|

市场调查报告书

商品编码

1549952

智慧音箱:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Smart Speaker - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

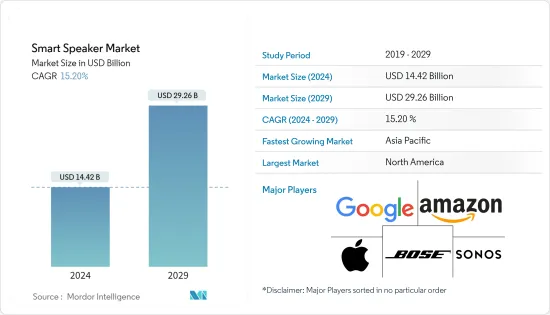

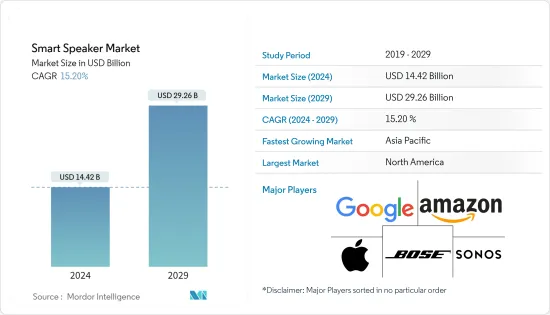

智慧音箱市场规模预计到2024年为144.2亿美元,预计到2029年将达到292.6亿美元,在预测期内(2024-2029年)复合年增长率为15.20%。

主要亮点

- 智慧音箱是一种内建虚拟助理的扬声器和语音命令设备。它可以免提操作,并使用特定的“热词”或多个“热词”提供互动操作。这些扬声器通常是无线的,可以连接到 Wi-Fi、蓝牙和其他无线通讯协定。智慧虚拟助理旨在透过语音命令激活,可协助您完成各种日常任务。

- 智慧扬声器将便利性、连接性和控制性无缝地整合到紧凑型扬声器中,使其成为许多智慧技术爱好者的必备小工具。这些语音助理已经超越了原来的功能,现在非常擅长串流音乐、管理日程、控制智慧家庭设备和搜寻网路。透过采用自然语言处理和人工智慧 (AI) 技术,智慧扬声器能够理解和回答问题、执行各种任务并提供娱乐。

- 随着智慧家庭技术的兴起和智慧家庭设备的出现,消费者的偏好正在转向智慧音箱。这些产品可以透过语音命令进行控制,这是它们受欢迎程度上升的主要推动力。只需使用语音命令即可控製家庭各个方面的便利性极大地吸引了消费者,导致对这些产品的需求激增,从而推动了市场的发展。智慧音箱的功能和特性包括语音命令、通话和通讯、智慧家庭控制、音乐播放、串流媒体、娱乐和媒体控制。

- 由于家庭自动化和人机互动的需求不断增长,预计该市场将在未来几年内成长。人工智慧技术的整合也有望推动市场。由人工智慧助理支援的声控设备变得非常流行,并且正在改变人们搜寻资讯和进行日常活动的方式。随着技术的进步,随着企业和个人寻求适应不断发展的数位环境,语音搜寻优化的重要性显着增加。

- 随着此类设备的需求不断增加,市场上的多家供应商不断投资推出各种产品,这有助于他们在市场上获得竞争优势。例如,苹果于 2023 年 3 月宣布,将于 2024 年上半年推出重新设计的配备 7 吋触控萤幕的 HomePod。第二代 Apple HomePod 于 2023 年初发布。这款智慧扬声器由 Apple 语音助理 Siri 提供支持,具有内建感应器和 EQ 麦克风。最新的 HomePod 由 Apple 专有的 S7 晶片组提供支持,可用作家庭对讲系统。

- 此外,Google的虚拟助理预计将在短期内大幅扩张,并成为 IVA 领域的主导者。 Google Home 语音助理在亚洲的采用率预计将大幅上升,特别是随着Google在多个国家推出该服务。目前,中国市场以阿里巴巴、小米、京东等老牌企业为代表。亚太国家对智慧家庭技术的投资不断增加,以及该地区家庭对智慧设备的需求不断增加,也将推动市场向前发展。

- 此外,智慧扬声器,尤其是那些利用麦克风进行语音辨识的智慧扬声器,引发了安全和隐私问题。音讯资料由多种服务透过网路上传到伺服器。 「Alexa」、「OK Google」和「Siri」等语音指令会启动扬声器,引起消费者的担忧,担心资料和语音模式可能被滥用于各种目的。由于资料主导创新的兴起,预计市场成长将面临挑战。

- 此外,无线技术的进步正在增加全球人口对先进音讯技术的采用,以应对 COVID-19 的后遗症。这项进步极大地促进了智慧音箱在家庭中的使用增加,进一步加速了远距工作文化的传播。

智慧音箱市场趋势

亚马逊 Alexa 预计将显着成长

- 亚马逊提供配备虚拟助理 Alexa 的 Amazon Echo 装置。预计亚马逊 Alexa 细分市场将在未来几年占据市场占有率。其先发优势导致其在各个地区,尤其是美国消费者中迅速采用。随着 Alexa 与多种智慧家居设备整合以及亚马逊与市场新兴企业合作的策略,这种采用预计在未来几年将会成长。此外,其他地区对这些设备的需求不断增长预计也将推动市场成长。

- 原始智慧扬声器的最新版本 Echo(第 4 代)提供除食谱等智慧显示器独有功能之外的所有 Alexa 功能。儘管尺寸小且价格合理,但第四代 Echo 仍可提供令人惊嘆的音质。与之前的型号相比,更直接的驱动设计提高了音讯输出。此外,杜比处理增强了单一扬声器的立体声效果,取代了先前型号的 360 度音讯设计。另一个值得注意的功能是能够根据周围的房间条件动态均衡声音,这项功能称为自动房间适应。

- 亚马逊目前正在利用生成式人工智慧技术来增强 Alexa 的功能。该公司已将生成式人工智慧与 Alexa 集成,以改善其智慧家庭管理系统。透过利用先进的大规模语言模型(LLM),亚马逊旨在更好地与用户沟通,更有效地预测他们的需求,并简化智慧家庭设备的控制和自动化。此外,随着生成式人工智慧的引入,亚马逊正在升级其文字转语音技术,并利用大规模转换模型,使 Alexa 更具表现力和对对话线索的回应能力。这种增强 Amazon Alexa 功能的技术进步预计将推动该领域的成长。

- 在 2023 年 9 月的年度设备展示会上,亚马逊宣布了融合先进人工智慧功能的新硬体和软体。一项显着的改进是新的 Alexa 语音已增强,听起来更像人类。此外,Alexa 将能够进行更自然的对话,而无需用唤醒词提示您。与 ChatGPT 等应用程式类似,Alexa 也能够代表您撰写和发送讯息。 Amazon Alexa 的这些进步预计对于推动该领域的显着成长至关重要。

- 该领域的成长预计将受到美国等地区智慧家庭中越来越多地采用 Amazon Alexa 的推动。亚马逊提供了多种开发选项,允许用户将智慧家庭设备与 Alexa 连接。 Alexa 在智慧家庭中的功能不仅仅是管理灯光和装置。将您的智慧电视、串流媒体设备和音响系统连接到支援 Alexa 的设备,将您的家变成中央娱乐中心。这将使消费者能够使用语音命令轻鬆控制所有这些设备。

- 增加对智慧家庭的投资以及政府促进智慧家庭技术采用的措施预计将进一步推动市场成长。例如,欧盟(EU)积极倡导智慧建筑,以提高能源效率、减少温室气体排放、发展永续都市区。同样,杜拜政府正透过智慧杜拜计画等措施鼓励采用智慧家居,鼓励居民和开发商投资创新。由于功能多样,这些措施预计将促进 Amazon Alexa 智慧音箱的使用。此外,中国、印度和日本等全部区域对智慧家庭技术不断增长的需求也预计将成为扩大市场机会的主要因素。

- 2024 年 2 月,亚马逊庆祝成立六週年,并共用了有关印度支援 Alexa 的装置使用情况的深入资料。该公司透露,印度 99% 的邮递区号地区(从都市区到农村地区)的客户都在购买 Alexa 智慧音箱和 Fire TV Stick。由于客户参与的提高,连接 Alexa 的智慧家庭设备的使用量在过去三年中增加了 200%。在印度的智慧家庭中,Alexa被用来管理各种智慧家电,如智慧灯、插头、风扇、电视、安全摄影机、空调、热水器、空气清净机等。

亚太地区预计将经历最快的成长

- 由于对物联网(IoT)服务和无线设备的需求不断增加,亚太地区的智慧音箱市场预计将大幅成长。中国、印度、日本和韩国等亚太国家的消费者对便利商品的偏好不断增加,推动了该地区受访市场的扩大。该地区已成为物联网技术的主要采用地区,消费者采用新技术的意愿激励製造商创新和产品推出。

- 智慧家庭投资的增加、该地区无线连接需求的增加以及物联网应用的激增正在推动智慧音箱市场的发展。尤其是中国,正大力投资智慧家居技术,推动智慧音箱等语音助理设备的采用。根据深圳市电子产业协会(CSHIA)预测,2022年中国智慧家居市场规模将超过6,520亿元人民币(898.5亿美元),2023年将达到7,157.1亿元人民币(986.3亿美元)。随着5G基础设施的进步和行动电话的高普及率,中国许多电子和家电製造商正在引入智慧家庭系统。

- 中国蓬勃发展的经济和显着的技术进步正在推动智慧城市的快速扩张。结果,城市基础设施变得更加互联和高效,显着提高了居民的生活和工作品质。消费者对舒适、健康、安全、方便、高效的生活方式的期望不断提高,进一步推动了智慧家庭的采用。随着智慧家居接受度的不断扩大,智慧音箱产业在未来几年的需求预计将激增。

- 印度、日本和韩国等亚洲国家因其便利性和便携性而纷纷采用智慧音箱。消费性电子製造业的崛起和无线连接需求的激增预计将成为该地区市场成长的主要推动力。支援母语的智慧音箱在亚太地区等技术先进地区的发展前景广阔。 Google、亚马逊 Alexa 和苹果 Siri 等主要企业正在透过产品发布和投资巩固其在这些国家的市场份额。

- Google Assistant、Alexa 和 Siri 在亚洲取得了巨大成功,但当地替代品可能很快就会流行起来。部分原因是美国科技公司在将亚洲语言融入语音助理和智慧音箱设备方面进展缓慢。也就是说,我们预计该地区对这些扬声器的需求将大幅增加。这一趋势的出现正值亚洲消费者越来越习惯将语音助理融入他们的日常生活,特别是随着新冠肺炎 (COVID-19) 大流行推动非接触式技术的发展。

- 2023 年 8 月,亚马逊电子商务平台报告称,2022 年印度支援 Alexa 的装置上多语言模式的使用量增加了 21%。据该公司称,近一半的 Echo 智慧音箱用户在与 Alexa 互动时选择印度语、英语、印地语等多语言模式。据透露,印度用户热衷于了解 Alexa 的好恶,以及她对相关主题的个人兴趣。这些对消费者偏好的洞察对于推动智慧音箱细分市场的进一步开拓至关重要。

- 此外,2023 年 2 月,亚马逊宣布印度用户现在可以选择 Alexa 的男性和女性声音。这项新功能允许印度用户切换到男声而不是当前的女声。这项增强功能为使用者与 Alexa 的互动提供了更多选择和自由。行业参与者的此类重大进步预计将影响该地区的市场成长潜力。

智慧音箱产业概况

智慧音箱市场是一个半固体市场,拥有苹果、Sonos、百度和 Bose 公司等知名公司。这些主要企业正在积极采取各种策略,包括联盟和收购,以加强产品系列併建立永续的竞争优势。

- 2023 年 9 月,PhonePe 透露,其 SmartSpeaker 已广受欢迎,在印度部署了超过 400 万台设备。这种快速扩张对于全国线下商家来说是前所未有的。 PhonePe 提供的 SmartSpeakers 在无缝确认客户付款方面发挥着至关重要的作用,无需人工干预。此外,这些设备提供的快速语音验证对于在该公司 360 万商家中建立高可靠性和可信度发挥关键作用。这些商家遍布全国 19,000 个邮递区号,PhonePe 的 SmartSpeaker 已成为他们企业的宝贵资产。

- 2023 年 6 月 亚马逊发布 Echo Pop 智慧音箱。 Amazon Echo Pop 由亚马逊 AZ2 Neural Edge 处理器提供支援。透过英语、印地语和印度英语的语音命令,您可以欣赏音乐、控制智慧型装置、安排闹钟、检查板球比分、设定提醒等。您也可以透过蓝牙连接 Echo Pop,从行动电话或电脑传输音乐。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- COVID-19 和其他宏观经济因素对市场的影响

第五章市场动态

- 市场驱动因素

- 扩大投资和政府努力推广智慧家居

- 消费者对智慧连网型设备的需求增加

- 市场挑战

- 人们对安全和隐私的担忧日益增加

第六章 市场细分

- 透过虚拟助手

- 亚马逊 Alexa

- 谷歌援助

- 苹果 Siri

- DuerOS

- 按成分

- 硬体

- 软体

- 按用途

- 智慧家庭

- 智慧办公室

- 消费者

- 按地区

- 北美洲

- 欧洲

- 亚洲

- 澳洲/纽西兰

- 拉丁美洲

- 中东/非洲

第七章 竞争格局

- 公司简介

- Apple Inc.

- Amazon.com Inc.

- Bose Corporation

- Sonos Inc.

- Google LLC(Alphabet Inc.)

- HARMAN International

- Baidu Inc.

- Xiaomi Corporation

- Sony Corporation

- Samsung Electronics Co. Ltd

第八章投资分析

第九章 市场机会及未来趋势

简介目录

Product Code: 50002602

The Smart Speaker Market size is estimated at USD 14.42 billion in 2024, and is expected to reach USD 29.26 billion by 2029, growing at a CAGR of 15.20% during the forecast period (2024-2029).

Key Highlights

- A smart speaker is a loudspeaker and voice command device with a built-in virtual assistant. It allows for hands-free activation and offers interactive actions using a specific "hot word" or multiple ones. These speakers are typically wireless and can connect to Wi-Fi, Bluetooth, or other wireless protocols. They are designed to be activated by voice commands and powered by an intelligent virtual assistant, which assists with various daily tasks.

- Smart speakers have become an essential gadget for numerous enthusiasts of smart technology, as they seamlessly combine convenience, connectivity, and control in a compact speaker. These voice-activated assistants have surpassed their initial functionalities and now excel in streaming music, managing schedules, controlling smart home devices, and searching the web. By employing natural language processing and artificial intelligence (AI) technologies, smart speakers possess the ability to comprehend and answer questions, execute diverse tasks, and offer entertainment.

- The rise in smart home technology and the availability of smart home devices have shifted consumer preferences toward smart speakers. The ability of these products to be controlled through voice commands has been a major driving force behind their increasing popularity. The convenience of controlling various aspects of the home simply by using voice commands has dramatically appealed to consumers, leading to a surge in demand for these products and subsequently boosting the market. Some of the functions and features of smart speakers include voice commands, calls and communication, smart home control, music playback, streaming, entertainment, and media control, among others.

- The market is projected to experience growth in the coming years due to the automation of household chores and the rising need for human-machine interaction. The market is also expected to be driven by the integration of AI technology. Voice-activated devices, which AI assistants support, have become extremely popular and are changing how individuals search for information and carry out their daily activities. With this technological advancement, the significance of voice search optimization has increased notably as businesses and individuals aim to adjust to the evolving digital environment.

- With the increasing demand for these devices, several vendors in the market are constantly investing in introducing various products, helping them gain a competitive edge in the market. For instance, in March 2023, Apple revealed that its redesigned HomePod is expected to be released in the first half of 2024, along with a 7-inch touchscreen display. The second-generation Apple HomePod was introduced earlier in 2023. Equipped with Siri, Apple's voice-activated personal assistant, the intelligent speaker includes built-in sensors and an EQ microphone. The latest HomePod runs on Apple's proprietary S7 chipset and can function as an in-home intercom system.

- Furthermore, it is projected that Google's virtual assistant will experience substantial expansion in the foreseeable future, positioning itself as the dominant IVA category. The adoption of Google Home voice assistant in Asia is predicted to surge, particularly with Google introducing its offerings in various countries. Currently, the Chinese market is characterized by established players such as Alibaba, Xiaomi, and JD.com. The rising investments in smart home technology throughout APAC nations, coupled with the increasing desire for smart devices among households in the region, are also poised to propel the market forward.

- Furthermore, security and privacy concerns arise with smart speakers, especially those utilizing a microphone for voice recognition. Voice data is uploaded to servers via the Internet by multiple services. The activation of speakers through voice commands like "Alexa," "OK Google," and "Siri" poses a risk of potential misuse of data and voice patterns for various purposes, causing apprehension among consumers. The market's growth is expected to face challenges due to the rise of data-driven innovations.

- Moreover, in response to the COVID-19 aftereffects, the global population has increasingly adopted advanced audio technologies due to the advancements in wireless technology. This progress has contributed significantly to the increased usage of smart speakers in households, which further accelerated the widespread adoption of remote work culture.

Smart Speaker Market Trends

Amazon Alexa is Expected to Witness Significant Growth Rate

- Amazon offers the Amazon Echo device powered by the virtual assistant Alexa. The Amazon Alexa division is forecasted to dominate the market share in the coming years. Its adoption is rapidly increasing in various regions, particularly among US consumers, due to its first-mover advantage. This adoption is expected to grow in the next few years because of Alexa's integration with multiple smart home devices and Amazon's strategy to collaborate with emerging players in the market. The increasing demand for these devices in other regions is also expected to drive the market's growth.

- The latest version of the original smart speaker, the Echo (4th Gen), offers all Alexa functions except those limited to smart displays like recipes. Despite its small size and reasonable price, this fourth-generation Echo delivers remarkable sound quality. It features a more direct driver design for improved audio output compared to previous models. Additionally, Dolby processing enhances the stereo effect from a single speaker, replacing the 360-degree audio design of older models. Another standout feature is its ability to dynamically equalize sound based on ambient room conditions, a function known as automatic room adaptation.

- Amazon is currently enhancing the capabilities of Alexa by utilizing generative AI technology. The company has integrated generative AI into Alexa to improve its smart home management system. By leveraging advanced large language models (LLM), Amazon aims to enhance communication with users, predict their needs more effectively, and simplify the control and automation of smart home devices. Furthermore, the implementation of generative AI has allowed Amazon to upgrade its text-to-speech technology, utilizing a large transformer model to make Alexa more expressive and responsive to conversational cues. Such technological advancements to boost the capabilities of Amazon Alexa are expected to drive the segment's growth.

- During its annual devices showcase in September 2023, Amazon unveiled new hardware and software incorporating advanced artificial intelligence capabilities. One notable improvement is the enhanced voice of the new Alexa, which will sound more human-like. Moreover, Alexa will be able to engage in more natural conversations without requiring a wake word to be prompted. Similar to applications like ChatGPT, Alexa will also be capable of composing messages on behalf of users and sending them. These advancements in Amazon Alexa are anticipated to be crucial in driving substantial growth within this segment.

- The segment's growth is anticipated to be driven by the rising adoption of Amazon Alexa in smart homes across different regions, such as the United States. Amazon provides various development options that enable users to connect their smart home devices with Alexa. In addition to managing lights and devices, Alexa's functionalities within smart homes go beyond that. It can transform the house into a central entertainment hub by linking the user's smart TV, streaming devices, and sound system to an Alexa-enabled device. This allows consumers to control all of these devices using voice commands effortlessly.

- The increasing investments in smart homes and the government's efforts to drive the adoption of smart home technology are further expected to drive the market's growth. For example, the European Union (EU) actively advocates for smart buildings to enhance energy efficiency, decrease greenhouse gas emissions, and develop sustainable urban areas. Likewise, the Dubai government is encouraging smart home adoption through initiatives like The Smart Dubai initiative, encouraging residents and developers to invest in innovation. Such developments are expected to boost the utilization of Amazon Alexa smart speakers due to their diverse functionalities. Furthermore, the growing demand for smart home technology across regions like China, India, Japan, and others is significantly expected to enhance the market opportunities.

- In February 2024, Amazon shared insightful data regarding using its Alexa-powered devices in India as it marked its sixth anniversary. The company revealed that its Alexa smart speakers and Fire TV Stick have been bought by customers in 99% of India's postal codes, spanning from urban areas to rural communities. This increased customer engagement has led to a 200% increase in the utilization of smart home devices connected to Alexa over the last three years. Within Indian smart homes, Alexa is utilized to manage various smart home appliances like smart lights, plugs, fans, TVs, security cameras, ACs, water heaters, and air purifiers.

Asia-Pacific is Expected to Witness Fastest Growth

- The smart speaker market in Asia-Pacific is projected to experience substantial growth due to the rising demand for Internet-of-Things (IoT)-enabled services and wireless devices. In APAC countries, such as China, India, Japan, Korea, and others, consumers' preference for convenience goods is growing, contributing to the expansion of the market studied in the region. The region is emerging as a critical adopter of IoT technology, and the willingness of consumers to embrace new technologies has motivated manufacturers to innovate and introduce advanced products.

- The growth in investments in smart homes, the growing demand for wireless connectivity in the region, and the surge in IoT applications are propelling the smart speaker market. China, in particular, is making significant investments in smart home technology, boosting the adoption of voice assistant devices like smart speakers. According to the Shenzhen Electronic Chamber of Commerce (CSHIA), the smart home market in China surpassed CNY 652 billion (USD 89.85 billion) in 2022 and reached CNY 715.71 billion (USD 98.63 billion) in 2023. With the advancement of 5G infrastructure and a high mobile phone penetration rate, numerous Chinese electronics and home appliance manufacturers have introduced smart home systems.

- China's booming economy and remarkable technological progress have been instrumental in the exponential expansion of smart cities. Consequently, urban infrastructure has become more interconnected and efficient, significantly enhancing its inhabitants' quality of life and work. The increasing consumer expectations for comfortable, healthy, safe, convenient, and efficient lifestyles have further stimulated the widespread adoption of smart homes. As the acceptance of smart homes continues to grow, the smart speaker industry is poised to experience a surge in demand in the coming years.

- Countries such as India, Japan, and South Korea in Asia have embraced smart speakers due to their convenience and portability. The rise in consumer electronics manufacturing and the surge in wireless connectivity demand are projected to be key drivers of the market's growth in the region. Smart speakers equipped with native language support hold great promise for growth in technologically progressive regions like APAC. Leading companies like Google, Amazon Alexa, and Apple Siri are solidifying their market presence in these countries through product releases and investments.

- Google Assistant, Alexa, and Siri have succeeded significantly in Asia, but local alternatives could soon gain more popularity. This is partly due to the delayed efforts of American tech companies in incorporating Asian languages into their voice assistant and smart speaker devices. Nevertheless, there is anticipated to be a notable increase in demand for these speakers in the region. This trend is particularly evident as Asian consumers are increasingly at ease integrating voice assistants into their daily routines, especially amidst the push toward touchless technology driven by the COVID-19 pandemic.

- In August of 2023, Amazon's e-commerce platform reported a 21% rise in the utilization of multilingual mode on Alexa-enabled devices in India during 2022. According to the company, nearly half of Echo smart speaker users opt for the Indian-English/Hindi multilingual mode when engaging with Alexa. It was also disclosed that Indian users are keen to learn about Alexa's preferences, dislikes, and personal interests in relevant subjects. These insights into consumer preferences will be crucial in propelling further developments in the smart speaker market sector.

- Furthermore, in February 2023, Amazon announced that Indian users can now choose between a male and female voice for Alexa. This new feature allows Indian users to switch to a male voice instead of the current female voice. This enhancement offers users more options and freedom in their interactions with Alexa. Such significant advancements by industry players are expected to influence the market's growth potential in the region.

Smart Speaker Industry Overview

The smart speaker market is characterized as a semi-consolidated market featuring prominent players like Apple, Sonos, Baidu Inc., Bose Corporation, and others. These key players are actively pursuing various strategies, including partnerships and acquisitions, to enhance their product portfolios and establish sustainable competitive advantages.

- September 2023: PhonePe revealed that its SmartSpeakers gained significant popularity, with over four million devices deployed throughout India. This rapid deployment is unprecedented among offline merchants nationwide. The SmartSpeakers offered by PhonePe play a crucial role in seamlessly verifying customer payments without requiring any manual intervention. Moreover, the swift audio confirmations provided by these devices have played a pivotal role in establishing high trust and reliability among the company's 3.6 crore merchants. These merchants are spread across 19,000 postal codes in the country, making PhonePe's SmartSpeakers an invaluable asset for their businesses.

- June 2023: Amazon unveiled the Echo Pop intelligent speaker. The Amazon Echo Pop features Amazon's AZ2 Neural Edge processor. It enables users to give voice commands in English, Hindi, and Hinglish, allowing them to enjoy music, control smart devices, schedule alarms, check cricket scores, and set reminders. Additionally, users can link the Echo Pop via Bluetooth to stream music from their phone or computer.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of COVID-19 Aftereffects and Other Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Investments and Government Efforts to Boost Smart Homes

- 5.1.2 Increasing Consumer Demand for Smart and Connected Devices

- 5.2 Market Challenges

- 5.2.1 Growing Concerns for Safety and Privacy

6 MARKET SEGMENTATION

- 6.1 By Intelligent Virtual Assistance

- 6.1.1 Amazon Alexa

- 6.1.2 Google Assistance

- 6.1.3 Apple Siri

- 6.1.4 DuerOS

- 6.2 By Component

- 6.2.1 Hardware

- 6.2.2 Software

- 6.3 By Application

- 6.3.1 Smart Homes

- 6.3.2 Smart Office

- 6.3.3 Consumer

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia

- 6.4.4 Australia and New Zealand

- 6.4.5 Latin America

- 6.4.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Apple Inc.

- 7.1.2 Amazon.com Inc.

- 7.1.3 Bose Corporation

- 7.1.4 Sonos Inc.

- 7.1.5 Google LLC (Alphabet Inc.)

- 7.1.6 HARMAN International

- 7.1.7 Baidu Inc.

- 7.1.8 Xiaomi Corporation

- 7.1.9 Sony Corporation

- 7.1.10 Samsung Electronics Co. Ltd

8 INVESTMENT ANALYSIS

9 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219