|

市场调查报告书

商品编码

1521653

全球休閒车金融市场:市场占有率分析、产业趋势/统计、成长预测(2024-2029)Recreational Vehicle Financing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

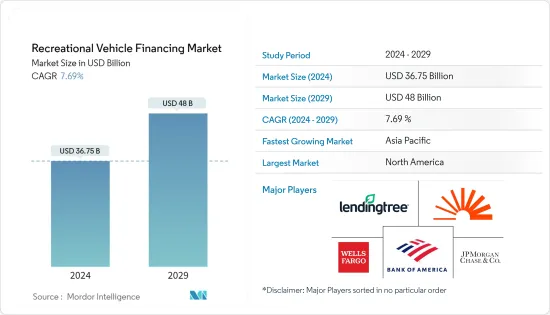

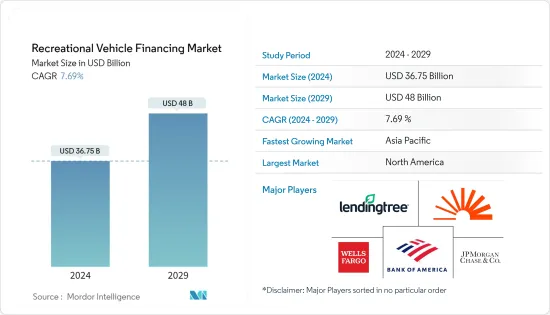

预计2024年全球休閒车金融市场规模将达367.5亿美元,2024年至2029年复合年增长率为7.69%,2029年将达480亿美元。

休閒车金融市场表现出适度的整合,由 LendingTree、LightStream、富国银行、美国银行、大通银行(摩根大通)等几家大型全球参与者主导。这些公司透过广泛的产品组合、技术进步和策略联盟在这个市场上建立了据点。

近年来,由于房车出行的日益普及、房车技术的进步以及创新融资解决方案的出现等因素,房车金融领域经历了显着的增长。据休閒车行业协会称,仅在美国,休閒车产业每年就产生 500 亿美元的经济影响。目前,该行业已有超过23,000家公司,创造了约45,000个直接就业机会和30亿美元的直接工资。因此,房车金融业已成为更广泛的房车市场不可或缺的一部分。

休閒车融资需求增加有几个驱动因素。首先,COVID-19 大流行已将消费者的偏好转向国内旅行和户外活动,以寻求比国际旅行更安全的替代方案。此外,休閒车技术的进步正在创造出更省油、更环保、技术更先进的车辆,这些车辆对越来越多的人越来越有吸引力。此外,零工经济和远距工作的兴起导致更多的人延长假期,增加了对休閒车作为舒适灵活的住宿选择的需求。最后,我们用户友好的线上平台和融资选项使潜在买家可以更轻鬆地研究、比较和确保为其所需的休閒车融资。

房车金融市场面临许多挑战与机会。主要挑战之一是休閒车产业的周期性,它受到经济波动和消费者情绪的影响。在景气衰退时期,由于潜在买家对支出变得更加谨慎,房车销售和融资可能会下降。但这也是休閒车金融公司提供有吸引力的优惠和奖励以鼓励在此期间购买的机会。很快,促进环保休閒车和永续实践的创新融资方案就可以克服这些挑战,并为产业创造更永续的未来做出贡献。

随着市场不断发展以满足不断变化的消费者需求,休閒车金融的未来看起来充满希望。此外,休閒车中智慧技术和连接功能的日益整合将推动对这些高科技车辆量身定制的先进融资解决方案的需求。最后,对永续性的持续关注将导致绿色融资选择的增加,支持绿色休閒车模式的开发,并促进负责任的旅行实践。总体而言,休閒车融资市场预计将继续成为整个休閒车产业充满活力和不可或缺的一部分。

休閒车金融市场趋势

由于消费者偏好的变化,市场需求增加

人们对休閒车 (RV) 融资的兴趣增加,很大程度上是因为自 COVID-19 大流行以来,人们越来越关注国内旅行和户外活动。消费行为的这些变化增加了对房车作为度假和旅行舒适便捷的住宿设施的需求。

有几个因素促成了这一变化。首先,健康和安全问题导致国际旅行吸引力下降,国内度假需求激增。房车度假比传统饭店度假便宜60%以上,因此人们购买房车主要是为了家庭露营和节省成本。流行的房车类型包括旅行拖车、A 型旅居车、第五轮和公园型休閒车 (PMRV)。在美国,五分之一的房车是旅行拖车,第五轮越来越受欢迎。

此外,随着人们寻求享受大自然和逃离家园,这种流行病激发了人们对户外活动和体验的兴趣。房车为探索国家公园、风景优美的路线和各种户外景点提供了舒适的基地。此外,消费者对房车融资偏好的变化是由与家人和朋友重新联繫的愿望所驱动的。因为房车为家人和朋友一起旅行提供了独特的机会,同时保持安全和私密的环境。

一个家庭的平均房车贷款额超过 45,000 美元。在美国,有4000万人参加房车露营,其中美国是最大的市场参与企业。千禧世代越来越多地参与房车露营,占露营者的 38%,但 X 世代和婴儿潮世代仍然主导着市场。拥有房车的典型家庭的收入约为 62,000 美元,每年平均使用房车四週。自2001年以来,美国的房车拥有量增加了16%,与1980年相比,现在有60%的家庭拥有房车。

最后,远距工作的兴起使许多人能够享受更长的假期并在不同地点工作。房车为这些远距工作者提供了便捷舒适的生活空间,让他们在探索新目的地的同时保持工作与生活的平衡。总而言之,消费者对休閒车融资偏好的变化是由健康和安全考虑、灵活性、可负担性、对户外体验的渴望以及与家人和朋友联繫的能力等因素驱动的,所有这些都使得房车越来越住宿。

预计亚太地区在预测期内将实现最高成长

预计休閒车(RV)金融市场在预测期内将成为亚太地区成长最快的市场。这一增长归因于多种因素,包括可支配收入的增加、中阶人口的成长以及国内旅游业的成长。随着亚太地区经济持续成长,可支配所得不断增加。可支配收入的增加使更多人能够购买休閒车,从而增加了休閒车融资的需求。 2022年,亚洲家庭可支配所得将达21.2兆美元,高于2019年(19.4兆美元)。因此,金融机构和贷方正在提供各种融资选择来服务这个不断增长的细分市场。

亚太地区的中阶正在迅速扩大,这群人越来越多地寻求休閒活动,包括房车旅行。随着越来越多的中阶投资房车,房车融资的需求也不断增加,推动了该地区房车融资市场的成长。除了便利、节省成本和健康问题之外,亚太地区的国内旅游业也出现了显着成长。房车为这些国内旅客提供了舒适灵活的住宿选择,使他们能够按照自己的步调探索各种目的地。国内旅游业的成长导致对休閒车的需求增加,反过来又增加了休閒车的融资。

在日本等国家,人口老化也推动了对提供舒适便捷的旅行和观光的房车的需求。日本人口正在老化,超过28%的人年龄在65岁以上。该人群越来越多地寻求露营和观光等休閒活动。大篷车和房车为老年人提供了一种舒适便捷的方式来旅行和探索日本美丽的风景。根据日本房车协会预测,2022年日本露营车的年总销售额将达到约762.5亿日圆。这说明房车金融成为人们更好的选择。

此外,亚太地区各国政府正在透过开发和改善房车公园和露营地的基础设施来促进国内旅游业。随着越来越多的人投资房车来探索自己的国家,这些倡议为房车金融市场的发展创造了有利的环境。在印度,政府计划允许私人参与者在森林、堡垒基地、山站和水坝等缓衝区的私人和国有土地上建立大篷车公园。房车公园也可以建在马哈拉斯特拉邦旅游发展公司(MTDC)住宿设施和农业旅游中心附近的空地上。

随着亚太地区越来越多的人认识到房车旅行的好处,包括节省成本、灵活性和与自然的联繫,对房车和房车融资的需求预计将增长。房车的日益普及可能会导致亚太地区在预测期内实现最高成长。

房车金融业概况

休閒车金融市场呈现适度整合的格局,由 LendingTree、LightStream、富国银行、美国银行、大通银行 (JPMorgan Chase) 等几家大型全球参与者主导。这些公司透过广泛的产品系列、技术进步和策略联盟在这个市场上站稳了脚跟。

2023 年 12 月,KKR 收购了价值 72 亿美元的优质休閒车贷款组合。此举表明 KKR 对不断增长的房车行业的持续兴趣,并加强了 KKR 在消费金融领域的影响力。

2023 年 7 月,美国银行宣布与 Rollick 合作开发一个新的休閒车和船隻线上市场。该平台旨在为客户提供无缝的购物体验,提供融资选择以及有关房车和船隻购买的专家建议。

2023年12月,盛德代表KKR收购了价值70亿美元的投资组合。这项交易标誌着 KKR 持续扩大其在消费金融业(尤其是休閒车领域)业务的另一个重要里程碑。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究成果

- 研究场所

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场驱动因素

- 可支配收入的增加和金融机构的低利率将增加市场需求

- 市场限制因素

- 高初始成本可能会抑製成长

- 价值链/供应链分析

- 波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- PESTLE分析

第五章市场区隔

- 搭车

- Motorhomes

- A级

- B级

- C级

- Caravans

- 旅行拖车

- 第五轮圈

- 玩具搬运工

- 卡车露营车

- 弹出预告片

- 折迭式露营拖车

- Motorhomes

- 按资金来源

- 银行/信用合作社

- 房车经销商融资

- 製造商融资

- 线上渲染

- 政府贷款

- 按地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 俄罗斯

- 西班牙

- 欧洲其他地区

- 亚太地区

- 印度

- 中国

- 日本

- 韩国

- 其他亚太地区

- 其他地区

- 南美洲

- 中东/非洲

- 北美洲

第六章 竞争状况

- 供应商市场占有率

- 併购

- 公司简介

- LendingTree

- LightStream

- Wells Fargo Bank

- SouthEast Financials

- Bank of America

- Chase(JPMorgan Chase)

- GreatRVLoan

- Good Sam

- Camping world finance

- Thor Industries Inc.

- Swift Group

- Knaus Tabbert GmbH

- Eura Mobil GmbH

- Avant Garde India

第七章 市场机会及未来趋势

The Recreational Vehicle Financing Market size is estimated at USD 36.75 billion in 2024, and is expected to reach USD 48 billion by 2029, growing at a CAGR of 7.69% during the forecast period (2024-2029).

The recreational vehicle financing market exhibits a moderately consolidated landscape, dominated by a few major global players such as LendingTree, LightStream, Wells Fargo Bank, Bank of America, Chase (JPMorgan Chase), and others. These companies have established a stronghold in the market through extensive product portfolios, technological advancements, and strategic collaborations.

In recent years, the recreational vehicle financing sector has experienced substantial growth, driven by factors such as the increasing popularity of recreational vehicle travel, advancements in recreational vehicle technology, and the emergence of innovative financing solutions. As per the Recreational Vehicle Industry Association, in the US alone, the recreational vehicle industry creates USD 50 billion in economic impact annually. More than 23,000 businesses are currently involved in the industry, creating nearly 45,000 direct employment opportunities and USD 3 billion in direct wages. As a result, the recreational vehicle financing industry has become an essential component of the broader recreational vehicle market.

Several driving factors have contributed to the increasing demand for recreational vehicle financing. Firstly, the COVID-19 pandemic has shifted consumer preferences toward domestic travel and outdoor activities as people seek safer alternatives to international vacations. Additionally, advancements in recreational vehicle technology have resulted in more fuel-efficient, eco-friendly, and technologically advanced vehicles, making them increasingly appealing to a wider audience. Furthermore, the rise of the gig economy and remote work has enabled more individuals to take extended vacations, fuelling the demand for recreational vehicles as a comfortable and flexible accommodation option. Lastly, user-friendly online platforms and financing options have made it easier for potential buyers to research, compare, and secure financing for their desired recreational vehicle.

The recreational vehicle financing market faces several challenges and opportunities. One of the primary challenges is the cyclical nature of the recreational vehicle industry, which is influenced by economic fluctuations and consumer confidence. During economic downturns, recreational vehicle sales and financing may decline as potential buyers become more cautious with their spending. However, this also presents an opportunity for recreational vehicle financing companies to offer attractive deals and incentives to encourage purchases during these periods. Soon, innovative financing options that promote eco-friendly recreational vehicles and sustainable practices can help overcome these challenges and contribute to a more sustainable future for the industry.

The future of recreational vehicle financing looks promising as the market continues to adapt and evolve to meet the changing needs of consumers. Additionally, the increasing integration of smart technology and connectivity features in recreational vehicles will drive demand for advanced financing solutions tailored to these high-tech vehicles. Lastly, the ongoing focus on sustainability will lead to more environmentally conscious financing options, supporting the development of eco-friendly recreational vehicle models and promoting responsible travel practices. Overall, the recreational vehicle financing market is expected to remain a dynamic and essential component of the broader recreational vehicle industry in the years to come.

Recreational Vehicle Financing Market Trends

Shift in Consumer Preferences Increases the Demand in the Market

The growing interest in recreational vehicle (RV) financing is primarily due to the increased focus on domestic travel and outdoor activities, which has become more prominent since the COVID-19 pandemic. This shift in consumer behavior has led to a higher demand for RVs as a comfortable and convenient accommodation choice for vacations and trips.

Several factors have contributed to this change. Firstly, concerns about health and safety have made international travel less appealing, causing a surge in demand for domestic vacations. People buy RVs mainly for family camping and cost savings, as an RV vacation can be over 60% cheaper than a traditional hotel-based vacation. Popular RV types include travel trailers, Type A motorhomes, fifth wheels, and park-model recreational vehicles (PMRVs). In the United States, one in five RVs is a travel trailer, while fifth wheels are gaining popularity.

Additionally, the pandemic has sparked an interest in outdoor activities and experiences as people seek to enjoy nature and escape their homes. RVs provide a comfortable base for exploring national parks, scenic routes, and various outdoor attractions. Furthermore, the shift in consumer preferences for RV financing is driven by the desire to reconnect with family and friends, as RVs offer a unique opportunity for families and friends to travel together while maintaining a safe and private environment.

The average RV financing amount for a household is over USD 45,000. In the United States, 40 million people participate in RV camping, with Americans being the largest market segment. Millennials are increasingly engaging in RV camping, accounting for 38% of campers, although Generation X and Baby Boomers still dominate the market. The typical RV-owning household has an income of around USD 62,000 and uses their RV for an average of four weeks per year. Since 2001, there has been a 16% increase in RV ownership in the US, and 60% more households own an RV compared to 1980.

Lastly, the rise of remote work has enabled many individuals to take extended vacations and work from various locations. RVs provide a convenient and comfortable living space for these remote workers, allowing them to maintain their work-life balance while exploring new destinations. In summary, the shift in consumer preferences for recreational vehicle financing is driven by factors such as health and safety concerns, flexibility, affordability, the desire for outdoor experiences, and the ability to connect with family and friends, all of which contribute to the growing popularity of RVs as a preferred accommodation option for domestic travel and vacations.

Asia-Pacific is Anticipated to Register the Highest Growth During the Forecast Period

Asia-Pacific is anticipated to register the highest growth during the forecast period for the Recreational Vehicle (RV) Financing Market. This growth can be attributed to several factors, including increasing disposable income, a growing middle-class population, and rising domestic tourists. As economies in Asia-Pacific continue to grow, disposable incomes are increasing. This growth in disposable income enables more people to afford RVs, leading to a higher demand for RV financing. In 2022, the household disposable income in Asia accounted for USD 21.20 trillion, which is greater than 2019 (USD 19.04 trillion). As a result, financial institutions and lenders are offering various financing options to cater to this growing market segment.

The middle class in Asia-Pacific is expanding rapidly, and this demographic is increasingly seeking recreational activities, including RV travel. As more people from the middle class invest in RVs, the demand for RV financing also increases, driving the growth of the RV Financing Market in the region. In addition to convenience, cost savings, and health concerns, there has been a significant increase in domestic tourism in Asia-Pacific. RVs offer a comfortable and flexible accommodation option for these domestic travelers, allowing them to explore various destinations at their own pace. This rise in domestic tourism has led to a higher demand for RVs and, consequently, RV financing.

In countries like Japan, the country's aging population also drives the demand for these products as they offer a comfortable and convenient way to travel and explore the country. Japan has an aging population, with over 28% being 65 years or older. This demographic is increasingly seeking out leisure activities such as camping and sightseeing, as they offer a chance to connect with nature and enjoy a slower pace of life. Caravans and motorhomes provide a comfortable and convenient way for seniors to travel and explore the country's scenic beauty. As per the Japan RV Association, the total annual sales value of camping vehicles in Japan amounted to around JPY 76.25 billion in 2022. This shows that recreational vehicle financing will be the better option for people.

Furthermore, governments in the Asia-Pacific are promoting domestic tourism by developing and improving infrastructure for RV parks and camping sites. These initiatives create a favorable environment for the growth of the RV Financing Market, as they encourage more people to invest in RVs and explore their own countries. In India, the government will allow private players to set up caravan parks on private or government land in buffer zones such as forests, the foot of the fort, hill stations, and dams. Caravan parks can be set up near Maharashtra Tourism Development Corporation (MTDC) accommodations or on their open land, as well as at Agri-tourism centers.

As more people in Asia-Pacific become aware of the benefits of RV travel, such as cost savings, flexibility, and the ability to connect with nature, the demand for RVs and RV financing is expected to grow. This increased popularity of RVs will contribute to the highest growth in Asia-Pacific during the forecast period.

Recreational Vehicle Financing Industry Overview

The recreational vehicle financing market exhibits a moderately consolidated landscape, dominated by a few major global players such as LendingTree, LightStream, Wells Fargo Bank, Bank of America, Chase (JPMorgan Chase), and others. These companies have established a stronghold in the market through extensive product portfolios, technological advancements, and strategic collaborations.

* In December 2023, KKR acquired a USD 7.2 billion portfolio of prime recreational vehicle loans. This move demonstrates KKR's continued interest in the growing RV industry and strengthens its presence in the consumer finance sector.

* In July 2023, US Bank unveiled a new online marketplace for recreational vehicles and boats, developed in collaboration with Rollick. The platform aims to provide a seamless shopping experience for customers, offering financing options and expert advice on RV and boat purchases.

* In December 2023, Sidley represented KKR in the acquisition of a USD 7 billion portfolio. This transaction marks another significant milestone for KKR as it continues to expand its presence in the consumer finance industry, particularly within the recreational vehicle sector.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing disposable income and Low-interest rates from lenders increase the market demand

- 4.3 Market Restraints

- 4.3.1 High initial costs may obstruct the growth

- 4.4 Value Chain / Supply Chain Analysis

- 4.5 Porters 5 Force Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 PESTLE Analysis

5 MARKET SEGMENTATION

- 5.1 By Vehicle

- 5.1.1 Motorhomes

- 5.1.1.1 Class A

- 5.1.1.2 Class B

- 5.1.1.3 Class C

- 5.1.2 Caravans

- 5.1.2.1 Travel Trailers

- 5.1.2.2 Fifth Wheels

- 5.1.2.3 Toy Haulers

- 5.1.2.4 Truck Campers

- 5.1.2.5 Pop-up Trailers

- 5.1.2.6 Folding Camping Trailers

- 5.1.1 Motorhomes

- 5.2 By Financing Sources

- 5.2.1 Banks and Credit Unions

- 5.2.2 RV Dealership Financing

- 5.2.3 Manufacturer Financing

- 5.2.4 Online Lenders

- 5.2.5 Government-backed Loans

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United kingdom

- 5.3.2.3 France

- 5.3.2.4 Russia

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 India

- 5.3.3.2 China

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 Rest of the World

- 5.3.4.1 South America

- 5.3.4.2 Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Mergers & Acquisitions

- 6.3 Company Profiles

- 6.3.1 LendingTree

- 6.3.2 LightStream

- 6.3.3 Wells Fargo Bank

- 6.3.4 SouthEast Financials

- 6.3.5 Bank of America

- 6.3.6 Chase (JPMorgan Chase)

- 6.3.7 GreatRVLoan

- 6.3.8 Good Sam

- 6.3.9 Camping world finance

- 6.3.10 Thor Industries Inc.

- 6.3.11 Swift Group

- 6.3.12 Knaus Tabbert GmbH

- 6.3.13 Eura Mobil GmbH

- 6.3.14 Avant Garde India