

- 健康与保健

- 安全监控

- 运动与健身

- 其他应用

- 按地理

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 欧洲其他地区

- 亚太

- 中国

- 日本

- 印度

- 亚太其他地区

- 拉丁美洲

- 中东和非洲

- 北美洲

第 7 章:竞争格局

- 公司简介

- STMicroelectronics NV

- Texas Instruments Incorporated

- Infineon Technologies AG

- Analog Devices Inc.

- InvenSense Inc. (TDK Corporation)

- AMS OSRAM AG

- Panasonic Corporation

- NXP Semiconductors NV

- TE Connectivity Ltd

- Bosch Sensortec GmbH (Robert Bosch GmbH)

第 8 章:投资分析

第 9 章:市场的未来

The Wearable Sensors Market size is estimated at USD 4.36 billion in 2024, and is expected to reach USD 7.83 billion by 2029, growing at a CAGR of 12.41% during the forecast period (2024-2029).

The electronics industry has thrived significantly, primarily due to digitalization, which drives the demand for wearable technology devices widely used for self-health monitoring applications.

Key Highlights

- Wearable sensors are crucial to wearable devices due to consumers' growing interest in tracking real-time motion-sensing activities, such as step counting and walking distance covered. Users can define their goals for fitness and health using the specific results provided by analyzing the generated data. Wearable technology completely relies on sensors to monitor consumers' health and data and helps make meaningful decisions. With evolving sensor technology, wearables are becoming smart and gaining popularity among consumers.

- Spending on consumer electronic products is also stimulating the growth of wearable devices. Further, the growing population's increasing urbanization and changing lifestyle have raised its health and safety awareness. This has been the major factor stimulating the growth of wearable devices, such as fitness trackers, ear wears, and smartwatches.

- With the ongoing miniaturization of sensors and related components, the growth of the advanced function sensors in smart wearables, the improvement in the battery sizes, and efficiency are the key drivers boosting the wearable motion sensors market.

- With consumers' growing propensity toward smart wearables, the prices of devices are also soaring along with the growing cost of components, thus limiting adoption in the market. Smartwatches and fitness trackers have low-cost segments that drive significant attention from consumers. However, with the proliferation of technology, other devices such as footwear, eyewear, and body wear products are highly priced and have lower adoption rates. Most wearable technologies are currently highly-priced, which is negatively impacting adoption in the market.

- The COVID-19 pandemic had a favorable effect on the market for wearable sensors and highlighted the necessity of utilizing digital infrastructure for remote patient monitoring. Wearable sensors could help with disease detection and tracking individual and population health since current viral tests and vaccines take a while to develop.

Wearable Sensors Market Trends

Sports and Fitness Segment to Hold Major Market Share

- The increasing demand for wellness monitors and fitness trackers is a crucial factor driving the growth of shipments of wearable sensors globally. Globally, demand for sensor-based devices is increasing as consumers become more aware of the features that these devices provide, such as remote monitoring of wellness and fitness. According to Cisco Systems, North America had the most 5G connections made using wearable devices in 2022. Together, wearables in North America and Asia accounted for around 70% of the wearable 5G connections worldwide in 2022.

- Wearable performance devices are significantly available to the general population and athletic teams. Advancements in technology have allowed individual endurance athletes, sports teams, and physicians to monitor functional movements, workloads, and biometric markers to increase performance. The increased growth is driving the market.

- Technology organizations are making significant strides in growing and advertising wearable gadgets for athletic teams. Companies like Zephyr Technology, Viperpod, Smartlife, miCoach, and Catapult are remodeling how athletic coaches make decisions, how sports activities are played, and professional sports players' performance, health, and safety. These technologies are also moving rapidly from the professional sports arena into markets for the general public.

- In June 2022, Garmin Ltd introduced the Forerunner 955 Solar, the company's first dedicated running smartwatch featuring solar charging. The Forerunner 955 Solar features a Power Glass solar charging lens, providing athletes with up to 20 days of battery life in smartwatch mode1 and up to 49 hours in GPS mode2. The smartwatch features an always-on, full-color display that is easy to read in direct sunlight. The responsive touchscreen, coupled with the traditional 5-button design, allows fast access to standard health features, easier map control, etc.

- Further, in September 2021, Whoop raised USD 200 million for athlete-focused fitness wearables. The Series F spherical brings Whoop's general investment to nearly USD 405 million. The spherical series, with the aid of using SoftBank's Vision Fund 2, places the valuation at USD 3.6 billion valuations. Additional investors include IVP, Cavu Venture Partners, GP Bullhound, Accomplice, NextView Ventures, and Animal Capital. They have all been part of an extended listing of former backers, together with the National Football League Players Association, Jack Dorsey, and some expert athletes.

Asia-Pacific to Register Fastest Growth

- China has been a significant player in the chip industry for many years, and the country is now emerging as a leader in chip miniaturization. One of the critical drivers of chip miniaturization in China is the development of advanced manufacturing techniques, such as nanotechnology, which enable the production of more minor and more efficient chips. This has led to a surge in the production of smaller and more efficient chips, which are essential for developing wearable sensors. In addition, the Chinese government has launched several initiatives to promote the development of digital healthcare and medical technologies, including wearable sensors.

- Japan is expected to observe significant growth in the wearable sensors market as it has experienced increasing digitization in recent years. This trend has been driven by several factors, including government initiatives to promote the adoption of digital technologies, a growing number of digital-native consumers, and the need to improve productivity and efficiency in various industries.

- The market for wearable sensors is rapidly growing in India, driven by several factors, including the increasing adoption of digital technologies, a growing focus on health and fitness, and a rising awareness of the benefits of wearable devices.

- The demand for wearable sensors in the Rest of Asia-Pacific has steadily increased over the past few years, driven by a growing interest in fitness and wellness, a rising aging population, and advancements in technology and healthcare.

- According to the ASEAN Post, nursing homes are not enough to meet the ever-growing aged population. The services provided at these homes are also inadequate, impacting the quality of life and creating isolation among residents. Property developers are also considering the issue of an aging society when creating housing for urban dwellers, thus presenting an untapped potential market for wearable sensors.

Wearable Sensors Industry Overview

The wearable sensors market is competitive with the presence of major players like STMicroelectronics NV, Texas Instruments Incorporated, Infineon Technologies AG, Analog Devices Inc., and InvenSense Inc. (TDK Corporation). Players in the market are adopting strategies such as partnerships, collaborations, innovations, and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- December 2022 - Analog Devices Inc. collaborated with Oregon Health & Science University (OHSU) to develop a smartwatch that detects key mental health indicators to help address the rising mental health crisis in teens. As per the collaboration on the first and one-of-a-kind project, OHSU would leverage ADI's innovative technology and products for the burgeoning worldwide mental health crisis to save, improve, and enrich human lives.

- December 2022 - Panasonic Industries introduced a new member of its famous Grid-Eye sensor family with a 90° lens that provides a broader field of vision (FoV) and reduces the number of sensors needed to cover a given area, enabling people to count and track applications. Grid-Eye 90° will improve systems built to track and count the movement of individuals as well as other applications. Privacy-conscious designers have praised the Grid-Eye family's 64-pixel resolution.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Assessment of COVID-19 Impact on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Awareness of Health and Fitness

- 5.1.2 Increasing Trend of Smart Wearable Devices

- 5.2 Market Challenges

- 5.2.1 Higher Costs Associated with Gadgets

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Chemical and Gas

- 6.1.2 Pressure

- 6.1.3 Image/Optical

- 6.1.4 Motion

- 6.1.5 Other Types of Sensors

- 6.2 By Application

- 6.2.1 Health and Wellness

- 6.2.2 Safety Monitoring

- 6.2.3 Sports and Fitness

- 6.2.4 Other Applications

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.2.4 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 India

- 6.3.3.4 Rest of Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 STMicroelectronics NV

- 7.1.2 Texas Instruments Incorporated

- 7.1.3 Infineon Technologies AG

- 7.1.4 Analog Devices Inc.

- 7.1.5 InvenSense Inc. (TDK Corporation)

- 7.1.6 AMS OSRAM AG

- 7.1.7 Panasonic Corporation

- 7.1.8 NXP Semiconductors NV

- 7.1.9 TE Connectivity Ltd

- 7.1.10 Bosch Sensortec GmbH (Robert Bosch GmbH)