|

市场调查报告书

商品编码

1627111

北美无线感测器:市场占有率分析、行业趋势、统计和成长预测(2025-2030)North America Wireless Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

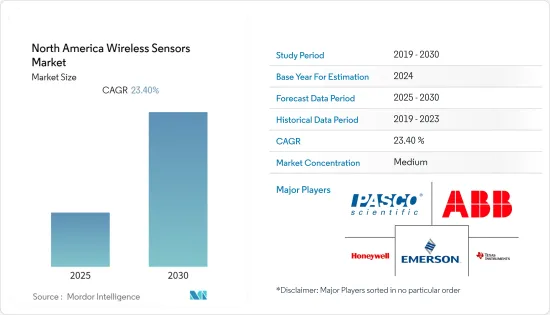

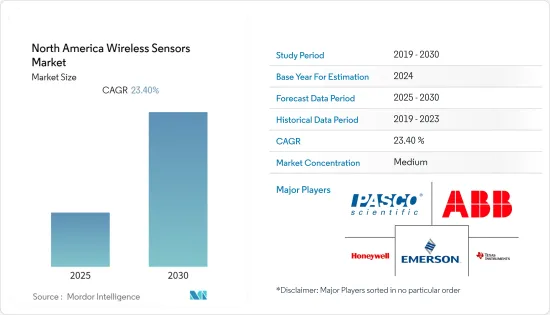

北美无线感测器市场预计在预测期内复合年增长率为 23.4%

主要亮点

- 无线感测器使关键系统之间的通讯自动化,并有助于缓解各种公共未来出现的问题。例如,漏水感测器可以安装在墙上,以检测管道故障和冬季可能爆裂的管道。同样,无线绳索感测器用于伺服器机房和资料中心,以检测电脑硬体附近是否有水。

- 这些感测器还支援灾害管理活动。例如,在德克萨斯州,桥樑上安装了无线感测器来检测水位是否高于特定阈值,表明该地区可能发生山洪。无线振动感测器用于拥有大型机械的工业工厂,以提前预测设备故障。

- 该地区的许多公司正在投资经济高效、安全且方便的无线技术。例如,状态监测技术和产品供应商SPM Instrument AB宣布推出用于工业设备远端监测的无线振动感测器Airius。该感测器是一款无线、电池供电的振动感测器,非常适合泵浦和风扇等标准生产设备的远端状态监测。

- 全部区域军事开支的增加为无人机/无人机等技术铺平了道路。此外,配备高阶导航系统的传统战斗机中无线感测器的使用也显着增加。由于上述因素,无线感测器的数量需求也在快速增加。

- 此外,该地区的国防部门正在采用无线感测器技术。这些感测器可协助组织监控其设施、识别可疑活动并追踪有价值的资产。此外,它也适用于银行。无线按钮可以变成员工的紧急按钮,零售商也可以在每个建筑物的网路基地台安装无线窗户感测器。

北美无线感测器市场趋势

汽车预计将占据较大市场占有率

- 在过去的几十年里,汽车经历了许多变化。以前,汽车依靠为前灯和火星塞供电的基本电气系统运行。随着技术的进步,汽车现在配备了最新的小工具,如收音机、警报器和雨刷。汽车安全方面也取得了各种技术进步,例如安全气囊的部署。随着越来越多的功能依赖这些感测器,工程师们正在努力开发更准确的感测器,以适应汽车应用。

- 目前,汽车领域的两大趋势是电气化和自动化。从长远来看,电动车在行业中的出现正在对无线感测器的需求产生巨大影响。电动车的增加意味着对感测器的需求增加,这意味着用于监控废弃电池、定位和检测汽车各种运动部件的感测器的激增。

- 此外,随着电动车变得越来越流行,高通等技术先驱开发了高效的汽车无线充电技术。这种无线充电技术为使用者提供了在无线充电站、停车场或家中高效充电的便利。该公司还透过一个主垫片实现了超过 90% 的传输效率。该公司相信,未来将能够进一步完善这项技术,以实现更有效率、更易于理解的实施。

- 支援 ADAS、资讯娱乐和自动驾驶系统的汽车应用中的感测器使用案例数量不断增加,凸显了对介面规范的需求。预计它将对未来的需求变得至关重要。

- 随着 ADAS 应用的发展并变得更加复杂,越来越需要有效的方法来向驾驶员提供安全警告和其他相关资讯。抬头显示器(HUD) 是少数将 ADAS资料整合到中央萤幕的新兴解决方案之一,使驾驶者能够将注意力集中在道路上,并在挡风玻璃上显示警报和警告。

美国占最大市场占有率

- 无线感测器市场的成长是由各个最终用户产业的应用所推动的。製造商正在投资研发工作,以提高无线感测器的准确性和可靠性。无线感测器用于建筑自动化、军事和国防、食品和饮料以及物料输送等行业中的资料监控和其他类似功能。

- 影响无线感测器市场的主要驱动因素是美国对新的可再生能源开发、能源来源和其他快速技术进步的需求不断增长。它们也是智慧电网的重要组成部分,可远端监控变压器和电力线路,并监控电力线路的温度和天气。

- 此外,美国主要的无线感测器供应商正在采取产品创新策略,以跟上各自行业的先进产品的步伐。例如,2020年2月,以创新和有价值的混凝土技术而闻名的凯顿国际公司推出了新型Maturix智慧混凝土感测器。 Maturix 智慧混凝土感测器是该地区第一个真正的无线混凝土监测感测器。

- 美国在几乎所有产业中自动化和智慧型装置的采用率也是最高的。由于工业化率高,该国是智慧家庭和智慧办公室的主导市场。与世界其他地区相比,该地区各产业无线感测器的采用增幅也最高。

- 此外,随着产业动态的变化,汽车製造商正在转向生产电动车,以满足高级消费者的需求。电动车的普及在美国迅速普及,车载无线感测器的需求大幅增加。

北美无线感测器产业概况

北美的无线感测器市场竞争非常激烈,因为多家供应商向国内和国际市场提供无线感测器。该市场似乎适度分散,拥有较大市场份额的主要参与者专注于扩大其国际基本客群。此外,这些公司不断创新产品,以扩大市场占有率并提高盈利。以下是市场的一些最新发展:

- 2021 年 8 月 - 来自麻省大学洛厄尔分校和东北大学的研究团队开发了一种无线感测器网络,可以即时检测空气、污水等中的冠状病毒。该计划名为“DiSenDa”,代表多模态感测器网路和数据分析的疾病监测。连接到感测器的探针专门设计用于检测空气或污水样本中是否存在 SARS-CoV-2 生物标记物。

- 2021 年 1 月 - Everactive 是一家建立物联网 (IoT) 解决方案的科技公司,筹集了 3,500 万美元资金,用于开发无电池无线感测器。这笔资金将用于加速该公司工业应用无电池无线感测器的销售、行销和产品开发。此外,EverActive的端到端监控解决方案针对目前未监控或监控不善的大量工业资产。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 技术简介

- COVID-19 市场影响评估

第五章市场动态

- 市场驱动因素

- 无线技术的采用增加(特别是在恶劣的环境中)

- 智慧工厂概念的出现(工业自动化)

- 市场挑战

- 与感测器产品相关的高安全需求和成本

- 网路安全问题和物联网领域的最新趋势

第六章 市场细分

- 按类型

- 压力感测器

- 温度感测器

- 化学/气体感测器

- 位置/接近感测器

- 其他类型

- 按最终用户产业

- 车

- 卫生保健

- 航太/国防

- 能源/电力

- 饮食

- 其他最终用户产业

- 按国家/地区

- 美国

- 加拿大

第七章 竞争格局

- 公司简介

- Honeywell International Inc.

- Emerson Electric Co.

- Texas Instruments Incorporated

- ABB Ltd.

- Pasco Scientific

- Monnit Corporation

- Phoenix Sensors LLC

- Schneider Electric

第八章投资分析

第九章 市场未来展望

The North America Wireless Sensors Market is expected to register a CAGR of 23.4% during the forecast period.

Key Highlights

- Wireless sensors help to automate communication between critical systems and mitigate future problems for different utilities. For instance, water leak sensors can be mounted on walls to detect plumbing failures or pipes that may burst in the winter. Similarly, wireless rope sensors are being used in server rooms and data centers to detect the presence of water near computer hardware.

- These sensors also support disaster management efforts. For instance, in Texas, wireless sensors are being installed on bridges to detect water levels above a certain threshold, thus, indicating potential flash flooding in the area. Wireless vibration sensors are used in industrial plants with large machinery to predict equipment failures before they occur.

- Many companies are investing in wireless technologies in the region, which are cost-effective, safe, and convenient. For instance, SPM Instrument AB, a provider of condition monitoring technology and products, announced the release of Airius, a range of wireless vibration sensors for remote monitoring of industrial equipment. This sensor is a wireless, battery-powered vibration sensor ideal for remote condition monitoring of standard production equipment, such as pumps and fans.

- The increasing military spending across the region paves the way for technologies like drones/unmanned aerial vehicles (UAVs). In addition, the usage of wireless sensors in traditional fighter jets with high-end navigation systems is increasing significantly. The factors mentioned above are creating an exponential demand for wireless sensors in volumes as well.

- Further, the defense sector in the region is embracing wireless sensor technology, as these sensors can help organizations monitor their premises, identify suspicious activity, and track valuable assets. Moreover, they also find applications in banks. They can turn wireless push buttons into panic buttons for employees and retailers to install wireless window sensors on every building access point.

North America Wireless Sensors Market Trends

Automotive is Expected to Hold Significant Market Share

- Automotive vehicles have undergone various changes over the last few decades. Previously, cars used to work with basic electrical systems that offered power for headlights and spark plugs. As technology progressed, cars were fitted with the latest gadgets, such as radios, alarms, and wipers. Various technological advancements have also been made for vehicles' safety, such as airbag deployment. The increase in these sensor-dependent features has driven engineers to develop more accurate sensors with automotive applications in mind.

- Currently, the two significant trends for the automotive sector are electrification and automation. The emergence of electric vehicles in the industry has dramatically impacted the demand for wireless sensors in the long term. More electric cars mean an increase in demand for sensors, a surge in sensors for used battery monitoring, and various positioning and detection of moving parts of automobiles.

- Moreover, with the increasing use of electric vehicles, technology pioneers like Qualcomm have developed efficient wireless charging technology for cars. This wireless charging technology offers convenience for users to charge their vehicles at wireless charging stations, parking lots, or at home efficiently. The company has also achieved transfer efficiency of more than 90% with a single primary base pad. The company believes that the technology can be further improved for better efficiency and more straightforward implementation in the future.

- As the use cases of sensors continue to increase in automobile applications to support ADAS, infotainment, and autonomous driving systems, the need for interface specifications is apparent. It is expected to be critical for future demand.

- As ADAS applications evolve and become more complex, there has been an increased need for effective methods to present safety alerts and other relevant information to the driver. Head-up displays (HUDs) are among the few emerging solutions for consolidating ADAS data into a centralized screen that allows the driver to keep the eyes on the road while viewing alerts and warnings that appear on the windshield time.

United States Accounts for the Largest Market Share

- The growth of the wireless sensors market is driven by the application in the various end-user industries. Manufacturers invest in R&D activities to improve the accuracy and reliability of wireless sensors. Wireless sensors are used for data monitoring and other similar functions and in building automation, military and defense, and other industries, like food and beverage and material handling.

- The key drivers influencing the wireless sensors market are the increasing need for new renewable energy development, energy sources, and other rapid technological advancements in the United States. They are also a vital component in smart grids for remote monitoring of transformers and power lines where they are put into service to monitor line temperature and weather conditions.

- Moreover, critical wireless sensor vendors in the United States adopt product innovation strategies to cater to advanced offerings across the industries. For instance, in Feb 2020, Kryton International Inc., a company known for innovative and valuable concrete technologies, launched its new Maturix smart concrete sensors. The Maturix smart concrete sensor is the first truly wireless concrete monitoring sensor in the region.

- The United States also has the highest adoption of automation and smart devices in almost every industry. Owing to a high rate of industrialization, the country is a dominant market for smart homes and smart offices. The area has also witnessed the most increased adoption of wireless sensors for various industry verticals compared to the world.

- Further, with changing dynamics in the industry, automotive manufacturers are moving toward electric vehicles production to meet the needs of advanced consumers. The use of electric vehicles in the United States has risen rapidly, significantly augmenting the demand for wireless sensors designed for automotive applications.

North America Wireless Sensors Industry Overview

The North American wireless sensor is highly competitive owing to multiple vendors providing wireless sensors to the domestic and international markets. The market appears to be moderately fragmented, and the major players with a prominent share in the market are focusing on expanding their customer base across international countries. Additionally, these companies are continuously innovating their products to increase their market share and increase their profitability. Some of the recent developments in the market are:

- August 2021 - A team of researchers from UMass Lowell and Northeastern University developed a wireless sensor network to detect coronavirus in the air, wastewater in real-time. The project is called "DiSenDa," which stands for Disease Surveillance with Multi-Modal Sensor Network and Data Analytics. The probes attached to the sensors have been specifically designed to detect the presence of biomarkers for SARS-CoV-2 in the air and wastewater samples.

- January 2021 - Everactive, a technology company that builds the Internet of Things (IoT) solutions, raised USD 35 million in funding to develop its battery-free wireless sensors. The funds will be used to accelerate sales, marketing, and product development of the company's battery-free wireless sensors for industrial applications. Moreover, Everactive's end-to-end monitoring solutions are aimed at high-volume industrial assets that are currently unmonitored or under-monitored due to sheer volume.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Technology Snapshot

- 4.5 Assessment of the Impact of COVID-19 on the market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Adoption of Wireless Technologies (Especially in Harsh Environments)

- 5.1.2 Emergence of Smart Factory Concepts (Industrial Automation)

- 5.2 Market Challenges

- 5.2.1 Higher Security Needs and Cost associated with the Sensor Products

- 5.2.2 Concerns pertaining to cybersecurity in the IoT space and recent developments

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Pressure Sensor

- 6.1.2 Temperature Sensor

- 6.1.3 Chemical and Gas Sensor

- 6.1.4 Position and Proximity Sensor

- 6.1.5 Other Types

- 6.2 By End-user Industry

- 6.2.1 Automotive

- 6.2.2 Healthcare

- 6.2.3 Aerospace and Defense

- 6.2.4 Energy and Power

- 6.2.5 Food and Beverage

- 6.2.6 Other End-user Industries

- 6.3 By Country

- 6.3.1 United States

- 6.3.2 Canada

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Honeywell International Inc.

- 7.1.2 Emerson Electric Co.

- 7.1.3 Texas Instruments Incorporated

- 7.1.4 ABB Ltd.

- 7.1.5 Pasco Scientific

- 7.1.6 Monnit Corporation

- 7.1.7 Phoenix Sensors LLC

- 7.1.8 Schneider Electric