|

市场调查报告书

商品编码

1851382

安瓿包装:市占率分析、产业趋势、统计、成长预测(2025-2030)Ampoules Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

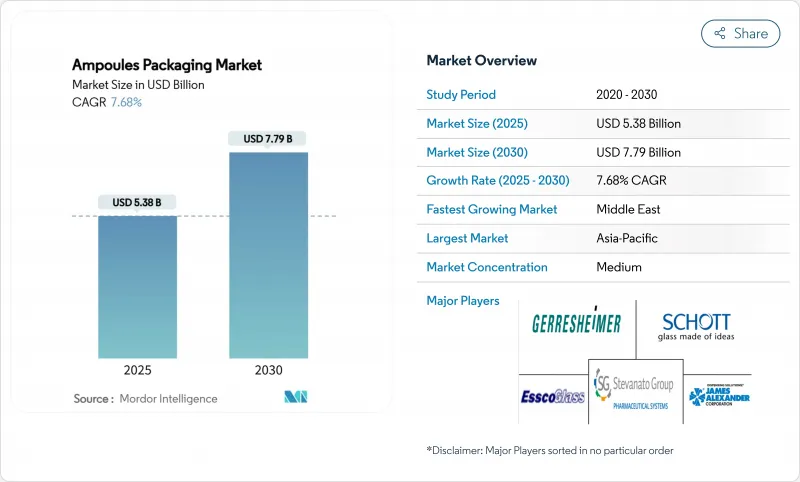

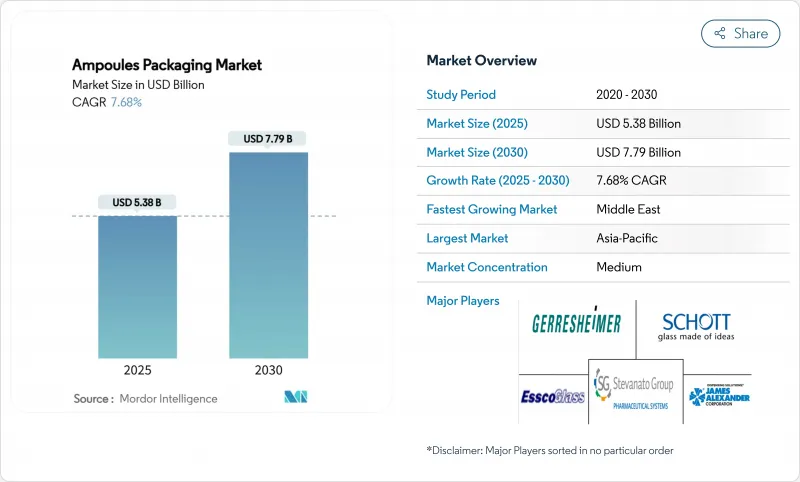

预计到 2025 年,安瓿包装市场规模将达到 53.8 亿美元,到 2030 年将扩大到 77.9 亿美元,预测期内复合年增长率将达到 7.68%。

生技药品的成长以及製药业向单剂量注射剂型的转型推动了市场扩张,而这项转型又受到全球法规优先考虑防篡改和连续包装容器的驱动。目前,玻璃安瓿因其化学惰性和已获监管机构认可而占据主导地位,但随着吹灌封(BFS)平台展现出其无菌性和成本效益,塑胶安瓿的市场也迅速成长。亚太地区的需求领先,中国和韩国将于2024年核准肉毒桿菌毒素的新适应症,而人工智慧赋能的视觉检测线正在加速提升大批量生产商的品质保证水准。市场竞争依然适中。主要供应商的差异化优势并非体现在单价上,而是体现在防篡改系统设计、可追溯性功能和永续性项目上,这在能源成本波动的情况下,也使得利润净利率受到一定影响。

全球安瓿包装市场趋势与洞察

对防窜改药品包装的需求

为了满足美国食品药品监督管理局 (FDA) 21 CFR 211.132 和欧盟《反假药指令》的要求,製药公司正大力投资研发可见的防拆封,推动安瓿瓶规格向折环和刻痕线技术发展,这些技术能够产生清晰的篡改痕迹。肖特製药 (SCHOTT Pharma) 的单点切割系统预计到 2024 年将占据全球折断系统细分市场 62% 的份额,这标誌着病患安全功能正从高阶配置转变为标准配置。防篡改技术也能降低高价值生技药品的责任风险,因为完整性受损会直接威胁治疗效果。医院越来越多地将简化的真伪验证作为采购标准,促使供应商优先考虑坚固耐用的折断设计。因此,替代材料的资质标准日益严格,巩固了玻璃在重症加护製剂中的主导地位。

I型玻璃的可回收性和循环价值

永续性要求正促使相关人员倾向于选择能够在不影响品质的前提下重新进入生产循环的容器。肖特製药、Corplex 和武田製药于 2024 年开展的一项闭合迴路初步试验表明,与原生玻璃相比,这种容器可减少 50% 的温室气体排放,同时满足美国药典 (USP) <660> 的耐化学性标准。欧洲监管机构目前正将采购奖励与可回收性评分挂钩,并鼓励当地医疗保健系统优先选择玻璃屑玻璃。 SGS 的审核已证实,回收的 I 型玻璃保持了相同的水解稳定性,确保了药品品质基准值不受影响。随着品牌所有者追求范围 3 的脱碳目标,能够保证可追溯回收成分的安瓿瓶製造商在供应合约中获得了优势。这一趋势也正在蔓延至亚太地区,跨国公司正将欧盟 ESG 标准纳入竞标流程中。

预填充式注射器占销售量

面向零售市场的生技药品和患者自用疗法正转向预充式註射器,这种包装方式能够提供更精准的剂量和更便捷的患者使用体验。 Stevanato集团2024年註射器销售成长15%,而管瓶销售量却下降了34%,凸显了注射器替代西林瓶的巨大压力。注射器更高的净利率促使生产商将生产时间从安瓿瓶转移到预充式註射器。重磅GLP-1促效剂将加速这一转变,因为自行注射的依从性是支付方选择预充式註射器的主要原因。儘管如此,对于一些对注射器塞子中硅油和钨残留物敏感的药物而言,安瓿瓶仍然必不可少。分散的需求迫使安瓿瓶生产商将目光投向那些对稳定性要求极高的小众分子药物,并加大行销投入,强调玻璃纯度的优势。

细分市场分析

到2024年,玻璃仍将占据安瓿包装市场87%的份额,这反映了其成熟的监管信誉和无与伦比的化学耐久性。然而,到2030年,塑胶的复合年增长率将达到9.78%,这主要得益于免除无菌验证步骤并降低人事费用的BFS生产线。在玻璃配方方面,i型硼硅酸在生技药品、肿瘤药物和高活性化合物的包装中占据主导地位。康宁的Valor配方在维持水解等级i级性能的同时,有效防止了分层现象,从而拓宽了玻璃在严苛低温运输环境中的应用范围。

製造商正在采用多元化的经营模式:肖特製药公司2024年销售额的55%将来自高价值、高价位的玻璃製品,而聚合物专家则专注于疫苗和学名药的销售量。一次完成容器的成型、填充和密封,减少了对二次包装的需求,简化了供应链,从而提升了塑胶製品的经济效益。儘管如此,到2025年,玻璃基解决方案的市场规模将达到46.9亿美元,超过塑胶的6.9亿美元。这一发展趋势取决于治疗风险接受度、所需的保质期以及永续性评估,表明两者将共存而非相互替代。

预计到2024年,直柄安瓿将以63%的市场份额领先安瓿包装市场,而诸如单点切割(OPC)、刻痕和色环易断设计等更人性化的包装形式也将以9.21%的复合年增长率增长。医疗保健机构越来越重视减少针刺伤和破损申诉,并将此作为采购标准之一,因此,易于开启的包装在护理和居家照护机构中至关重要。同时,漏斗形安瓿仍适用于黏稠製剂和悬浮液,其宽口设计便于高效填充。

易开启设计也受到疫苗和化妆品领域自我给药趋势的推动。肖特製药的easyOPC设计可将开启力差异降低60%,进而降低配製过程中液体溢出的风险。随着断裂系统专利的到期,中型製造商将能够复製这些功能,从而加剧低利润治疗层级的价格竞争。然而,高端生技药品仍倾向于采用专有的断裂技术,以确保无菌性和可追溯性,从而增强创新领先企业的利润弹性。预计到2030年,易开启型安瓿包装市场规模将超过21亿美元,主要得益于差异化的人体工学价值。

区域分析

到2024年,亚太地区将占全球销售额的39%,这主要得益于中国、印度和韩国产能的扩张,以及各国政府推动注射剂供应链在地化进程。中国生物製药产值预计在2024年达到5,653亿元(7,84亿美元),到2029年将超过1.4兆元(1,940亿美元)。在韩国,江南区美容产业丛集带动了对一体化小批量玻璃製品的订单;而在印度,「印度製造」奖励则支持了疫苗瓶罐罐产能的扩张。同时,东南亚国协透过税收优惠和简化GMP核准来吸引合约研发生产企业(CDMO),从而提升了该地区的竞争力。

北美市场正经历稳定成长,这得益于生技药品的商业化进程以及《药品供应链安全法案》(DSCSA) 合规期限对连续式初级包装容器的要求。美国主要受高价值订单的推动,这些订单包括符合美国药典 (USP) <1790> 中关于注射剂目视检查建议的 I 型玻璃包装和人工智慧检测线。加拿大鼓励供应商提供双语包装和 GS1 相容条码,以满足美国的可追溯性标准。值得注意的是,除草剂诉讼和供应链衝击正促使製药公司从墨西哥采购安瓿瓶,扩大了北美内部贸易。

欧洲是一个经济发达且成熟的地区,永续性和循环经济目标驱动着采购决策。欧盟对包装和包装废弃物法规的修订要求到2030年回收率至少达到70%,这将推动对闭合迴路I型玻璃的需求。德国医院于2024年组成采购联盟,与供应商签订五年合约,确保供应商提供的玻璃屑含量至少达到50%。同时,由于天然气供应中断导致能源价格波动,加剧了人们对熔炉停机的担忧,促使一些公司囤积硼硅酸玻璃管。然而,欧盟为生命科学基础建设拨出的復苏资金将补贴下一代检测设备,部分抵销成本的担忧。

在中东地区,沙乌地阿拉伯和阿联酋的复合年增长率最高,到2030年将达到9.03%,这得益于两国将公共卫生预算转向本地製造业。利雅德的「2030愿景」医药计画将共同资助一座无菌注射剂工厂,从而创造对灌封式註射器(BFS)和管状生产线的待开发区需求。海湾合作委员会(波湾合作理事会)的竞标规则优先考虑成本效益,这使得印度和欧洲的中型企业能够获得市场份额。然而,技术纯熟劳工有限,因此需要透过技术转移伙伴关係,包括设备供应和长期服务协议。

在拉丁美洲,宏观经济不稳定阻碍了疫苗的普及,儘管巴西国家卫生监督局(ANVISA)正按照欧盟口蹄疫疫苗的要求推广疫苗序列化,从而为可追溯安瓿瓶的出现创造了可能。然而,非洲联盟(非盟)提出的2040年实现60%国内疫苗生产的目标,可望在预测期的后半段刺激疫苗生产设施(BFS)的投资。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 对防篡改包装的需求

- i-玻璃的可回收性与循环价值

- 加强注射剂可追溯性监管

- 生技药品CDMO转向单剂量安瓿瓶

- 利用人工智慧实现零缺陷视觉侦测线

- 亚太地区注射美容的兴起

- 市场限制

- 预填充式注射器蚕食了销售量

- 废弃利器和化学废弃物的负担

- 低碳炉管材供应不稳定

- 玻璃分层召回风险

- 价值链分析

- 监管环境

- 技术展望

- 波特五力分析

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- 评估市场宏观经济趋势

第五章 市场规模与成长预测

- 依材料类型

- 玻璃

- 塑胶

- 按安瓿类型

- 直茎

- 漏斗型

- 封闭式(D 型)

- 简易开局(OPC、评分、CBR)

- 以体积(毫升)

- 2毫升或更少

- 3-5 mL

- 6-10 mL

- 10毫升或更多

- 透过製造技术

- 传统管材成型

- 吹塑-灌封-密封塑料

- 高级雷射评分

- 按最终用户行业划分

- 製药

- 个人护理和化妆品

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 其他欧洲地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 亚太其他地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 其他非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Schott Pharma AG and Co. KGaA

- Gerresheimer AG

- Stevanato Group SpA

- SGD Pharma

- Nipro PharmaPackaging International NV

- Shandong Pharmaceutical Glass Co., Ltd.

- James Alexander Corporation

- Global Pharmatech Pvt. Ltd.

- Essco Glass Pvt. Ltd.

- AAPL Solutions Pvt. Ltd.

- Hindusthan National Glass and Industries Ltd.

- Ardagh Group SA

- PGP Glass Pvt. Ltd.(Piramal)

- Amcor plc(Rigid Plastics)

- Unicep Packaging LLC

- Catalent Pharma Solutions, Inc.

- Recipharm AB(BFS)

- Weiler Engineering, Inc.

- Owens-Illinois, Inc.(OI)

- Vetropack Holding AG

第七章 市场机会与未来展望

The ampoules packaging market reached USD 5.38 billion in 2025 and is projected to climb to USD 7.79 billion by 2030, translating to a 7.68% CAGR over the forecast period.

Expansion is anchored in the pharmaceutical sector's pivot toward single-dose injectable formats, propelled by biologics growth and global regulations that prioritize tamper-evident, serialised containers. Glass ampoules currently dominate because they combine chemical inertness with established regulatory acceptance, yet plastic formats are scaling quickly as blow-fill-seal (BFS) platforms prove their sterility and cost benefits. Asia-Pacific leads demand after China and South Korea approved new botulinum toxin indications in 2024, while AI-enabled visual inspection lines accelerate quality-assurance gains for high-volume producers. Competitive intensity remains moderate: leading suppliers differentiate on break-system design, traceability features and sustainability programs instead of unit price, cushioning margins even as energy-related costs fluctuate.

Global Ampoules Packaging Market Trends and Insights

Demand for Tamper-Evident Pharmaceutical Packs

Drug manufacturers are investing heavily in visible tamper-evidence to satisfy FDA 21 CFR 211.132 and EU Falsified Medicines Directive requirements, steering ampoule specifications toward break-ring and score-line technologies that produce unmistakable indicators of interference. SCHOTT Pharma's One-Point-Cut system captured 62% of the global break-system sub-market by 2024, demonstrating how patient-safety features have moved from premium to standard expectation. Tamper-evidence also lowers liability risk for high-value biologics because compromised integrity directly threatens therapeutic efficacy. Hospitals increasingly cite simplified authenticity checks as a procurement criterion, encouraging suppliers to prioritise robust break designs. The resulting shift tightens qualification windows for alternative materials, reinforcing glass dominance in critical-care formulations.

Recyclability and Circular Value of Type-I Glass

Sustainability mandates push stakeholders to prefer containers that can re-enter production loops without downgrading quality. Type-I borosilicate satisfies this need: a 2024 closed-loop pilot by SCHOTT Pharma, Corplex and Takeda trimmed greenhouse-gas emissions by 50% versus virgin glass while meeting USP <660> chemical resistance benchmarks. European regulators now tie procurement incentives to recyclability scores, encouraging local health systems to favour glass derived from cullet streams. SGS audits confirm recycled Type-I maintains identical hydrolytic stability, so pharmaceutical-quality thresholds remain intact. As brand owners target Scope 3 decarbonisation, ampoule producers that guarantee traceable recycled content secure supply-agreement advantages. These developments extend to Asia-Pacific as multinationals transplant EU ESG criteria into regional tender processes.

Prefilled Syringes Cannibalising Volumes

Retail-oriented biologics and self-administered therapies are migrating to ready-to-inject syringes that offer dosing accuracy and patient convenience. Stevanato Group's 15% surge in syringe revenue in 2024 coincided with a 34% slump in vial sales, exemplifying format substitution pressure. Syringes carry superior margins, prompting producers to reallocate furnace hours away from ampoules. The shift is accelerated by blockbuster GLP-1 agonists, where self-injection adherence drives payer preference. Nevertheless, ampoules remain vital for drugs sensitive to silicone oil or tungsten residue associated with syringe stoppers. The segmented demand profile obliges ampoule suppliers to target niche, stability-critical molecules and invest in marketing that highlights glass purity advantages.

Other drivers and restraints analyzed in the detailed report include:

- Regulatory Push on Injectable Traceability

- Biologics CDMO Shift Toward Single-Dose Ampoules

- Tubing Supply Volatility from Low-Carbon Furnaces

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Glass maintained an 87% share of the ampoules packaging market in 2024, reflecting entrenched regulatory confidence and unmatched chemical durability. Plastic formats, however, are logging a 9.78% CAGR through 2030, powered by BFS lines that cut sterility validation steps and shrink labor outlays. Within glass, Type-I borosilicate remains the default for biologics, oncology drugs and highly reactive compounds. Corning's Valor composition eliminates delamination while retaining hydrolytic class I properties, widening glass's applicability to high-stress cold-chain environments.

Manufacturers adopt divergent business models: SCHOTT Pharma derived 55% of 2024 revenue from high-value glass offerings that command premium pricing, whereas polymer specialists chase volume in vaccines and generics. Supply-chain simplicity strengthens plastic economics because containers form, fill and seal in one pass, reducing secondary packaging needs. Still, the ampoules packaging market size for glass-based solutions stood at USD 4.69 billion in 2025, dwarfing plastic's USD 690 million contribution. The trajectory indicates coexistence rather than displacement, hinging on therapeutic risk tolerance, required shelf-life and sustainability calculus.

Straight-stem ampoules led with 63% of ampoules packaging market share in 2024, but user-friendly formats such as One-Point-Cut (OPC), score-ring and color-breakring designs are rising at 9.21% CAGR. Healthcare providers increasingly rank reduced needlestick injuries and breakage complaints as procurement criteria, making easy-open options indispensable for nursing and at-home care settings. In parallel, funnel-type ampoules retain relevance for viscous or suspension formulations where wider necks enable efficient filling.

Easy-open uptake is also fueled by self-administration trends in vaccines and aesthetics. SCHOTT Pharma's easyOPC design cuts opening force variability by 60%, thereby decreasing spillage risk during dose preparation. As break-system patents expire, mid-tier producers can emulate these features, intensifying price competition in lower-margin therapeutic classes. Nonetheless, premium biologics continue to favor proprietary break technologies that guarantee sterility and traceability, reinforcing margin resilience for innovation leaders. The ampoules packaging market size for easy-open variants is projected to surpass USD 2.1 billion by 2030, supported by differentiating ergonomic value.

The Ampoules Packaging Market Report is Segmented by Material Type (Glass, and Plastic), Ampoule Type (Straight-Stem, Funnel-Type, Closed Form D, and More), Capacity (<=2 ML, 3-5 ML, and Above 10 ML), End-User Industry (Pharmaceutical, and Personal Care and Cosmetics), Manufacturing Technology (Conventional Tubular Forming, Blow-Fill-Seal Plastic, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific controlled 39% of global revenue in 2024, buoyed by capacity expansions across China, India and South Korea as governments localise injectable drug supply chains. China's biopharmaceutical output hit CNY 565.3 billion (USD 78.4 billion) in 2024 and could eclipse CNY 1.4 trillion (USD 194 billion) by 2029, sustaining demand for ampoules despite sporadic API export restrictions tied to the 2024 Anti-Espionage Law. South Korea's aesthetics cluster in Gangnam fuels consistent small-volume glass orders, while India's "Make in India" incentives support BFS capacity additions for vaccines. Concurrently, ASEAN members court CDMOs by offering tax holidays and streamlined GMP approvals, amplifying regional competitiveness.

North America's growth is steadier, underpinned by biologics commercialisation pipelines and DSCSA compliance deadlines that require serialised primary containers. The United States drives high-value orders for Type-I glass and AI-enabled inspection lines that satisfy USP <1790> recommendations for parenteral visual inspection. Canada works to align with US traceability norms, spurring suppliers to provide bilingual packaging and GS1-compatible codes. Notably, herbicide litigation and supply-chain shocks have encouraged drug makers to dual-source ampoules from Mexico, broadening North American intra-regional trade.

Europe remains a value-rich but mature territory where sustainability and circular-economy targets dictate purchasing. The revised EU Packaging and Packaging Waste Regulation obliges recyclability scores above 70% by 2030, elevating demand for closed-loop Type-I glass streams. German hospitals formed a buying consortium in 2024 that gives 5-year contracts to vendors meeting >=50% cullet content, signalling future procurement norms. Meanwhile, energy-price volatility tied to gas supply cuts heightened concern over furnace downtime, prompting some firms to stockpile borosilicate tubing. Yet EU Recovery Funds earmarked for life-science infrastructure will subsidise next-generation inspection gear, partially offsetting cost fears.

The Middle East recorded the highest regional CAGR at 9.03% through 2030 as Saudi Arabia and the UAE channel public-health budgets into local manufacturing. Riyadh's Vision 2030 pharmaceutical programme co-funds sterile injectables plants, creating greenfield demand for BFS and tubular lines. Gulf Cooperation Council tender rules prioritize cost-effectiveness, positioning Indian and European mid-tier firms to capture share. However, limited skilled labour necessitates technology-transfer partnerships that intertwine equipment supply with long-term service contracts.

Latin America's uptake is hindered by macroeconomic instability, yet Brazil's ANVISA pushes serialization that mirrors EU-FMD requirements, opening opportunities for traceability-enabled ampoules. Africa remains nascent outside Egypt's vaccine complex; nonetheless, the African Union's 2040 target for 60% local vaccine manufacturing may catalyse BFS investments later in the forecast horizon.

- Schott Pharma AG and Co. KGaA

- Gerresheimer AG

- Stevanato Group S.p.A.

- SGD Pharma

- Nipro PharmaPackaging International NV

- Shandong Pharmaceutical Glass Co., Ltd.

- James Alexander Corporation

- Global Pharmatech Pvt. Ltd.

- Essco Glass Pvt. Ltd.

- AAPL Solutions Pvt. Ltd.

- Hindusthan National Glass and Industries Ltd.

- Ardagh Group S.A.

- PGP Glass Pvt. Ltd. (Piramal)

- Amcor plc (Rigid Plastics)

- Unicep Packaging LLC

- Catalent Pharma Solutions, Inc.

- Recipharm AB (BFS)

- Weiler Engineering, Inc.

- Owens-Illinois, Inc. (O-I)

- Vetropack Holding AG

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Demand for tamper-evident pharma packs

- 4.2.2 Recyclability and circular value of Type-I glass

- 4.2.3 Regulatory push on injectable traceability

- 4.2.4 Biologics CDMO shift toward single-dose ampoules

- 4.2.5 AI-enabled zero-defect visual inspection lines

- 4.2.6 Rise of injectable aesthetics in APAC

- 4.3 Market Restraints

- 4.3.1 Prefilled syringes cannibalising volumes

- 4.3.2 Post-use sharps and chemical waste burden

- 4.3.3 Tubing supply volatility from low-carbon furnaces

- 4.3.4 Glass delamination recall risk

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Assessment of Macro Economic Trends on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Material Type

- 5.1.1 Glass

- 5.1.2 Plastic

- 5.2 By Ampoule Type

- 5.2.1 Straight-stem

- 5.2.2 Funnel-type

- 5.2.3 Closed (Form D)

- 5.2.4 Easy-Open (OPC, Score-Ring, CBR)

- 5.3 By Capacity (mL)

- 5.3.1 <=2 mL

- 5.3.2 3-5 mL

- 5.3.3 6-10 mL

- 5.3.4 >10 mL

- 5.4 By Manufacturing Technology

- 5.4.1 Conventional Tubular Forming

- 5.4.2 Blow-Fill-Seal Plastic

- 5.4.3 Advanced Laser Scoring

- 5.5 By End-user Industry

- 5.5.1 Pharmaceutical

- 5.5.2 Personal Care and Cosmetics

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 United Kingdom

- 5.6.2.2 Germany

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Russia

- 5.6.2.7 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 India

- 5.6.3.3 Japan

- 5.6.3.4 South Korea

- 5.6.3.5 Rest of Asia-Pacific

- 5.6.4 South America

- 5.6.4.1 Brazil

- 5.6.4.2 Argentina

- 5.6.4.3 Rest of South America

- 5.6.5 Middle East

- 5.6.5.1 Saudi Arabia

- 5.6.5.2 United Arab Emirates

- 5.6.5.3 Rest of Middle East

- 5.6.6 Africa

- 5.6.6.1 South Africa

- 5.6.6.2 Nigeria

- 5.6.6.3 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Schott Pharma AG and Co. KGaA

- 6.4.2 Gerresheimer AG

- 6.4.3 Stevanato Group S.p.A.

- 6.4.4 SGD Pharma

- 6.4.5 Nipro PharmaPackaging International NV

- 6.4.6 Shandong Pharmaceutical Glass Co., Ltd.

- 6.4.7 James Alexander Corporation

- 6.4.8 Global Pharmatech Pvt. Ltd.

- 6.4.9 Essco Glass Pvt. Ltd.

- 6.4.10 AAPL Solutions Pvt. Ltd.

- 6.4.11 Hindusthan National Glass and Industries Ltd.

- 6.4.12 Ardagh Group S.A.

- 6.4.13 PGP Glass Pvt. Ltd. (Piramal)

- 6.4.14 Amcor plc (Rigid Plastics)

- 6.4.15 Unicep Packaging LLC

- 6.4.16 Catalent Pharma Solutions, Inc.

- 6.4.17 Recipharm AB (BFS)

- 6.4.18 Weiler Engineering, Inc.

- 6.4.19 Owens-Illinois, Inc. (O-I)

- 6.4.20 Vetropack Holding AG

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment