|

市场调查报告书

商品编码

1550353

全球薪资核算服务:市场占有率分析、产业趋势、统计、成长趋势预测(2024-2029)Global Payroll Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

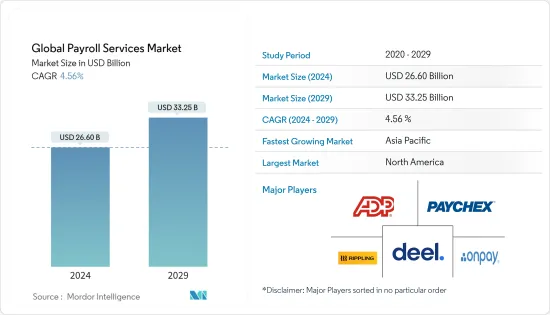

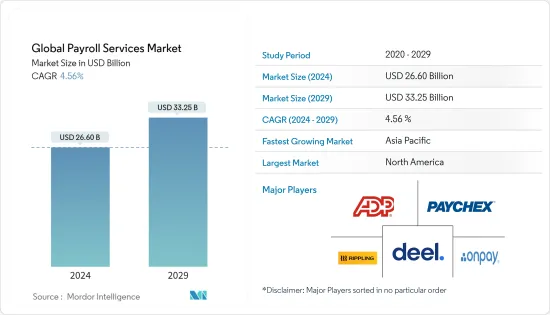

2024年全球薪资核算服务市场规模预计为266亿美元,预计2029年将达到332.5亿美元,在市场估计和预测期间(2024-2029年)复合年增长率为4.56%。

薪资核算服务市场涉及透过软体和自动化简化公司薪资核算和人力资源职能的第三方公司。这些服务处理的业务包括确保准确及时的付款、管理员工时间和出勤、处理劳工赔偿和工资税以及促进直接存款。薪资核算服务的主要类型包括薪资核算、簿记、报税表准备以及针对小型、中型和大型企业的其他会计服务。特别是,薪资核算和簿记服务管理员工付款和财务业务,在各个领域都很受欢迎,包括 BFSI、消费品、IT、公共服务和医疗保健。远距工作、零工经济、不断变化的法规、网路安全以及对可自订和可扩展解决方案的需求等趋势正在推动预期的成长。

未来几年的主要趋势包括人工智慧和自动化的整合、技术进步、向云端基础的薪资核算解决方案的转变、员工自助服务入口网站以及全球薪资核算服务的扩展。薪资核算服务市场专注于员工薪资管理、税务合规和财务业务。该行业在帮助公司优化薪资核算流程并确保准确性、效率和法规遵循方面发挥着至关重要的作用。经验丰富的薪资核算服务提供者可以处理各种业务,从薪资税处理、扣除和社会福利管理到薪资核算和报告。它旨在减轻薪资核算管理负担,使公司能够专注于其核心业务和策略目标。

在评估薪资核算服务时,有几个重要的特征很突出。准确性至关重要,因为它可以确保工资、预扣税和扣除额的准确计算。合规性至关重要,我们一流的服务可确保遵守不断变化的劳工和税务法规。安全是重中之重,强大的通讯协定和加密可以保护敏感的员工和资料。此外,医疗保健、饭店和建设业等特定行业解决方案不断涌现,以满足特定行业的合规需求并减少错误。随着公司在全球扩张,对简化且合规的薪资核算服务的需求正在迅速增加。随着全球化和远距工作趋势,企业正在寻找能够处理跨多个国家/地区和货币的复杂薪资核算、税务申报和彙报的解决方案。这项转变为跨国公司和开展国际业务的中小企业提供全面解决方案的提供者提供了巨大的机会。提供者正在将其产品扩展到薪资核算处理之外,包括员工管理、时间管理和人力资源合规支持,帮助公司降低成本并提高法规合规性。

全球薪资核算服务市场趋势

采用云端基础的薪资核算解决方案

在云端基础的解决方案激增的推动下,全球薪资核算服务市场日益转向云端基础的解决方案。基于云端的服务现在是各种规模企业的最佳选择,无论行业或规模如何,因为它们比传统的本地系统提供了无数的好处。这项变化的关键驱动因素是云端解决方案的成本效益。透过选择云端基础的薪资核算服务,企业可以避免在硬体、软体和维护方面的大量投资,而是选择即用即付的订阅模式。这使您可以降低初始成本并更灵活地分配资源。

此外,云端解决方案还提供无与伦比的灵活性和扩充性。企业可以根据不断变化的需求快速调整薪资核算业务,而无需任何额外的实施工作。这种敏捷性对于员工需求季节性或波动的公司来说是一个福音。可访问性也是云端的优势。云端基础的薪资核算允许企业随时随地管理薪资核算流程。资料安全和合规性问题对于推动云端解决方案的采用也至关重要。提供者在最高层级的安全性方面投入巨资,减轻企业的合规负担并降低违规和处罚的风险。

此外,这些解决方案还拥有强大的自动化和整合功能。透过与人力资源和财务系统无缝同步,简化薪资核算流程并减少人为错误。税务运算和自助服务入口网站等自动化功能可提高效率、提高准确性并节省企业宝贵的时间和资源。值得注意的是,云端基础的薪资核算的吸引力不仅仅针对大公司。中小型企业也很快意识到这些好处并接受它们。云端解决方案正在创造公平的竞争环境,并透过提供先前为大型企业保留的高级功能,为小型企业提供全球竞争优势。

亚太地区占最大市场占有率

2023年,薪资核算服务市场见证了亚太地区的崛起。需求的成长主要是由于跨国公司的存在不断增加,特别是在中国、印度和新加坡等主要国家。这些国家强劲的经济扩张增加了对简化薪资核算服务的需求,特别是考虑到劳动力的多样性。此外,该地区对云端基础的薪资核算解决方案和技术进步的关注进一步加速了市场的成长。随着公司越来越重视合规性和监管合规性,他们对薪资核算服务提供者的依赖也随之增加。因此,亚太市场是全球薪资核算服务市场成长最快的部分之一。

亚太地区薪资核算服务市场也受惠于政府改善商业环境和吸引外国投资的措施。中国和印度等国家已经实施了简化税法和劳动法的改革,使企业更容易运作。这项改革创造了一个环境,让薪资核算服务提供者更容易提供解决方案。同时,越来越多的公司将薪资核算业务外包给专业公司。这背后的两个目标是降低业务成本和专注于核心业务。该地区中小型企业(SME)的日益普及以及他们对具有成本效益和高效的薪资核算解决方案的寻求也促进了市场的成长。

全球薪资核算服务业概览

薪资核算服务市场得到整合,少数大公司占了很大比例。这些行业领导者拥有资源和专业知识,可以为跨国公司和大型企业提供量身定制的端到端薪资核算服务。这些公司提供广泛的服务,包括薪资核算、税务合规和人力资源管理,并为全球客户提供服务。市场主要企业包括ADP、Paychex、Rippling、Deel、OnPay等。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场驱动因素

- 行动和网路普及将推动薪资核算服务市场的成长

- 远距工作的快速成长加速了薪资核算服务市场的成长

- 市场限制因素

- 资料安全和隐私

- 价值链/供应链分析

- 波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 对市场创新的见解

- 洞察监理市场影响

第五章市场区隔

- 按类型

- 薪资核算/簿记服务

- 税务申报服务

- 其他会计服务

- 按用途

- 小型企业

- 中型公司

- 大公司

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 其他北美地区

- 欧洲

- 德国

- 英国

- 法国

- 俄罗斯

- 西班牙

- 其他欧洲国家

- 亚太地区

- 印度

- 中国

- 日本

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 中东

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 其他中东地区

- 北美洲

第六章 竞争状况

- 市场集中度概况

- 公司简介

- ADP

- Paychex

- Rippling

- Deel

- OnPay

- Papaya Global Ltd

- Workday

- Gusto

- Alight

- Justworks*

第七章市场机会与未来趋势

第 8 章 免责声明与出版商讯息

The Global Payroll Services Market size is estimated at USD 26.60 billion in 2024, and is expected to reach USD 33.25 billion by 2029, growing at a CAGR of 4.56% during the forecast period (2024-2029).

The payroll services market involves third-party companies that streamline the payroll and HR functions of businesses through software and automation. These services handle tasks like ensuring accurate and timely payments, managing employee time and attendance, handling workers' compensation and payroll taxes, and facilitating direct deposits. Key types of payroll services include payroll and bookkeeping, tax preparation, and other accounting services catering to small, medium, and large businesses. Specifically, payroll and bookkeeping services manage staff payments and financial operations and are prevalent across various sectors, including BFSI, consumer products, IT, public services, healthcare, and more. Trends like remote work, the gig economy, evolving regulations, cybersecurity, and the need for customizable, scalable solutions fuel the projected growth.

Critical trends in the coming years include AI and automation integration, technological advancements, a shift toward cloud-based payroll solutions, employee self-service portals, and an expanding global payroll service landscape. The payroll services market is dedicated to managing employee remuneration, tax compliance, and financial operations. This industry is pivotal in helping businesses optimize their payroll processes, ensuring accuracy, efficiency, and legal compliance. Seasoned payroll service providers handle tasks ranging from payroll tax processing, deductions, and benefits management to salary calculations and report generation. They aim to reduce the administrative load of payroll, enabling businesses to concentrate on their core operations and strategic objectives.

Several vital characteristics stand out when evaluating payroll services. Accuracy is paramount, as it ensures precise calculations for wages, tax withholdings, and deductions. Compliance is crucial, with top services ensuring adherence to evolving labor and tax regulations. Security is a top priority, safeguarding sensitive employee and financial data through robust protocols and encryption. Additionally, the market is witnessing the emergence of specialized solutions tailored to specific industries like healthcare, hospitality, and construction, addressing their unique compliance needs and reducing errors. As businesses increasingly operate globally, the demand for streamlined, compliant payroll services surges. With the trend of globalization and remote work, companies are seeking solutions that can handle complex payroll calculations, tax filings, and reporting across multiple countries and currencies. This shift presents a significant opportunity for providers to offer comprehensive solutions, catering to multinational corporations and smaller businesses with international operations. Beyond payroll processing, providers are expanding their offerings to include workforce management, time tracking, and HR compliance support, aiding businesses in cost reduction and improved regulatory compliance.

Global Payroll Services Market Trends

Adoption of Cloud-based Payroll Solutions

The global payroll services market is witnessing a robust trend toward cloud-based solutions, propelled by their popularity. These cloud offerings, favored for their myriad benefits over traditional on-premise systems, are now the go-to choice for businesses across industries and sizes. A primary driver for this shift is the cost-effectiveness of cloud solutions. By opting for cloud-based payroll services, businesses sidestep hefty investments in hardware, software, and maintenance, instead opting for a subscription model based on usage. This slashes upfront costs and allows for more agile resource allocation.

Moreover, cloud solutions offer unparalleled flexibility and scalability. Businesses can swiftly adjust their payroll operations to match evolving needs sans the hassle of additional installations. This agility is a boon for firms with seasonal or fluctuating workforce demands. Accessibility is another ace up the cloud's sleeve. With cloud-based payroll, businesses can manage their payroll processes from anywhere and anytime, a feature increasingly valued in today's dynamic work environments. Data security and compliance concerns are also pivotal in driving the adoption of cloud solutions. Providers invest heavily in top-tier security, easing the compliance burden on businesses and mitigating risks of breaches and penalties.

Furthermore, these solutions boast robust automation and integration capabilities. Seamlessly syncing with HR and finance systems, they streamline payroll processes, curbing manual errors. Automated features like tax calculations and self-service portals boost efficiency and enhance accuracy, saving businesses valuable time and resources. It is worth noting that the allure of cloud-based payroll is not exclusive to corporate giants. Small and medium-sized enterprises are swiftly recognizing and embracing these benefits. Cloud solutions are leveling the playing field by offering advanced functionalities previously reserved for more prominent players, empowering smaller businesses to compete globally.

Asia-Pacific Holds the Largest Market Share

In 2023, the payroll services market witnessed Asia-Pacific's ascendancy. This rise in demand was chiefly propelled by the growing presence of multinational corporations, particularly in key nations such as China, India, and Singapore. The robust economic expansion in these countries has heightened the necessity for streamlined payroll services, especially given the diverse nature of their workforces. Furthermore, the region's pivot toward cloud-based payroll solutions and technological advancements has only accelerated this market's growth. As companies increasingly prioritize compliance and regulatory adherence, they are increasingly relying on payroll service providers. Consequently, the Asia-Pacific market is one of the swiftest-growing segments in the global payroll services landscape.

The payroll services market in Asia-Pacific is also benefiting from government initiatives to improve business environments and attract foreign investments. Countries like China and India have introduced reforms to simplify tax structures and labor laws, making it easier for businesses to operate. The reforms have fostered a conducive environment for payroll service providers to offer solutions. Simultaneously, companies outsourcing payroll functions to specialized providers are on the rise, driven by a dual goal, i.e., cutting operational costs and honing in on core business activities. The increasing penetration of small and medium-sized enterprises (SMEs) in the region also contributes to the market's growth, as these businesses seek cost-effective and efficient payroll solutions.

Global Payroll Services Industry Overview

The payroll services market is consolidated, with a handful of significant players commanding a substantial market share. These industry leaders have the resources and expertise to deliver end-to-end payroll services tailored to multinational corporations and large enterprises. Their extensive service portfolios encompass payroll processing, tax compliance, and HR management, catering to a global clientele. Some of the major players in the market are ADP, Paychex, Rippling, Deel, and OnPay.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Mobile and Internet Proliferation Propelling Growth in Payroll Services Market

- 4.2.2 Remote Work Surge Accelerates Growth in Payroll Services Market

- 4.3 Market Restraints

- 4.3.1 Data Security and Privacy

- 4.4 Value Chain / Supply Chain Analysis

- 4.5 Porters Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Insights on Technological Innovation in the Market

- 4.7 Insights on the Impact of Regulatory Bodies on the Market

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Payroll and Bookkeeping Services

- 5.1.2 Tax Preparation Services

- 5.1.3 Other Accounting Services

- 5.2 By Application

- 5.2.1 Small Business

- 5.2.2 Medium Business

- 5.2.3 Large Business

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Russia

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 India

- 5.3.3.2 China

- 5.3.3.3 Japan

- 5.3.3.4 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.5 Middle East

- 5.3.5.1 United Arab Emirates

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 Rest of Middle East

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 ADP

- 6.2.2 Paychex

- 6.2.3 Rippling

- 6.2.4 Deel

- 6.2.5 OnPay

- 6.2.6 Papaya Global Ltd

- 6.2.7 Workday

- 6.2.8 Gusto

- 6.2.9 Alight

- 6.2.10 Justworks*