|

市场调查报告书

商品编码

1692112

逻辑IC(积体电路) -市场占有率分析、产业趋势与统计、成长预测(2025-2030)Logic IC (Integrated Circuit) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

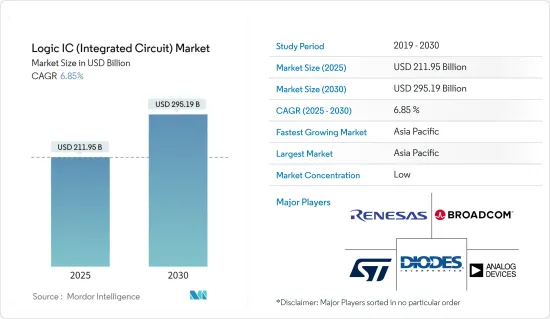

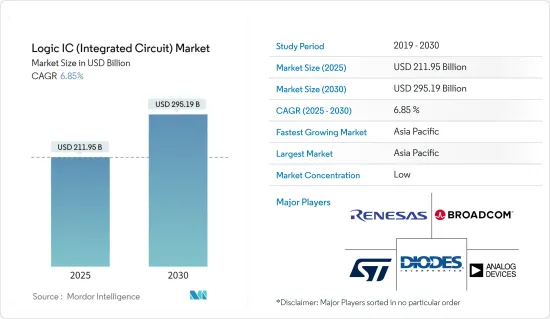

逻辑积体电路市场规模预计在 2025 年为 2,119.5 亿美元,预计到 2030 年将达到 2,951.9 亿美元,预测期内(2025-2030 年)的复合年增长率为 6.85%。

就出货量而言,预计将从 2025 年的 679.7 亿台成长到 2030 年的 834.6 亿台,预测期间(2025-2030 年)的复合年增长率为 4.19%。

随着半导体製造製程的不断发展,更加复杂、高效的逻辑积体电路正在被开发出来。更小的电晶体尺寸、更高的性能以及更低的功耗使得开发适用于广泛应用的高性能逻辑积体电路成为可能。逻辑积体电路非常灵活,可用于各种各样的应用。它可以配置为执行多种逻辑功能,例如 AND、OR、NOT 和 XOR。这种灵活性使得能够设计和开发满足各行业要求的智慧电路,包括消费性电子、汽车、通讯和工业自动化。

主要亮点

- 逻辑积体电路对电子设备的小型化和整合化做出了重大贡献。半导体製造技术的最新发展使得小型、复杂的逻辑电路能够整合单晶片。这种整合使得电子系统能够增加功能,同时减少其物理尺寸和消费量,从而能够用于便携式设备、无线技术和其他空间受限的应用。显示器驱动器、通用逻辑和 MOS 触控萤幕控制器是近年来在市场上受到广泛关注的一些逻辑组件。

- 此外,终端用户产业的进步也推动了对小型、坚固的半导体设备的需求。例如,与传统 PCB基板相比,现代智慧型手机需要更小的 PCB基板。此外还出现了一些形状不规则、各异的物联网设备,例如穿戴式设备,这些设备只有透过小型化才能实现。因此,预计对小型化 IC 元件的需求将大幅增加。

- 随着智慧家庭、办公室、穿戴式装置、远端监控和控制技术的引入,物联网和工业物联网的出现对电子设备的设计和尺寸产生了重大影响。此外,在开发穿戴式技术时,小型化是OEM和设计师的首要任务。

- 另一个需要小型化电子元件的进步是便携式电子产品,它需要更小、更薄的半导体系统来节省空间并缩小尺寸。对于航太和电动车等高度整合、高速的应用,改善电气性能以最大限度地减少噪音影响的需求也很明显。由于在设计最终产品时考虑到这些因素,逻辑 IC 组件在先进电子系统的开发中变得越来越重要。

- 逻辑积体电路有望执行各种复杂的功能。随着技术的进步,电子设备有望具有更多尖端的功能和性能。设计师必须结合复杂的逻辑和演算法来满足这些需求。功能的增加导致设计更大、更复杂,使得管理和优化各个元件之间的复杂互动成为一项挑战。

- 新冠疫情引发重大市场变化,影响了客户行为、企业收益和公司营运的多个方面。此次疫情暴露了先前未被注意到的供应方面的风险,可能导致重要零件短缺。因此,半导体公司正在积极重组其供应链,以提高其弹性,这些调整可能会持续到后疫情时代。

逻辑IC(积体电路)市场趋势

快速成长的汽车领域

- 逻辑积体电路对于汽车控制和通讯系统至关重要。它们用于引擎控制单元(ECU)、变速箱控制单元(TCU)、防锁死煞车系统、资讯娱乐、安全气囊控制模组、系统和许多其他电控系统。这些积体电路能够处理和执行用于车辆控制、监控和通讯的先进演算法和逻辑功能。

- 消费者期望他们的车辆能够提供先进的功能、便利性和无缝的用户体验,包括舒适性、安全性和便利性,包括先进的驾驶辅助系统 (ADAS)、智慧照明系统、个人化设定、语音控制等。满足消费者期望和提供创新功能正在推动汽车产业对逻辑积体电路的需求。

- 自动紧急煞车、车道偏离警告和主动式车距维持定速系统等各种 ADAS 技术在现代汽车中变得越来越普遍。逻辑积体电路对于处理感测器资料、做出即时决策和控制车辆功能至关重要。未来的趋势可能会看到更先进的 ADAS 功能的发展,这将需要具有更高运算能力、更低延迟和增强感测器融合能力的逻辑 IC。

- 在汽车产业,安全性和功能性要求至关重要。逻辑积体电路可确保各种汽车系统(包括 ADAS、自动驾驶和动力传动系统控制)的安全可靠运作。汽车市场对符合 ISO 26262 等严格安全标准的高性能、可靠逻辑 IC 的需求推动着这个市场的发展。

- 追求自动驾驶汽车是汽车产业的关键趋势。逻辑积体电路对于自动驾驶所需的复杂处理和决策至关重要。

- 根据罗兰贝格预测,2025年4级轻型自动驾驶汽车的渗透率预计将达到1%,此后市场占有率将逐步提升。此外,预计到 2030 年,4 级小型自动驾驶汽车将占据全球市场的 5%。随着自动驾驶技术的进步,对具有更强处理能力、先进的感测器整合和强大安全功能的逻辑积体电路的需求可能会增加。

- 此外,环境问题和政府法规正在加速向电动车的转变。电动车基于先进的电力电子和电池管理,需要专门的逻辑积体电路来确保最佳的能源利用、马达控制和充电基础设施整合。

- 根据IEA最新报告,2022年全球电动车购买量将超过1,000万辆,预计2023年销量将成长35%,达到1,400万辆。到2023年,中国、欧洲、美国等地区的电动车销量将达到1,390万辆。

亚太地区实现强劲成长

- 亚太地区仅包括中国和日本的分析。该地区是全球半导体产业中一个充满活力且快速成长的领域。凭藉新兴经济体、强大的製造能力和不断增长的电子设备需求,亚太地区在推动逻辑积体电路的创新、生产和消费方面发挥关键作用。

- 亚太地区是全球半导体製造中心,中国和日本等国家在半导体製造和组装处于领先地位。领先的半导体代工厂、组装和测试设施以及电子製造服务的存在使得逻辑积体电路的生产高效且具有成本效益。中国拥有庞大且快速扩张的消费性电子和汽车市场,工业化和自动化程度的提高正在推动 ADAS 和电动车的发展。

- 中国被誉为全球汽车及旅游产业的领导者,国内市场表现稳定,潜力大。中国工业和资讯化部预测,到2025年国内汽车产量将达到3,500万辆,进一步巩固中国作为世界领先汽车製造商之一的地位。根据中汽协数据显示,2023年8月中国新能源车销量为84.6万辆,其中搭乘用80.8万辆,商用车3.9万辆。其中,纯电动车(BEV)保有量为55.9万辆,插电式混合动力车(PHEV)保有量为24.8万辆。

- 此外,根据中国汽车物流市场预测,到2025年,新能源乘用车类别中的纯电动车(BEV)预计将占据84%的市场占有率,这将推动该领域出现重大技术进步,例如将ADAS整合到BEV中。 2024年,中国很可能在智慧驾驶系统的采用上达到阈值。由于 AD 等级的采用速度快于预期,车辆更换週期可能会缩短。供应量的增加,可能伴随着密集的消费者教育和媒体曝光,将加速中国消费者向智慧驾驶的转变。

- 亚太地区电动车市场的快速成长预计将对逻辑积体电路(IC)市场产生重大影响。随着电动车融入 ADAS 和智慧驾驶系统等更先进的技术,对积体电路(尤其是处理和控制系统积体电路)的需求可能会激增。此外,向电动车的转变需要开发充电基础设施,而这在很大程度上依赖积体电路技术。因此,专门从事逻辑积体电路的半导体公司预计全部区域不断扩大的电动车市场中获益。

逻辑IC(积体电路)市场概况

由于全球参与者和小型参与者的存在,逻辑积体电路市场变得分散。市场的主要企业包括意法半导体公司 (STMicroelectronics NV)、瑞萨电子公司 (Renesas Electronics Corp.)、ADI 公司 (Analog Devices Inc.)、博通公司 (Broadcom Inc.) 和 Diodes 公司 (Diodes Incorporated)。市场上的各种公司正在采用收购和联盟等各种策略来加强其产品供应并获得永续的竞争优势。

- 2024年4月,Centrica Energy与意法半导体签署了一份长期合同,为义大利供应可再生能源电力。这是一份为期 10 年的合同,涉及义大利一座新建太阳能发电厂生产的能源。

- 2024 年 4 月,瑞萨电子开始营运仅生产晶圆的甲府工厂。位于山梨县甲斐市。甲府工厂先前由瑞萨电子旗下的瑞萨半导体製造株式会社营运150毫米和200毫米晶圆生产线。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业价值链/供应链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 竞争对手之间的竞争

- 替代品的威胁

- 市场宏观经济走势分析

- 技术简介

第五章市场动态

- 市场驱动因素

- 更加重视设备集成

- 加大工厂设备投资,扩大产能

- 市场限制

- 逻辑IC设计的复杂度不断增加

第六章市场区隔

- 按 IC 类型

- 数字双极

- 采用MOS逻辑

- MOS通用

- MOS闸阵列

- MOS驱动器/控制器

- MOS标准单元

- MOS 特殊用途

- 按应用

- 家用电子电器

- 车

- 资讯科技和通讯

- 电脑

- 其他的

- 按地区

- 美洲

- 欧洲

- 亚洲

- 澳洲和纽西兰

- 中东和非洲

第七章竞争格局

- 公司简介

- STMicroelectronics NV

- Renesas Electronics Corp.

- Analog Devices Inc.

- Broadcom Inc.

- Diodes Incorporated

- NXP Semiconductors NV

- ON Semiconductor Corporation

- Texas Instruments Inc.

- Intel Corporation

- Toshiba Corporation

第八章投资分析

第九章:市场的未来

The Logic IC Market size is estimated at USD 211.95 billion in 2025, and is expected to reach USD 295.19 billion by 2030, at a CAGR of 6.85% during the forecast period (2025-2030). In terms of shipment volume, the market is expected to grow from 67.97 billion units in 2025 to 83.46 billion units by 2030, at a CAGR of 4.19% during the forecast period (2025-2030).

Ongoing advancements in semiconductor manufacturing processes have led to the development of more complex and efficient logic ICs. Smaller transistor sizes, improved performance, and lower power consumption enable the creation of high-performance logic ICs for a wide range of applications. A logic IC is very flexible and can be used in various applications. One can configure them to perform multiple logical functions, such as AND, OR, NOT, and XOR. This flexibility allows for designing and developing intelligent circuits that meet requirements in different industries, such as consumer electronics, automotive, telecommunications, and industry automation.

Key Highlights

- Logic ICs have significantly aided the miniaturization and integration of electronic devices. The development of the technology to manufacture semiconductors has produced small, more complex logic circuits on a single chip in recent years. This integration increases functionality while reducing electronic systems' physical size and energy consumption so that they can be used in portable devices, wireless technology, or space-constrained applications. Display drivers, general purpose logic, and MOS touch screen controllers are some of the logic components that have gained significant market traction in recent years.

- Furthermore, advances in end-user industries have created the need for small and robust semiconductor devices. For instance, nowadays, smartphones require a smaller PCB board, unlike traditional PCB boards. There has also been the advent of IoT devices, such as wearables with irregular and different shapes, which can only be achieved through miniaturization. This is expected to boost the need for miniaturized IC components significantly.

- The advent of the IoT and IIoT has largely impacted the design and size of electronics, with the introduction of technologies like smart homes, offices, wearables, remote monitoring, and control. Moreover, OEMs and designers consider miniaturization a primary focus while creating wearable technologies.

- Another advancement that demands miniaturized electronic components is portable electronic equipment, which requires smaller and thinner semiconductor systems for saving space and miniaturization. Due to highly integrated, high-speed applications like aerospace and electric vehicles, the demand for improved electrical performance to minimize noise effects is also evident. As a result of these considerations when designing end products, logic IC components are becoming increasingly important in developing advanced electronic systems.

- Logic ICs are expected to perform a wide range of complex functions. The demand for more state-of-the-art features and capabilities in electronic devices grows as technology advances. Designers need to incorporate complex logic circuits and algorithms to meet these requirements. This increased functionality leads to larger and more intricate designs, making it challenging to manage and optimize the complex interactions between different components.

- The market has undergone substantial changes due to the COVID-19 pandemic, impacting customer behavior, business revenues, and various aspects of corporate operations. The pandemic revealed previously unnoticed risks on the supply side, potentially resulting in shortages of essential parts and components. Consequently, semiconductor companies are proactively restructuring their supply chains to enhance resilience, and these adjustments may persist in the post-pandemic era.

Logic IC (Integrated Circuit) Market Trends

The Automotive Segment to Witness Rapid Growth

- Logic ICs are essential in vehicle control and communications systems. They are used in engine control units (ECUs), transmission control units (TCUs), antilock braking systems infotainment, airbag control modules, systems, and various other electronic control units. ICs can process and execute sophisticated algorithms and logical functions for vehicle control, monitoring, and communication.

- Consumers expect vehicles to offer advanced features, convenience, and a seamless user experience, including comfort, safety, and convenience, such as advanced driver assistance, intelligent lighting systems, personalized settings, and voice control. Meeting consumer expectations and providing innovative features drive the demand for logic ICs in the automotive industry.

- Various ADAS technologies, such as automatic emergency braking, lane departure warning, and adaptive cruise control, are becoming more prevalent in modern vehicles. Logic ICs are critical in processing sensor data, enabling real-time decision-making, and controlling vehicle functions. Future trends may involve the development of more advanced ADAS features, requiring logic ICs with higher computational power, low latency, and enhanced sensor fusion capabilities.

- In the automotive industry, safety and functional requirements are of great importance. Logic ICs ensure various automotive systems' safe and reliable operation, including ADAS, autonomous driving, and powertrain control. The need for high-performance, reliable logic ICs that meet stringent safety standards, such as ISO 26262, drives the demand in the automotive market.

- The pursuit of autonomous vehicles is a significant trend in the automotive industry. Logic ICs are essential for the complex processing and decision-making required for autonomous driving.

- According to Roland Berger, in 2025, the penetration rate of level 4 light autonomous vehicles is expected to be 1%, with a gradually increasing market share in subsequent years. Furthermore, 5% of the global market is anticipated to comprise level 4 light autonomous vehicles by 2030. As self-driving technology advances, logic ICs with increased processing power, advanced sensor integration, and robust safety features are likely to be in demand.

- Moreover, due to environmental concerns and government regulations, the shift toward the use of electric vehicles is gaining momentum. EVs are based on advanced power electronics and battery management, which requires specialized logic ICs to ensure optimum energy use, motor control, or charging infrastructure integration.

- According to the latest report from IEA, over 10 million electric vehicles were bought worldwide in 2022, and sales were estimated to increase by 35% in 2023 to reach 14 million. In 2023, China, Europe, the United States, and other regions sold 13.9 million electric vehicles.

Asia-Pacific to Register Major Growth

- Asia-Pacific consists of the analysis of only China and Japan. The region is a dynamic and rapidly growing segment of the global semiconductor industry. With emerging economies, strong manufacturing capabilities, and growing demand for electronic devices, Asia-Pacific is pivotal in driving innovation, production, and consumption of logic ICs.

- Asia-Pacific is a global manufacturing hub for semiconductor production, with countries such as China and Japan leading in semiconductor manufacturing and assembly. The presence of leading semiconductor foundries, assembly and testing facilities, and electronics manufacturing services enables efficient and cost-effective production of logic ICs. It is home to a vast and rapidly expanding consumer electronics market and automotive market with developments in ADAS and EVs along with increasing industrialization and automation.

- China is known as a global leader in the automotive and mobility industry owing to the consistent performance of the domestic market and its enormous potential. The Chinese Ministry of Industry and Information Technology projects that domestic vehicle production will reach 35 million by 2025, further strengthening its position as the world's leading car manufacturer. According to CAAM, China's new energy vehicle sales amounted to 846,000 units, 808,000 of which were passenger EVs and 39,000 were commercial electric vehicles during August 2023. Sales of BEVs and PHEVs recorded 559,000 and 248,000 vehicles, respectively.

- Furthermore, according to the forecast from China's automotive logistics market, it is expected that the battery electric vehicles (BEV) in the new energy passenger vehicle category will have 84% of the market share by 2025, which leads to major technological advancements in the segment like integration of ADAS in BEVs. In 2024, China is likely to achieve a threshold in adopting intelligent driving systems. The replacement cycle of vehicles could be shortened by more rapid adoption of AD levels than anticipated. An increase in supply may be accompanied by intensive consumer education and media exposure, which will accelerate Chinese consumers' shift toward smart driving.

- The rapid growth of EV markets in Asia-Pacific is expected to impact the logic integrated circuit (IC) market significantly. As EVs incorporate more advanced technologies like ADAS and intelligent driving systems, the demand for ICs, especially those for processing and control systems, will likely surge. Additionally, the shift toward EVs necessitates developing charging infrastructure, which relies heavily on IC technology. As a result, semiconductor companies specializing in logic ICs are poised to benefit from the expanding EV markets across the region.

Logic IC (Integrated Circuit) Market Overview

The logic IC market is fragmented due to the presence of both global players and small and medium-sized enterprises. Some of the major players in the market are STMicroelectronics NV, Renesas Electronics Corp., Analog Devices Inc., Broadcom Inc., and Diodes Incorporated. The various players in the market are adopting different strategies, such as acquisitions and partnerships, to enhance their product offerings and gain a sustainable competitive advantage.

- In April 2024, a long-term agreement was signed between Centrica Energy and STMicroelectronics for the supply of electricity produced from renewable sources in Italy. It is a 10-year contract for energy produced by a new solar farm in Italy.

- In April 2024, Renesas started the operation of Kofu Factory, a dedicated wafer fab. It is located in Kai City, Yamanashi Prefecture, Japan. The Kofu Factory previously operated both 150 mm and 200 mm wafer fabrication lines under Renesas Semiconductor Manufacturing Co., a subsidiary of Renesas.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain/Supply Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Intensity of Competitive Rivalry

- 4.3.5 Threat of Substitutes

- 4.4 Analysis of Macroeconomic Trends on the Market

- 4.5 Technology Snapshot

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Focus on Device Integration

- 5.1.2 Increasing Capital Expenditure of Fabs to Augment Production Capacity

- 5.2 Market Restraints

- 5.2.1 Complexity Associated with Logic IC Design

6 MARKET SEGMENTATION

- 6.1 By IC Type

- 6.1.1 Digital Bipolar

- 6.1.2 By MOS Logic

- 6.1.2.1 MOS General Purpose

- 6.1.2.2 MOS Gate Arrays

- 6.1.2.3 MOS Drivers/Controllers

- 6.1.2.4 MOS Standard Cells

- 6.1.2.5 MOS Special Purpose

- 6.2 By Application

- 6.2.1 Consumer Electronics

- 6.2.2 Automotive

- 6.2.3 IT and Communication

- 6.2.4 Computer

- 6.2.5 Other Applications

- 6.3 By Geography

- 6.3.1 Americas

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Australia and New Zealand

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 STMicroelectronics NV

- 7.1.2 Renesas Electronics Corp.

- 7.1.3 Analog Devices Inc.

- 7.1.4 Broadcom Inc.

- 7.1.5 Diodes Incorporated

- 7.1.6 NXP Semiconductors NV

- 7.1.7 ON Semiconductor Corporation

- 7.1.8 Texas Instruments Inc.

- 7.1.9 Intel Corporation

- 7.1.10 Toshiba Corporation