|

市场调查报告书

商品编码

1626897

拉丁美洲的活性和智慧包装:市场占有率分析、行业趋势和成长预测(2025-2030)Latin America Active and Intelligent Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

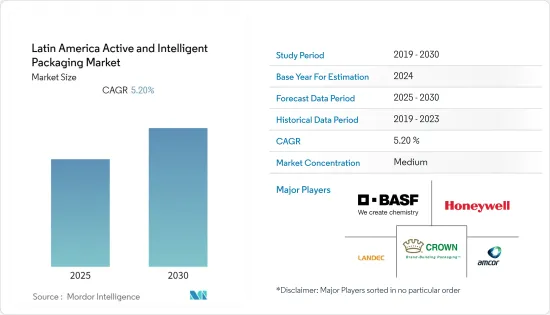

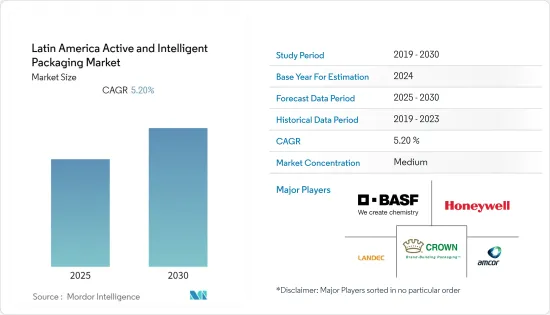

拉丁美洲活性包装和智慧包装市场预计在预测期内复合年增长率为5.2%

主要亮点

- 随着世界城市人口的成长和生活方式趋势的变化,对已调理食品、冷冻肉类和包装食品的需求不断增加。冷冻食品、肉品、蔬菜和水果的供应跨境,使当地市场走向全球。此外,随着零售业的快速发展,对有吸引力的先进包装的需求也在增长。

- 此外,仿冒品,特别是在新兴国家的製药和个人护理行业,迫使公司在包装中使用 RFID 等技术。所有这些因素都解释了对活性和智慧包装的需求的显着增长。然而,高昂的安装和实施成本需要初始资金,并且与这些系统相关的安全问题对市场成长构成了挑战。

- RFID 是众多自动识别技术之一,可为肉类生产、分销和零售链带来多种潜在好处。这包括可追溯性、库存管理、成本节约、安全性以及提高品质和安全性。防止产品召回也被认为是RFID技术的重要角色。因此,这是客户对此类包装产品需求不断增长的主要动力。

- 虽然智慧包装与活性包装有明显不同,但智慧包装的功能允许使用者使用它来检查活性包装系统的有效性和完整性,带来额外的功能,并且相辅相成。智慧包装可以被认为是最终用户行业可用的其他包装功能的推动者,并在此过程中帮助客户提供优质的产品。

- 此外,革命性工业4.0 的采用和疫情的蔓延增加了由Microsoft Azure 云端服务等各种软体支援的互联包装的使用,为该地区的零售商/电子零售商、品牌所有者、食品和饮料公司提供支持这对製造商有利。这正在推动市场研究。

拉丁美洲活性包装与智慧包装市场趋势

更长的保质期和消费者生活方式的变化预计将推动市场发展

- 消费者越来越需要保质期长且易于使用的产品。这需要公司开发替代包装解决方案。最佳食用日期是产品的一个重要方面。对于希望在不依赖先进冷藏链的情况下扩大产品供应的公司来说,提供更长保质期的製造包装已变得至关重要。

- 保护产品免受氧气、水分和微生物等潜在劣化因素的影响,可延长保存期限。为了保护他们的产品,企业需要能够实现相同目标且具有成本效益的包装解决方案。减少整个食品供应链的浪费将是减少农业对环境影响和满足不断增长的粮食需求的关键活动。因此,投资高效、低成本、可持续的加工和包装解决方案,以延长产品(特别是乳製品、婴儿食品和营养补充剂)的保质期是一个可行的解决方案,对主动和增强型智能包装的需求将会增加; 。

- 生活方式的改变以及由此产生的消费者对加工、包装和已调理食品的依赖正在增加对活性包装和智慧包装解决方案的需求。超级市场文化的出现也改变了购物格局,增加了对包装的需求,特别是在食品和饮料领域。人们生活方式的变化导致从家庭烹饪转向已烹调产品。除了易于使用之外,这些产品的包装方式还必须确保它们新鲜且未受污染。

- 近几个月来,我们看到消费者因 COVID-19 爆发而囤积不易腐烂的物品。活性、智慧包装材料和生产流程等技术进步促使包装设计师创造出延长产品保质期的包装产品和包装方法。

- 此外,RFID 和 NFC 等智慧包装解决方案可以整合到任何包装材料中,包括塑胶、纺织品和原生纤维。这种灵活性正在提高所研究市场的采用率。

食品是市场成长的关键因素之一

- 根据巴西政府预测,2021年,巴西包装食品零售额预计将达到1,166亿美元,较2016年成长32.2%。本预测显示高成长率的领域包括已调理食品、早餐用麦片谷类、婴儿食品、调味酱料和调味料、加工肉品以及水产品和汤。这样的成长率预计将增加对活性包装和智慧包装解决方案的需求。

- 依材料类型,阿根廷包装市场分为四个部分:塑胶、纸张、铝箔和纤维素包装。因此,关注疫情的消费者可以使用 RFID 和 NFC 等智慧包装来追踪产品从运输到储存的整个过程。此外,Amcor 是阿根廷的主要参与企业之一。该公司透过 RFID 和 NFC 技术实现食品追踪。这表明该地区对技术包装的需求不断增长。

- 从事食品加工和农产品企业(Tyson、Bachoco、Driscolls、Sunny Ridge 等)也需要比现有技术更好的环保包装技术。烘焙点心和咸味零食也呈现强劲成长,为墨西哥软包装製造商提供了广泛的机会。咸味零食产品系列包括洋芋片、玉米饼和玉米片,是最重要的产品领域。对已烹调营养食品的日益依赖也推动了墨西哥零食产品领域的包装市场。

- 此外,巴西的食品配送应用正在兴起,员工可以上门订餐。这种增长是在大流行期间出现的,非接触式送货等各种措施促进了使用。因此,对智慧包装的需求不断增长,因为它可以让客户了解他们的包装如何到达家门口,并知道该产品可以安全食用。

拉丁美洲活性包装与智慧包装产业概况

拉丁美洲活性和智慧包装市场适度整合,主要参与者包括BASFSE、Amcor Ltd、霍尼韦尔国际公司、Landec Corporation、Bemis Company Inc.、Crown Holdings Inc.、Ball Corporation、Timestrip UK Ltd。 。公司不断投资于策略联盟和产品开发,以占领更多的市场占有率。近期市场趋势如下。

- 2021 年 5 月 - 经过持续的市场筛检过程,Four04 Packaging Ltd 被认定为 Coveris 策略成长计画的理想合作伙伴。生鲜食品、水果和麵包包装是该公司的特色业务。该公司提供的产品系列完美地补充了 Coveris 在这些市场中的现有产品线。

- 2021 年 5 月 - Sealed Air 开发了一种新的热成型包装解决方案。与常用的层压材料相比,Sealed Air 声称其新型 CRYOVAC 品牌 LID830R 是一种更薄、更耐滥用的防雾覆盖薄膜,可减少包装重量高达 50%。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 市场驱动因素

- 更长的保存期限和消费者生活方式的改变

- 对新鲜、高品质食品的需求不断增长

- 市场问题

- 包装材料对人体影响的相关问题

- 智慧包装的安全和隐私问题

第五章 COVID-19 对市场的影响

第六章 市场细分

- 按类型

- 活性包装

- 气体清除器/发送器

- 水分清除剂

- 微波基座

- 其他活性封装技术

- 智慧包装

- 编码和标记

- 天线(RFID 和 NFC)

- 感测器和输出设备

- 其他智慧包装技术

- 活性包装

- 按最终用户产业

- 食物

- 饮料

- 医疗保健

- 个人护理

- 其他行业

- 按国家/地区

- 巴西

- 墨西哥

- 其他拉丁美洲

第七章 竞争格局

- 公司简介

- BASF SE

- Amcor Ltd

- Honeywell International Inc.

- Landec Corporation

- Bemis Company Inc.

- Crown Holdings Inc.

- Ball Corporation

- Sonoco Products Company

- Graphic Packaging International LLC

- Timestrip UK Ltd

- Sealed Air Corporation

- Dessicare Inc.

- WestRock Company

第八章投资分析

第九章 市场未来展望

The Latin America Active and Intelligent Packaging Market is expected to register a CAGR of 5.2% during the forecast period.

Key Highlights

- With the growing urban population and changing lifestyle trends worldwide, the demand for ready-to-eat, frozen meat, and packaged food is increasing. The supply of frozen foods, meat products, vegetables, and fruits surpass boundaries, giving regional markets global exposure. Moreover, with the retail industry propelling rapidly, the need for attractive and advanced packaging is also increasing.

- The increase in counterfeit products, especially in the pharmaceutical and personal care industries in emerging economies, also compelled companies to use technologies, such as RFID, during packaging. All these factors account for a substantial rise in the demand for active and intelligent packaging. However, the initial capital needed due to higher costs of installation and implementation and security issues regarding these systems is challenging the market's growth.

- RFID is one of many automatic identification technologies that offer some potential benefits to meat production, distribution, and retail chain. These include traceability, inventory management, labor-saving costs, security, and the promotion of quality and safety. The prevention of product recalls it is also considered a key role of RFID technology. Thus, it acts as a major driving factor for the increased demand from the customers for such products for packaging.

- Although intelligent packaging is distinctly different from active packaging, the features of intelligent packaging enable the user to use it to check the effectiveness and integrity of active packaging systems, bringing added features and complementing each other. Intelligent packaging can be considered the enabler of the other packaging features that end-user industries can utilize, and in the process, help their customers offer quality products.

- Furthermore, the introduction of revolutionary industry 4.0 and the spread of the pandemic has increased the use of connected packaging powered by various software such as Microsoft Azure cloud services to benefit the retailers/e-tailers, brand owners, and food manufacturers in the region. This is driving the market studied.

Latin America Active & Intelligent Packaging Market Trends

Longer Shelf Life and Changing Consumer Lifestyle is expected to drive the market

- Consumers have been demanding products with extended shelf life and easier usage. This has necessitated the companies to develop alternate packaging solutions. Shelf life has been an important aspect of the product. Companies looking to expand their product offerings with less dependency on sophisticated cold storage chains have become imperative to produce packages that provide longer shelf life.

- The shelf life can be increased by protecting the products from potential deteriorating agents, such as oxygen, moisture, and microbes. In order to protect their products, companies need a packaging solution that can achieve the same and is also cost-effective. Reducing wastage throughout the food supply chain is likely to become a crucial activity to reduce the environmental impact of agriculture and serve the increasing food demand. Therefore, investing in efficient, low-cost, and sustainable processing and packaging solutions to increase the shelf life of products (especially dairy, baby food, and nutraceuticals) is a viable solution, thus augmenting the requirement of active and intelligent packaging.

- Changing lifestyle and the consequent dependence of consumers on processed, packaged, and precooked food is increasing the demand for active and intelligent packaging solutions. The advent of the supermarket culture has also altered the landscape of shopping and has increased the need for packaging, especially in food and beverage products. The altering lifestyle of people has resulted in the shift from home-cooked to ready-to-eat products. In addition to this ease of use, these products should also be packaged in such a way to ensure they are fresh and uncontaminated.

- In the past few months, consumers have been witnessed stocking up on shelf-stable goods owing to the impact of the COVID-19 outbreak. Technological advancements such as active and intelligent packaging materials and production processes have led packaging designers to produce packaging products and methods that increase the shelf life of the products.

- Moreover, intelligent packaging solutions such as RFIDs and NFcs can be incorporated into any packaging material such as plastic, fiber, virgin fiber, among others. Such flexibility increases the adoption in the market studied.

Food is One of the Significant Factor for Market Growth

- According to the Brazilian government, by the year 2021, the retail sales in packaged food in Brazil are anticipated to reach USD 116.6 billion, a growth rate of 32.2% since 2016. High growth rates in the forecast include ready meals, breakfast cereals, baby food, sauces dressings and condiments, processed meat, and seafood and soup. Such growth rates are expected to increase the demand for active and intelligent packing solutions.

- Based on the material types, the packaging market in Argentina is categorized into four segments: plastic, paper, aluminum foil, and cellulose packaging materials. Thus intelligent packaging such as the RFIDs and NFCs can be included to track the products from transport to storage by consumers that are concerned amind the pandemic. Further, one of the major players in Argentina is Amcor. The company allows tracking of food products through RFID and NFC technology. This is indicative of the growing demand for technology-infused packaging in the region.

- The companies involved in food processing and agribusiness (Tyson, Bachoco, Driscolls, Sunny Ridge, etc.) also require better and greener packaging technologies than the available ones. Baked and salted snacks are also showing strong growth, providing extensive opportunities for flexible packaging manufacturers in Mexico. The salted snacks product group, including potato chips, tortillas, and corn chips, is the most significant product segment. Also, a greater reliance on ready-prepared nutritious foods drives the packaging market in the snack product segment in Mexico.

- Furthermore, Brazil is witnessing increased food delivery applications that allow personnel to order food at doorsteps. The increase was witnessed amid the pandemic, and various initiatives such as the non-contact deliveries are driving the use of applications. Thus the need for intelligent packaging increases as it allows customers and understand how the package arrived at their doorstep and enables them to know that the product is safe to consume.

Latin America Active & Intelligent Packaging Industry Overview

The Latin America Active and Intelligent Packaging market is moderately consolidated, with a few major companies like BASF SE, Amcor Ltd, Honeywell International Inc., Landec Corporation, Bemis Company Inc., Crown Holdings Inc.Ball Corporation, Timestrip UK Ltd are some players. The companies are continuously investing in making strategic partnerships and product developments to gain more market share. Some of the recent developments in the market are:

- May 2021 - Four04 Packaging Ltd was identified as an ideal partner for Coveris' strategic growth plans through a continuous market screening procedure. Packaging for fresh food and fruit, as well as bread, is a specialty of the company. It offers a product portfolio that ideally complements Coveris' existing product lines in these markets.

- May 2021 - A new thermoforming packaging solution has been developed by Sealed Air. When compared to commonly used laminates, Sealed Air claims that the new CRYOVAC brand LID830R is a thin, high abuse resistance, anti-fog top lid film that can reduce packing weight by up to 50%.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Market Drivers

- 4.4.1 Longer Shelf Life and Changing Consumer Lifestyle

- 4.4.2 Growing Demand for Fresh and Quality Food Products

- 4.5 Market Challenges

- 4.5.1 Issues with the Effects of Packaging Materials on the Human Body

- 4.5.2 Security and Privacy Issues in the Case of Intelligent Packaging

5 IMPACT OF COVID-19 ON THE MARKET

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Active Packaging

- 6.1.1.1 Gas Scavengers/Emitters

- 6.1.1.2 Moisture Scavenger

- 6.1.1.3 Microwave Susceptors

- 6.1.1.4 Other Active Packaging Technologies

- 6.1.2 Intelligent Packaging

- 6.1.2.1 Coding and Markings

- 6.1.2.2 Antenna (RFID and NFC)

- 6.1.2.3 Sensors and Output Devices

- 6.1.2.4 Other Intelligent Packaging Technologies

- 6.1.1 Active Packaging

- 6.2 By End-user Vertical

- 6.2.1 Food

- 6.2.2 Beverage

- 6.2.3 Healthcare

- 6.2.4 Personal Care

- 6.2.5 Other End-user Verticals

- 6.3 By Country

- 6.3.1 Brazil

- 6.3.2 Mexico

- 6.3.3 Rest of Latin America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 BASF SE

- 7.1.2 Amcor Ltd

- 7.1.3 Honeywell International Inc.

- 7.1.4 Landec Corporation

- 7.1.5 Bemis Company Inc.

- 7.1.6 Crown Holdings Inc.

- 7.1.7 Ball Corporation

- 7.1.8 Sonoco Products Company

- 7.1.9 Graphic Packaging International LLC

- 7.1.10 Timestrip UK Ltd

- 7.1.11 Sealed Air Corporation

- 7.1.12 Dessicare Inc.

- 7.1.13 WestRock Company