|

市场调查报告书

商品编码

1624577

中东和非洲的安瓿包装:市场占有率分析、产业趋势和成长预测(2025-2030)MEA Ampoules Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

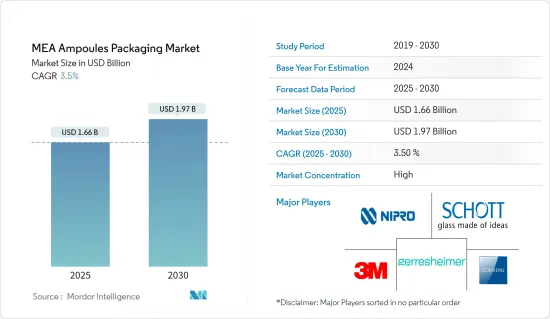

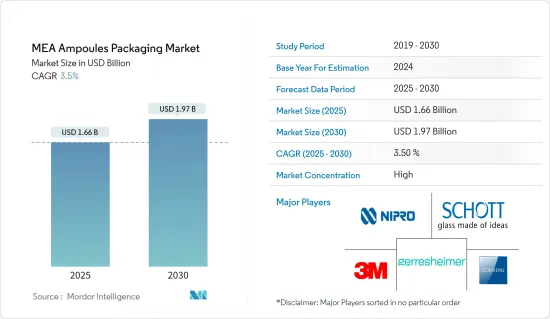

中东和非洲安瓿包装市场规模预计到 2025 年为 16.6 亿美元,预计到 2030 年将达到 19.7 亿美元,预测期内(2025-2030 年)复合年增长率为 3.5%。

製药业的成长正在推动市场的成长。该地区的药品产量不断增加,对安瓿的需求也随之增加。

主要亮点

- 中东和非洲地区的製药业发展潜力巨大,为安瓿製造商提供了许多机会。此外,地方政府透过长期计画的持续支持和投资,支持医药产业的永续发展。

- 《杜拜 2030 年工业战略》和《阿布达比 2030 年愿景》将製药业视为具有巨大成长潜力的产业。 《杜拜2030年工业战略》和《阿布达比2030年愿景》将製药业确定为具有巨大成长潜力的产业,製药业的成长前景、出口潜力和中长期经济影响显示我们的目标是实现重大发展。

- 该行业正在不断发展,需要包装来治疗传染性和非传染性疾病。因此,药品生产对安瓿包装的需求不断增加,以保护药品免受损坏、生物污染和外部影响。

- 非洲拥有临床试验基础设施和能力,其中大部分位于南非。因为南非在研发方面的投资比非洲大陆其他地区都多。 Ardagh 集团的非洲分公司 Ardagh Glass Packaging-Africa (AGP-Africa) 宣布投资扩大其位于南非豪登省 Nigel 工厂的生产能力。为了满足未来几年的预期需求,该公司将扩大其设施,增加第三座熔炉,以实现永续玻璃包装的生产。

- 为了提高国产药品的品质和完整性,政府推出了严格的规则和法规,导致玻璃作为药品包装产品材料的使用增加。由于它们对环境产生负面影响,各国政府和监管机构已禁止和限制在药品包装中使用某些类型的塑料,例如一次性塑料和某些非再生塑料。

中东和非洲安瓿包装市场趋势

玻璃安瓿的采用预计将变得引人注目。

- 玻璃安瓿因其各种优点(包括 100%诈欺包装)而广泛应用于製药业作为注射药物的初级包装。安瓿也是注射药物初级包装的热门选择,并在中东和非洲等成本敏感的新兴市场中广泛采用。

- 该地区政府正在加强和支持,以促进学名药的采用以及学名药商店的建立。该地区感染疾病爆发的高发生率将推动注射剂的采用,并预计在预测期内增加玻璃安瓿的采用。根据 Alpen Capital 的数据,2022 年医疗保健支出将为 607 亿美元,2023 年将增加至 638 亿美元。医疗保健支出的增加将推动市场成长。

- 对于爱滋病毒/爱滋病等疾病的治疗,越来越需要无菌注射药物设备来注射药物,因为使用同一设备注射药物很容易发生感染。安瓿有时也用于储存和运输药物。由于该地区爱滋病毒/爱滋病的高风险,玻璃安瓿的使用预计会增加。

- 阿拉伯联合大公国(UAE)拥有最发达的医药市场之一和强大的医疗基础设施。阿联酋国内药品製造商正在增加药品产量。辉瑞、诺华、葛兰素史克 (GSK)、默克、艾伯维、礼来、拜耳、阿斯特捷利康、赛诺菲、百时美施贵宝和安进等大型製药企业和跨国公司长期以来透过製造和当地销售管道建立了影响力。

- 沙乌地阿拉伯国家工业发展与物流计画(NDLP)预计,到2030年,沙乌地阿拉伯的製药业务将价值440亿沙乌地里亚尔(约117.2亿美元)。根据ITA估计,2022年医疗保健和社会发展支出预计为368亿美元,占总预算的14.4%,是继教育和军事之后的第三大类别。医疗保健产业私有化是沙乌地阿拉伯政府的目标。成长机会的增加将为各种玻璃安瓿包装公司投资该领域创造机会。

南非预计将占有很大份额

- 由于相对稳定的政治气候和来自世界各地的企业的大量投资,南非的经济正在蓬勃发展。该国的製药业也在显着成长。

- 南非製药业的快速成长得益于快速的都市化、医疗保健支出的增加以及主要企业投资的增加。鼓励国际参与者扩大在南非製药业的影响力。 Aspen Pharmacare 等公司正在见证成长,2023 年估值为 22.0561 亿美元,2020 年估值为 18.236 亿美元。这种收益成长预计将提振安瓿市场。

- 随着南非製药业的快速发展,对合适的包装解决方案的需求也不断增长。这是因为药品在药品供应链中从製造到消费的各个过程中都必须小心处理。这主要是由于药物的敏感性,暴露在外在环境中就失去了治疗效果和药效。因此,製药公司必须遵守严格的消费者安全和环境法规。

- 由于疾病发病率的上升以及对维持医疗解决方案免受外部环境影响的需求不断增长,製药公司在製造、储存和包装的每个阶段都在确保药品的品质。此外,製药公司正在推出治疗该国流行的重大疾病的药物,进一步增加了南非对安瓿的需求。

- 在收入水平提高、环保意识增强、有利的人口趋势以及向单向包装的转变等多种因素的推动下,非洲对永续包装的需求正在显着增加。

- 根据非洲大陆自由贸易区(AfCFTA)私部门策略,非洲大陆40%的疾病和残疾是由爱滋病毒/爱滋病、结核病、疟疾、腹泻和呼吸道疾病引起的,所有这些疾病都可以透过包装药物治疗。的是这可能为该国安瓿等医药包装产品创造商机。

中东和非洲安瓿包装产业概况

玻璃安瓿高度透明,易于检查和监控内容物。随着製药业的扩张,对玻璃安瓿的需求也不断增长。随着生产水准的提高,该地区对药用玻璃产品的需求正在迅速增加。

由于康宁公司、3M公司、肖特公司、格雷斯海默公司和尼普罗公司等主要企业很少,市场变得整合。市场参与者正在努力与多个区域组织建立重要合作,以扩大其在市场中的影响力和份额。该地区製药业的市场发展预计将为现有参与者和新进入者提供机会。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场动态

- 市场驱动因素

- 对安全可靠的药品包装的需求不断增长

- 增加政府对包装材料的法规

- 市场限制因素

- 环境和永续性议题

第六章 市场细分

- 材料

- 玻璃

- 塑胶

- 国家名称

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 南非

- 埃及

第七章 竞争格局

- 公司简介

- SCHOTT AG

- Corning Incorporated

- 3M Company

- Gerresheimer AG

- Nurrin Pharmalab Pty(Ltd)

- Yadong Pharma Packaging Industry Co. Ltd

- Nipro Corporation

第八章投资分析

第九章 市场机会及未来趋势

The MEA Ampoules Packaging Market size is estimated at USD 1.66 billion in 2025, and is expected to reach USD 1.97 billion by 2030, at a CAGR of 3.5% during the forecast period (2025-2030).

The growing pharmaceutical industry is helping the market grow. The need for ampoules increases with the increasing pharmaceutical production in the region.

Key Highlights

- Middle East and Africa has enormous potential for the pharmaceutical industry's growth, posing several opportunities for ampoule manufacturers. Additionally, the regional government supports the pharmaceutical industry's sustainable development through continued support and investments in long-term plans.

- The Dubai Industrial Strategy 2030 and the Abu Dhabi Vision 2030 view the pharmaceutical industry as one with major growth potential. They aim to make significant developments due to the growth prospects, export potential, and mid-term to long-term economic impact of the industry.

- The industry is growing, and there is a need for packaging to heal communicable and non-communicable diseases. Thus, the demand for ampoule packaging in pharmaceutical manufacturing is increasing as it protects pharmaceuticals from damage, biological contamination, and external influences.

- Africa has clinical trial infrastructure and capabilities, most of which are in South Africa, as it has invested more heavily in R&D than others on the continent. The African business division of Ardagh Group, Ardagh Glass Packaging - Africa (AGP - Africa), announced an investment to expand the manufacturing capacity of its Nigel factory in Gauteng, South Africa. To satisfy anticipated demand over the coming years, the company will expand its facility by adding a third furnace, enabling it to produce sustainable glass packaging.

- Introducing stringent rules and regulations to improve the quality and integrity of domestically manufactured drugs increases the usage of glass as a material for pharmaceutical packaging products. Due to adverse environmental impact, governments and regulatory bodies have introduced bans or restrictions on several specific types of plastics used for pharmaceutical packaging, such as single-use plastics or certain non-recycled plastics.

MEA Ampoules Packaging Market Trends

Glass Ampoules Are Expected to Witness Significant Adoption

- Glass ampoules are widely adopted as a type of primary packaging in the pharmaceutical industry for injection drugs due to their various benefits, such as 100% tamper-proof packaging. Also, ampoules are a popular choice for primary packaging for injectables and are widely adopted in cost-sensitive or emerging markets like Middle East and Africa.

- The region is witnessing an increase in government initiatives and support to foster the adoption of generic products, coupled with the move to start generic medical stores. The high prevalence of infectious diseases in the region is expected to drive the adoption of injectables, increasing the adoption of glass ampoules during the forecast period. According to Alpen Capital, the healthcare expenditure was USD 60.7 billion in 2022, which increased to USD 63.8 billion in 2023. Such increases in healthcare expenditures drive the market's growth.

- In the case of diseases like HIV/AIDS treatment, the need for sterile drug injection equipment for injecting drugs increases, as the disease can easily be transmitted by using the same equipment to inject the drug. Hence, ampoules may be used for drug storage and transport. This is expected to increase the adoption of glass ampoules in the region, as the risk of HIV/AIDS is high.

- The UAE pharmaceutical market is one of the most developed and has a robust healthcare infrastructure. Domestic medication manufacturers in the United Arab Emirates have increased their production of medicines. With their long-standing presence in the nation through manufacturing or local distribution channels, major research-based pharmaceutical companies and top multi-nationals, like Pfizer, Novartis, GlaxoSmithKline (GSK), Merck, AbbVie, Eli Lily, Bayer, AstraZeneca, Sanofi, BMS, and Amgen, have opened up opportunities for market growth.

- The Saudi National Industrial Development and Logistics Program (NDLP) estimates that Saudi Arabia's pharmaceutical business will be worth SAR 44 billion (USD 11.72 billion approximately) by 2030. According to ITA, healthcare and social development were estimated to be valued at USD 36.8 billion in 2022, or 14.4% of its overall budget, and the third-largest category after education and the military. Privatizing the healthcare sector is a goal of the Saudi Arabian government. The increase in growth would create opportunities for various glass ampoule packaging companies to invest in the sector.

South Africa Expected to Hold a Significant Share

- South Africa's economy is booming due to a relatively stable political scenario and the enormous investments made by companies worldwide. The country has also seen significant growth in the pharmaceutical industry.

- The rapid growth in the pharmaceutical industry in South Africa can be attributed to rapid urbanization, an increase in healthcare spending, and a rise in investments by leading pharmaceutical companies. International players are encouraged to expand their presence in the pharmaceutical landscape of South Africa. Companies such as Aspen Pharmacare are witnessing growth; it was valued at USD 2205.61 million in 2023 and USD 1823.6 million in 2020. Such revenue growth would leverage the market for ampoules.

- With rapid growth in the pharmaceutical industry in South Africa, the need for proper packaging solutions also increases. This is because during the various processes in the supply chain of a pharmaceutical product, starting from manufacture to consumption, the pharmaceutical products need to be handled carefully. This is mainly due to the sensitivity of narcotics, which lose their therapeutic or medicinal properties when exposed to any exterior environment. Hence, pharmaceutical companies must follow stringent consumer safety and environmental regulations.

- Due to the growing number of diseases and the growing need to keep medical solutions safe from the external environment, pharmaceutical companies ensure the quality of pharmaceuticals throughout the manufacturing, storing, and packaging processes. Also, pharmaceutical companies are launching drugs to treat major diseases prevalent in the country, further boosting the demand for ampoules in South Africa.

- Africa is experiencing a significant increase in the need for sustainable packaging, fueled by several factors, including rising income levels, growing environmental consciousness, favorable demographics, and a move toward one-way packaging.

- According to the African Continental Free Trade Area (AfCFTA) Private Sector Strategy, 40% of the disease hindrance on the continent is due to HIV/AIDS, tuberculosis, malaria, diarrhea, and respiratory diseases, all of which are commonly treated by packaged medicines. This might create opportunities for pharmaceutical packaging products, including ampoules, in the country.

MEA Ampoules Packaging Industry Overview

Glass ampoules offer superior transparency, facilitating effortless inspection and monitoring of their contents. As the pharmaceutical industry expands, it fuels the demand for glass ampoules. The region is witnessing a surge in demand for these pharmaceutical glass products, driven by escalating production levels.

The market is consolidated due to very few major players, such as Corning Incorporated, 3M Company, Schott AG, Gerresheimer AG, and Nipro Corporation. The market players strive to create significant collaborations with several regional organizations to expand their market presence and share. Developments in the pharmaceutical industry in the region are expected to provide opportunities for the existing as well as new market players.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Safe and Reliable Pharmaceutical Packaging

- 5.1.2 Increasing Government Mandates Regarding Packaging Material

- 5.2 Market Restraints

- 5.2.1 Environmental and Sustainability Issues

6 MARKET SEGMENTATION

- 6.1 Material

- 6.1.1 Glass

- 6.1.2 Plastic

- 6.2 Country

- 6.2.1 Saudi Arabia

- 6.2.2 United Arab Emirates

- 6.2.3 South Africa

- 6.2.4 Egypt

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 SCHOTT AG

- 7.1.2 Corning Incorporated

- 7.1.3 3M Company

- 7.1.4 Gerresheimer AG

- 7.1.5 Nurrin Pharmalab Pty (Ltd)

- 7.1.6 Yadong Pharma Packaging Industry Co. Ltd

- 7.1.7 Nipro Corporation