|

市场调查报告书

商品编码

1626319

北美LED构装:市场占有率分析、产业趋势、成长预测(2025-2030 年)North America LED Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

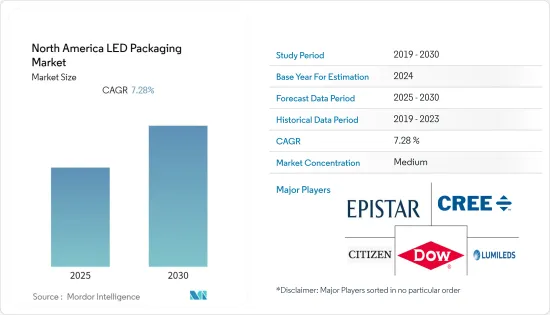

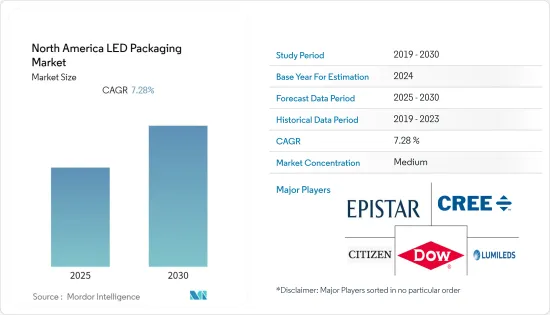

北美LED构装市场预计在预测期间内复合年增长率为7.28%

主要亮点

- 工业中智慧照明(互联照明)系统的采用也将有助于 LED 的日益普及。由于LED用途广泛,使用LED的设备在颜色变化和亮度方面比传统光源具有更大的优势。

- 此外,对节能照明系统的需求不断增长、LED产品价格下降、严格的政府法规等是推动北美地区采用LED照明的关键因素,导致LED构装市场在过去几年中强劲增长。例如,根据美国能源局的数据,美国冷白光LED灯的价格为每千流明0.88美元,预计2035年将降至0.3千流明。

- 此外,自过去十年以来,LED 在住宅和商业照明中的使用呈指数级增长,提供了白炽灯或萤光照明系统无法实现的广泛功能。

- 自COVID-19爆发以来,各家公司都面临供应链挑战。 LED产业也不例外,因为生产LED和驱动器所使用的原料大多来自亚洲国家,而且由于该地区在3月和4月受到疫情的严重影响,该产业受到了重创。此外,疫情导致汽车和家用电子电器产业显示面板需求下降。消费者减少了高阶智慧型手机和 OLED 电视等昂贵产品的支出,对市场产生了负面影响。

- 由于供应链问题,预计短期内LED价格将会上涨,这种上涨可能会持续到2021年中期。据行业协会 ELCOMA 称,由于供应链短缺,LED 灯泡和照明产品的价格可能比 3 月上涨高达 10%。

北美LED构装市场趋势

商业领域不断增长的需求预计将推动市场区隔

- LED照明产品以其性能、效率和长期节省而闻名, LED构装的光输出效率通常达到80-90%。 LED照明在办公室、职场和商业建筑中的好处仅限于上述因素,安装高品质的LED照明可以创造健康的职场环境并提高员工生产力。

- 在任何商业空间中,在根据您的要求选择合适的LED构装之前,功率需求、调光状态、IP 等级、效率和额定功率是最重要的。例如,灯式LED、顶式LED、侧边LED、SMD式LED、高功率LED、覆晶LED等不同类型的LED构装可用于不同的场合以及不同尺寸、散热的LED。有一个。

- 办公室等商业建筑的能源消耗占美国总能源消费量的近20%,其中38%的能源消费量来自照明。在过去的市场时期,紧凑型萤光、线性萤光、高强度放电灯和白炽灯被广泛使用。

- 此外,高端商业照明市场主要包括博物馆、画廊和其他使用下照灯、投影机和反射板的展览照明应用。随着LED照明渗透率的提高,美国各大厂商也积极发展LED照明业务。

- LED 照明製造商预计将在商业建筑领域找到利润丰厚的市场机会。此外,能源成本的上涨和成本控制的加强正在推动 LED 照明等节能产品在各种商业环境中的普及,预计将推动调查市场的发展。例如,2020 年 8 月,大纳舒厄基督教青年会 (YMCA) 宣布,透过将 YMCA 的三个分店升级并转换为全 LED 照明,在改善碳足迹方面迈出了重要一步。扣除回扣和奖励后,YMCA 的计划成本为 190,000 美元,预计在另外 24 个月内收回成本节省。在当前的市场情况下,LED 可节省约 50% 至 70% 的能源,预计将渗透到商业照明的几乎所有领域。

晶片级封装预计将在预测期内显着增长

- 晶片级封装(CSP) LED构装的LED晶片体积与LED构装总体积的比例接近。这本质上是一个涂有磷光体层的裸露 LED晶粒,晶粒的底部采用 P 和 N 触点金属化,形成电气连接和热路径。

- CSP 是覆晶LED 的最新形式,它在 P 型 GaN 层顶部实现电极垫片,以防止光学损耗,同时提高传热效率和封装可靠性,从而显着节省商业基础设施的成本,预计对LED架构的需求将持续成长。

- 市场上的供应商正在推出新产品以保持竞争优势。例如,三星推出了LM101B CSP LED,它在转换层中使用薄膜磷光体,以减少表面粗糙度、减少颜色变化并提供均匀的厚度控制。此外,FEC(圆角增强型 CSP)技术在晶片表面周围形成了 TiO2(二氧化钛)墙,并将光输出反射到顶部,使这款中功率CSP 的效率高达205 lm/W(业界领先的效率( 65mA) ,CRI 80+,5,000K)。

- 此外,一些供应商还为特定应用提供晶片级封装 (CSP) LED。例如,欧司朗为品牌时尚精品店和珠宝店的高端零售照明设计 CSP LED。客製化CoB和小型灯具的专门设计是CSP支援的主要应用。

北美LED构装产业概况

北美LED构装市场竞争激烈,有几家主要公司进入该市场。从市场占有率来看,目前少数大公司占据市场主导地位。这些拥有高市场份额的大公司正专注于扩大海外基本客群。这些公司利用策略合作措施来扩大市场占有率并提高盈利。此外,在市场上营运的公司正在收购新兴企业以增强其产品能力。

- 2021 年 9 月 - Lumileds 推出新款 Luxeon 7070 (77mm) LED,针对高性能陶瓷高功率LED,但基于导线架和塑胶封装,适用于街道照明和体育场馆照明等应用。此外,彩色固体照明 (SSL) 系统的开发商现在拥有更多选择,包括 Lumileds 的磷光体转换 PC 红橙色 LED。

- 2021 年 8 月 - 西铁城电子开发了 CL-V501 系列,这是一款向上的多色 LED,具有出色的混色、紧凑且高亮度。样品将于2021年10月开始出货,预定于2022年1月开始量产。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场驱动因素

- 对高速网路的需求不断增长

- 对能源效率不断增长的需求

- 市场限制因素

- 缺乏意识和增加资本投入

- 产业价值链分析

- 波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- COVID-19 市场影响评估

第五章市场区隔

- 类型

- 板载晶片(COB)

- 表面黏着型元件(SMD)

- 晶片级封装 (CSP)

- 按最终用户产业

- 住宅

- 商业的

- 其他的

- 地区

- 北美洲

- 美国

- 加拿大

- 北美洲

第六章 竞争状况

- 公司简介

- Lumileds Holding BV

- Dow Silicones Corporation

- Citizen Electronics Co.,Ltd.

- Cree, Inc.

- Epistar Corporation

- OSRAM Licht AG

- Everlight Electronics Co., Ltd.

- LG Corporation(LG Innotek)

- Samsung Electronics Co. Ltd

- Nichia Corporation

第七章 投资分析

第八章市场的未来

The North America LED Packaging Market is expected to register a CAGR of 7.28% during the forecast period.

Key Highlights

- The growing popularity of LEDs would also contribute to the introduction of intelligent lighting (connected lighting) systems in industries. As, the versatility of the LEDs, the powered devices are more likely to benefit from the use of LEDs than conventional light sources in terms of color variability and brightness.

- Further, the growing demand for energy-efficient lighting systems, declining prices of LED products, and stringent government regulations are some of the major factors driving the adoption of LED lighting in North America and is also expected to drive the LED packaging market in the forecast period. For instance, according to the US Department of Energy, the price of cool white LED lamps in the United States was USD 0.88 per Kilolumen and is forecasted to drop to USD 0.3 Kilolumen by 2035.

- Additionally, Since the past decade, the use of LEDs for residential and commercial lighting has increased exponentially, with a wide range of features that incandescent and fluorescent lighting systems are unable to deliver.

- Since the outbreak of COVID-19, various businesses have been facing challenges pertaining to the supply chain. The LED industry is no exception; as a prominent share of the raw materials for the production of LEDs and Drivers originated from Asian countries, the industry was significantly influenced during the months of March and April as the region was under severe clutches of the pandemic. Further, the pandemic led to a decline in demand for display panels from the automotive and consumer electronics industries. Consumers have reduced their spending on expensive products, such as high-end smartphones and OLED TVs, which has negatively impacted the market.

- Owing to the supply chain issues, the prices of LEDs are expected to go up for a short period of time and may last till mid-2021. According to the industry body ELCOMA, prices of LED bulbs and lights may see an increase of up to 10% from March due to supply chain shortages.

North America LED Packaging Market Trends

Growing Commercial Segment Demand is Expected to Boost the Studied Market

- LED lighting products are known for their performance, efficiency, and long-term savings, as the light output efficiency of LED packages can generally reach 80 to 90%. The benefits of LED lighting in offices, workplaces, or commercial buildings are limited to the above factors, and that installing high-quality LED lights creates a healthy work environment and increases employee productivity.

- For any commercial space, power requirement, dimming status, IP ratings, efficiency, and power rating are most important before choosing the right LED packages as per requirement. For instance, different occasions and LEDs with different sizes, heat-dissipation methods, and luminescence efficiency will have different types of LED packages such as Lamp-LED, TOP-LED, Side-LED, SMD-LED, High-Power-LED, Flip Chip-LED, etc.

- Commercial buildings like offices account for almost twenty percent of the United States' total energy consumption, and thirty-eight percent of this energy consumption is attributed to lighting. In the historical market period, widely-utilized lighting methods were compact fluorescent, linear fluorescent, high-intensity discharge, and incandescent lightings.

- Further, the high-end commercial lighting market mainly includes museums, galleries, and other exhibition lighting applications that primarily use downlights, projectors, and reflectors. Major American manufacturers are also actively developing the LED lighting business, with the rising LED lighting penetration rate.

- LED lighting manufacturers are further anticipated to witness lucrative market opportunities in the commercial construction segment. The rising cost of energy and increased focus on strong cost management have also supported the strong take-up of energy-saving products, like LED lighting in different commercial settings, and is expected to drive the studied market. For instance, in Aug 2020, The YMCA of Greater Nashua announced that it had taken a large step in improving its carbon footprint by upgrading and converting the Y's three facility branches to full LED lighting. The project cost to the YMCA after rebates and incentives was USD 190,000, and it further anticipates that in 24 months, the project will pay for itself in cost savings. In the current market scenario, LEDs lead to around 50% to 70% energy savings and are expected to penetrate almost every niche of commercial lighting.

Chip Scale Package is Expected to Grow Significantly in the Forecast Period

- A chip scale package (CSP) LED package has a close-ratio between the volume of the LED chip and the total volume of the LED package. It is essentially a bare LED die on which a phosphor layer is coated, with the underside of the die metalized with the P and N contacts to form the electrical connection and thermal path.

- The growing demand for CSP LED architecture which is the latest incarnation of flip-chip LEDs and prevents light loss due to the mounting of electrode pad on the upside of P-type GaN layer while improving heat transfer efficiency and package reliability due to a significant cost saving in commercial infrastructure is expected to augment the studied market.

- Vendors in the market are introducing new products to maintain their competitive advantage. For instance, Samsung introduced LM101B CSP LEDs that use a film phosphor in the conversion layer to reduce surface roughness and enable uniform control of thickness with small color dispersion. The fillet-enhanced CSP (FEC) technology forms TiO2 (Titanium dioxide) walls around the chip surface to reflect its light output toward the top, allowing the mid-power CSP to deliver an industry-leading efficacy of up to 205 lm/W (65mA, CRI 80+, 5000K).

- Moreover, some of the vendors offer Chip Scale Package (CSP) LEDs to specific applications. For instance, OSRAM designs CSP LEDs for high-class retail lighting in brand fashion boutiques and jewelry stores. Professional designs for customized CoB and small luminaires are the main applications being supported by CSP.

North America LED Packaging Industry Overview

North America LED packaging market is moderately competitive and consists of several major players. In terms of market share, few of the major players currently dominate the market. These major players with prominent shares in the market are focusing on expanding their customer base across foreign countries. These companies are leveraging on strategic collaborative initiatives to increase their market share and increase their profitability. The companies operating in the market are also acquiring start-ups to strengthen their product capabilities.

- September 2021 - Lumileds announced the launch of a new Luxeon 7070 (77-mm) LED based on a lead frame and plastic package, yet that is intended to target high-performing, ceramic, high-power LEDs in applications such as street lights and sports-venue lighting. In addition, developers working on color solid-state lighting (SSL) systems continue to get more options in their tool chest, including a Lumileds phosphor-converted, PC Red-Orange LED.

- August 2021 - Citizen Electronics Co., Ltd developed upward-lighting multicolor LEDs in the 'CL-V501 Series' that have realized a better color mixing property and being small and high in brightness. Shipment of samples would start from October 2021, and mass production is expected to start from January 2022.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Demand For High-Speed Network

- 4.2.2 Increasing Demand for Energy-efficient

- 4.3 Market Restraints

- 4.3.1 Lack of Awareness and Higher Capital Investment Required

- 4.4 Industry Value Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Assessment of the Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Chip-on-board (COB)

- 5.1.2 Surface-mount Device (SMD)

- 5.1.3 Chip Scale Package (CSP)

- 5.2 End-User Vertical

- 5.2.1 Residential

- 5.2.2 Commercial

- 5.2.3 Other End-User Verticals

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Lumileds Holding B.V.

- 6.1.2 Dow Silicones Corporation

- 6.1.3 Citizen Electronics Co.,Ltd.

- 6.1.4 Cree, Inc.

- 6.1.5 Epistar Corporation

- 6.1.6 OSRAM Licht AG

- 6.1.7 Everlight Electronics Co., Ltd.

- 6.1.8 LG Corporation (LG Innotek)

- 6.1.9 Samsung Electronics Co. Ltd

- 6.1.10 Nichia Corporation