|

市场调查报告书

商品编码

1549783

全球视讯编码器市场:市场占有率分析、行业趋势/统计、成长预测(2024-2029)Video Encoder - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

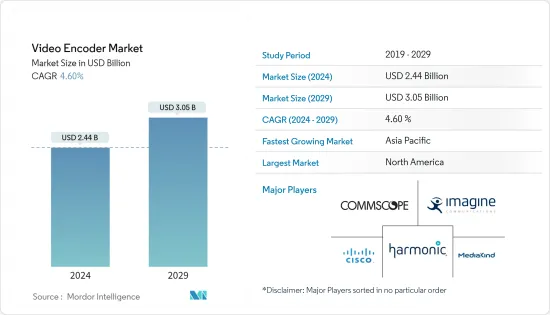

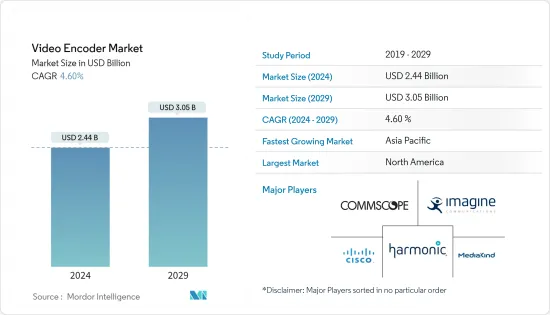

根据预测,2024年全球视讯编码器市场规模预计为24.4亿美元,2029年达到30.5亿美元,在预测期内(2024-2029年)复合年增长率为4.60%。

主要亮点

- 由于各种平台上对高品质视讯串流和广播的需求不断增长,视讯编码器市场正在经历强劲增长。视讯编码器将视讯讯号转换为适合透过网际网路和其他网路传输的数位格式。该市场的成长是由线上视讯内容消费的增加、OTT 服务的Over-The-Top以及直播串流活动的激增所推动的。社群媒体平台的激增(其中影片内容是关键的参与工具)进一步推动了对高级影片编码解决方案的需求。

- 技术进步对于塑造视讯编码器市场至关重要。压缩演算法的创新,例如 H.265 (HEVC) 和新兴的 AV1转码器,在保持视讯品质的同时提高压缩率,促进高效的资料传输和储存。这些进步将支持对 4K 和 8K 视讯解析度不断增长的需求,这需要更多的频宽和储存容量。

- 此外,整合人工智慧(AI)和机器学习(ML)的硬体编码器的发展代表了一个重要趋势。这些整合提高了即时视讯处理能力并优化了网路资源。

- 此外, Cisco、Harmonic 和 Axis Communications (Canon) 等大公司在视讯编码器市场上处于领先地位。除了这些产业巨头之外,新兴企业也透过创新解决方案掀起波澜。这些公司正在积极采取合併、收购、联盟和产品发布等策略,以巩固其市场地位。特别是,许多公司正在与 OTT服务供应商和广播公司建立策略联盟,以利用协同效应效应并扩大客户范围。

- 视讯编码器市场前景非常广阔,成长机会巨大。视讯标准的持续发展、5G网路的全球推广以及对虚拟实境(VR)和扩增实境(AR)等身临其境型体验不断增长的需求将推动进一步的创新和应用。优先考虑研发并快速回应技术变革的公司可能能够更好地利用新趋势并保持竞争优势。

- 儘管视讯编码器市场拥有许多成长动力,但出现了一个显着的障碍,即与硬体视讯编码器相关的高昂初始成本。这些设备对于将即时影像转换为广播或串流媒体的数位格式至关重要,通常需要大量的前期投资。特别是对于小型企业和新兴企业来说,这些费用可能是一个主要障碍。由此产生的高成本可能会阻止潜在客户采用新技术或对现有设置进行现代化改造,从而阻碍市场扩张和创新。此外,这些成本可能对公司的整体投资收益产生直接影响,导致製造商考虑削减成本措施并提供灵活的资金筹措选择以促进更广泛的采用,这凸显了激励其他人的重要性。

视讯编码器市场趋势

影片串流平台的普及推动市场成长

- Netflix、Amazon Prime 和 YouTube 等影片串流服务的日益普及,增加了人们对高品质、低延迟串流媒体的渴望。因此,这一趋势正在推动对高级视讯编码器的需求。这些编码器的任务是高效压缩影片、保持品质并确保无缝观看,尤其是在 4K 和 8K 等要求较高的解析度下。 Inplayer的数据显示,18.4%的OTT用户年龄在25岁至29岁之间,11.5%的用户年龄在30岁至36岁之间。值得注意的是,大约 15% 的 OTT 用户年龄在 17 岁以下。

- 用户生成和专业内容的兴起带动了串流影片製作的繁荣。因此,对高效影片编码解决方案的需求不断增加。这些解决方案对于增加内容量、快速上传和确保无缝串流媒体体验至关重要。这一趋势是视讯编码器市场的主要驱动因素。

- 此外,活动、游戏、体育和社交媒体中即时串流媒体的激增增加了对即时视讯编码解决方案的需求,并推动了视讯编码器市场的发展。快速处理即时内容并最大限度地减少延迟的编码器对于提供流畅且引人入胜的观看体验至关重要。

- 此外,智慧型手机、平板电脑和智慧型电视上影片串流使用量的快速成长凸显了对自我调整视讯编码的需求。编码器对于将影片调整为各种萤幕大小和网路速度至关重要,并且正在推动影片编码器市场的发展。

预计亚太地区将占据最大的市场占有率

- 中国地面电波地面电视广播的出现改善了现有服务并为新应用铺平了道路。 DTT 广播标准可实现 HDTV 和多个 SDTV 节目的广域固定接收。新服务还包括行动、穿戴式和高速应用程式。

- 中国政府也努力改善人们的观看体验,并鼓励主要城市开始免费提供地面电波高清电视广播内容。这将有助于推动数位地面广播市场和整个高清电视行业的成长,包括高清平板、晶片组、发送器、软体和内容製作。

- 随着Netflix、亚马逊和Disney+Hotstar等OTT服务对原创和收购内容进行投资,订阅视讯点播将占OTT总收入的93%,到2024年将占印度的30.7%,达到27亿美元。截至 2024 年 1 月,YouTube 已吸引了 4.62 亿用户,观看人数使美国相形见绌,成为印度领先的影片平台。

- 韩国公司正在开发视讯编码器解决方案并引领广播和串流媒体市场。例如,KT公司在订阅观看和管理方面领先韩国付费电视服务产业,其在DTH领域占据主导地位,在IPTV领域占据主导地位,占据最大份额。

- 近年来,由于技术的进步,能够录製和显示比高清电视(HDTV)分辨率更高的4K影像的相机、显示器和平板电脑等设备迅速普及。随着这些设备变得越来越普遍,日本对透过广播和网路分发传输高清影像的下一代影像编码的期望越来越高。 4K电视正在普通家庭中普及,各大电视製造商也推出了许多型号。

视讯编码器产业概况

视讯编码器市场竞争激烈,Harmonic Inc.、CommScope Holding Company Inc. 和 MediaKind 等领先公司不断增强能力以保持竞争力。这些公司策略性地专注于产品创新、併购、收购和合作伙伴关係,以使其产品系列多样化并扩大其全球足迹。

- 2024 年 1 月,主要企业Arcturus 宣布更新其 HoloSuite 工具组。此更新引入了一种新颖的方法,可让您向游戏引擎无缝交付轻量级、可扩展的体积影像。 Arcturus 为虚拟製作团队和游戏开发人员提供支援。使用者可以在不牺牲资料品质的情况下使用更多的体积字元来丰富他们的数位景观。

- 2023 年 11 月,影像和音讯转码器技术专家 MainConcept 宣布发布适用于 OTT 和电视广播工作流程的最新版本即时编码应用程式。新版的Live Encoder 3.4支援VVC/H.266和MPEG-5 LCEVC转码器。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 视讯转码器分析与演进

- VVC核准的公司/法人公司名单

- 为 VVC 标准做出贡献的公司名单

- COVID-19 对市场的影响

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

第五章市场动态

- 市场驱动因素

- 视讯串流平台日益普及

- 轻鬆整合硬体编码器和摄影机

- 云端视讯编码技术带动需求

- 市场挑战

- 硬体视讯编码器的初始成本较高

第六章 市场细分

- 按用途

- 付费电视

- 有线视讯编码器

- 卫星视讯编码器

- IPTV视讯编码器

- 广播/数位地面电视 (DTT)

- 贡献视讯编码器

- 回程传输分配视讯编码器

- DTT 视讯编码器

- 安全和监视

- 付费电视

- 按地区

- 美洲

- 美国

- 加拿大

- 巴西

- 墨西哥

- 其他领域

- 欧洲

- 德国

- 英国

- 法国

- 俄罗斯

- 波兰

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 韩国

- 日本

- 其他亚太地区

- 中东/非洲

- 土耳其

- 以色列

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 南非

- 其他中东/非洲

- 美洲

第七章 竞争格局

- 公司简介

- Harmonic Inc.

- Commscope Holding Company Inc.

- MediaKind

- Cisco Systems Inc.

- Imagine Communications

- Z3 Technology

- ATEME

- Adtec Digital

- Telairity(VITEC)

- Axis Communications AB(Canon Inc.)

第八章投资分析

第9章市场的未来

The Video Encoder Market size is estimated at USD 2.44 billion in 2024, and is expected to reach USD 3.05 billion by 2029, growing at a CAGR of 4.60% during the forecast period (2024-2029).

Key Highlights

- The video encoder market is witnessing strong growth, driven by the rising demand for high-quality video streaming and broadcasting across various platforms. Video encoders convert video signals into digital formats suitable for transmission over the Internet or other networks. This market's expansion is fueled by the increasing consumption of online video content, the proliferation of over-the-top (OTT) services, and the surge in live-streaming activities. The widespread adoption of social media platforms, where video content is a key engagement tool, further propels the demand for advanced video encoding solutions.

- Technological advancements are pivotal in shaping the video encoder market. Innovations in compression algorithms, such as H.265 (HEVC) and the emerging AV1 codec, enhance compression rates while maintaining video quality, facilitating efficient data transmission and storage. These advancements support the increasing demand for 4K and 8K video resolutions, which require significantly more bandwidth and storage capacity.

- Additionally, the development of hardware encoders that integrate artificial intelligence (AI) and machine learning (ML) represents a significant trend. These integrations improve real-time video processing capabilities and optimize network resources.

- Moreover, major players such as Cisco Systems Inc., Harmonic Inc., and Axis Communications AB (Canon Inc.) lead the pack in the video encoder market. Alongside these industry stalwarts, newer firms are making waves with innovative solutions. These players are actively pursuing strategies like mergers, acquisitions, partnerships, and product launches to bolster their market positions. Notably, many are forging strategic ties with OTT service providers and broadcasters, seeking to tap into synergies and broaden their customer reach.

- The video encoder market exhibits a highly promising outlook with significant growth opportunities. The ongoing evolution of video standards, the global deployment of 5G networks, and the increasing demand for immersive experiences, such as virtual reality (VR) and augmented reality (AR), are set to drive further innovations and applications. Companies prioritizing research and development and swiftly adapting to technological shifts will be well-positioned to capitalize on emerging trends and maintain their competitive advantage.

- While the video encoder market boasts numerous growth drivers, a notable hurdle emerges in the form of the steep initial costs associated with hardware video encoders. These devices, pivotal for transforming raw video into digital formats for broadcasting and streaming, often demand a significant upfront investment. This financial outlay can pose a formidable obstacle, especially for smaller enterprises and startups. The resulting high costs may dissuade potential customers from embracing new technologies or modernizing their existing setups, constraining market expansion and stifling innovation. Moreover, these expenses can directly impact a company's overall return on investment, underscoring the importance for manufacturers to explore cost-cutting measures or offer flexible financing options to spur wider adoption.

Video Encoder Market Trends

Increasing Popularity of Video Streaming Platforms is Expected to Drive the Market Growth

- The rising popularity of video streaming services such as Netflix, Amazon Prime, and YouTube has heightened the appetite for high-quality, low-latency streaming. Consequently, this trend drives the demand for advanced video encoders. These encoders are tasked with compressing videos efficiently, maintaining quality, and guaranteeing seamless viewing, especially at resolutions as demanding as 4K and 8K. According to Inplayer, among OTT users, 18.4% fall in the 25 - 29 age bracket, with 11.5% in the 30 - 36 range. Notably, approximately 15% of OTT users are under 17 years old.

- The rise of user-generated and professional content has led to a boom in video production for streaming. Consequently, there is a growing demand for efficient video encoding solutions. These solutions are crucial for increasing content volume, ensuring swift uploads, and seamless streaming experiences. This trend serves as a significant driver of the video encoder market.

- Moreover, the surge in live streaming across events, gaming, sports, and social media has heightened the need for real-time video encoding solutions, driving the video encoder market. Encoders that can process live content swiftly, ensuring minimal delays, are pivotal for delivering a smooth and engaging viewer experience.

- Also, the surge in smartphone, tablet, and smart TV usage for video streaming has underscored the necessity for adaptive video encoding. Encoders, pivotal for tailoring videos to diverse screen sizes and network speeds, are driving the video encoder market.

Asia-Pacific is Expected to Hold the Largest Market Share

- The advent of terrestrial digital television broadcasting in China has improved existing services and paved the way for new applications. The DTT broadcast standard enables wide-area fixed reception on HDTV and multiple SDTV programs. New services also include mobile, wearable, and high-speed applications.

- The Chinese government is also working to improve people's viewing experience, and China encouraged major cities to start offering free terrestrial HDTV broadcast content. This helps drive growth in the digital terrestrial market and the HDTV industry as a whole, including high-definition flat panels, chipsets, transmitters, software, and content creation.

- Investments by OTT services like Netflix, Amazon, and Disney+ Hotstar in original and acquired content will enable subscription video-on-demand to make up 93% of the total OTT revenue, increasing to 30.7% by 2024, amounting to USD 2.7 billion in India. By January 2024, YouTube emerged as the leading video platform in India, attracting 462 million users, significantly outpacing the United States in viewership.

- South Korean organizations are developing video encoder solutions to drive the broadcasting and streaming market. For example, KT Corp. is driving the pay TV services industry in South Korea regarding subscriptions and supervision, owing to its monopoly in the DTH segment and strong position in the IPTV segment, where it has the greatest share.

- In recent years, technological advances have led to the rapid spread of devices such as cameras, displays, and tablets that can record and display 4K video in higher resolution than high-definition televisions (HDTVs). With the proliferation of these devices, expectations are rising for next-generation video encoding for delivering HD video over broadcast and network delivery in Japan. 4K TVs are becoming increasingly popular in the home, and many models are available from major TV manufacturers.

Video Encoder Industry Overview

The video encoder market is highly competitive, with major players like Harmonic Inc., CommScope Holding Company Inc., and MediaKind continuously enhancing their capabilities to maintain a competitive edge. These companies strategically focus on product innovations, mergers, acquisitions, and partnerships to diversify their product portfolios and expand their global footprint.

- In January 2024, Arcturus, a key player in volumetric video technology, unveiled an update for its HoloSuite toolset. This update introduces a novel approach, enabling the seamless delivery of lightweight, scalable volumetric video to game engines. Arcturus empowers not just virtual production teams but also game developers. Users can now enrich their digital landscapes with more volumetric characters without compromising on data quality.

- In November 2023, MainConcept, a video and audio codec technology specialist, announced the release of the latest version of its real-time encoding application for OTT and TV broadcasting workflows. The new version, Live Encoder 3.4, supports VVC/H.266 and MPEG-5 LCEVC codecs.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Analysis of Video Codecs and Their Evolution

- 4.3 List of VVC-approved and Incorporated Companies

- 4.4 List of Companies Contributing to the VVC Standard

- 4.5 Impact of COVID-19 on the Market

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Popularity of Video Streaming Platforms

- 5.1.2 Easy Integration of Hardware Encoders with Video Cameras

- 5.1.3 Cloud Video Encoding Technology to Drive the Demand

- 5.2 Market Challenges

- 5.2.1 High Initial Cost of Hardware Video Encoder

6 MARKET SEGMENTATION

- 6.1 By Application

- 6.1.1 Pay TV

- 6.1.1.1 Cable Video Encoder

- 6.1.1.2 Satellite Video Encoder

- 6.1.1.3 IPTV Video Encoder

- 6.1.2 Broadcast and Digital Terrestrial Television (DTT)

- 6.1.2.1 Contribution Video Encoder

- 6.1.2.2 Backhaul and Distribution Video Encoder

- 6.1.2.3 DTT Video Encoder

- 6.1.3 Security and Surveillance

- 6.1.1 Pay TV

- 6.2 By Geography

- 6.2.1 Americas

- 6.2.1.1 United States

- 6.2.1.2 Canada

- 6.2.1.3 Brazil

- 6.2.1.4 Mexico

- 6.2.1.5 Rest of the Americas

- 6.2.2 Europe

- 6.2.2.1 Germany

- 6.2.2.2 United Kingdom

- 6.2.2.3 France

- 6.2.2.4 Russia

- 6.2.2.5 Poland

- 6.2.2.6 Rest of Europe

- 6.2.3 Asia-Pacific

- 6.2.3.1 China

- 6.2.3.2 India

- 6.2.3.3 South Korea

- 6.2.3.4 Japan

- 6.2.3.5 Rest of Asia-Pacific

- 6.2.4 Middle East and Africa

- 6.2.4.1 Turkey

- 6.2.4.2 Israel

- 6.2.4.3 United Arab Emirates

- 6.2.4.4 Saudi Arabia

- 6.2.4.5 South Africa

- 6.2.4.6 Rest of Middle East and Africa

- 6.2.1 Americas

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Harmonic Inc.

- 7.1.2 Commscope Holding Company Inc.

- 7.1.3 MediaKind

- 7.1.4 Cisco Systems Inc.

- 7.1.5 Imagine Communications

- 7.1.6 Z3 Technology

- 7.1.7 ATEME

- 7.1.8 Adtec Digital

- 7.1.9 Telairity (VITEC)

- 7.1.10 Axis Communications AB (Canon Inc.)