|

市场调查报告书

商品编码

1519933

重力压铸:市场占有率分析、产业趋势/统计、成长预测(2024-2029)Gravity Die Casting - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

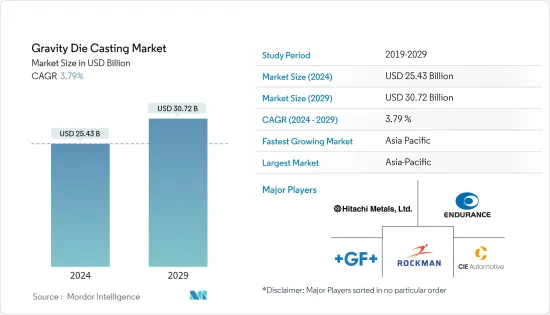

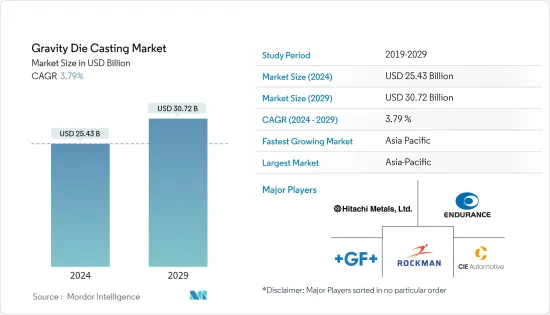

2024年重力压铸市场规模为254.3亿美元,预计到2029年将达到307.2亿美元,在预测期内(2024-2029年)复合年增长率为3.79%。

重力压铸是最古老的压铸方法之一。这种压铸方法用于製造尺寸精确、形状精细、表面光滑或有纹理表面的金属零件。重力铸造的基本优点是生产速度快。可重复使用的模具使我们每天能够生产数百个铸件。高精度零件可降低加工成本,高表面光洁度可节省精加工成本。

由于其高导热性,在预测期内,电气和电子行业对铝压铸件的需求可能会增加。由于汽车业对轻质金属的偏好和汽车销售的增加,压铸机械的需求量很大。

从长远来看,市场预计将受益于可再生能源发电的开拓以及消费性电子、电脑和通讯产业的快速扩张。

随着新技术的发展,汽车零件在最近的趋势中不断进步和创新。尤其是使用轻质材料生产汽车零件正在引起全国的关注。此外,由于 CAFE 标准和 EPA(美国环保署)减少车辆排放气体和提高燃油效率的政策,汽车製造商正在使用非铁金属来减轻车辆重量。因此,过去的汽车市场越来越多地使用压铸零件来减轻重量。

重力铸造市场趋势

汽车产业可望获得主要市场占有率

重力压铸是製造一些高精度汽车零件的标准製程。该工艺非常适合引擎相关零件等零件,因为永久模具中熔体的快速定向硬化可产生具有有吸引力的机械性能的精细緻密结构。

然而,从内燃机到电动车等替代引擎的趋势对压铸零件的需求产生了不可避免的影响。例如,内燃机有大约 200 个铸件,但电动传动系统只需要大约 25 个,即十分之一。

二氧化碳排放的减少、政府推动汽车轻量化的倡议以及汽车压铸机技术的快速发展等因素预计将刺激市场需求。

在生态学和经济要求的推动下,全球汽车产业正在创造新的白色车身设计,其中结构压铸件有助于显着减轻重量。此外,由于铸件功能的融入、新的铝合金概念和新的零件设计趋势,压铸结构件的产量进一步增加。此外,乘用车和商用车的销售量都在增加,预计将支持市场成长。

汽车工业消耗了全球 60% 以上的铸件产品。因此,考虑到与汽车和运输行业相关的成长机会,市场上的几家公司正在专注于扩大其製造工厂。例如

- 2022 年 11 月:通用汽车宣布将投资 4,500 万美元扩建位于印第安纳州贝德福德的铝压铸造厂,为底特律都会区的两家生产电动车的组装厂供货。

- 2022 年 8 月:Stellantis 宣布向 Kokomo 铸造厂投资 1,400 万美元。用于将现有压铸机和电池改造为 1.6 升 i-4 涡轮增压装置的铸造厂投资将完成,该装置具有直接燃油喷射和混合电动车 (HEV) 应用的灵活性。

与砂型铸造等其他方法相比,此方法还提供更好的公差和表面光洁度。因此,这是一项经过验证的技术,可生产 1,000 至 10,000 件的相当大批量的产品。然而,模具成本各不相同,通常高于砂型铸造方法。

因此,製造商预计将根据不断变化的市场环境调整其产品组合,预计将在预测期内推动市场发展。

亚太地区主导市场

由于製造业和基础设施发展投资增加,亚太地区正在经历快速工业化。预计该地区航太、国防和建筑等行业将显着增长,这将为重力压铸市场创造新的机会。

由于多种因素,包括对轻质部件的需求增加、可支配收入的增加以及对能源效率和永续性。

亚太地区的重力压铸市场很大程度上是由全球最大的汽车市场中国推动的。由于政府鼓励使用轻质和节能部件,预计重力压铸在中国的需求将会很高。此外,电动车在中国的普及预计将为市场打开新的大门。

可支配收入的增加和对燃油效率的日益关注正在推动亚太地区另一个重要市场印度对轻质零件的需求。随着印度政府鼓励使用轻质且节能的零件,预计印度对重力压铸的需求将会增加。此外,市场预计将受益于印度电动车的日益普及。

汽车的高需求也导致了更多目标商标产品製造商和汽车零件製造商的出现。因此,印度在汽车和汽车零件方面发展了专业知识,增加了对印度製造的压铸汽车零件的需求并促进了市场成长。

根据工业製造商协会(ACMA)预测,到2026年,印度汽车零件出口预计将达到300亿美元。预计到2026年,汽车零件产业的收益将达到2,000亿美元。

该地区正在经历重大的技术进步,预计将增加重力压铸的使用。材料科学、设计软体和自动化技术的进步预计将提高重力压铸的效率和质量,使其对各个行业更具吸引力。

重力铸造产业概况

市场的主要企业包括 Rockman Industries、Endurance Group、Minda Corporation、Hitachi Metals、Georg Fischer Limited、MAN Group (Alucast)、Zollern GmbH、Esko Die Casting 和 CIE Automotive。市场主要企业正在扩大产能以满足不断增长的需求。例如

- 2023 年 6 月,中国汽车零件供应商 Asiaway Automotive Components 在墨西哥圣路易斯波托西投资 4,140 万美元的新厂第一期工程运作。这层级层级生产铝,组装生产锌汽车零件。

- 2023年9月,Rox Motor Tech与北京汽车股份有限公司共同创立的汽车品牌Polestones宣布获得山东潇夏先锋集团10亿美元战略投资。这笔资金将用于全铝车身研发、整合压铸技术以及短期智慧製造工厂计划。

- 2022 年 5 月:GF 位于沙夫豪森(瑞士)的分店GF Casting Solutions 宣布将利用其经验来改进电动车零件 (EV) 的开发。透过从设计和概念的早期阶段与客户合作,公司能够创造出满足客户要求的产品。在联合开发阶段,GF Casting Solutions 为两款雷诺混合型打造了轻质晶粒电池外壳。机壳由铝合金製成,可实现出色的功能整合和冷却迴路整合。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场驱动因素

- 汽车产业的成长推动重力压铸市场的需求

- 市场限制因素

- 高加工成本可能阻碍市场扩张

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 目的

- 车

- 电力/电子

- 工业用途

- 其他用途

- 原料

- 铝

- 锌

- 地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 德国

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 其他亚太地区

- 世界其他地区

- 南美洲

- 中东/非洲

- 北美洲

第六章 竞争状况

- 供应商市场占有率

- 公司简介

- Rockman Industries

- Endurance Group

- Minda Corporation

- Hitachi Metals

- Georg Fischer Limited

- MAN Group(Alucast)

- Zollern GmbH

- Harrison Castings

- Esko Die Casting

- CIE Automotive

第七章 市场机会及未来趋势

- 电动车的扩张

The Gravity Die Casting Market size is estimated at USD 25.43 billion in 2024, and is expected to reach USD 30.72 billion by 2029, growing at a CAGR of 3.79% during the forecast period (2024-2029).

Gravity-die casting is one of the oldest methods of die casting. This die-casting process is used to create accurately dimensioned, finely defined, smooth, or textured surface metal parts. The fundamental benefit of gravity die casting is its fast-manufacturing speed. The reusable die tooling enables the production of hundreds of castings per day. High-definition parts reduce machining costs, while higher surface finish saves finishing expenses.

Due to its high thermal conductivity, the electrical and electronics industry is likely to see an increase in demand for aluminum die-casting parts during the forecast period. Die-casting machinery is in high demand as a result of the automotive industry's growing preference for lightweight metals and rising automobile sales.

Over the long term, the market is anticipated to benefit from the development of renewable power generation and the rapid expansion of the consumer electronics, computers, and communication industries.

With the development of new technologies, automotive parts have seen advancement and innovation in recent years. Among them, auto component manufacturing using lightweight materials has received national attention. In addition, automakers are using lightweight non-ferrous metals to reduce the weight of vehicles as a result of CAFE standards and EPA policies to reduce automobile emissions and improve fuel economy. As a result, the former automotive market is witnessing a significant boost from the use of die-cast parts to reduce weight.

Gravity Die Casting Market Trends

Automotive Industry is Expected Capture Major Market Share

Gravity die casting is a standard process for manufacturing some high-integrity automotive parts. This process produces fine-grained and dense structures with attractive mechanical properties, due to the fast and oriented hardening of the melts in permanent metal molds, which makes it ideal for components like engine-related parts.

But the trend away from the combustion engine toward alternatives like electric powered vehicles has inevitable effects on the demand for die-casted parts. For instance, while a combustion engine contains approximately 200 casted parts, only around 25, i.e., one tenth of them, are needed for an electrical drivetrain.

Factors such as lowering carbon emissions increased government initiatives to promote the usage of lighter vehicles, and rapid development of technology in automotive die-casting machines are anticipated to boost demand in the market.

Driven by ecological and economic requirements, the global automotive industry has been creating new body-in-white designs in which structural die-cast components help significantly reduce weight. Moreover, the production of die-cast structural components has increased even more due to incorporating functions into the castings, new aluminum alloy concepts, and new component design trends. Moreover, growing vehicle sales, not only in the passenger car segment but also for commercial vehicles, are expected to support the market's growth.

The automotive industry consumes over 60% of the cast products used worldwide. Thereby, considering the growth opportunities associated with the automobile and transportation industry, several players in the market are focusing on manufacturing plant expansion. For instance,

- November, 2022: General Motors announced an investment of USD 45 million in expanding its aluminum die-casting foundry in Bedford, Indiana, to feed two metro Detroit assembly plants that will produce electric vehicles.

- August, 2022: Stellantis announced an investment of USD 14 million in the Kokomo casting plant. The investment at the Casting Plant will be used to convert existing die-cast machines and cells for 1.6-liter, I-4 turbocharged units with direct fuel injection and flexibility for hybrid-electric vehicle (HEV) applications.

This method also gives better tolerances and surface finish than other methods, like sand casting. Hence, it represents a proven technology to produce fairly large batch quantities of the order of 1,000 to 10,000. But tooling costs vary and are generally higher than the sand-casting method.

Hence, manufacturers are expected to revamp their portfolio to the changing market conditions, which is expected to drive the market over the forecast period.

Asia-Pacific Dominates the Market

The Asia-Pacific region is witnessing rapid industrialization, driven by increasing investments in manufacturing and infrastructure development. This is expected to create new opportunities for the gravity die-casting market, as several industries such as aerospace, defense, and construction are expected to witness significant growth in the region.

The Asia-Pacific region is the biggest and fastest-growing market for gravity die casting because of a number of factors, like the growing demand for lightweight components, rising disposable incomes, and a growing emphasis on energy efficiency and sustainability.

The gravity die-casting market in the Asia-Pacific region is largely driven by China, the largest automotive market in the world. Gravity die-casting is expected to be in high demand in China as a result of the government's efforts to encourage the use of lightweight and energy-efficient components. Also, the rising reception of electric vehicles in China is supposed to set out new open doors for the market.

Due to rising disposable incomes and an increasing focus on fuel efficiency, India, another significant market in the Asia-Pacific region, is experiencing a growing demand for lightweight components. Gravity die casting is expected to be in high demand in India as a result of the government's efforts to encourage the use of lightweight and energy-efficient components. Additionally, the market is anticipated to benefit from the rising popularity of electric vehicles in India.

Significant demand for automobiles also led to the emergence of more original equipment and auto components manufacturers. As a result, India developed expertise in automobiles and auto components, which helped boost the demand for Indian die-casted auto components, propelling the market growth.

As per the Automobile Component Manufacturers Association (ACMA) forecast, auto component exports from India is expected to reach USD 30 Billion by 2026. The auto component industry is projected to record USD 200 Billion in revenue by 2026.

The region is seeing substantial technological advancements, which are projected to increase the usage of gravity die casting. Developments in materials science, design software, and automation technologies are predicted to increase gravity die casting efficiency and quality, making it more appealing to a variety of sectors.

Gravity Die Casting Industry Overview

Some of the major players in the market include Rockman Industries, Endurance Group, Minda Corporation, Hitachi Metals, Georg Fischer Limited, MAN Group (Alucast), Zollern GmbH, , Esko Die Casting, and CIE Automotive. Key players in the market are expanding their production capacity to cater to the increased demand. For instance,

- June 2023, Chinese automotive supplier Asiaway Automotive Components inaugurated the first phase of its new plant in San Luis Potosi, Mexico with an investment of USD 41.4 million. The Tier 2 supplier produces aluminum and zinc automotive components using the die-casting process (HPDC 125T - 6600T), CNC, machining, cleaning, testing, assembly, warehousing and distribution to various Tier 1 companies in San Luis Potosi and throughout northern Mexico.

- September 2023, Polestones, an auto brand jointly established by Rox Motor Tech Co., Ltd. and Beijing Automobile Works, announced that it received a USD 1 billion strategic investment from Shandong Weiqiao Pioneering Group. The funds will be used for all-aluminum vehicle body R&D, integrated die casting technologies, and a short-process intelligent manufacturing plant project.

- May, 2022: GF Casting Solutions, a branch of GF, Schaffhausen (Switzerland), said that it will use its experience to improve the development of electric car parts and components (EVs). The company is able to create goods that satisfy the demands of its clients by cooperating with them from the early design and conceptual phases. In a cooperative development phase, GF Casting Solutions created a lightweight die-cast battery housing for Renault's two hybrid models. The enclosure is built of an aluminum alloy, which allows for great functional integration and an integrated cooling circuit.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Growth of the Automotive Industry to Drive Demand in the Gravity Die Casting Market

- 4.2 Market Restraints

- 4.2.1 High Processing Cost May Hamper Market Expansion

- 4.3 Industry Attractiveness - Porter's Five Force Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Application

- 5.1.1 Automotive

- 5.1.2 Electrical and Electronics

- 5.1.3 Industrial Applications

- 5.1.4 Other Appplications

- 5.2 Raw Material

- 5.2.1 Aluminum

- 5.2.2 Zinc

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Germany

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 South Korea

- 5.3.3.6 Rest of Asia-Pacific

- 5.3.4 Rest of the World

- 5.3.4.1 South America

- 5.3.4.2 Middle East & Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Rockman Industries

- 6.2.2 Endurance Group

- 6.2.3 Minda Corporation

- 6.2.4 Hitachi Metals

- 6.2.5 Georg Fischer Limited

- 6.2.6 MAN Group (Alucast

- 6.2.7 Zollern GmbH

- 6.2.8 Harrison Castings

- 6.2.9 Esko Die Casting

- 6.2.10 CIE Automotive

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Adoption of Electric Vehicles