|

市场调查报告书

商品编码

1550263

人力资本咨询服务:市场占有率分析、产业趋势、成长预测(2024-2029)Human Capital Advisory Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

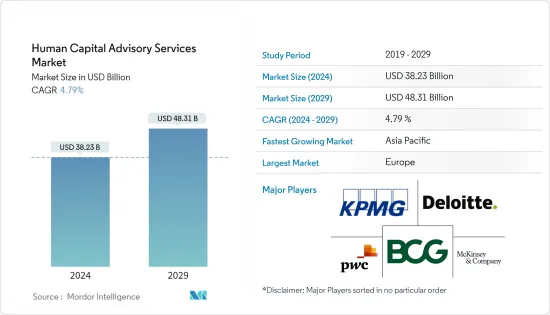

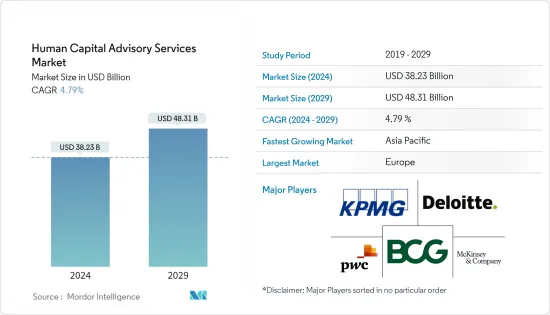

人力资本咨询服务市场规模预计到 2024 年为 382.3 亿美元,预计到 2029 年将达到 483.1 亿美元,在预测期内(2024-2029 年)复合年增长率为 4.79%。

主要亮点

- 人力资本咨询服务市场的成长受到各种宏观和微观因素的影响。例如,经济成长往往会导致业务扩张,从而增加对人力资本咨询服务的需求。相反,当经济低迷时,随着公司寻求优化劳动力和降低成本,需求就会增加。

- 此外,在竞争激烈的劳动力市场中,对人才管理和保留的兴趣的增加将增加对人力资源咨询服务的需求。远距工作和零工经济的兴起需要新的人力资源策略和政策。劳动法的变化,例如最低工资调整、医疗保健规定和多元化要求,也正在影响市场。实施人工智慧、人力资源分析和自动化工具等人力资源技术需要专门的咨询服务。

- 就业率的上升直接带动了对人力资本咨询服务的需求。例如,随着组织扩大员工队伍,他们需要大量的人才管理策略来吸引、留住和培养顶尖人才。人力资源顾问专注于绩效管理、职涯发展和继任规划。

- 此外,随着公司规模的扩大,常常需要重组其组织或创造新的框架。在这种情况下,人力资源咨询服务至关重要,可以提供有关组织设计、变革管理和文化整合的见解。

- 预计还有各种技术趋势将推动市场发展。例如,资料分析透过查看竞争基准化分析、能力差距分析、学习机会、劳动力模式、人才需求等,帮助人力资源部门管理整个人才生命週期。从技术和分析的角度来看,人力资源职能正在不断扩展。

- 例如,2024 年 5 月,人力资源和薪资技术公司 PeopleStrong 与 Google Cloud 合作,采取策略性倡议,推动亚洲公司的人力资源转型和创新。此次合作将把 Google Cloud 的先进人工智慧工具(例如 Vertex AI 和 Gemini 模型)整合到 PeopleStrong 已经强大的人力资源技术平台中。 PeopleStrong 的 HR Tech 4.0 平台脱颖而出,成为由先进生成人工智慧提供支援的印度开创性 HR Tech 解决方案。平台拥有超过2,200个开放API,打造无缝人力资源生态系统,提升员工体验与管理效率。

- 另一方面,由于对外包机构的依赖日益增加,市场成长面临挑战。这个市场涉及公司将其人力资源职能委託给外部服务提供者。公司可以简化人力资源业务、降低成本、提高效率并减轻业务负担。然而,将绩效管理和员工回馈等关键职能移交给外包公司可能会面临放弃控制权并加剧员工不满的风险。虽然人力资源外包带来了专业技能和扩充性,但它对 IT 和酒店业等行业尤其有利。

人力资本咨询服务的市场趋势

中小企业成长显着

- 中小型企业越来越依赖人力资本咨询服务来应对人力资源 (HR) 转型、人力资源分析和技术整合的复杂性。这一趋势是由小型企业特有的挑战所推动的,包括有限的内部专业知识、资源限制和快速的技术创新。

- 当中小型企业努力保持竞争力时,他们往往缺乏有效管理人力资源职能和利用资料分析进行策略决策所需的专业知识。人力资本咨询公司透过提供针对这些中小企业的特定需求和成长阶段的解决方案来提供必要的支援。

- 中小企业面临的主要挑战之一是先进人力资源技术的整合。虽然大公司可能拥有无缝实施新技术的基础设施和预算,但小型企业往往在选择、实施和优化人力资源软体解决方案方面遇到困难。这些技术对于自动化管理业务、提高员工敬业度和推动资料主导的人力资源策略至关重要。

- 研究表明,89% 的企业面临技术整合挑战,尤其是拥有 0 至 25 名员工的小型企业。这凸显了技术引导的重要性,也凸显了产业对数位化适应不足而落后的风险。

- 此外,人力资源挑战和团队文化也被认为是并行的挑战。研究表明,70% 的公司很难找到合适的团队成员,儘管只有 33% 的公司对现有团队感到满意。此外,我们发现 75% 的公司强烈希望加强企业文化并创造积极的职场环境。

- 此外,人力资源、薪资和社会福利软体供应商 Zenefits 还透过技术整合帮助中小型企业简化人力资源流程。透过提供针对小型企业需求量身定制的易于使用的平台,Zenefits 使他们能够更有效地处理人力资源职能,释放资源以专注于成长和创新。

- 据欧盟委员会称,到 2023 年,欧盟 (EU) 将有约 2,440 万家中小企业。另外还有 132 万家小型企业和 202,278 家中型企业。中小企业是欧洲经济的支柱。这些企业约占欧洲所有活跃企业的99.8%,创造了欧盟总付加价值的近52%。

欧洲预计将占据较大市场占有率

- 在对组织转型、市场开拓和有效的劳动力管理策略的日益关注的推动下,欧洲人力资本咨询市场正在经历显着成长。各行业的公司都认识到,优化人力资源对于在快速发展的商业环境中获得竞争优势和永续成长至关重要。当公司寻求适应市场动态、技术进步和监管变化时,组织转型和发展服务至关重要。

- 2023 年 11 月,Cendyn 与 SiteMinder 建立策略合作伙伴关係,以增强 70,000 多家饭店的收益管理能力。此次合作使 Cendyn 客户能够利用 SiteMinder 的收益平台,补充其现有的中央预订系统 (CRS) 功能。 SiteMinder 的收益平台为 Cendyn 的用户提供了透过 SiteMinder 处理费率方案和库存的可能性。此外,您还可以存取 SiteMinder 的完整分销管道(酒店业的大型生态系统),使您能够捕获更动态的收益流组合併加快上市速度。

- 2023 年 11 月,全球数位工程和技术解决方案供应商 Nagarro 将与 UKG 加强合作,作为其策略技术合作伙伴生态系统的一部分,为每个人提供人力资源、薪资和劳动力管理解决方案。

- 透过此次合作,Nagarro 和 UKG 将透过 Ginger AI 整合彻底改变劳动力管理,以简化业务并提高效率。利用 Nagarro 和 UKG Pro Workforce Management(以前称为 UKG Dimensions)的组织可以透过 Microsoft Teams 利用 Nagarro 的企业 AI 平台 Ginger AI 的强大功能,使他们能够满足 Masu 的日常工作需求。 Ginger AI 简化了关键劳动力管理功能的处理,消除了多次登入和平台切换的麻烦。

- 随着企业意识到有效的组织变革、劳动力管理和人才开拓策略的策略价值,欧洲人力资本咨询市场正在不断增长。这些顾问利用他们的专业知识帮助企业克服挑战、利用机会并培养有弹性的人才,从而在充满活力的经济环境中取得长期成功。

人力资本咨询服务业概述

人力资本咨询服务市场高度分散,主要参与者包括毕马威、德勤、普华永道、波士顿顾问集团和麦肯锡公司。市场参与者正在采取联盟和收购等策略来增强其产品供应并获得永续的竞争优势。

- 2023 年 11 月 - 德勤印度与全球薪资核算技术供应商 Ramco Systems Limited 建立策略伙伴关係。此次合作将 Ramco 的先进薪资核算平台与德勤的专业咨询和管理服务结合。两家公司都致力于提供全面的薪资核算解决方案。该解决方案涵盖营运服务、确保合规性、提供无缝的用户体验,并在 150 多个国家/地区提供广泛的覆盖范围。所有这些功能都可以透过统一的薪资核算平台方便地存取。

- 2023 年 11 月 - 普华永道印度公司宣布与基于软体即服务 (SaaS) 的人力资源 (HR) 科技公司 Darwinbox 建立策略合作伙伴关係,帮助印度各地的组织转变其人力资源转型解决方案。普华永道印度公司和 Darwinbox 合作,为印度的组织提供人力资源转型解决方案。透过利用 Darwinbox 在整个员工生命週期中先进的人力资本管理 (HCM) 技术以及普华永道印度公司的行业专业知识,我们的目标是推动印度公司的数位转型。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 竞争程度

- 替代品的威胁

第五章市场动态

- 市场驱动因素

- 经济成长和新业务增加

- 併购增加

- 市场限制因素

- 成立内部顾问小组

- 独立顾问兴起导致人才短缺

- 人力资本咨询市场的技术格局

第六章 市场细分

- 按服务类型

- 人力资源外包

- 人力资源咨询

- 组织变革/组织发展

- 员工管理

- 合规与道德

- 人力资源转型

- 文化与变革

- 其他的

- 学习与发展

- 按组织规模

- 小型企业

- 大公司

- 按最终用户

- 资讯科技

- 卫生保健

- BFSI

- 工业/製造业

- 其他的

- 按地区

- 北美洲

- 欧洲

- 亚洲

- 澳洲/纽西兰

- 拉丁美洲

- 中东/非洲

第七章 竞争格局

- 公司简介

- KPMG

- Deloitte

- PWC

- Boston Consulting Group

- McKinsey & Company

- Capgemini

- Bain and Company

- Accenture

- Mercer

- Korn Ferry

- Aon Plc(Aon Hewitt India)

- Jombay(CIEL HR)

- Ernst & Young Global Limited

- Basiltree Consulting Private Limited

- Robert Half Inc.

- Think Talent Services

- Vendor Positioning Analysis

第八章 未来市场展望

The Human Capital Advisory Services Market size is estimated at USD 38.23 billion in 2024, and is expected to reach USD 48.31 billion by 2029, growing at a CAGR of 4.79% during the forecast period (2024-2029).

Key Highlights

- The growth of the HR advisory market is influenced by various macro and micro factors. For instance, Economic growth often leads to business expansions, increasing the demand for HR advisory services. Conversely, economic downturns drive demand as companies seek to optimize their workforce and reduce costs.

- Moreover, a heightened focus on talent management and retention in competitive labor markets raises the demand for HR advisory. The rise in remote work and the gig economy necessitates new HR strategies and policies. Changes in labor laws, such as minimum wage adjustments, healthcare mandates, and diversity requirements, also impact the market. Adopting HR technologies like AI, HR analytics, and automation tools requires specialized advisory services.

- An increase in employment rates directly drives demand for HR advisory services. For instance, as organizations expand their workforce, they require substantial talent management strategies to attract, retain, and nurture top talent. HR advisors specialize in performance management, career development, and succession planning.

- Moreover, as companies scale, they often require organizational restructuring or the creation of new frameworks to support their growing staff. In such scenarios, HR advisory services are pivotal, offering insights into organizational design, change management, and cultural integration.

- There are various technological trends that are expected to drive the market. For example, Data analysis assists HR in managing the entire talent lifecycle by looking into competitive benchmarking, competency gap analysis, learning opportunities, workforce patterns, talent demands, etc. The human resource function is expanding from both a technological and an analytics perspective.

- For instance, in May 2024, PeopleStrong, an HR and payroll tech company, teamed up with Google Cloud in a strategic move to drive HR transformation and innovation across Asian businesses. This partnership will see the integration of Google Cloud's advanced AI tools, such as Vertex AI and Gemini models, into PeopleStrong's already robust HR tech platform. PeopleStrong's HR Tech 4.0 platform stands out as India's pioneer HR tech solution, leveraging advanced Generative AI. Boasting over 2,200 open APIs, the platform fosters a seamless HR ecosystem, enhancing employee experiences and administrative efficiency.

- On the contrary, Market growth faces a challenge with the rising reliance on outsourcing agencies. This market involves companies delegating their HR functions to external service providers. Businesses can streamline HR tasks, cut costs, boost efficiency, and lighten their administrative load. Yet, entrusting agencies with critical functions like performance management and employee feedback risks ceding control and could spark employee discontent. While outsourcing HR can bring specialized skills and scalability, it's particularly beneficial for industries such as IT and hospitality.

Human Capital Advisory Services Market Trends

SMEs to Register Significant Growth

- Small and medium-sized enterprises (SMEs) are increasingly relying on human capital advisory services to navigate the complex landscape of human resources (HR) transformation, HR analytics, and technology integration. This trend is driven by several challenges unique to SMEs, including limited internal expertise, resource constraints, and the rapid pace of technological change.

- As SMEs strive to remain competitive, they often lack the specialized knowledge required to effectively manage HR functions and leverage data analytics for strategic decision-making. Human capital advisory firms provide essential support by offering tailored solutions that align with the specific needs and growth stages of these smaller businesses.

- One significant challenge SMEs face is the integration of advanced HR technologies. While larger corporations may have the infrastructure and budgets to adopt new technologies seamlessly, SMEs often struggle with selecting, implementing, and optimizing HR software solutions. These technologies are crucial for automating administrative tasks, improving employee engagement, and facilitating data-driven HR strategies.

- According to the survey, 89% of businesses face challenges with technology integration, particularly smaller enterprises with 0 to 25 employees. This underscores the importance of technical guidance and highlights the risk of falling behind due to inadequate adaptation to industry digitization.

- Additionally, HR challenges and team culture were identified as parallel issues. According to the research, The survey found that 70% of businesses struggle to find suitable team members, despite only 33% being satisfied with their current teams. Additionally, 75% of businesses express a strong desire to enhance company culture and create positive work environments.

- In addition to this, Zenefits, a company that provides HR, payroll, and benefits software, has been instrumental in helping SMEs streamline their HR processes through technology integration. By offering a user-friendly platform tailored to the needs of smaller businesses, Zenefits enables SMEs to handle HR functions more efficiently, freeing up resources to focus on growth and innovation.

- According to the European Commission, there were approximately 24.4 million small and medium-sized enterprises in the European Union in 2023. A further 1.32 million enterprises were small firms, while 202,278 were medium-sized firms. Small and medium-sized enterprises form the backbone of the European economy. These companies comprise around 99.8 percent of all active European businesses, producing almost 52% of the total value added in the EU.

Europe is Expected to Hold Significant Market Share

- The human capital advisory market in Europe is experiencing significant growth, driven by the increasing focus on organizational change and development, as well as effective employee management strategies. Companies across various sectors are realizing the critical importance of optimizing their human resources to achieve competitive advantage and sustained growth in a rapidly evolving business landscape. Organizational change and development services are crucial as businesses seek to adapt to market dynamics, technological advancements, and regulatory changes.

- In November 2023, Cendyn and SiteMinder formed a strategic partnership to enhance revenue management capabilities for over 70,000 hotels. Through this collaboration, Cendyn customers gained access to SiteMinder's revenue platform, complementing their existing central reservation system (CRS) capabilities. SiteMinder's revenue platform offers Cendyn's users the potential to handle their rate plans and inventory through SiteMinder. Moreover, they will have access to SiteMinder's complete ecosystem of distribution channels, the big ecosystem for the hotel industry, in order to gain a more dynamic mix of revenue streams and increase their speed-to-market.

- In November 2023, Nagarro, a global provider of digital engineering and technology solutions, introduced an enhanced collaboration with UKG, which is a provider of HR, payroll, and workforce management solutions for all people, as part of its strategic technology partner ecosystem.

- Through this collaboration, Nagarro and UKG revolutionized workforce management with Ginger AI integration, simplifying operations and boosting efficiency. Organizations leveraging Nagarro and UKG Pro Workforce Management (formerly UKG Dimensions) can harness the power of Nagarro's enterprise AI platform, Ginger AI, through Microsoft Teams, meeting the world of work where they are every day. Ginger AI simplifies the handling of crucial workforce management functions, eliminating multiple login hassles or platform-switching.

- Overall, the human capital advisory market in Europe is expanding as businesses recognize the strategic value of effective organizational change, employee management, and talent development strategies. By leveraging specialized expertise, these advisors enable companies to navigate challenges, capitalize on opportunities, and foster a resilient workforce capable of driving long-term success in a dynamic economic environment.

Human Capital Advisory Services Industry Overview

The Human Capital Advisory Services Market is highly fragmented with the presence of major players like KPMG, Deloitte, PWC, Boston Consulting Group, and McKinsey & Company. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- November 2023 - Deloitte India and Ramco Systems Limited, a global payroll technology provider, signed a strategic partnership. This collaboration integrated Ramco's advanced payroll platform with Deloitte's specialized advisory and managed services. Together, they committed to providing a comprehensive payroll solution. This solution covers operational services, ensures compliance, offers a seamless user experience, and provides extensive coverage across 150+ countries. All these features are conveniently accessible through a unified payroll platform.

- November 2023 - PwC India announced a strategic partnership with Darwinbox, a Software as a Service (SaaS) based human resource (HR) technology firm, to assist organizations throughout India to revolutionize HR transformation solutions. PwC India and Darwinbox have joined forces to enhance HR transformation solutions for Indian organizations. By leveraging Darwinbox's advanced Human Capital Management (HCM) technology across the entire employee lifecycle, along with PwC India's industry expertise, they aim to drive digital transformations in Indian enterprises.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Degree of Competition

- 4.2.5 Threat of Substitutes

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Economic Growth and the Growing Number of New Businesses

- 5.1.2 Increased Mergers and Acquisitions

- 5.2 Market Restraints

- 5.2.1 Organizations Establishing in-house Advisory Groups

- 5.2.2 Lack of Talent Due to the Rise of Independent Consultants

- 5.3 Technology Landscape of Human Capital Advisory Market

6 MARKET SEGMENTATION

- 6.1 By Service Type

- 6.1.1 HR Outsourcing

- 6.1.2 HR Consulting

- 6.1.2.1 Organizational Change and Development

- 6.1.2.2 Employee Management

- 6.1.2.3 Compliance and Ethics

- 6.1.2.4 HR Transformation

- 6.1.2.5 Culture and Change

- 6.1.2.6 Others

- 6.1.3 Learning and Development

- 6.2 By Organization Size

- 6.2.1 SMEs

- 6.2.2 Large Enterprise

- 6.3 By End Users

- 6.3.1 Information Technology

- 6.3.2 Healthcare

- 6.3.3 BFSI

- 6.3.4 Industrial and Manufacturing

- 6.3.5 Others

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia

- 6.4.4 Australia and New Zealand

- 6.4.5 Latin America

- 6.4.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 KPMG

- 7.1.2 Deloitte

- 7.1.3 PWC

- 7.1.4 Boston Consulting Group

- 7.1.5 McKinsey & Company

- 7.1.6 Capgemini

- 7.1.7 Bain and Company

- 7.1.8 Accenture

- 7.1.9 Mercer

- 7.1.10 Korn Ferry

- 7.1.11 Aon Plc (Aon Hewitt India)

- 7.1.12 Jombay (CIEL HR)

- 7.1.13 Ernst & Young Global Limited

- 7.1.14 Basiltree Consulting Private Limited

- 7.1.15 Robert Half Inc.

- 7.1.16 Think Talent Services

- 7.2 Vendor Positioning Analysis