|

市场调查报告书

商品编码

1637904

美国安瓿包装:市场占有率分析、产业趋势、统计数据、成长预测(2025-2030 年)United States Ampoules Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

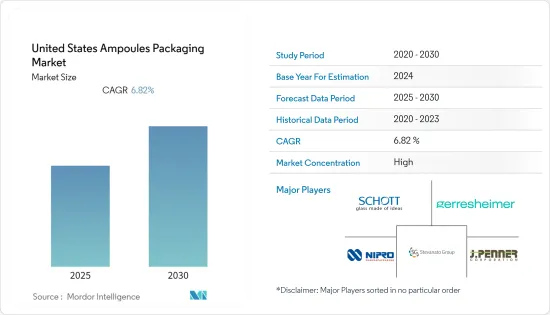

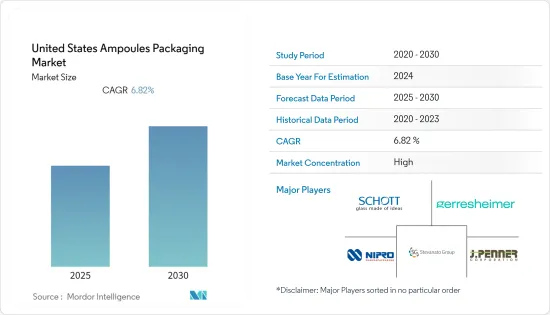

预计预测期内美国安瓿包装市场的复合年增长率为 6.82%。

主要亮点

- 安瓿瓶广泛用于製药和化学实验室,用于储存和保存药物溶液、胶囊和液体。这对产品的保质期有重大影响,因为它可以防止药品的污染和掺假。玻璃安瓿瓶透明度高,易于检查内容物,相对不透湿、不透气,对大多数药物具有耐化学性,因此具有很强的保护性。

- 塑胶安瓿瓶推出市场是为了解决安瓿瓶破裂时玻璃颗粒可能进入内容物的担忧。预计这将为塑胶安瓿製造商创造机会,因为他们可能会受到不同国家监管升级和标准的影响。

- 为了满足各个终端用户产业日益增长的需求,一些公司生产客製化尺寸的玻璃安瓿瓶。直柄安瓿瓶和开口漏斗玻璃安瓿瓶是两种不同的安瓿瓶。由于疫苗市场的成长,直柄安瓿瓶的需求预计会增加。近期的新冠疫情,为蓬勃发展的疫苗产业的发展提供了进一步的动力。

- 此外,为了维持药物特性,玻璃是药用安瓿瓶市场最常用的首选材料。例如,叶酸钙等细胞毒药物通常以 3 mg/ml 注射的形式包装在 10 ml 安瓿瓶中。安瓿的另一个重要应用领域是化妆品/美容行业。脸部、眼部、头髮和手部高品质酏剂和精华液的市场不断增长是市场发展的关键驱动因素。

- 然而,玻璃安瓿瓶的製造和运输成本比塑胶安瓿瓶更高,对使用过的安瓿瓶的不当处理可能会在预测期内阻碍市场的成长。

- 由于製造延误造成供应链困难,COVID-19 的蔓延对市场产生了负面影响。然而,随着生产更多的 COVID 疫苗以对抗 COVID-19 的传播,情况发生了变化,这导致製药业务对安瓿瓶的需求增加,从而促进了 COVID-19 期间市场的扩张。

美国安瓿瓶包装市场趋势

玻璃具有较高的商业价值,因此可回收性高

- 美国消费者重视永续和环保的包装解决方案,这就是为什么製造商选择玻璃安瓿瓶而不是其他包装解决方案。 Gerresheimer 等公司服务于国际医药和医疗保健行业的所有细分市场,涵盖美容和卫生的各个方面。

- 由于大多数包装解决方案都是基于玻璃的,因此药品包装只占废弃物的一小部分。玻璃包装也是100%可回收的,从环保角度来看,它是首选的包装选择。此外,有色玻璃(例如琥珀色或红色)可以保护内容物免受紫外线和某些波长的伤害。玻璃安瓿瓶易于加热灭菌,适合用于药品包装。

- 此外,政府推出了严格的法规,限制 PET 材料在药品包装中的使用,这使得玻璃包装在製药业更具吸引力。

- 此外,根据玻璃包装协会 (GPI) 的说法,使用回收玻璃製造新产品可减少原材料消耗、减少排放气体、延长熔炉等玻璃製造设备的使用寿命并节省能源。例如,在製造过程中每使用10%的回收碎玻璃(玻璃屑),能源成本就会降低约2-3%。

- 玻璃包装协会已设立目标并正在製定计划,到2030年实现美国50%的回收率。然而,美国玻璃容器的回收率仅37%左右,需要迎头赶上。欧洲已实现约74%的高玻璃回收率。市政当局和材料回收机构正在努力透过认证和试点计画来提高美国的玻璃回收率。

- 据 IQVIA 称,2021 年品牌药销售额占美国药品金额的 84%。 2021年药品总支出将达到约5,740亿美元。 2012年至2021年期间,支出将逐年增加,总合2,550亿美元。支出的增加无疑将影响预测期内对安瓿瓶的需求。

製药业占很大份额

- 由于疫苗储存需求的不断增长,对药用玻璃安瓿瓶的需求预计会增加。此外,随着美国居民健康问题的增加,製造业急剧增加以满足需求。儘管许多公司在新冠疫情期间看到需求受到负面影响,但一些行业却实现了成长,其中包括製药玻璃产业。

- 此外,肖特 (Schott) 和 Gerresheimer AG 等玻璃製造商报告称,为适应 COVID-19 疫苗相关的发展,製药业对安瓿瓶、瓶子和管瓶的需求增加。

- 由于担心光线和紫外线透过率太高,安瓿瓶在医药市场的使用量不断增加。安瓿可以提供更好的保护和安全,防止受到各种波长的辐射,对于储存多种药物至关重要。塑胶安瓿瓶的可塑性刺激了多种形状和尺寸的安瓿瓶的生产,以满足製药业的各种应用。

- 此外,越来越多的消费者选择单剂量肠外包装,而不是多剂量包装。塑胶安瓿瓶提供固定剂量,有助于製药公司减少药物过度填充和製造过程中的其他低效率,从而控製成本。因此,塑胶安瓿瓶对于经营昂贵药品的製药公司来说特别有利。

- 此外,美国主要製药公司在全球医药市场占有较大的份额,2021年美国的份额为40.8%就证明了这一点。例如,根据 IQVIA 的数据,2021 年,美国是全球最大的国内医药市场,约占所有医药支出的 41%。中国已确立其第二大市场地位,市场占有率接近12%。

美国安瓿瓶包装产业概况

由于市场供应商数量较少且该地区的行业已成熟,美国安瓿瓶包装市场正在整合。市场参与者正在寻找新方法,例如策略伙伴关係和新产品发布,以加速美国安瓿包装市场的发展。

- 2022 年 1 月:Ritedose Corporation 宣布计划开发和商业化 20 年来第一种分配单剂量液体药物的新方法。经过五年的研究和开发,这家开发了吹灌封单剂量技术的公司推出了SuredoseRx™,这是一种更简单、更实用的为医护人员和患者分配单剂量液体药物的方法。到了。该公司将在 Ritedose Corp. 的非专利液体药物新单剂量吹灌密封安瓿瓶中推出三种最受欢迎的液体药物,以降低溢出和污染的风险。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

- 产业价值链分析

- COVID-19 产业影响评估

第五章 市场动态

- 市场驱动因素

- 防窜改药品包装的需求

- 提高可回收玻璃的商业价值

- 市场限制

- 对倾倒使用过的安瓿瓶的担忧

第六章 市场细分

- 按材质

- 玻璃

- 塑胶

- 按最终用户

- 药品

- 个人护理和化妆品

第七章 竞争格局

- 公司简介

- Schott AG

- J. Penner Corporation

- Gerresheimer AG

- Stevanato Group

- Accu-Glass, LLC

- Nipro Pharma Packaging International NV

- James Alexander Corporation

- Wheaton Group(DWK Life Sciences, Inc.)

第八章投资分析

第九章:市场的未来

简介目录

Product Code: 48413

The United States Ampoules Packaging Market is expected to register a CAGR of 6.82% during the forecast period.

Key Highlights

- Ampoules are widely used in pharmaceutical and chemical laboratories to preserve and store medicinal fluids, capsules, and liquids. They have greatly influenced the shelf life of products as they prevent contamination and mix of medicines. Glass ampoules offer high transparency enabling easy inspection of their contents and higher protection as they are relatively impervious to moisture and air and chemically resistant to most medicinal products.

- The emergence of plastic ampoules in the market has been to counter some of the concerns relating to glass particles entering the contents during the breaking of the ampoules. This is expected to create an opportunity for plastic ampoules manufacturers and may be impacted by regulatory upgrades and standards in the respective nation.

- Several players are manufacturing custom-sized glass ampoules to cater to the swelling demand from various end-user industries. Straight stem ampoules and open funnel glass ampoules are manufactured for two different ampoules. Straight-stem ampoules are expected to witness increased demand owing to the growth of the vaccine market. The recent COVID-19 pandemic has provided further impetus to developing the fast-growing vaccine industry.

- Additionally, to maintain the properties of the medications, glass is a preferred material predominantly used in the pharmaceutical ampoule market. For instance, cytotoxic medicines, such as calcium folinate, are primarily packed in 3 mg/ml injection in the 10ml ampoule. Other significant areas of application for ampoules constitute the cosmetics/beauty industry. The growing market for high-quality elixirs and serum products for the face, eye area, hair, and hands have been a significant driver in the studied market.

- However, improper disposal of used ampoules will impede market expansion in the projected timeframe as glass ampoules are more expensive to manufacture and ship compared to plastic ones.

- The spread of COVID-19 negatively impacted the market due to supply chain difficulties brought on by delayed manufacturing. However, the situation drastically changed because more COVID vaccines were produced to counter the spread, which increased the demand for ampoules in the pharmaceutical business, which aided the market expansion during COVID-19.

US Ampoules Packaging Market Trends

High Commodity Value of Glass Resulting in High Recyclability

- Consumers in the United States are placing greater importance on sustainable, eco-friendly packaging solutions, which allows manufacturers to adopt glass ampoules over alternative packaging solutions. Companies such as Gerresheimer serve all market segments of the international pharmaceutical and healthcare industry, covering all aspects of beauty and hygiene.

- Pharmaceutical packaging accounts for a small proportion of waste because most of the packaging solutions use glass as a material. Additionally, glass packaging is 100% recyclable, which makes it a desirable packaging option from an environmental point of view. Moreover, colored glass, such as amber and red-colored glass, protects its contents from ultraviolet rays and specific wavelengths. Glass ampoules can easily sterilize using heat, making them suitable for pharmaceutical packaging.

- Furthermore, strict government regulations regarding the restrictions on the usage of PET material for pharmaceutical packaging further increase the attractiveness of glass packaging for the pharmaceutical industry.

- Also, according to the Glass Packaging Institute (GPI), using recycled glass in the manufacturing of new products reduces the consumption of raw materials, cuts emissions, extends the life of glass-making equipment such as furnaces, and saves energy. For instance, energy costs are reduced by around 2-3% for every 10% crushed recycled glass (cullet) used in the production process.

- The Glass Packaging Institute has set a target and plans to achieve a 50% recycling rate in the United States by 2030. However, the United States needs to catch up to the glass recycling rate, with around 37% of container glass being recycled. Europe has achieved a higher glass recycling rate of about 74%. Municipalities and Materials Recovery Facilities are attempting to increase the United States glass recycling rate through certifications and pilot programs.

- According to IQVIA, sales of brand-name drugs accounted for an 84% share of the money spent on medicines in the United States in 2021. The total amount spent on medicines reached about USD 574 billion in 2021. The spending increased year on year between 2012 and 2021, raising the total by USD 255 billion. The increased spending will undoubtedly impact the demand for ampoules in the projected time.

Pharmaceutical Industry will have a Significant Share

- Pharmaceutical glass ampoules demand is expected to increase due to the growing need for vaccine storage. Also, owing to the increasing health-related issues among the people living in the United States, manufacturing to meet the demand has increased dramatically. Even though many businesses faced negatively affected demand during the COVID-19 pandemic, few sectors, including the pharmaceutical glass industry, witnessed growth.

- Additionally, glassmakers such as Schott and Gerresheimer AG have reported increased demand from the pharmaceutical sector for ampoules, bottles, and vials to meet COVID-19 vaccine-related developments.

- Concerns such as light and ultraviolet penetration led to the growth in the use of ampoules in the pharmaceutical market. Ampoules offer better protection and security from various wavelengths of radiation and are mandatory for storing several medications. The moldable characteristic of plastic ampoules has stimulated ampoule manufacturing in multiple shapes and sizes for different uses in the pharmaceutical sector.

- Moreover, the choice of unit-dose parenteral packaging for consumers over multi-dose packaging has increased. Plastic ampoules provide fixed dosages to help pharmaceutical companies control costs by reducing drug overfill and other inefficiencies in the production process. Hence, plastic ampoules are especially advantageous for pharmaceutical companies dealing with costly drugs.

- Furthermore, the leading pharmaceutical companies in the United States hold a significant share of the global pharmaceutical markets, which is evident from the fact that the united states had 40.8% in 2021. For instance, according to IQVIA, In 2021, the United States held the position as the world's largest national pharmaceutical market, accounting for around 41% of all pharmaceutical expenditures. With a nearly 12% market share, China has established itself as the second-largest market.

US Ampoules Packaging Industry Overview

The United States Ampoules Packaging Market is consolidated due to the presence of few vendors in the market and the maturity status of the industry in the region. The market players are finding new ways, such as strategic partnerships or launching new products, to accelerate the development of ampoule packaging in the United States.

- January 2022: The Ritedose Corporation announced the development of and planned to commercialize the first new way to dispense single-dose liquid medications in two decades. After five years of research and development, the blow-fill-seal unit dosage technology creator introduced SuredoseRxTM, a simpler and more practical method for healthcare professionals to dispense and for patients to consume single doses of liquid drugs. The company is debuting three of its most popular liquid drugs in a new, single-dose, blow-fill-seal ampoule for generic liquid medications from Ritedose Corp. to reduce the risk of spills and contamination.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Demand for Tamper-proof Pharmaceutical Product Packaging

- 5.1.2 Commodity Value of Glass Increased with Recyclability

- 5.2 Market Restraints

- 5.2.1 Concerns Regarding Dumping of Used Ampoules

6 MARKET SEGMENTATION

- 6.1 By Material

- 6.1.1 Glass

- 6.1.2 Plastics

- 6.2 By End-user

- 6.2.1 Pharmaceutical

- 6.2.2 Personal Care and Cosmetic

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Schott AG

- 7.1.2 J. Penner Corporation

- 7.1.3 Gerresheimer AG

- 7.1.4 Stevanato Group

- 7.1.5 Accu-Glass, LLC

- 7.1.6 Nipro Pharma Packaging International NV

- 7.1.7 James Alexander Corporation

- 7.1.8 Wheaton Group (DWK Life Sciences, Inc.)

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219