|

市场调查报告书

商品编码

1624588

北美安瓿包装:市场占有率分析、产业趋势与成长预测(2025-2030)North America Ampoules Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

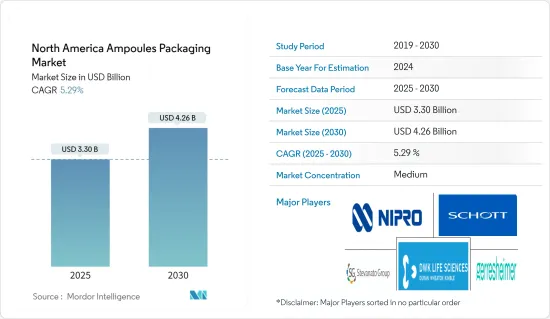

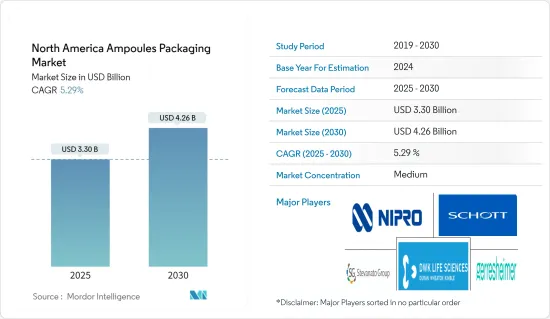

北美安瓿包装市场规模预计到2025年为33亿美元,预计2030年将达到42.6亿美元,预测期内(2025-2030年)复合年增长率为5.29%。

主要亮点

- 儘管北美製药业比其他行业更成熟,但在创新和竞争方面正在经历显着增长,因此对安瓿包装的需求预计将增长。日益增长的环境问题和医疗基础设施支出的增加正在推动环保包装解决方案的开发和创新。

- 急慢性疾病患者数量的不断增加,对安瓿包装的需求产生了直接正面的影响。由于对无菌、防篡改、无反应和卓越性能的需求不断增长,该市场预计将增长。

- 加拿大对注射药物的需求正在迅速增加,这极大地推动了市场的成长。对抗癌药物、抗体偶联物、类固醇和输液等速效、高效价药物的强劲需求预计将成为成长的主要动力。

- 製药业对无菌医疗包装产品的需求不断增长可能会推动预测期内的市场成长。 StatCan预测,2024年加拿大製药和药品製造业销售额将达99.4亿美元。

- 历史上,製造商利用玻璃来製造安瓿。然而,塑胶的广泛使用和成本效益导致其采用量迅速增加,从而显着降低了安瓿成本。与其他类型的安瓿相比,这种实惠的价格是其主要优势。与多剂量替代品相比,消费者越来越喜欢单剂量注射包装。根据食品药物管理局(FDA) 的资料,在美国,单位剂量塑胶安瓿占药品包装市场的近 24%。此外,它在金额方面有超越其他公司的势头,预计成长速度将高于平均水平。

- 然而,对安瓿倾销的担忧正在阻碍市场扩张。塑胶对环境构成了重大挑战,因为它们难以分解。安瓿製造中越来越多地使用绿色塑胶和生物分解性塑胶等永续材料,这预示着市场的成长。

- 旨在提高国产药品的完整性和品质的严格法律增加了玻璃在药品包装中的使用。製药业对无菌医疗包装的需求不断增长预计将在预测期内推动市场成长。

北美安瓿包装市场趋势

医药终端用户产业预计创纪录成长

- 製药最终用户产业的成长将推动安瓿市场。透过生物技术的发展引入註射疗法正在推动这一领域的成长。由于该地区生物技术的发展和应用,以及对配备 RFID 标籤等先进技术的安瓿的需求增加,以防止药品假冒的潜在威胁和成本,该细分市场也出现了增长。

- 生产和研究活动的增加增加了对确保药品安全和保护的法规的需求。因此,製造商正在与合约包装商合作开发药物附加檔,透过印刷和图形传达剂量和给药资讯。

- 根据 2024 年 2 月 IQVIA 报告,到 2027 年,北美药品销售额预计将达到约 9,920 亿美元,巩固其作为全球药品销售领先区域市场的地位。

- 该地区的药品销售不断增长,直接推动了对安瓿等包装形式的需求。根据 IQVIA 2024 年 2 月报告,美国到 2023 年持续维持全球最大医药市场地位,收益超过 6,700 亿美元。预计这些趋势将有助于未来市场的成长。

- 此外,消费者越来越多地选择单剂量注射包装而不是多剂量替代品。塑胶安瓿可进行计量给药,使製药公司能够透过最大限度地减少药物过量填充和简化製造流程来更有效地控製成本。因此,塑胶安瓿对于处理高价值药品的製药公司特别有用。

预计美国将主导市场

- 美国已成为全球玻璃安瓿包装的主要市场,尤其是製药业。美国经济不断增长,消费者在医疗保健和药品方面的支出不断增加,对玻璃包装解决方案的需求不断增加。此外,美国消费者越来越重视永续和环保的包装。这些不断变化的偏好促使製造商更青睐玻璃安瓿而不是塑胶安瓿。

- 消费者、立法者、客户和媒体都非常重视包装的环保特性。玻璃是主要选择,预计将推动美国市场的成长。美国零售联合会最近的一项调查发现,美国和加拿大近 70% 的消费者重视品牌的永续性和环境友善性。

- 美国许多製药公司计划采用玻璃安瓿实施更高产量比率和高速的填充线。例如,Labiana Pharmaceuticals 透过推出一系列新的液体安瓿并投资最先进的线上颗粒检测设备来扩大其製造能力。此次扩建采用 Bausch & Strobel 的优质安瓿填充线,生产量为每小时 20,000 瓶。此外,我们还整合了专为线上生产而设计的 Pilastro RS1 最终光学侦测机,吞吐量高达每小时 12,000 件。

- 製药业主要涉及药品的生产。这些药物可诊断、治疗、治癒和预防各种疾病。製药业是全球最大的产业之一,全球市场价值超过1.2兆美元。世界顶尖製药公司包括辉瑞(Pfizer)、默克(Merck)、强生(Johnson & Johnson)(皆位于美国)。因此,美国製药业是世界上最大的製药业之一。

- 医疗保健支出的增加和政府对药品包装市场的资本投资也是市场成长的主要动力。根据医疗保险和医疗补助服务中心 (CMS) 的数据,美国医疗保健支出预计到 2023 年将达到 47,993 亿美国,到 2032 年将达到 77,050 亿美元。在技术创新、不断增长的需求和策略联盟的推动下,安瓿包装市场处于良好的成长态势。

北美安瓿包装产业概况

北美安瓿包装市场是半静态的,少数供应商占了很大比例。市场参与企业正在寻找新的方法来形成策略联盟和合作,以创新并推动该地区安瓿包装市场的发展。

- 2023 年 10 月 玻璃先驱肖特推出下一代 I 型硼硅酸玻璃管,以满足製药业不断变化的需求。这种创新产品和相关服务符合三个关键的行业趋势:提高製药复杂性、解决永续性和提高数位化。製药转换器利用肖特玻璃管生产优质管瓶、安瓿、注射器和药筒。

- 2023年3月,拜耳股份公司宣布计划在美国投资10亿美元进行药物研发,目标是让其在美国的销售额翻一番,并在10年内成为该国顶级製药公司。拜耳公司美国製药业务总裁Sebastian Guth表示,该公司过去三年将其製药业务行销部门的美国员工数量增加了约50%,到2030年将增加美国员工数量预计将增加约 75%。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 市场驱动因素

- 製药业对无菌包装解决方案的需求增加

- 市场限制因素

- 对倾倒使用过的安瓿的担忧

第五章市场区隔

- 材料

- 玻璃

- 塑胶

- 最终用户产业

- 药品

- 个人护理和化妆品

- 国家名称

- 美国

- 加拿大

第六章 竞争状况

- 公司简介

- SCHOTT AG

- Gerresheimer AG

- Nipro Pharma Packaging International NV

- DWK Life Sciences

- Stevanato Group

- Accu-Glass LLC

- VWR International LLC.

- SGD Pharma

第七章 投资分析

第八章 市场机会及未来趋势

简介目录

Product Code: 46548

The North America Ampoules Packaging Market size is estimated at USD 3.30 billion in 2025, and is expected to reach USD 4.26 billion by 2030, at a CAGR of 5.29% during the forecast period (2025-2030).

Key Highlights

- The demand for ampoule packaging is expected to grow as the pharmaceutical industry in North America is growing significantly in terms of innovation and competitiveness despite its mature status compared to other areas. A rise in environmental concerns and increasing spending on healthcare infrastructure has sparked the development and innovation of eco-friendly packing solutions.

- The growth in patients with acute and chronic illnesses has directly and positively impacted the demand for ampoule packaging. The market is expected to grow due to the rise in demand for sterile, tamper-proof, and non-reactive items with excellent performance.

- Canada's surging demand for injectable pharmaceuticals is significantly boosting the market's growth. The strong demand for oncology treatments and other high-potency drugs, like antibody conjugates, steroids, and IV fluids that necessitate a rapid onset of action, is anticipated to be the primary growth catalyst.

- The rising demand for sterile medical packaging products from pharmaceutical industries is set to propel the growth of the market during the forecast period. StatCan projects that in 2024, the revenue from Canada's pharmaceutical and medicine manufacturing industry will reach USD 9.94 billion.

- Historically, manufacturers have relied on glass to produce ampoules. However, with the widespread availability and cost-effectiveness of plastic, its adoption has surged, significantly driving down ampoule costs. This affordability stands out as a key advantage of plastic ampoules compared to their counterparts. Consumers increasingly favor unit-dose parenteral packaging over multi-dose alternatives. In the United States, data from the Food and Drug Administration (FDA) indicates that unit-dose plastic ampoules constitute nearly 24% of the pharmaceutical packaging market. Furthermore, they are poised to outpace others in terms of value, presenting above-average growth prospects.

- However, concerns over ampoule dumping are hindering the expansion of the market. Given that plastics are not easily decomposed, they pose significant environmental challenges. The rising use of sustainable materials, like green or biodegradable plastics, in ampoule production bodes well for the market's growth.

- Stringent legislation aimed at enhancing the integrity and quality of domestically produced pharmaceuticals has led to increased use of glass in pharmaceutical packaging. The rising demand for sterile medical packaging in the pharmaceutical industry is projected to drive market growth during the forecast period.

North America Ampoules Packaging Market Trends

The Pharmaceutical End-user Industry is Expected to Record Growth

- The growing pharmaceutical end-user industry drives the ampoule market. The introduction of injectable therapies through the development of biotechnology is driving the growth of the segment. The segment is also expected to grow due to the development of biotechnologies and their applications in the region, along with increasing demand for ampoules with advanced technologies like RFID tags to protect against potential threats and costs of drug counterfeiting.

- The increasing manufacturing and research activities are raising the demand for regulations to ensure drug safety and protection. Hence, manufacturers are collaborating with contract packagers to develop drug adherence packages that communicate dosage information through print and graphics.

- According to the IQVIA report in February 2024, North America's pharmaceutical sales are expected to reach approximately USD 992 billion by 2027, solidifying its position as the leading regional market in global pharma sales.

- Pharmaceutical sales are growing in the region and are directly contributing to the demand for packaging formats like ampoules. According to a February 2024 report by IQVIA, the United States maintained its position as the world's largest pharmaceutical market in 2023, raking in over USD 670 billion in revenue. Such trends are expected to contribute to market growth in the future.

- Furthermore, consumers are increasingly opting for unit-dose parenteral packaging instead of multi-dose alternatives. Plastic ampoules, offering fixed dosages, enable pharmaceutical companies to manage costs more effectively by minimizing drug overfill and streamlining production processes. As a result, plastic ampoules are particularly beneficial for pharmaceutical firms handling high-value medications.

The United States Expected to Dominate the Market

- The United States stands as the leading global market for packaging, particularly in terms of glass ampoules for the pharmaceutical industry. With the US economy on a growth trajectory, consumer spending on healthcare and medicines is increasing, subsequently bolstering the demand for glass packaging solutions. Moreover, American consumers are increasingly prioritizing sustainable and environmentally friendly packaging. This shift in preference is prompting manufacturers to favor glass ampoules over their plastic counterparts.

- Consumers, legislators, customers, and the media alike are placing heightened emphasis on packaging's environmental attributes. Glass, being the primary choice, is anticipated to propel the growth of the market in the United States. A recent study by the National Retail Federation highlighted that almost 70% of consumers in both the United States and Canada value sustainability and eco-friendliness in brands.

- Many pharmaceutical companies in the United States are set to see enhanced yields from glass ampoules and the introduction of high-speed filling lines. For example, Labiana Pharmaceuticals expanded its manufacturing capabilities by launching a new range of liquid ampoules and investing in state-of-the-art equipment for in-line particle detection. Its expansion features a premium ampoule filling line from Bausch & Strobel, boasting a production capacity of 20,000 ampoules per hour. Additionally, it integrated a Pilastro RS1 final optical inspection machine, designed for in-line production with a throughput of up to 12,000 units per hour.

- The pharmaceutical industry is mainly concerned with the production of pharmaceutical drugs. These drugs diagnose, treat, cure, or prevent various diseases. The pharmaceutical industry is one of the largest in the world, with a global market value of more than USD 1.2 trillion. Top global pharmaceutical companies include Pfizer, Merck, and Johnson & Johnson (all based in the United States). As a result, the pharmaceutical industry in the United States is among the largest in the world.

- Increasing healthcare spending and the government's capital investment in the pharmaceutical packaging market are also major drivers of market growth. According to the US Centers for Medicare and Medicaid Services (CMS), healthcare spending in the United States reached USD 4,799.3 billion in 2023, and it is projected to reach USD 7705 billion by 2032. The ampoules packaging market, driven by technological innovation, growing demand, and strategic collaborations, is well-positioned to experience growth.

North America Ampoules Packaging Industry Overview

The ampoule packaging market in North America is semi-consolidated due to the presence of a few vendors holding significant market shares. The market players are finding new ways, such as strategic partnerships or collaborations, to innovate the development of ampoule packaging in the region, fostering growth.

- October 2023: Glass pioneer SCHOTT unveiled its next-generation type I borosilicate glass tubing, tailored to address the evolving demands of the pharmaceutical industry. This innovative product and its accompanying services align with three pivotal industry trends: the increasing complexity of pharmaceuticals, a commitment to sustainability, and the push toward digitalization. Pharmaceutical converters utilize SCHOTT's glass tubing to manufacture premium vials, ampoules, syringes, and cartridges, adept at storing everything from straightforward medications to intricate, high-complexity drugs.

- March 2023: Bayer AG announced plans to invest USD 1 billion in drug R&D in the United States, aiming to double its US sales by the end of the decade, making it the top pharmaceutical company in the country. According to Sebastian Guth, President of Bayer's pharmaceuticals business in the United States, the company increased the number of US employees working on the marketing of its pharmaceutical business by about 50% over the past three years, which is expected to further increase by about 75% by 2030.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Value-Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Market Driver

- 4.4.1 Increasing Demand for Sterile Packaging Solutions for the Pharmaceutical Industry

- 4.5 Market Restraint

- 4.5.1 Concerns Regarding Dumping of Used Ampoules

5 MARKET SEGMENTATION

- 5.1 Material

- 5.1.1 Glass

- 5.1.2 Plastic

- 5.2 End-User Industry

- 5.2.1 Pharmaceutical

- 5.2.2 Personal Care and Cosmetic

- 5.3 Country

- 5.3.1 United States

- 5.3.2 Canada

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 SCHOTT AG

- 6.1.2 Gerresheimer AG

- 6.1.3 Nipro Pharma Packaging International NV

- 6.1.4 DWK Life Sciences

- 6.1.5 Stevanato Group

- 6.1.6 Accu-Glass LLC

- 6.1.7 VWR International LLC.

- 6.1.8 SGD Pharma

7 INVESTMENT ANALYSIS

8 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219