|

市场调查报告书

商品编码

1444894

聊天机器人:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Chatbot - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

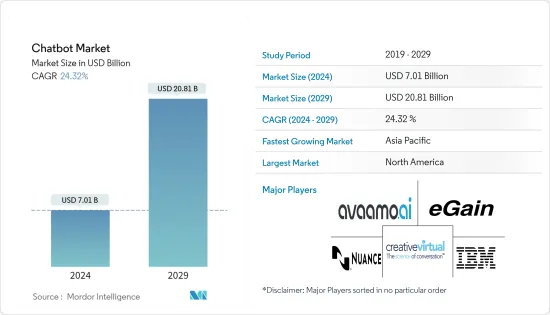

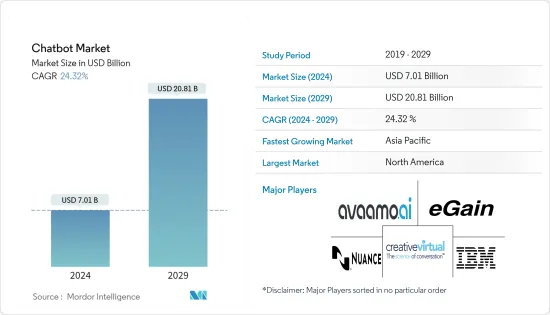

2024年聊天机器人市场规模预计为70.1亿美元,预计到2029年将达到208.1亿美元,在预测期内(2024-2029年)复合年增长率为24.32%。

由于对讯息应用程式的需求不断增长以及世界各地各公司越来越多地采用消费者分析,聊天机器人市场正在不断增长。世界各地的供应商正在透过整合人工智慧和自然语言处理等技术进行重大产品创新,以满足客户需求和市场需求。

主要亮点

- 聊天机器人是一种软体应用程序,它使用人工智慧和自然语言处理来理解人类需求,并以最终用户最小的努力实现所需的结果。他们充当客户体验接触点的虚拟助理。机器人不仅解释用户意图,还处理用户请求并立即返回适当的答案。

- 该市场主要是由讯息应用程式的主导地位不断增强以及对客户分析的需求不断增长所推动的。

- 随着讯息应用程式的使用越来越多,将聊天机器人与讯息应用程式整合可以让您透过客户的首选应用程式联繫他们,从而为您带来更高的投资收益并改善用户体验。此外,讯息应用程式允许聊天机器人保存用户的聊天历史记录,以供将来个性化用户体验并获得可行的见解。

- 根据 Hootsuite 发布的 2022 年 1 月通讯应用程式使用统计数据,WhatsApp 拥有 20 亿月有效用户,其次是微信,拥有 12.63 亿月有效用户,其次是 Facebook Messenger,拥有 12.63 亿月有效用户,共有 9.98 亿人。聊天机器人具有合理模仿人类的能力,使品牌能够在不断发展的通讯平台上更有效地与消费者互动。

- 由于 COVID-19 的爆发,各个组织越来越多地部署聊天机器人来回答客户问题和其他相关资讯。随着各种组织因封锁而采用远端工作,公司严重依赖聊天机器人来减轻客户询问的负担,而客户服务员工的互动却很少。

- 行销和销售团队经常面临着赢得销售和不断改善客户体验的压力。与传统的客户服务相比,聊天机器人每天 24 小时提供服务,即使负责人无法回答客户问题。聊天机器人可以帮助您在不影响工作时间的情况下为客户提供支援。此外,机器人可以轻鬆地同时处理大量请求,而不会过载。因此,企业可以使用聊天机器人来改善消费者体验,因为他们无需等待即可获得正确的资讯。

聊天机器人市场趋势

零售业将显着成长

- 聊天机器人在零售业的主要用途包括产生潜在客户、支援店内购买、发送行动警报和更新以及提供即时服务。

- 网路购物互动过程中,聊天机器人可以根据客户的偏好(例如价格分布、功能以及其他用户的排名和评论)呈现不同的产品选择。零售商可以透过将推荐演算法整合到聊天机器人中来增加收入,让用户找到符合他们口味的产品。

- 客户可能想查看或试用他们在您的网站上看到的产品。用户可以使用聊天机器人搜寻附近的商店并了解其营业时间。客户还可以使用聊天机器人选择他们想要的产品,输入他们的地址和联络讯息,然后下订单。此外,聊天机器人还提供与客户意图相关的即将推出的产品的讯息,并允许客户在此类产品发布之前进行预订。

- 美国等北美国家的零售业已大量采用聊天机器人。例如,Instacart 是一家经营杂货配送和取货服务的美国零售公司,于 2023 年 3 月将 OpenAI 的 ChatGPT 技术添加到其杂货配送应用程式中。 Instacart 成为越来越多的公司(包括 Facebook 和 Snapchat)中最新一家转向人工智慧语言工具来改善客户服务、增强客户体验并加快行销和自动化任务的公司。

预计亚太地区将出现显着成长

- 亚太地区正在经历显着的工业化,增加了市场对聊天机器人的需求。中国、印度、印尼、越南、马来西亚、菲律宾和泰国等新兴国家零售和电子商务业务的扩张刺激了零售商和电子商务企业主对聊天机器人的高需求和大量采用。

- 亚太地区聊天机器人市场在 COVID-19感染疾病期间实现了高速成长。由于该地区 COVID-19感染疾病的增加以及该地区主要经济体政府宣布的封锁,各种组织正在使用聊天机器人来回答患者有关药物和医生咨询的问题,其采用率增加。从远端位置在线。

- 聊天机器人正在转变为对话体验,透过跨不同通讯管道使用自动化和手动解决方案提供即时、个人化的体验。我们正在该地区的市场研究中进行投资,以便为客户提供无缝的解决方案。

- 通讯服务的使用量显着增加,甚至预计在用户数量方面超过社交网站。自然语言处理的重大进步简化了电脑和人类语言之间的互动。这些因素可能会在预测期内推动市场。

聊天机器人产业概述

聊天机器人市场竞争激烈,参与者有大有小。这种碎片化是由于使用开放原始码框架、API 和开发平台开发聊天机器人应用程式相对容易。结果,许多小供应商进入市场,导致市场分散。市场上一些知名的参与者包括 IBM Corporation、eGain Corporation、Nuance Communications、Creative Virtual Ltd 和 Avaamo Inc。

- 2023 年 4 月 - Zendesk 与美国着名人工智慧研究机构 OpenAI 合作。该公司计划为用户提供人工智慧支援的解决方案,以简化客户体验和客户服务员工的票据产生活动。 Zendesk 和 OpenAI 正在合作,透过将专有的 Zendesk 基础模型与 OpenAI 整合来提高其功能。

- 2023 年 1 月 - Kore.ai 在纽约市举行的全国零售联合会展览会 (NRF 2023) 上宣布推出 RetailAssist,这是一种针对零售行业的对话式销售助理解决方案。 RetailAssist 透过开发业务服务自动化、客製化、全通路履约以及 24/7 售前和售后服务和支援方面的专业知识,帮助零售和电子商务公司实现营运现代化。我们支持扩张和转型。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对的强度

- 产业价值链分析

- 评估 COVID-19 对市场的影响

第五章市场动态

- 市场驱动因素

- 通讯应用程式的主导地位日益增强

- 对消费者分析的需求不断增长

- 市场限制因素

- 整合复杂性和资料问题

第六章市场区隔

- 按最终用户产业

- BFSI

- 卫生保健

- 资讯科技/通讯

- 零售

- 旅行和招待

- 其他最终用户产业

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第七章 竞争形势

- 公司简介

- IBM Corporation

- Egain Corporation

- Nuance Communications Inc.(Microsoft Corp.)

- Creative Virtual Ltd

- Avaamo Inc.

- EdgeVerve Systems Limited

- Zendesk Inc.

- Inbenta Holdings Inc.

- Serviceaide Inc.

- Amelia US LLC(Ipsoft Inc.)

- Kore.ai Inc.

- AWS Inc.(Amazon.com Inc.)

- [24]7.ai Inc.

- Artificial Solutions International AB

- Dialogflow(Google)

- LiveChat Inc.

第八章投资分析

第九章市场机会与未来趋势

The Chatbot Market size is estimated at USD 7.01 billion in 2024, and is expected to reach USD 20.81 billion by 2029, growing at a CAGR of 24.32% during the forecast period (2024-2029).

The chatbot market is witnessing growth due to increasing demand for messenger applications and the growing adoption of consumer analytics by various businesses globally. Vendors globally are making significant product innovations by integrating technologies such as AI and NLP to cater to customer needs and market requirements.

Key Highlights

- Chatbots are software applications that utilize artificial intelligence and natural language processing to understand human needs and guide them to the desired outcome with as minimal work by the end user as possible. They act as virtual assistants for customer experience touchpoints. Bots not only interpret the user intent but also process their requests and give prompt relevant answers.

- The market is primarily driven by the rising domination of messenger applications and increasing demand for customer analytics.

- Due to the increasing use of messenger applications, integration of chatbots with messengers yield a higher return on investment as approaching the customers on their preferred application improves user experience. Moreover, messenger applications allow chatbots to save the user's chat history for future purposes to personalize the user experience and gain actionable insights.

- The messaging app usage statistics of January 2022 released by Hootsuite show that WhatsApp has 2,000 million active monthly users, followed by WeChat with 1,263 million monthly active users, followed by Facebook Messenger with 998 million Monthly active users. Chatbots with the ability to reasonably mimic humans allow brands to engage consumers more efficiently on these growing messaging platforms.

- With the outbreak of COVID-19, chatbots have been increasingly deployed by various organizations to respond to customer queries and other related information. As different organizations adopted remote working due to the lockdowns imposed, companies became heavily dependent on chatbots to reduce the burden of customer queries due to the minimal availability of customer service employees.

- Marketing and sales teams are often under pressure to gain sales and constantly improve the customer experience. In contrast to traditional customer service, chatbots are available around the clock, even when sales personnel fail to attend to customer queries. Chatbots help support customers without interruption of working hour limitations. Moreover, bots can easily handle a high number of requests and process them all simultaneously without ever being overworked. Thus, the availability of correct information without waiting helps enterprises boost consumer experience using chatbots.

Chatbot Market Trends

Retail to Have Significant Growth

- The applications of chatbots in the retail industry mainly include generating leads, supporting in-store purchases, sending mobile alerts and updates, and providing instant service.

- During an online shopping interaction, the chatbot can present a variety of product selections based on the customer's preferences, such as price range, features, and other users' rankings and comments. Retailers may enhance income by integrating recommendation algorithms into chatbots, and users can discover products that match their preferences.

- Customers may wish to see or try on a product they saw on the website. The user can use the chatbot to find nearby stores and learn about their opening hours. Customers can also use the chatbot to select their desired product, provide their address and contact information, and place orders. Additionally, the chatbot can provide information on upcoming products related to the customer's intent, allowing them to place pre-orders for such products before they go on sale.

- North American countries like the United States are witnessing significant adoption of chatbots in retail. For instance, in March 2023, a US-based retail firm that operates grocery delivery and pick-up services, Instacart, added OpenAI's ChatGPT technology to its grocery delivery app. Instacart has become the latest of a growing list of companies, including Facebook and Snapchat, that choose the AI language tool to boost customer services, improve customer experience, and fasten their marketing and automated tasks.

Asia-Pacific is Expected to Witness Significant Growth Rates

- Asia-Pacific is witnessing a significant increase in industrialization, increasing the need for chatbots in the market. The increasing retail and e-commerce business in emerging economies, such as China, India, Indonesia, Vietnam, Malaysia, the Philippines, and Thailand, accelerated the high demand and significant adoption of chatbots by retailers and e-commerce business owners.

- The Asia-Pacific chatbot market experienced high growth during the COVID-19 pandemic. Due to the increased number of COVID-19-infected patients in the region and the lockdown announced by the government of significant economies in the region, the deployments of chatbots increased by various organizations to handle patients' queries related to their medication and consultation with doctors online from remote locations.

- Chatbots are being transformed with conversational experiences that deliver immediate, personalized experiences using automated and manual solutions across various messaging channels. The region is witnessing investments in the market studied to provide seamless solutions to its customers.

- There is a significant growth in the usage of messaging services, which is further anticipated to exceed social networking sites in terms of the number of users. A significant development in natural language processing simplifies the interactions between computer and human languages. Factors such as these are likely to drive the market during the forecast period.

Chatbot Industry Overview

The chatbot market is highly competitive, owing to the presence of many small and large players. This fragmentation is due to the relative ease of developing chatbot applications using open-source frameworks, APIs, and development platforms. As a result, numerous small-scale vendors have entered the market, contributing to its fragmentation. Some prominent players in the market are IBM Corporation, eGain Corporation, Nuance Communications, Creative Virtual Ltd, and Avaamo Inc.

- April 2023 - Zendesk partnered with OpenAI, a prominent America-based AI research laboratory. The firm would provide its users with AI-supported solutions to simplify ticket-generating activities for CX and customer service employees. Zendesk and OpenAI are working together to improve the capabilities of Zendesk's foundation models, which are proprietary, by integrating them with OpenAI's.

- January 2023 - Kore.ai declared that the firm would introduce RetailAssist, a conversational sales assistant solution for the retail sector, at the National Federation of Retailers exhibition (NRF 2023) in New York City. RetailAssist helps retail and e-commerce businesses modernize, scale, and transform operations by developing expertise in self-service automation, customization, omnichannel fulfillment, and 24/7 pre-/post-sales service and support.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Domination of Messenger Applications

- 5.1.2 Increasing Demand for Consumer Analytics

- 5.2 Market Restraints

- 5.2.1 Integration Complexities and Data Concerns

6 MARKET SEGMENTATION

- 6.1 By End-user Vertical

- 6.1.1 BFSI

- 6.1.2 Healthcare

- 6.1.3 IT and Telecommunication

- 6.1.4 Retail

- 6.1.5 Travel and Hospitality

- 6.1.6 Other End-user Verticals

- 6.2 By Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia-Pacific

- 6.2.4 Latin America

- 6.2.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 IBM Corporation

- 7.1.2 Egain Corporation

- 7.1.3 Nuance Communications Inc. (Microsoft Corp.)

- 7.1.4 Creative Virtual Ltd

- 7.1.5 Avaamo Inc.

- 7.1.6 EdgeVerve Systems Limited

- 7.1.7 Zendesk Inc.

- 7.1.8 Inbenta Holdings Inc.

- 7.1.9 Serviceaide Inc.

- 7.1.10 Amelia US LLC (Ipsoft Inc.)

- 7.1.11 Kore.ai Inc.

- 7.1.12 AWS Inc. (Amazon.com Inc.)

- 7.1.13 [24]7.ai Inc.

- 7.1.14 Artificial Solutions International AB

- 7.1.15 Dialogflow (Google)

- 7.1.16 LiveChat Inc.