|

市场调查报告书

商品编码

1627208

亚太地区无线感测器:市场占有率分析、产业趋势和成长预测(2025-2030)APAC Wireless Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

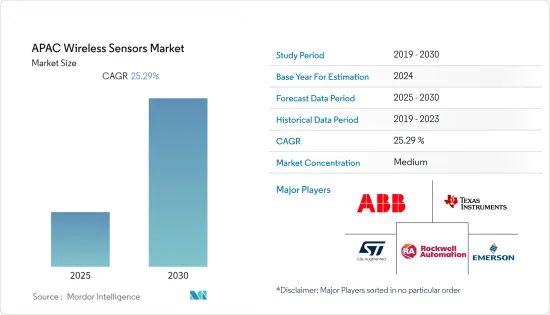

亚太无线感测器市场预计在预测期内复合年增长率为25.29%

主要亮点

- 预计亚太市场在未来几年将显着成长。由于印度和中国等新兴国家的存在,该地区的成长速度是其他地区中最快的,这些国家具有巨大的成长潜力。

- 无线感测器用于工厂、生产流程和其他类似功能的资料监控,以及建筑自动化、国防、物料输送以及食品和饮料等产业。新能源来源的不断探索、可再生能源的开发、政府法规和快速的技术进步是推动无线感测器市场良好成长的关键因素。

- 作为智慧电网的重要组成部分,它们的使用也越来越多,用于远端监控变压器和电力线路,以及电力线路的温度和天气监控。

亚太无线感测器市场趋势

智慧工厂的采用率不断提高

- 亚太地区是电气和电子设备製造市场最大的地区之一。该地区也是无线感测器技术的重要供应商,特别是在中国和日本。

- 中国和日本等国家也正在拥抱智慧製造,将PLC和SCADA等控制系统用于资产监控和远端製程监控等各种目的。例如,中国计划在2025年建立智慧製造体系,完成重点产业转型。

- 中国、印度、日本和新加坡等国家对智慧型手机等消费性电子设备的需求强劲,鼓励许多供应商在该地区设立生产基地。容易取得的原材料以及较低的设置和人事费用也有助于公司在该地区建立生产基地。

- 此外,州政府加大对智慧工厂的支持和投资也有助于工厂发展,进而支持无线感测器的使用。

该地区汽车产业越来越多地采用智慧感测器

- 中国是全球最大的汽车市场之一,也是全球最大的汽车(包括电动车)生产国,拥有巨大的成长潜力。根据中国工业协会(CAAM)的数据,2021年9月中国商用车销量约31.7万辆。中国销量约占全球汽车销量的32.56%。 2020年,中国插电式混合动力汽车销量约25万辆,而几年前还不到10万辆。

- 由于这些产业占据无线感测器市场的很大一部分,因此该地区在预测期内蕴藏着巨大的机会。联网汽车概念和汽车安全法规的不断发展预计也将推动无线感测器在该地区的采用。

- 该地区自动驾驶和高级驾驶辅助系统(ADAS)的标准化正在取得进展,市场有望重振。针对乘客安全、工业自动化、环境监测等的支持性政府法规也使亚太地区成为无线感测器的重要买家。中国汽车市场受到了2019年起要求新车使用TPMS的法规的影响。该地区是丰田、日产、本田、马自达、三菱、斯巴鲁和铃木等知名汽车製造商的所在地,使其成为该市场的潜在买家。

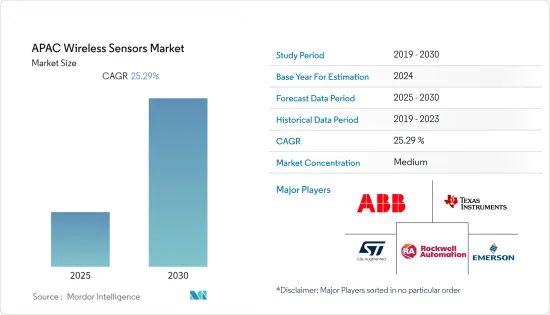

亚太地区无线感测器产业概况

亚太无线感测器市场的竞争格局已适度饱和,因为该地区有多个参与企业。

- 2020年5月:中国预计到2025年投资约1.4兆美元,鼓励城市政府和华为技术有限公司等私人科技巨头安装第五代无线网路、安装摄影机和感测器,呼吁开发支援人工智慧的软体从自动驾驶到自动化工厂和大规模监控的一切。这些投资预计将开发该地区的无线感测器市场。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间的敌对关係

- 市场驱动因素

- 无线技术的采用增加(特别是在恶劣的环境中)

- 智慧工厂概念的兴起(工业自动化)

- 市场限制因素

- 不同标准导致的频宽限制和相容性问题

- 产业价值链分析

- COVID-19 对市场的影响

- 技术简介

- 技术类型

- Bluetooth

- 无线网路和无线区域网

- ZigBee

- Wirelessshart

- RFID

- EnOcean

- 其他的

- 技术类型

第五章市场区隔

- 感测器类型

- 压力

- 温度

- 影像

- 流动

- 化学和气体

- 位置和邻近度

- 其他的

- 工业部分

- 车

- 医疗保健

- 航太/国防

- 能源/电力

- 石油和天然气

- 饮食

- 其他的

- 按国家/地区

- 中国

- 日本

- 印度

- 其他的

第六章 竞争状况

- 公司简介

- ABB Ltd

- STMicroelectronics

- Texas Instruments Incorporated

- Rockwell Automation Inc.

- Emerson Electric Co

- Honeywell International Inc.

- Schneider Electric SA

- Endress+Hauser SA

- Yokogawa Electric Corporation

- Siemens AG

- General Electric

第七章 投资分析

第八章 市场机会及未来趋势

简介目录

Product Code: 51052

The APAC Wireless Sensors Market is expected to register a CAGR of 25.29% during the forecast period.

Key Highlights

- The Asia Pacific market is expected to augur significant growth in the coming years. It is growing at the fastest pace, as compared to the other regions, owing to the presence of emerging countries such as India and China, which offer huge potential for growth.

- Wireless sensors are used in factory settings for data monitoring, the flow of production, and other similar functions, as well as in building automation, defense, and other industries like materials handling and food and beverage. The increasing quest for new energy sources, renewable energy development, government regulations, and rapid technological advancements are the key drivers which are making the wireless sensors market grow lucratively.

- Their usage has also increased as they are a vital component in smart grids for remote monitoring of transformers and power lines where they are put into service to monitor line temperature and weather conditions.

APAC Wireless Sensors Market Trends

Increasing Adoption of Smart Factories

- The Asia Pacific is one of the largest region in the electrical and electronics manufacturing market. The region is also a significant vendor of wireless sensor technologies, especially in China and Japan.

- Countries, such as China and Japan, are also embracing smart manufacturing, which includes the use of control systems, such as PLC, and SCADA, among others, for various purposes, such as asset monitoring and remote process monitoring. For instance, China aims to establish its intelligent manufacturing system and complete the key industries' transformation by 2025.

- Significant demand for consumer electronics devices like smartphones from countries such as China, India, Japan, and Singapore, are encouraging many vendors to set up production establishments in the region. The availability of raw materials and the low establishment and labor costs have also helped companies launch their production centers in the region.

- Moreover, the increase support and investment by the state governments for smart factories also aids their growth and, in turn, the usage of wireless sensors.

Increasing adoption of smart sensors in the region's automobile sector

- China is one of the world's largest car markets and the world's largest production site for cars, including electric cars, with much growth potential. According to the China Association of Automobile Manufacturers (CAAM), in September 2021, approximately 317,000 commercial vehicles were sold in China. Sales in China accounted for about 32.56% of global motor vehicle sales. In 2020, around 0.25 million plug-in hybrid cars had been sold in China, which increased from less than 0.1 million a few years back.

- As these industries account for a significant portion of the wireless sensor market, the region offers an excellent opportunity over the forecast period. The growing concept of connected cars and regulations regarding automotive safety is also expected to drive the adoption of wireless sensors in the region.

- The standardization of autonomous driving and advanced driver assistance systems (ADAS) in the region is expected to boost the market. Supportive government regulations aimed at passenger safety, industrial automation, environment monitoring, etc., also make the Asia Pacific substantial buyers of wireless sensors. The Chinese auto market was affected by regulations that mandate the use of TPMS for new vehicles, starting in 2019. The region houses prominent automakers, such as Toyota, Nissan, Honda, Mazda, Mitsubishi, Subaru, and Suzuki, which are potential buyers of the market.

APAC Wireless Sensors Industry Overview

The competitive landscape within the Asia Pacific Wireless Sensor market is moderately saturated as the region is home to multiple players.

- May 2020: China is expected to invest an estimated USD 1.4 trillion up till 2025, calling on urban governments and private tech giants like Huawei Technologies Co. to lay fifth-generation wireless networks, install cameras and sensors, and develop AI software that will underpin autonomous driving to automated factories and mass surveillance. Such investments are expected to develop the wireless sensor market in the region.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Force Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Market Drivers

- 4.3.1 Increasing Adoption of Wireless Technologies (especially in harsh environments)

- 4.3.2 Emergence of Smart Factory Concepts (Industrial Automation)

- 4.4 Market Restraints

- 4.4.1 Bandwidth Contraints and Compatibility Issues due to Variety of Standards

- 4.5 Industry Value Chain Analysis

- 4.6 Impact of COVID-19 on the Market

- 4.7 Technology Snapshot

- 4.7.1 Type of Technology

- 4.7.1.1 Bluetooth

- 4.7.1.2 WiFi and Wlan

- 4.7.1.3 ZigBee

- 4.7.1.4 Wirelessshart

- 4.7.1.5 RFID

- 4.7.1.6 EnOcean

- 4.7.1.7 Others

- 4.7.1 Type of Technology

5 MARKET SEGMENTATION

- 5.1 Type of Sensor

- 5.1.1 Pressure

- 5.1.2 Temperature

- 5.1.3 Image

- 5.1.4 Flow

- 5.1.5 Chemical and Gas

- 5.1.6 Position and Proximity

- 5.1.7 Others

- 5.2 Industry

- 5.2.1 Automotive

- 5.2.2 Healthcare

- 5.2.3 Aerospace and Defense

- 5.2.4 Energy and Power

- 5.2.5 Oil and Gas

- 5.2.6 Food and Beverage

- 5.2.7 Others

- 5.3 By Country

- 5.3.1 China

- 5.3.2 Japan

- 5.3.3 India

- 5.3.4 Others

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 ABB Ltd

- 6.1.2 STMicroelectronics

- 6.1.3 Texas Instruments Incorporated

- 6.1.4 Rockwell Automation Inc.

- 6.1.5 Emerson Electric Co

- 6.1.6 Honeywell International Inc.

- 6.1.7 Schneider Electric SA

- 6.1.8 Endress+Hauser SA

- 6.1.9 Yokogawa Electric Corporation

- 6.1.10 Siemens AG

- 6.1.11 General Electric

7 INVESTMENT ANALYSIS

8 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219