|

市场调查报告书

商品编码

1626337

北美纸包装:市场占有率分析、行业趋势、统计和成长预测(2025-2030)North America Paper Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

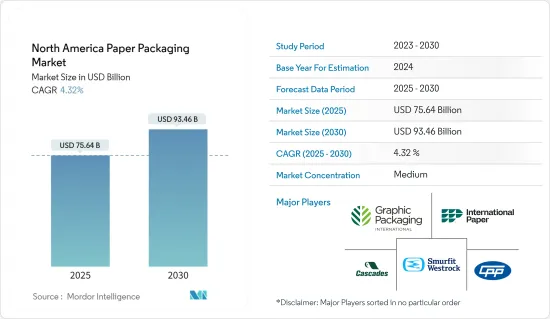

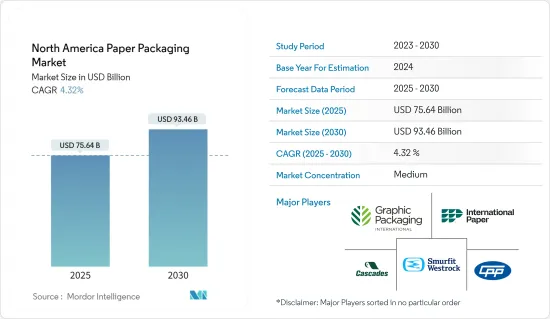

北美纸包装市场规模预计到2025年为756.4亿美元,预计到2030年将达到934.6亿美元,预测期内(2025-2030年)复合年增长率为4.32%。

主要亮点

- 纸包装脱颖而出,成为环保包装解决方案的领先选择。其多功能性使其能够生产各种尺寸,同时保持紧凑的占地面积,使其成为几乎所有最终用户行业的理想选择,特别是与体积较大的替代品相比。

- 根据美国人口普查局的数据,纸浆厂预计到 2024 年将产生 61.1 亿美元的收益。此外,纸板厂预计将产生 340.2 亿美元的收益,造纸厂预计将产生 395.5 亿美元的收入。随着电子商务发展成为零售业日益重要的元素,纸包装将受益匪浅。

- 此外,该地区已成为最大的瓦楞包装市场之一,因为该地区拥有多家食品服务公司和包装食品公司,包括已调理食品、简便食品和预製食品。由于繁忙的工作生活安排和便利性,对户外食品的高需求也是推动市场成长的重要因素。根据国际专利权协会的数据,到 2024年终,美国快餐店 (QSR) 数量预计将达到 199,808 家。

- 消费者越来越意识到与包装相关的环境风险,并做出更环保的购买选择。消费者、政府和媒体向製造商施加压力,要求在产品、包装和工艺中采用更环保的做法,进一步放大了这种转变。值得注意的是,消费者愿意为环保包装支付溢价。由于这些趋势,纸包装市场有望成长。

- 然而,森林砍伐为纸包装产业带来了重大挑战,包括供应链风险、环境问题、监管压力和永续创新的需求。解决森林砍伐问题需要政府、企业、消费者和环境组织等相关人员共同努力,促进纸包装产业负责任的森林管理和永续采购惯例。

北美纸包装市场趋势

环境问题创造了纸包装的需求

- 几十年来,许多政府措施和日益严格的法规提高了人们对与包装材料处置和回收相关的环境问题的认识。根据美国森林与造纸协会报告,2022年美国纸张和纸板回收率达约68%。

- 尤其是纸板,业界常称为硬纸板,在美国脱颖而出,成为顶级的回收包装材料。事实上,大约有 3400 万吨纸板被收集回收再生用。此外,全国用于製造新盒子的材料中约有 50% 来自再生纸。

- 近年来,普通商品(尤其是食品和饮料)采用更生态的包装的趋势日益明显。其中大部分采取了大幅限制一次性塑胶使用的宣传活动形式,这一主题在过去五年中获得了公众的大力支持。

- 消费者正在利用自己的购买力迫使大型餐厅品牌做出改变,选择具有永续实践的品牌,甚至愿意为永续选择支付更多费用。主要食品服务品牌正在放弃塑料,转向可回收纺织品和纸质包装等替代品。北美政府正在製定无塑胶法规,促使商家和消费品牌重新考虑他们的供应链和包装选择。

- 包装产业最显着的趋势以循环经济为中心。目前,包装业以100%可回收纸板为主,符合环保安全、无污染标准。由于有机饮料、果汁、椰子水、能量饮料和非乳製品饮料(杏仁奶和豆奶)等各种饮料的需求激增,液体包装市场预计将出现高速成长。

电子商务和医药行业的扩张创造了对各类纸包装的需求

- 随着越来越多的消费者转向网路购物,对将这些产品安全地交付给客户的包装材料的需求也在增加。纸板包装和纸盒包装因其多功能性、耐用性和成本效益而成为电子商务行业包装产品的主要材料之一。

- 不断增长的电子商务需求正在推动北美纸质包装市场的发展,因为需要适合在线零售、可自订、永续且针对高效物流和履约业务进行优化的包装材料,从而促进了纸质包装市场的成长。根据美国人口普查局数据,2024年第二季度,美国零售电商销售额达到约2,916亿美元,较上季度有所成长。

- 随着处方药需求的增加,对安全储存、运输和展示这些药物的二级和三级包装解决方案的需求也在增加。对包装材料不断增长的需求预计将使北美纸包装市场的公司受益,这些公司在为製药行业提供包装解决方案方面发挥关键作用。

- 根据加拿大健康资讯研究所 (CIHI) 的数据,2023 年,加拿大非处方药总支出达到 67 亿加元(49 亿美元),而处方药支出达到 411 亿加元(30.2 亿美元)70。据同一消息来源称,2020 年处方药支出将达到 353 亿加元(260 亿美元)。

北美纸包装产业概况

北美纸包装市场是一个竞争激烈的市场,有多家领先公司。其中一些重要公司目前在市场占有率方面处于市场领先地位。这些拥有大量市场占有率的主要企业正致力于扩大海外基本客群。市场的主要企业包括 International Paper、Smurfit Westrock、Graphic Packaging International、Cascades Inc. 和 Canadian Paper and Packaging。

- 2024 年 3 月 ProAmpac 是软包装和材料科学领域的全球领导者,收购了领先的再生牛皮纸製造商 UP Paper。 UP Paper成立于2016年,已成为北美顶级的100%未漂白再生牛皮纸製造商,快速回应多样化的包装需求。利用我们在纤维和薄膜材料科学方面的专业知识,Proanpack 和 UP Paper 旨在创新并提供环保的软包装解决方案。

- 2024 年 2 月 Graphic Packaging 将其位于美国奥古斯塔的漂白纸板製造厂以 7 亿美元的价格出售给 Clearwater Paper。 Clearwater Paper 将此次收购视为加强其在纸板製造业影响力的策略性倡议。调整后的 EBITDA 估值约为 1 亿美元,此次交易凸显了 Graphic Packaging 加强其产品组合的承诺。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 产业价值链分析

第五章市场动态

- 市场驱动因素

- 电子商务的增加创造了对各种纸包装的需求

- 对塑胶包装产品的监管导致需求增加

- 市场限制因素

- 森林砍伐对纸质包装材料的影响

第六章 市场细分

- 依产品类型

- 折迭式纸盒

- 瓦楞纸箱

- 其他产品类型

- 按最终用户产业

- 食品

- 饮料

- 卫生保健

- 个人护理

- 电子商务

- 电器产品

- 其他最终用户产业

- 按国家/地区

- 美国

- 加拿大

第七章 竞争格局

- 公司简介

- International Paper Company

- Smurfit Westrock

- Cascades Inc.

- Packaging Corporation of America

- Graphic Packaging International Inc.

- Mondi PLC

- DS Smith PLC

- Sealed Air Corporation

- ProAmpac Holdings Inc.

- Canadian Paper and Packaging Co. Ltd

- Clearwater Paper Corporation

第八章投资分析

第九章 市场未来展望

The North America Paper Packaging Market size is estimated at USD 75.64 billion in 2025, and is expected to reach USD 93.46 billion by 2030, at a CAGR of 4.32% during the forecast period (2025-2030).

Key Highlights

- Paper packaging stands out as a leading choice among eco-friendly packaging solutions. Its versatility allows it to be produced in various sizes while maintaining a compact footprint, making it an ideal fit for nearly every end-user industry, especially when compared to bulkier alternatives.

- According to the US Census Bureau, in 2024, pulp mills are expected to generate a revenue of USD 6.11 billion. Also, paperboard mills are expected to generate a revenue of USD 34.02 billion, and paper mills are expected to generate a revenue of USD 39.55 billion in the same year. With e-commerce evolving as an increasingly critical element of retail, paper packaging stands to benefit substantially.

- Moreover, the region emerges as one of the largest markets for corrugated packaging as the area has several foodservices and packaged food companies, including ready-to-eat, convenience, and ready-to-make meals. The high demand for out-of-home food due to busy work-life schedules and convenience is also a key factor driving the market growth. According to the International Franchise Association, the number of quick-service restaurants (QSRs) in the United States is estimated to reach 199,808 units by the end of 2024.

- Consumers are increasingly aware of the environmental risks associated with packaging, leading them to favor more eco-friendly purchasing choices. This shift is further amplified by pressures from consumers, the government, and the media on manufacturers to adopt greener practices in their products, packaging, and processes. Notably, consumers are willing to pay a premium for eco-friendly packaging. As a result of these trends, the paper packaging market is poised for growth.

- However, deforestation poses significant challenges to the paper packaging industry, including supply chain risks, environmental concerns, regulatory pressures, and the need for sustainable innovation. Addressing deforestation requires collaboration among stakeholders, including governments, companies, consumers, and environmental organizations, to promote responsible forest management and sustainable sourcing practices in the paper packaging industry.

North America Paper Packaging Market Trends

Environmental Concerns Creating Demand for Paper Packaging

- Over the decades, due to numerous government initiatives and increasingly stringent regulations, there has been growing awareness regarding the environmental hazards related to the disposal and recycling of packaging materials. The American Forest and Paper Association reported that the recycling rate for paper and paperboard in the United States reached approximately 68% in 2022.

- Notably, cardboard, often referred to as corrugated in the industry, stands out as the top recycled packaging material in the United States. In fact, around 34 million tons of cardboard were recovered for recycling. Moreover, about 50% of the material used nationwide for producing new boxes is sourced from recycled paper.

- In recent years, there has been a significant push for more ecological packaging of common things, particularly food and beverages. This has mostly taken the form of campaigns to drastically restrict the use of single-use plastics, a subject that has gathered massive public support in the previous five years.

- Consumers are using their purchasing power more readily to force major foodservice brands to change, choosing brands with sustainable commitments and even being willing to pay more for sustainable choices. Major foodservice brands are moving away from plastics and toward alternatives like recyclable fiber and paper packaging. North American governments are enacting plastic-free regulations, which is causing merchants and consumer brands to reconsider their supply chains and packaging options.

- The most evident trends in the packaging industry revolve around a circular economy. Currently, the packaging industry is dominated by paperboards that are 100% recyclable, which caters to environmental safety and standards to eliminate pollution. The liquid packaging market is expected to grow at a higher rate owing to the surge in demand for various beverages, such as organic drinks, fruit juices, tender coconut water, energy drinks, and non-dairy drinks (almond and soy milk).

The Expanding E-commerce and Pharmaceutical Industries Creating Demand for Various Paper Packaging Types

- As more consumers shift toward online shopping, there is a corresponding increase in the need for packaging materials to deliver these products to customers safely. Corrugated and folding carton packaging are among the primary materials used for packaging goods in the e-commerce industry due to their versatility, durability, and cost-effectiveness.

- The increasing demand for e-commerce is driving the growth of the North American paper packaging market by necessitating packaging materials suitable for online retail, customizable, sustainable, and optimized for efficient logistics and fulfillment operations. According to the US Census Bureau, in the second quarter of 2024, retail e-commerce sales in the United States amounted to roughly USD 291.6 billion, marking an increase compared to the previous quarter.

- With higher demand for prescription drugs, there will be a corresponding increase in the requirement for secondary and tertiary packaging solutions to store, transport, and display these medications safely. This increased demand for packaging materials is expected to benefit companies in the North American paper packaging market, as they play a crucial role in providing packaging solutions for the pharmaceutical industry.

- According to the Canadian Institute for Health Information (CIHI), in 2023, the total expenditure on non-prescription drugs in Canada amounted to CAD 6.7 billion (USD 4.9 billion), while spending on prescription drugs increased to CAD 41.1 billion (USD 30.27 billion). According to the same source, in 2020, the expenditure on prescription drugs was recorded at CAD 35.3 billion (USD 26 billion).

North America Paper Packaging Industry Overview

The North American paper packaging market is competitive with several influential players. Some of these important players in terms of market share are currently leading the market. These influential players with significant market shares are focused on expanding their customer base abroad. Some of the key players in the market include International Paper, Smurfit Westrock, Graphic Packaging International, Cascades Inc., and Canadian Paper and Packaging Co. Ltd.

- March 2024: ProAmpac, a global leader in flexible packaging and material science, acquired UP Paper, a leading producer of recycled kraft paper. Established in 2016, UP Paper swiftly became a top North American producer of 100% unbleached recycled kraft paper, serving diverse packaging needs. Leveraging their expertise in fiber and film-based material science, ProAmpac and UP Paper are set to innovate and deliver eco-friendly flexible packaging solutions.

- February 2024: Graphic Packaging divested its bleached paperboard manufacturing facility in Augusta, United States, selling it to Clearwater Paper for USD 700 million. Clearwater Paper perceives this acquisition as a strategic move to bolster its presence in the paperboard manufacturing industry. With an Adjusted EBITDA valuation of approximately USD 100 million, the deal underscores Graphic Packaging's commitment to refining its portfolio.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Growth of E-commerce Creating Demand for Various Paper Packaging Types

- 5.1.2 Regulations on Plastic-based Packaging Products Contributes to Higher Demand

- 5.2 Market Restraints

- 5.2.1 Effects of Deforestation on Paper Packaging

6 MARKET SEGMENTATION

- 6.1 By Product Type

- 6.1.1 Folding Cartons

- 6.1.2 Corrugated Boxes

- 6.1.3 Other Product Types

- 6.2 By End-user Industry

- 6.2.1 Food

- 6.2.2 Beverage

- 6.2.3 Healthcare

- 6.2.4 Personal Care and Household Care

- 6.2.5 E-commerce

- 6.2.6 Electrical Products

- 6.2.7 Other End-user Industries

- 6.3 By Country

- 6.3.1 United States

- 6.3.2 Canada

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 International Paper Company

- 7.1.2 Smurfit Westrock

- 7.1.3 Cascades Inc.

- 7.1.4 Packaging Corporation of America

- 7.1.5 Graphic Packaging International Inc.

- 7.1.6 Mondi PLC

- 7.1.7 DS Smith PLC

- 7.1.8 Sealed Air Corporation

- 7.1.9 ProAmpac Holdings Inc.

- 7.1.10 Canadian Paper and Packaging Co. Ltd

- 7.1.11 Clearwater Paper Corporation