|

市场调查报告书

商品编码

1550305

日本塑胶瓶盖和瓶盖:市场占有率分析、行业趋势和统计、成长预测(2024-2029)Japan Plastic Caps And Closures - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

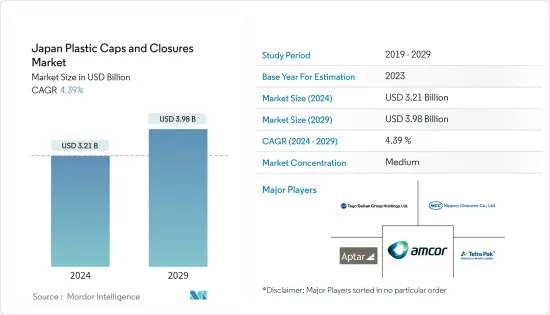

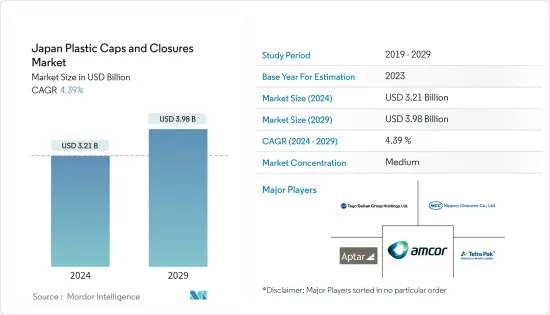

日本塑胶瓶盖和瓶盖市场规模预计到 2024 年为 32.1 亿美元,在预测期内(2024-2029 年)复合年增长率为 4.39%,预计到 2029 年将达到 39.8 亿美元。

出货量方面,预计将从2024年的182.1亿台成长到2029年的217.8亿台,预测期间(2024-2029年)复合年增长率为3.65%。

主要亮点

- 在消费者对西式美食以及从大众消费到消费品的各种产品偏好变化的推动下,日本的食品和饮料产业持续成长。美国农业部(USDA)资料显示,2023年,日本将成为美国农产品第四大市场,进口总额达130亿美元,使美国成为日本最大的外国食品和饮料市场。

- 在日本,对果汁和瓶装水等非酒精饮料的需求正在增加,推动了对塑胶瓶盖的需求。美国的资料突显了日本对美国非酒精饮料日益增长的偏好,尤其是矿泉水和果汁。同时,日本消费者倾向于更健康的饮料和无酒精啤酒,进一步增加了对塑胶瓶盖和瓶盖的需求。

- 日本製造商专注于产品差异化,并将投资转向永续、高品质、价格有竞争力的产品,以满足不断变化的消费者需求。 Nippon Closure 等公司是可回收塑胶瓶盖研究的先驱,推出生物含量为 30% 的瓶盖,以减少其环境足迹并推动市场成长。

- 然而,日本塑胶市场面临挑战。由于供需失衡而导致的塑胶价格波动会直接影响塑胶瓶盖和瓶盖的製造成本,并阻碍市场成长。此外,塑胶废弃物的增加是日本面临的双重挑战,限制了对塑胶包装解决方案的需求。

日本塑胶瓶盖和瓶盖市场趋势

螺帽占比最高

- 由于其气密密封特性,旋盖在食品、饮料、化妆品和药品等各个领域中广泛应用。

- 日本製造商主要采用 HDPE、LDPE 和聚丙烯等树脂材料生产这些盖子,并提供从连续到不连续的不同类型的螺纹。这些瓶盖在饮料瓶中特别受欢迎,各种应用的需求不断增加,因为它们在增强包装的美观性以及保持产品的风味和品质方面发挥着至关重要的作用。

- Amcor Group GmbH 和 Aptar Group Inc. 等主要企业引领市场,客製化螺纹盖以满足各种最终用户的需求。例如,Amcor 的 13/415mm 螺纹罗纹无衬盖专为製药和个人护理最终用途而量身定制。这些盖子的多功能性和优点正在推动它们在各个行业的采用,从食品和饮料到家庭护理、宠物护理和营养食品。

- 在日本,由聚乙烯 (PE)、聚丙烯 (PP) 和其他树脂製成的螺旋盖正在兴起,推动了对产品的需求。这种快速成长主要是由于原料塑胶消费量的增加,主要用于包装解决方案。根据经济产业省最新统计,2024年4月聚乙烯(PE)消费量达84.03吨,聚丙烯(PP)消费量达105.75吨。

食品领域预计将主导市场

- 食品製造的进步导致日本饮食发生重大变化,从传统的生鲜食品转向大规模生产和加工食品。这项变化导致加工食品和已调理食品的增加,尤其受到日本年轻一代和双收入家庭的青睐,推动了市场的显着成长。

- 据美国农业部(USDA)称,日本的老龄化人口越来越青睐富含蛋白质和营养的食品。食品包装用塑胶盖和密封件的需求激增是日本对加工肉类日益增长的需求的直接反应,并且需要增加塑胶盖和密封件的产量来配合。

- 在日本,果酱、腌菜、香辛料和坚果通常装在带有塑胶密封盖的瓶子或容器中。这些密封容器旨在防止污染和篡改,并且易于打开和分配。它在延长产品保质期、保护产品免受外部因素影响以及控制包装内的氧气含量方面发挥关键作用,凸显了它们在推动市场成长方面的重要性。

- 日本对美国进口产品的依赖,包括加工肉品、乳製品、烘焙产品和蔬菜,很大程度上是由强劲的食品零售业所推动的。日本海关资料显示,美国向日本供应26%的肉品、12%的加工蔬菜、6%的新鲜水果和4%的加工水果,导致日本市场对塑胶瓶盖和瓶盖的需求。的是。

日本塑胶瓶盖和瓶盖产业概况

日本的塑胶瓶盖和瓶盖市场适度整合,国内公司包括: Nippon Closures、Toyo Seiken Group Holdings Ltd 以及 Amcor Group GmbH、Aptar Group Inc. 和 Tetra Pak 等国际参与者为了在市场上占据一席之地,公司专注于新产品开发、合作伙伴关係、併购和合作。在那里。

- 2024 年 4 月美国Aptar Group Inc. 宣布推出最新产品 Future Desktop Closure。这种创新的瓶盖专为美容和个人护理领域设计,完全由聚乙烯 (PE) 製成,完全可回收。其安全锁环值得注意,可提高运输可靠性,最终为最终用户创造优质体验。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 买方议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

第五章市场动态

- 市场驱动因素

- 日本食品和饮料产业的崛起

- 市场对创新产品的需求不断增加

- 市场挑战

- 日本塑胶价格波动

第六章 行业法规、政策与标准

第七章 市场区隔

- 按树脂

- 聚乙烯(PE)

- 聚对苯二甲酸乙二酯 (PET)

- 聚丙烯(PP)

- 其他塑胶材质(聚苯乙烯、PVC、聚碳酸酯等)

- 依产品类型

- 螺桿式

- 自动贩卖机

- 没有螺丝

- 儿科的

- 按最终用途行业

- 食品

- 饮料

- 瓶装水

- 碳酸饮料

- 酒精饮料

- 果汁和能量饮料

- 其他饮料

- 个人护理和化妆品

- 家用化学品

- 其他最终用途产业

第八章 竞争格局

- 公司简介

- Amcor Group GmbH

- Aptar Group Inc.

- Sonoco Products Company

- Nippon Closures Co. Ltd.

- Toyo Seiken Group Holdings Ltd.

- Nihon Yamamura Glass Co. Ltd.

- Tetra Laval International SA

- Mikasa Industry Co. Ltd.

第 9 章回收与永续性观点

第10章 未来展望

The Japan Plastic Caps And Closures Market size is estimated at USD 3.21 billion in 2024, and is expected to reach USD 3.98 billion by 2029, growing at a CAGR of 4.39% during the forecast period (2024-2029). In terms of shipment volume, the market is expected to grow from 18.21 billion units in 2024 to 21.78 billion units by 2029, at a CAGR of 3.65% during the forecast period (2024-2029).

Key Highlights

- The Japanese food and beverage industry is on the rise, driven by shifting consumer tastes toward Western cuisine and a broad spectrum of products, ranging from bulk to consumer-oriented. According to data from the United States Department of Agriculture (USDA), in 2023, Japan emerged as the fourth largest market for United States agricultural goods, with imports totaling USD 13 billion, solidifying the United States as Japan's top foreign food and beverage supplier.

- Japan's increasing appetite for non-alcoholic beverages, like juices and bottled water, boosts the demand for plastic caps. Data from the USDA highlights Japan's growing preference for US non-alcoholic beverages, especially mineral water and juices. Concurrently, Japanese consumers are leaning towards healthier drinks and non-alcoholic beers, further fueling the need for plastic caps and closures.

- Japanese manufacturers focus on product differentiation, channeling investments into sustainable, high-quality, and competitively priced offerings to cater to evolving consumer demands. Companies like Nippon Closures Co. Ltd. are pioneering research in recyclable plastic caps, even introducing caps with 30% biomass content to reduce environmental footprints, bolstering market growth.

- However, Japan's plastic market faces challenges. Fluctuating plastic prices, driven by demand-supply imbalances, directly impact the production costs of plastic caps and closures, potentially hindering market growth. Additionally, the country's mounting plastic waste poses a dual challenge, constraining the demand for plastic packaging solutions.

Japan Plastic Caps and Closures Market Trends

Threaded Caps Segment to Have the Highest Share

- Threaded caps find extensive applications across various sectors, including food, beverages, cosmetics, and pharmaceuticals, due to their airtight sealing properties, which are crucial for preventing leaks and maintaining product integrity, especially in Japan.

- Japanese manufacturers craft these caps predominantly from resin materials like HDPE, LDPE, and polypropylene, offering variations in thread types, from continuous to non-continuous closures. These caps, especially popular for beverage bottles, enhance packaging aesthetics and play a pivotal role in preserving the product's flavor and quality, thus amplifying their demand across a spectrum of applications.

- Key players such as Amcor Group GmbH and Aptar Group Inc. lead the market, customizing their threaded caps to cater to various end-users. For instance, Amcor's 13/415 mm threaded ribbed linerless cap is specifically tailored to pharmaceutical and personal care end-use. The versatility and benefits of these caps have propelled their adoption, transcending industries from food and beverages to home care, pet care, and nutraceuticals.

- In Japan, the utilization of Polyethylene (PE), Polypropylene (PP), and other resins for crafting threaded caps are on the rise, bolstering product demand. This surge is largely propelled by Japan's escalating consumption of raw material plastics, primarily for packaging solutions. Recent figures from the Ministry of Economy, Trade, and Industry (METI) reveal that in April 2024, Polyethylene (PE) consumption stood at 84.03 Metric Tons, while Polypropylene (PP) consumption reached 105.75 Metric Tons.

Food Segment Expected to Dominate the Market

- Advancements in food manufacturing have led to a notable shift in the Japanese diet, transitioning from traditional fresh produce to mass-produced and processed foods. This change has seen a rise in pre-processed ingredients and ready-to-eat meals, especially favored by Japan's younger generation and dual-income households, driving substantial market growth.

- According to the United States Department of Agriculture (USDA), Japan's aging demographic increasingly values protein-rich and nutritious foods. The surging demand for plastic caps and closures in food packaging directly responds to Japan's heightened appetite for processed meat products, necessitating a corresponding rise in plastic lid and closure production.

- In Japan, jams, pickles, spices, and nuts are typically found in bottles or containers with airtight plastic closures. These closures prevent contamination and tampering and are engineered for convenient opening and dispensing. Their pivotal role in extending product shelf life, safeguarding against external elements, and managing oxygen levels within the packaging underscores their significance in driving market growth.

- Japan's reliance on the United States for imports, spanning processed meat, dairy, bakery items, and vegetables, is largely steered by the robust food retail sector. Japan Customs data reveals that the U.S. supplies Japan with 26% of its meat products, 12% of processed vegetables, 6% of fresh fruits, and 4% of processed fruits, further fueling the demand for plastic caps and closures in the Japanese market.

Japan Plastic Caps and Closures Industry Overview

The Japanese plastic caps and closures market is moderately consolidated, with domestic players such as Nippon Closures Co. Ltd, Toyo Seiken Group Holdings Ltd, and International players including Amcor Group GmbH, Aptar Group Inc., and Tetra Pak. To solidify their footprint in the market, the players focus on new product development, partnerships, mergers and acquisitions, and collaborations.

- April 2024: Aptar Group Inc., a United States-based company in Japan, unveiled its latest product, the Future Disc Top closure. This innovative closure, designed for the beauty and personal care sector, is crafted exclusively from Polyethylene (PE), making it entirely recyclable. Its secure locking ring is noteworthy, a feature that enhances its transit reliability, ultimately resulting in a premium experience for end-users.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Buyers

- 4.3.2 Bargaining Power of Suppliers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Food and Beverage Sector in the Country

- 5.1.2 Increased Demand for Innovative Products in the Market

- 5.2 Market Challenge

- 5.2.1 Volatility in Plastic Prices in Japan

6 INDUSTRY REGULATION, POLICY AND STANDARDS

7 MARKET SEGMENTATION

- 7.1 By Resin

- 7.1.1 Polyethylene (PE)

- 7.1.2 Polyethylene Terephthalate (PET)

- 7.1.3 Polypropylene (PP)

- 7.1.4 Other Plastic Materials (Polystyrene, PVC, Polycarbonate, etc.)

- 7.2 By Product Type

- 7.2.1 Threaded

- 7.2.2 Dispensing

- 7.2.3 Unthreaded

- 7.2.4 Child-Resistant

- 7.3 By End-Use Industries

- 7.3.1 Food

- 7.3.2 Beverage

- 7.3.2.1 Bottled Water

- 7.3.2.2 Carbonated Soft Drinks

- 7.3.2.3 Alcoholic Beverages

- 7.3.2.4 Juices & Energy Drinks

- 7.3.2.5 Other Beverages

- 7.3.3 Personal Care & Cosmetics

- 7.3.4 Household Chemicals

- 7.3.5 Other End-Use Industries

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Amcor Group GmbH

- 8.1.2 Aptar Group Inc.

- 8.1.3 Sonoco Products Company

- 8.1.4 Nippon Closures Co. Ltd.

- 8.1.5 Toyo Seiken Group Holdings Ltd.

- 8.1.6 Nihon Yamamura Glass Co. Ltd.

- 8.1.7 Tetra Laval International S.A.

- 8.1.8 Mikasa Industry Co. Ltd.