|

市场调查报告书

商品编码

1548914

数位体验平台:市场占有率分析、产业趋势/统计、成长预测(2024-2029)Digital Experience Platform - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

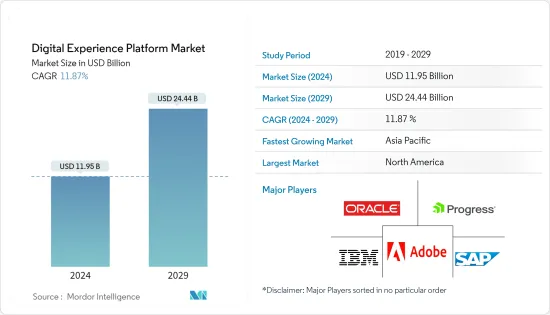

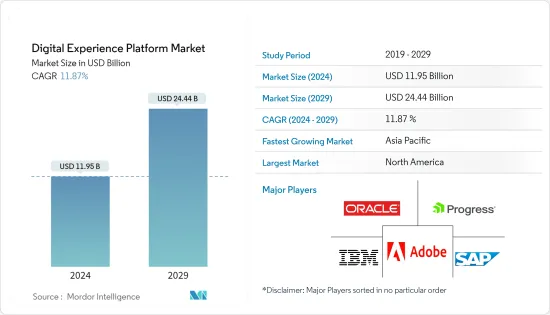

数位体验平台市场规模预计到 2024 年为 119.5 亿美元,到 2029 年达到 244.4 亿美元,在市场估计和预测期间(2024-2029 年)复合年增长率为 11.87%。

社交网路、影片共用、託管服务、Web 应用程式和播客的激增迫使公司将资源引导至数位体验平台 (DXP)。 DXP 使组织能够识别客户的直接需求,并透过各种数位管道提供客製化内容。此外,DXP 还提供其他优势,例如即时客户行为追踪、整合高级分析以及与现有框架的无缝整合。

此外,透过 DXP,人工智慧可以利用用户行为、偏好和上下文资料来实现个人化内容传送、产品推荐和客户旅程。这种增强的个人化显着提高了用户参与度和满意度。机器学习为分析提供动力,使从大量资料中提取可操作的见解变得更加容易。这些见解为资料主导的决策和策略提供支持,并改善整体数位体验平台。

公司正在透过不同的行销管道推动整合、个人化和优化的用户参与,从而推动该细分市场的成长。数位体验平台 (DXP) 解决方案承诺客製化数位体验、增强客户互动并提高业务效率。随着人们越来越关註一流的数位体验,许多供应商正在采用基于结果的收益模式。这些动态正在推动服务领域的成长。

云端基础的数位体验平台 (DXP) 利用云端基础架构提供有效数位体验管理所需的灵活性、扩充性和可存取性。透过依靠云端供应商更新和维护其基础设施,企业可以从降低的维护成本中受益,并确保在每个客户接触点提供一致的高品质体验。

数位体验平台的 CMS 快速安装和差距分析功能对其成功至关重要。阻碍全球数位体验平台市场扩张的一个突出因素是需要增加基础设施来解决常见问题。由于对资料隐私和安全性日益增长的担忧,在数位体验平台领域运营的全球和本地公司正遇到重大障碍。这些担忧将阻碍未来几年市场的成长轨迹。

数位体验平台市场趋势

预计可伸缩安全注射器细分市场在预测期内将显着成长

- 数位体验平台 (DXP) 的云端部署是指将平台的基础架构、应用程式和服务託管在云端伺服器上,而不是本地硬体上。这种方法可实现扩充性、灵活且经济高效的数位客户体验管理,并且易于维护、自动更新和改进的资源分配。

- 该市场中的公司正在与云端解决方案和服务供应商合作,以增强客户体验。例如,2024 年 5 月,Contentstack 和 Google Cloud 建立了新的合作伙伴关係,以扩大可组合数位体验的范围。此次合作将使全球品牌能够增强建置、监督和交付解决方案的能力。透过利用这项合作关係,Contentstack 的客户将能够存取安全且可扩展的云端平台,使 Contentstack 成为第一个获得全球三大云端服务供应商核准的DXP 供应商。

- 根据 Flexera Software 2023-2023 年报告,47% 的中小企业受访者表示他们已经在使用 AWS CloudFormation 范本。 AWS CloudFormation 可协助您建立称为「堆迭」的模板,以快速、可靠地预置应用程式和服务。

- 2023 年下半年,29% 的企业受访者表示,他们每年在公共云端上的支出超过 1,200 万美元。随着企业继续迁移到云端作为其数位转型计画的一部分,公共云端支出仍然强劲。

- 到 2024 年下半年,预计 45% 的中小企业每年将在公共云端服务上投资高达 60 万美元。各个提供者提供的这些服务通常包括应用程式、虚拟机器和储存。公共云端的主要优势之一是成本效益,因为组织只需为他们使用的服务付费。

- 与传统系统不同,云端DXP提供扩充性、灵活性和即时资料处理,这对于适应动态的市场环境和客户偏好至关重要。透过利用先进的分析、人工智慧和机器学习,企业可以提供个人化的内容和体验。这种资料主导的方法可以实现更精确的定位和参与,从而提高客户满意度和忠诚度。

预计北美将在预测期内占据主要市场占有率

- 在各产业(尤其是零售、金融服务和通讯)快速数位转型的推动下,亚太地区的数位体验平台 (DXP) 正在显着成长。

- 这种快速增长归因于该地区互联网普及率的迅速提高、行动装置的广泛采用以及精通技术的人群渴望增强数位互动。亚太地区的企业越来越多地投资 DXP,为客户提供个人化、无缝且引人入胜的数位体验,这在当今竞争激烈的市场中至关重要。

- 2023 年 12 月,总部位于曼谷的创新和数位体验机构 Rabbit's Tale 加入Accenture Song(原Accenture Interactive)。 RabbitTale 因在品牌策略、内容创作、广告、数位行销、客户经验、CRM、资料分析等方面为泰国和其他地区的客户提供支援而闻名,此次整合将使Accenture能够为当地企业提供支持,我们将加强人力资源发展。此次合併将增强Accenture支持当地企业和培养当地人才的能力。此次合作旨在根据当地市场的独特需求和偏好提供有影响力的数位体验。

- 此外,由于越来越多地采用语音商务作为销售各种产品和服务的管道,预计该区域市场的开拓将进一步推动。电子商务的蓬勃发展,增强了数位商务的实力,建立了收益和利润共用的双通路。

数位体验平台产业概况

数位体验平台市场是半固定的,全球有大量公司。主要公司有 Adobe Inc.、Oracle Corporation、SAP SE、IBM Corporation 和 PROGRESS SOFTWARE CORPORATION。该市场的进入障碍较低至中等,导致出现多个新参与企业。

2024 年 3 月 - Databricks 和 Adobe 宣布建立策略合作伙伴关係,使两家公司的共用客户能够充分发挥资料的潜力,并实现更聪明和可扩展的消费者互动。客户现在可以在 Databricks 资料智慧平台和 Adobe Experience Platform(包括其应用程式)之间无缝整合资料。此外,您还可以将自己的模型从 Databricks 汇入到 Adobe。

2023 年 10 月 - Sitecore 宣布云端基础体验平台的最新产品。 XM Cloud Plus 和 Sitecore Accelerate 这两个新解决方案旨在简化和加速品牌向云端的迁移。我们让向 SaaS 的过渡变得更加容易,并使企业能够利用强大的企业解决方案。这些服务由 Sitecore 定制,为品牌提供所需的工具和支持,以促进无缝过渡到 Sitecore云端基础的可组合解决方案。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 评估宏观经济因素对数位体验平台市场的影响

第五章市场动态

- 市场驱动因素

- 扩展云端基础的解决方案部署

- 巨量资料分析需求不断成长

- 市场挑战

- 与传统业务流程和基础设施的整合问题

第六章 市场细分

- 按成分

- 平台

- 服务

- 依部署类型

- 本地

- 云

- 按最终用户

- 零售

- 资讯科技/通讯

- BFSI

- 卫生保健

- 其他最终用户

- 按地区

- 北美洲

- 欧洲

- 亚洲

- 澳洲/纽西兰

- 拉丁美洲

- 中东/非洲

第七章 竞争格局

- 公司简介

- Adobe Inc.

- Oracle Corporation

- SAP SE

- IBM Corporation

- PROGRESS SOFTWARE CORPORATION

- Salesforce Inc.

- OpenText Corporation

- RWS Holdings PLC

- Sitecore Holding II A/S

- Acquia Inc.

- Squiz

- Bloomreach Inc.

- Crownpeak Technology Inc.

- Magnolia International Ltd

- Jahia Solutions Group SA

第八章投资分析

第九章 市场机会及未来趋势

The Digital Experience Platform Market size is estimated at USD 11.95 billion in 2024, and is expected to reach USD 24.44 billion by 2029, growing at a CAGR of 11.87% during the forecast period (2024-2029).

The surge in social networking, video sharing, hosted services, web applications, and podcasting has become instrumental in compelling businesses to channel resources into digital experience platforms (DXPs). DXPs empower organizations to discern customers' immediate needs and deliver tailored content across diverse digital channels. Beyond this, DXPs provide additional benefits like real-time client activity tracking, integrated advanced analytics, and seamless incorporation into existing frameworks.

Moreover, within a DXP, artificial intelligence leverages user behavior, preferences, and contextual data for personalized content delivery, product recommendations, and customer journeys. This heightened personalization significantly boosts user engagement and satisfaction. Machine learning bolsters analytics, facilitating the extracting of actionable insights from extensive data. These insights empower data-driven decisions and strategies, elevating the overall digital experience platforms.

Enterprises push for integrated, personalized, optimized user engagement across diverse marketing channels, fueling the segment's growth. Digital Experience Platform (DXP) solutions promise tailored digital experiences, enhanced customer interactions, and boosted business efficiency. With a heightened focus on top-notch digital experiences, many vendors are adopting outcome-based revenue models. These dynamics collectively propel the growth of the service segment.

A cloud-based digital experience platform (DXP) utilizes cloud infrastructure to offer the flexibility, scalability, and accessibility required for effective digital experience management. By entrusting infrastructure updates and maintenance to cloud providers, companies benefit from reduced maintenance costs and ensure a consistent, high-quality experience across all customer touchpoints.

The rapid installation and gap analysis capabilities of a digital experience platform's CMS are pivotal for its triumph. A notable impediment to the global digital experience platform market's expansion is the need for more infrastructure to address prevalent issues. Both global and regional companies operating in the digital experience platform sector encounter notable obstacles due to escalating data privacy and security worries. These concerns are poised to impede the market's growth trajectory in the coming years.

Digital Experience Platform Market Trends

Retractable Safety Syringes Segment Expected to Witness Significant Growth During the Forecast Period

- Cloud deployment in a digital experience platform (DXP) refers to hosting the platform's infrastructure, applications, and services on cloud servers rather than on-premises hardware. This approach allows for scalable, flexible, and cost-effective management of digital customer experiences, ensuring easier maintenance, automatic updates, and better resource allocation.

- The players in the market are collaborating with cloud solutions or service providers to enhance the customer experience. For instance, in May 2024, Contentstack and Google Cloud forged a new partnership, broadening the scope of composable digital experiences. This collaboration equips global brands with enhanced capabilities to craft, oversee, and deliver solutions. By leveraging this partnership, Contentstack's clientele gains access to a secure and scalable cloud platform, marking Contentstack as the inaugural DXP provider to be endorsed by all three major global cloud service providers.

- According to the Flexera Software Report 2023-2023, 47% of SMB respondents indicated that they were already using AWS CloudFormation templates. AWS CloudFormation helps create templates for quick and reliable provisioning of the applications or services called "stacks."

- In late 2023, 29% of the enterprise respondents indicated that their organizations spent more than USD 12 million on public cloud annually. Public cloud spending remains strong as organizations continuously migrate to the cloud as part of their digital transformation plans.

- By late 2024, 45% of small and medium-sized businesses are expected to invest up to USD 600,000 annually in public cloud services. These services, offered by various providers, typically encompass applications, virtual machines, and storage. One of the key advantages of public clouds is their cost-effectiveness, with organizations paying solely for the services they utilize.

- Unlike traditional systems, cloud DXPs provide scalability, flexibility, and real-time data processing, which are essential for adapting to dynamic market conditions and customer preferences. They enable businesses to deliver personalized content and experiences by leveraging advanced analytics, artificial intelligence, and machine learning. This data-driven approach allows for more precise targeting and engagement, improving customer satisfaction and loyalty.

North America Expected to Hold Significant Market Share During the Forecast Period

- The Asia-Pacific region has experienced significant growth in digital experience platforms (DXPs), driven by the rapid digital transformation across various industries, particularly retail, financial services, and telecommunications.

- This surge is attributed to the region's burgeoning internet penetration, widespread adoption of mobile devices, and a tech-savvy population eager for enhanced digital interactions. Businesses in APAC are increasingly investing in DXPs to deliver personalized, seamless, and engaging digital experiences to their customers, a necessity in today's competitive market.

- In December 2023, Rabbit's Tale, a creative and digital experience agency based in Bangkok, joined Accenture Song, formerly known as Accenture Interactive. Known for aiding clients in Thailand and other regions through brand strategy, content creation, advertising, digital marketing, customer experience, CRM, and data analysis, Rabbit's Tale's integration will bolster Accenture's ability to support local enterprises and cultivate local talent. This move aims to deliver impactful and tailored digital experiences that resonate with the distinct demands and tastes of the regional market.

- In addition, the regional market's development is anticipated to be further supported by the growing adoption of voice commerce as a channel for selling various products and services. The robust e-commerce sector enhances digital commerce, establishing a dual channel for generating revenue and sharing profits.

Digital Experience Platform Industry Overview

The digital experience platform market is semi-consolidated, with numerous players worldwide. The major players are Adobe Inc., Oracle Corporation, SAP SE, IBM Corporation, and PROGRESS SOFTWARE CORPORATION. The market poses low to moderate barriers to entry for new players, enabling several new entrants to gain traction.

March 2024 - Databricks and Adobe unveiled a strategic partnership to empower their shared clients to maximize their data's potential, enabling more intelligent and scalable consumer interactions. Customers now have the capability to seamlessly integrate data between the Databricks Data Intelligence Platform and the Adobe Experience Platform, including its applications. Additionally, they can also import their own models from Databricks to Adobe.

October 2023- Sitecore unveiled its latest offerings within its cloud-based digital experience platform. The two new solutions, XM Cloud Plus and Sitecore Accelerate aim to streamline and expedite brands' transition to the cloud. They make the journey to SaaS more accessible and empower businesses to harness robust enterprise solutions. These offerings, tailored by Sitecore, equip brands with the necessary tools and offer the requisite support, facilitating a seamless migration to Sitecore's cloud-based composable solutions.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of Macroeconomic Factors on the Digital Experience Platform Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Deployment of Cloud-Based Solutions

- 5.1.2 Rising Demand for Big Data Analytics

- 5.2 Market Challenges

- 5.2.1 Integration Issues with Legacy Business Processes and Infrastructure

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Platform

- 6.1.2 Services

- 6.2 By Deployment Type

- 6.2.1 On-Premise

- 6.2.2 Cloud

- 6.3 By End Users

- 6.3.1 Retail

- 6.3.2 IT and Telecom

- 6.3.3 BFSI

- 6.3.4 Healthcare

- 6.3.5 Other End Users

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia

- 6.4.4 Australia and New Zealand

- 6.4.5 Latin America

- 6.4.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Adobe Inc.

- 7.1.2 Oracle Corporation

- 7.1.3 SAP SE

- 7.1.4 IBM Corporation

- 7.1.5 PROGRESS SOFTWARE CORPORATION

- 7.1.6 Salesforce Inc.

- 7.1.7 OpenText Corporation

- 7.1.8 RWS Holdings PLC

- 7.1.9 Sitecore Holding II A/S

- 7.1.10 Acquia Inc.

- 7.1.11 Squiz

- 7.1.12 Bloomreach Inc.

- 7.1.13 Crownpeak Technology Inc.

- 7.1.14 Magnolia International Ltd

- 7.1.15 Jahia Solutions Group SA