|

市场调查报告书

商品编码

1629788

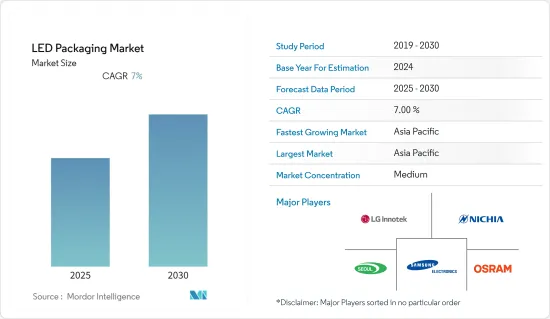

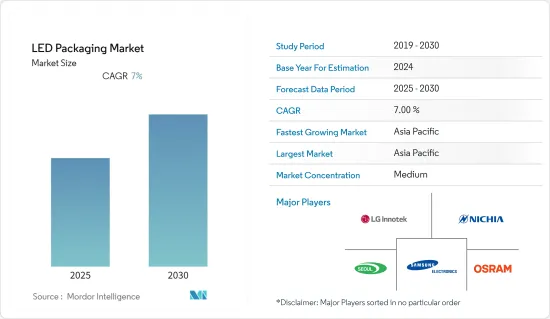

LED构装:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)LED Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

LED构装市场预计在预测期间内复合年增长率为7%

主要亮点

- LED 技术透过为广大消费者提供紧凑、高效的照明解决方案并提高效率,正在激发照明产业的想像力。产业创新饱和状态,同时市场产能过剩。对于电视显示器应用,业界正在从 OLED 转向 QLED(量子点发光二极体),这是最新的创新。预计这将进一步渗透市场。

- 封装设计过程直接影响温度、发光效率、波长和寿命等因素,进而降低整体营运成本。因此,功率 LED 晶片封装技术的改进正在增加 LED 解决方案的采用。

- LED构装要求非常严格。如果LED晶片在封装内放置不准确,会直接影响整个封装设备的发光效率。任何稍微偏离固定位置都会导致LED光线无法从反光杯完全反射,进而影响LED的亮度。

- LED构装应用的快速进步预计将推动创新和消费,从而推动未来几年LED构装市场的发展。另一方面,高饱和度可能会限制产品的可接受性,从而限制市场成长。

- 未来几年,对能够改善夜间能见度和方面能见度的新型 LED 的需求预计将超过现有 LED。 CSP LED 常用于汽车应用,如车头灯、车内照明、环境照明、指示器、车头灯丛集、驾驶员监控系统和停车辅助系统摄影机灯。 LED构装的需求也受到中央堆迭显示器、仪錶群显示器和汽车显示器市场采用扩增实境OLED 的高需求推动。

- 自COVID-19爆发以来,各家公司的供应链都面临挑战。 LED产业也不例外,由于用于製造LED和驱动器的原材料大部分来自亚洲国家,因此该地区在3月和4月受到疫情的严重影响,因此该行业受到了显着影响。此外,疫情导致汽车和家用电子电器产业显示面板需求下降。消费者减少了高阶智慧型手机和 OLED 电视等昂贵产品的支出,对市场产生了负面影响。

- LED构装应用的快速增强预计将在未来几年推动技术创新和消费成长,从而带动LED构装市场。另一方面,高饱和度可能会限制产品的采用并影响市场成长。

- 由于参与企业寻求获得市场占有率,激烈的市场竞争继续压低价格,从而限制了利润。

LED构装市场趋势

政府采用节能 LED 的措施和法规将推动市场发展

- 由于消费者需求转向 LED 等节能照明,住宅领域的前景基本上乐观。此外,最近的政府倡议和消费者意识的提高预计将对该行业产生重大影响。

- 例如,印度政府于 2015 年启动的一项旨在提高该国能源效率的倡议UJALA 截至 2021 年 8 月已分发了超过 36 兆个 LED 灯泡。这些倡议预计将对LED构装市场产生重大影响。

- 在所有照明光源中,LED照明占有很大的份额。由于意识的提高和政府措施的加强,LED 的渗透率正在提高。根据国际能源总署(IEA)预测,2025年LED在照明市场的渗透率预计将达到75.8%。

- LED 的日益普及也可能导致智慧照明系统(连网照明)在工业中的采用增加。与传统照明相比,互联繫统可能更能从 LED 的使用中受益,因为 LED 在颜色变化和亮度方面非常灵活。

- 2021 年 10 月,美国能源局(DOE) 宣布将投资 6,100 万美元用于 10 个先导计画,这些项目将利用新技术将数千个家庭和企业改造为最先进的节能结构。这包括从白炽灯和卤素灯泡切换到更节能的 LED 照明。因此,由于LED市场的成长,预计美国LED构装市场在预测期内将出现成长。

亚太地区将成长最快

- 亚太地区的照明系统目前正在发生重大变化。由于效率提高,该地区的公司正在其行业中采用 LED 照明系统。

- 过去五年来,中国一直在逐步减少白炽灯泡产品的销售量。这意味着过时的技术很快就会被更先进、更盈利的技术所取代。

- 印度政府向最终用户推广具有成本效益的 LED 的计划已获得一些关注。该国正在将所有路灯更换为 LED,并采用智慧 LED 来製作交通号誌。此举可能会增加当地LED製造商的需求,并带动LED构装市场的成长。

- 多项政府和私人倡议正在推动全部区域基础设施现代化和智慧城市等发展对智慧高效照明系统的需求,这将直接推动该地区的LED构装市场。

- 亚太地区政府的能源效率倡议对LED构装市场的成长做出了重大贡献。印度和中国等国家目前正在实施多项旨在提高能源效率的政府计画和计画。 Unnat Jyoti by Affordable LEDs for All (UJALA) 是印度政府于 2015 年发起的倡议,旨在鼓励该国提高能源效率,截至 2021 年 8 月已分发超过 36 兆个 LED 灯泡。

LED构装产业概况

LED构装市场因其性质而适度细分,因为有多家参与企业提供LED构装。

- 2021 年 9 月 - Lumileds 推出采用导线架和塑胶封装的全新 Luxeon 7070 (7.7mm) LED,面向街道照明和体育场馆照明等应用的高性能陶瓷高功率LED。此外,彩色固体照明 (SSL) 系统的开发商现在拥有更多选择,包括 Lumileds 的磷光体转换 PC 红橙色 LED。

- 2021 年 8 月 - 西铁城电子宣布开发出「向上照明多色 LED」。在小型高亮度LED构装中改进了混色特性。它适用于游戏设备、电脑键盘、家用电子电器产品、业余嗜好用品、显示器、汽车环境照明、彩色照明等的照明和指示器。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 竞争公司之间的敌对关係

- 替代品的威胁

- 产业价值链分析

- COVID-19 市场影响评估

第五章市场动态

- 市场驱动因素

- 政府采用节能 LED 的措施和法规

- 对智慧照明解决方案的需求增加

- 市场限制因素

- 市场竞争加剧

第六章 市场细分

- 按类型

- 板载晶片(COB)

- 表面黏着型元件(SMD)

- 晶片级封装 (CSP)

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 其他的

第七章 竞争格局

- 公司简介

- Samsung Electronics Co. Ltd

- OSRAM Opto Semiconductors GmbH

- Nichia Corporation

- LG Innotek

- Seoul Semiconductor Co. Ltd

- Stanley Electric Co. Ltd

- Lumileds Holding BV

- Everlight Electronics Co. Ltd

- Toyoda Gosei Co.

- Dow Corning

- Citizen Electronics Co. Ltd

- TT Electronics PLC

第八章投资分析

第9章 未来趋势

简介目录

Product Code: 56708

The LED Packaging Market is expected to register a CAGR of 7% during the forecast period.

Key Highlights

- LED technology has been capturing the imagination of the lighting industry by offering small and efficient lighting solutions to a diverse set of consumers with enhanced efficiency. Innovations in the industry are saturated, and at the same time, the market has overcapacity. For TV display applications, the industry is moving from OLED to QLED (Quantum dot Light-emitting diode), the latest innovation. This is expected to penetrate more into the market.

- The design process of packaging has directly influenced factors such as temperature, luminescence efficiency, wavelength, life span, and others and has reduced the overall operational costs. Hence, owing to the improvements in the packaging technology of power LED chips, there is increased adoption of LED solutions.

- The requirements for LED packaging are very stringent. If LED chips are not placed into the package precisely, the luminescence efficiency of the overall packaging device might be affected directly. Any variation from the established position will prevent LED light from being entirely reflected from the reflective cup, affecting LED's brightness.

- Rapid advancements in LED package applications are projected to boost innovation and consumption in the coming years, propelling the LED packaging market. On the other hand, high saturation may limit product acceptance, which, in turn, limits market growth.

- The demand for new LEDs that provide improved night vision and enhanced side visibility is anticipated to outpace existing LEDs in the coming years. CSP LEDs are commonly used in automotive applications such as headlights, cabin illumination, ambient lighting, indicator lights, headlight clusters, driver monitoring systems, and parking-assistance system camera lights. LED package's demand is also driven by high demand for central stack displays, instrument cluster displays, and the introduction of augmented reality-enabled OLED in the automotive display market.

- Since the outbreak of COVID-19, various businesses have faced challenges in the supply chain. The LED industry is no exception; as a significant share of the raw materials for producing LEDs and Drivers originated from Asian countries, the industry was significantly influenced during March and April as the region was under severe clutches of the pandemic. Further, the pandemic led to a decline in demand for display panels from the automotive and consumer electronics industries. Consumers have reduced spending on expensive products, such as high-end smartphones and OLED TVs, negatively impacting the market.

- The rapid enhancement in the applications of LED packaging is expected to increase innovation and consumption in the upcoming years, driving the LED packaging market. On the other hand, high saturation may restrict product adoption, which may affect the market's growth.

- The high competition in the market is restricting the margin, as there is a continuous decline in prices by players to gain market share.

LED Packaging Market Trends

Government Initiatives and Regulations to Adopt Energy-efficient LEDs will Drive the Market

- The residential sector outlook has largely been optimistic, driven by a shift in consumer demand toward energy-effective lighting, such as LEDs. Moreover, recent government initiatives and growing awareness among consumers are expected to have a significant impact on the industry.

- For instance, UJALA, a Government of India initiative launched in 2015 to promote energy efficiency in the country, has already distributed over 36 crores of LED light bulbs as of August 2021. such initiatives will show a substantial effect on the LED Packaging Market.

- Out of all the lighting sources, LED lights hold a major share. The growing awareness and increasing government policies have increased LEDs' penetration rate. According to the International Energy Agency (IEA), the penetration rate of LEDs into the lighting market is expected to reach 75.8% in 2025.

- The increasing prominence of LEDs can also lead to the adoption of smart lighting systems (connected lighting) in industries. Owing to the flexibility of LEDs in terms of color variation and brightness, connected systems are more likely to benefit from the use of LEDs over traditional lighting sources.

- In October 2021, the US Department of Energy (DOE) announced that it would invest USD 61 million in ten pilot projects that will use new technologies to turn thousands of homes and businesses into cutting-edge, energy-efficient structures. This involves switching out incandescent and halogen bulbs for more energy-efficient LED lighting. As a result, with the increase in the LED market, the LED Packaging Market in the United States will grow in the forecasted time period.

Asia-Pacific to Witness the Fastest Growth

- Currently, Asia-Pacific is experiencing a tremendous shift in lighting systems, as companies in this region are adopting LED lighting systems in the industries, owing to their improved efficiency.

- China has gradually reduced the sale of incandescent light bulb products during the last five years. This ensures that outdated technology is soon to be replaced by more advanced and profitable technology.

- The Indian government's plan of deploying cost-effective LED's across the end users received a decent response. The country is on the verge of replacing all street lamps with LED and adopting smart LEDs for traffic signals. This move is likely to increase the demand for local LED manufacturers, leading to the growth of the LED packaging market.

- Multiple governmental and private initiatives have been driving the need for smart and efficient lighting systems in the modernization and development of infrastructure, such as smart cities across the region, which directly boosts the market for LED packages in the region.

- Government energy efficiency initiatives in the Asia Pacific region have made a significant contribution to the growth of the LED packaging market. Several government schemes and plans to promote energy efficiency are currently in the works in countries such as India and China. Unnat Jyoti by Affordable LEDs for All (UJALA), an initiative launched by the Government of India in 2015 to encourage energy efficiency in the country, has already distributed over 36 crores of LED light bulbs as of August 2021.

LED Packaging Industry Overview

The LED packaging market is moderately fragmented in nature due to the presence of several players offering LED packaging.

- September 2021 - Lumileds launched the new Luxeon 7070 (7.7-mm) LED with a lead frame and plastic package aimed at high-performing, ceramic, high-power LEDs in applications such as street lights and sports-venue lighting. Furthermore, developers working on color solid-state lighting (SSL) systems continue to get more options in their tool chest, including a Lumileds phosphor-converted, PC Red-Orange LED.

- August 2021 - Citizen Electronics Co. Ltd announced the development of 'Upward-lighting Multicolor LEDs.' Small, high-brightness LED packages that feature an improved color mixing property. They are intended for illumination and indicators for game devices, keyboards for personal computers, home appliances, hobby goods, displays, ambient lighting for automobiles, colored lighting, etc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitute Products

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the COVID-19 Impact on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Government Initiatives and Regulations to Adopt Energy-efficient LEDs

- 5.1.2 Increasing Demand for Smart Lighting Solutions

- 5.2 Market Restraints

- 5.2.1 High Level of Competition in the Market

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Chip-on-Board (COB)

- 6.1.2 Surface-mount Device (SMD)

- 6.1.3 Chip Scale Package (CSP)

- 6.2 By Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia Pacific

- 6.2.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Samsung Electronics Co. Ltd

- 7.1.2 OSRAM Opto Semiconductors GmbH

- 7.1.3 Nichia Corporation

- 7.1.4 LG Innotek

- 7.1.5 Seoul Semiconductor Co. Ltd

- 7.1.6 Stanley Electric Co. Ltd

- 7.1.7 Lumileds Holding BV

- 7.1.8 Everlight Electronics Co. Ltd

- 7.1.9 Toyoda Gosei Co.

- 7.1.10 Dow Corning

- 7.1.11 Citizen Electronics Co. Ltd

- 7.1.12 TT Electronics PLC

8 INVESTMENT ANALYSIS

9 FUTURE TRENDS

02-2729-4219

+886-2-2729-4219