|

市场调查报告书

商品编码

1690738

客户资讯系统:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Customer Information System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

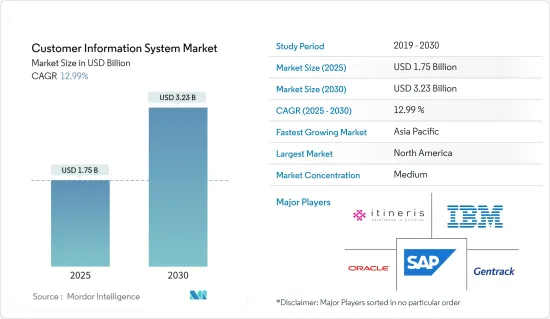

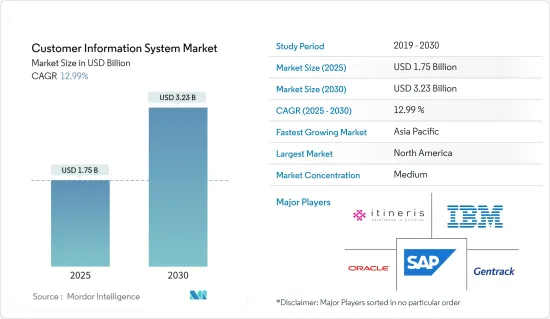

预计 2025 年客户资讯系统市场规模为 17.5 亿美元,到 2030 年将达到 32.3 亿美元,预测期内(2025-2030 年)的复合年增长率为 12.99%。

人们越来越关注客户满意度,因此客户资讯系统 (CIS) 的采用也越来越广泛。公司正在转向能够有效整合 CRM 解决方案与具有使用者定义栏位的动态资料库的解决方案。

关键亮点

- 公司优先提供完整的客户资料历史记录和随附文檔,以减少回应时间并帮助销售负责人更好地了解问题。客户资讯系统是客户满意度的核心,它为销售负责人提供即时客户资料库资料,从而提高服务品质。整合 CIS 解决方案可直接存取有用的客户信息,消除重复资料输入,并允许更快地跟进问题和查询。

- 目前,CIS 解决方案供应商的市场趋势是,从添加到 CRM 软体的文件中提取的资讯(公司名称、地址、订单号码、支援问题及其解决方案等)的整合度不断提高。 CIS 系统将这些文件与提供资料背景的相关资讯(例如提案、合约、通讯和电子邮件)相集成,帮助提供分析支援。

- 数位技术改变了公共产业客户与产品和服务互动的方式。需要一个高效的解决方案和软体包公共产业解决从公共产业计量表到现金的整个流程,并支援多种客户沟通管道,如客服中心、互动式语音应答 (IVR) 等。 CIS 解决方案允许公司将其独特的客户管理需求与其软体无缝集成,而不是强迫他们围绕软体需求进行合理化。

- CIS 储存非公开的公司资讯,例如销售、客户和企业资料资料。系统中的资料外洩可能会对您的业务造成不利影响,可能导致诉讼并对您的品牌声誉和消费者信任造成无法弥补的损害。因此,许多公司对于实施该系统犹豫不决。资料隐私外洩的风险正在限制市场成长并对 CIS 供应商构成重大挑战。

- COVID-19 疫情的爆发促使全部区域的各组织采取一切必要措施,确保其员工和社区的安全。然而,儘管疫情肆虐,跨产业的企业仍必须继续寻求市场机会、实现销售并解决客户问题。此外,随着在家工作规定的实施,企业越来越多地被要求在这种远距工作环境中与客户合作,这对受访市场产生了积极影响。

客户资讯系统(CIS)市场趋势

零售业显着成长

- 零售业的资讯系统解决方案发挥至关重要的作用,执行各种任务,如规划、库存控制、预算控制、客户资讯管理、销售目标管理、POS 交易、物流等。

- 许多公司在开发 CIS 解决方案时都考虑到了经济实惠性,以使其适合各种规模的组织。例如,2023 年 1 月,Info Noble 的解决方案创建了一个 CRM 系统,无论组织规模如何,该系统都成本低、易于设定且具有使用者友好的 UI。

- 消费者资讯管理软体分析现有和潜在客户的资料,帮助企业更了解他们,以维持和发展关係。为了帮助企业推动销售并更了解客户,客户关係管理系统收集零售领域的关键联络资讯、个人资讯、销售历史、客户沟通和客户回馈相关资讯。

- 许多以消费者为中心的企业主要关注遵守当地的隐私法,这可能会以加强其整体资料管理计画为代价。客户资料以及获取和提炼资料的过程最终是 B2C 公司的核心。透过提高客户资料的品质和完整性,企业可以更了解消费者行为,并针对特定细分市场提供新产品和服务,同时实现并维持合规性。

- 为了将资料转化为有意义的知识,公司必须为每个客户连接不同的系统,将来自忠诚度应用程式和相关社交媒体的非结构化和资料资料连结到每个人。企业可以建立全面的资料管理程序,并透过将所有可用的操作与单一消费者联繫起来,为客户获取新的见解。

预计北美将占据主要份额

- 北美是 CIS 软体的主要采用地区之一,被认为是公共产业和能源分析的关键市场之一。该地区的需求主要受到新兴经济体对研发创新和技术进步的高度重视的推动。

- 此外,该地区拥有一批实力雄厚的供应商进入市场。其中包括 IBM 公司、Oracle 公司和 SAP SE。与加拿大相比,美国在需求成长方面发挥重要作用。需求正在成长,尤其是在石油和天然气、精製和发电领域。

- 在过去的几年里,整合系统已经成熟到CIS-as-a-Service(CaaS)成为现实的程度。使用 CaaS 的好处很多,而且立竿见影。与传统实施相比,CaaS 的总拥有成本 (TCO) 至少低 40%,运行成本为每米每月 1-2 美元,具体取决于所需的规模和服务。例如,由美国俄亥俄河谷的一个市政当局运营的 Wipro 正在采用 CaaS,并计划将其作为服务机构提供,以便其他水务公司共用其基础设施。

- 在美国,由于公共重新关注减少无收益水 (NRW),对智慧电錶的需求强劲。智慧收费和洩漏检测的附加好处正在刺激智慧电錶的安装,预计这将推动受调查市场的成长。计量和更新的需求(例如来自智慧电网和智慧系统)使得 CIS 对于计量到现金 (M2C) 流程、新产品创造和供应最佳化至关重要。 CIS 也将能够管理 AMI(进阶计量基础设施)产生的大量资料。

- 在美国,NV Energy 是首批全面部署 AMI 的投资者拥有的公用事业公司之一,已安装了 131 万个智慧电錶。根据美国能源效率经济委员会 (ACEEE) 的说法,它是少数几个能够充分发挥 AMI资料潜力的主要 IOU 之一。最广泛使用的是透过企业资料分析和非行为需求面管理 (DSM) 计划进行的 Bidgley 线上家庭能源审核。

客户资讯系统(CIS)产业概览

客户资讯系统市场呈现半静态状态,只有少数参与企业拥有主要市场占有率。拥有较大市场份额的大公司正致力于扩大跨地区的基本客群。这些公司正在利用策略创新和协作倡议来扩大市场占有率并提高盈利。

2023 年 1 月,能源公司 AGL Energy (AGL) 与微软合作,提供基于云端的资料平台,使 AGL 能够根据澳洲严格的消费者资料权利 (CDR) 法律为其客户提供消费者资料权利服务。这将使 AGL 能够为其客户提供符合澳洲严格的消费者资料权利 (CDR) 法律的消费者资料权利服务。

2023 年 1 月,全球自然健康和鞋类公司 VIVOBAREFOOT 将与 Arvato CRM Solutions伙伴关係,以改善客户服务并支持其在英国和国际上的发展。根据协议,Arvato 将与该公司合作开发多通路顾客关怀解决方案,该解决方案可随着品牌扩张而扩展,确保消费者继续收到对其咨询的快速、友好的回应。

2022 年 12 月,服务于纽约和 PJM 市场的能源供应商 Ameripro Energy Corp. 与为公共产业能源企业提供云端基础的客户体验和软体即服务 (SaaS) 解决方案的领先供应商 VertexOne 宣布两家公司展开合作。 VertexOne 的客户资讯系统 (CIS) 平台 VXretail 已被 Ameripro Energy Corp. 选择用于 EDI 交易管理,而其客户服务、发票和市场异常响应平台 VXexchange 将负责客户服务。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 工业影响评估

第五章市场动态

- 市场驱动因素

- 全球公共产业消费不断成长

- 云端运算和物联网技术的兴起

- 市场问题

- 严格的政府资料法规

第六章市场区隔

- 按部署

- 云

- 本地

- 按组件

- 按解决方案

- 按服务

- 按最终用户

- CRM 的最终用户

- BFSI

- 零售

- 通讯

- CIS 最终用户

- 用水和污水管理

- 能源公共产业

- 其他的

- CRM 的最终用户

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第七章竞争格局

- 公司简介

- Oracle Corporation

- Fluentgrid Limited

- IBM Corporation

- Wipro Limited

- Cayenta CIS

- Gentrack Group Limited

- SAP SE

- Itineris NV

- Hydro Comp Enterprises Ltd

- Open International LLC

第八章投资分析

第九章:未来展望

The Customer Information System Market size is estimated at USD 1.75 billion in 2025, and is expected to reach USD 3.23 billion by 2030, at a CAGR of 12.99% during the forecast period (2025-2030).

The growing adoption of a Customer Information System (CIS) is driven by the increasing focus on customer satisfaction. Companies are moving toward a suite of solutions that can effectively integrate CRM solutions into a dynamic database with user-defined fields.

Key Highlights

- Companies have prioritized decreasing customer response times and providing sales personnel with a full history of the customer data and accompanying documents to help them better understand the problem. Central to the customer satisfaction theme, Customer Information Systems equip sales personnel with real-time customer database data, which leads to an enhanced quality of service. The follow-up of issues and queries becomes faster with the integration of CIS solutions as the scope of duplicate data entries is eliminated with direct access to useful customer information.

- The current market trends of vendors offering CIS solutions can be characterized by the increasing integration of information extracted from documents added to the CRM software, including company names and addresses, order numbers, and support issues and their resolution. The CIS systems help with providing analytical support by integrating these documents with related information like proposals, contracts, correspondence, and emails that provide the context for that data.

- Digital technology has changed the way utility customers interact with products and services. There is a need for highly efficient solutions and software packages to resolve this utility meter-to-cash utility meter-to-cash process and enable several client communications channels, including call centers, interactive voice responses (IVRs), and others. CIS solutions allow companies to seamlessly integrate their unique customer management needs with the software rather than compelling companies to streamline according to the software needs.

- CIS stores the companies' private information, including sales, customer, and corporate intelligence data. A system data breach could be detrimental to the company, resulting in lawsuits or irrevocable harm to its brand's reputation and consumer trust. Many companies are hesitant to adopt the system as a result. The risk of data privacy violations is restricting market growth and providing a significant challenge for CIS vendors.

- The outbreak of COVID-19 prompted organizations across the region to undertake all the necessary steps to ensure the safety of their employees and the community. However, organizations operating in multiple verticals must pursue market opportunities, close sales, and resolve customer issues despite the pandemic. Also, following the mandate of working from home, companies have increasingly been required to collaborate with their clients in this remote working environment, which has created a positive impact on the studied market.

Customer Information System (CIS) Market Trends

Retail to Witness Significant Growth

- Information system solutions in the retail sector play a vital role and perform a variety of tasks, including planning, inventory control, budgeting, maintaining customer information and sales targets management, as well as point-of-sale transactions and logistics.

- Many companies are developing their CIS solutions suitable for organizations of any size with a consideration of affordable pricing. For instance, in January 2023, Info Noble's solution made a CRM system at a low cost, with ease of setup, and with a user-friendly UI for organizations irrespective of their sizes.

- Consumer information management software analyses data about existing and potential customers to help a firm better understand the client to keep and grow customer relationships. To assist businesses in driving sales and obtaining a better understanding of their customers, customer relationship management systems collect information related to contact details, personal information, sales history, customer communication, and customer feedback, which are important in the retail sector.

- Many consumer-oriented businesses are primarily concerned with adhering to local privacy laws, which may come at the expense of enhancing their entire data management program. Customer data and the process of acquiring and improving that data are ultimately at the heart of B2C firms. Organizations may better understand consumers' behaviors and target new products and services to specific segments by enhancing the quality and completeness of their customer data, all while achieving and maintaining compliance.

- To turn the data into meaningful knowledge, the company must link the various systems together by the customer and associate both unstructured and structured data from the loyalty app and any related social media with each individual. A business can establish a comprehensive data management program to incorporate fresh insights for its customers by tying all available actions to a single consumer, which would be beneficial for retail businesses and driving the adoption of CIS in the retail sector.

North America is Expected to Hold Major Share

- North America is one of the major adopters of CIS software and is considered to be one of the leading markets for utility and energy analytics. A higher focus on innovations mainly drives the demand in the region through R&D and technology advancement in developed economies.

- Moreover, the region has a strong foothold of vendors in the market. Some of them include IBM Corporation, Oracle Corporation, and SAP SE, among others. The United States plays a crucial role in increasing the demand when compared to Canada. The country has increased demand, especially from oil and gas, refining, and power generation segments.

- Over the last few years, integrated systems have matured to the point where CIS as a Service (CaaS) has become a reality. The advantages of using CIS as a Service are varied and immediate. The TCO (total cost of ownership) for CaaS, as compared with traditional implementations, is at least 40% lower, and the run cost can be between USD 1 and USD 2 per meter per month, depending on the size and services needed. For example, Wipro, a municipally owned and operated utility in the Ohio Valley of the USA, has adopted CaaS and planning to offer it in the form of a Service Bureau that allows other water utilities to share the infrastructure.

- In the United States, there is a huge demand for smart metering due to the renewed focus on the reduction of NRW by the utilities. The added advantages of smart billing and leak detection have spurred the installation of smart meters, which is expected to drive the growth of the studied market. With metering and newer needs (from smart grids and smart systems, etc.), CIS has become essential to the meter-to-cash (M2C) process, to the creation of new products, and to optimizing supply. Also, CIS can be able to manage the large volume of data generated by AMI (Advanced Metering Infrastructure).

- In the United States, NV Energy was one of the first investor-owned utilities (IOUs) to fully roll out AMI with its 1,310,000 smart meter deployment. It is one of the few major IOUs working with most of AMI data's potential, according to the American Council for an Energy-Efficient Economy (ACEEE). The widest use is for online home energy audits through Bidgley's enterprise data analytics and non-behavioral demand-side management (DSM) programs.

Customer Information System (CIS) Industry Overview

The market for the customer information system is semi-consolidated, as few players own a major market share. The major players with a prominent share in the market are focusing on expanding their customer base across regions. These companies are leveraging strategic innovations and collaborative initiatives to increase their market share and increase their profitability.

In January 2023, Energy company AGL Energy (AGL) partnered with Microsoft to offer a cloud-powered data platform that enables AGL to provide Consumer Data Rights services to clients in accordance with the strict Consumer Data Rights (CDR) legislation of Australia. Consumers would have more leverage as a result of this move, and fascinating additional opportunities would arise for AGL to offer distinctive customer experiences.

In January 2023, The global natural health and footwear company VIVOBAREFOOT would benefit from a partnership with Arvato CRM Solutions that would improve customer service and support its growth in the UK and internationally. In this agreement, Arvato would collaborate with the company to develop multichannel customer care solutions that scale with the brand as it expands and continue to offer prompt, helpful responses to consumer inquiries.

In December 2022, Ameripro Energy Corp., an energy supplier entering the New York and PJM markets, and VertexOne, the leading provider of cloud-based, customer experience, software-as-a-service (SaaS) solutions for the utility and energy business, announced their partnerships. The customer information system (CIS) platform VXretail from VertexOne has been selected by Ameripro Energy Corp. to conduct EDI transaction management, while VXexchange, a platform for customer service, billing, and market exceptions, would handle customer service.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Global Utility Consumption

- 5.1.2 Emerging Cloud and IoT Technologies

- 5.2 Market Challenges

- 5.2.1 Stringent Government Data Regulations

6 MARKET SEGMENTATION

- 6.1 By Deployment

- 6.1.1 Cloud

- 6.1.2 On-Premises

- 6.2 By Component

- 6.2.1 Solution

- 6.2.2 Services

- 6.3 By End-User

- 6.3.1 End-User by CRM

- 6.3.1.1 BFSI

- 6.3.1.2 Retail

- 6.3.1.3 Telecommunications

- 6.3.2 End-User by CIS

- 6.3.2.1 Water and Wastewater Management

- 6.3.2.2 Energy and Utility

- 6.3.2.3 Other End-Users

- 6.3.1 End-User by CRM

- 6.4 By Region

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Oracle Corporation

- 7.1.2 Fluentgrid Limited

- 7.1.3 IBM Corporation

- 7.1.4 Wipro Limited

- 7.1.5 Cayenta CIS

- 7.1.6 Gentrack Group Limited

- 7.1.7 SAP SE

- 7.1.8 Itineris NV

- 7.1.9 Hydro Comp Enterprises Ltd

- 7.1.10 Open International LLC