|

市场调查报告书

商品编码

1627181

拉丁美洲无线感测器:市场占有率分析、行业趋势和成长预测(2025-2030)Latin America Wireless Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

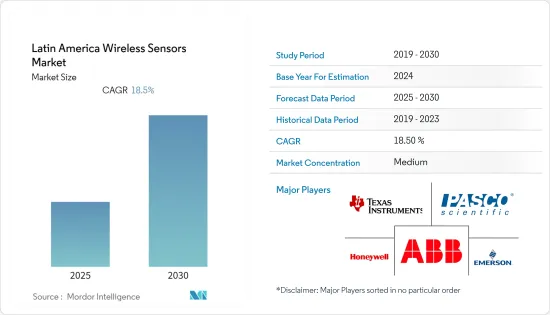

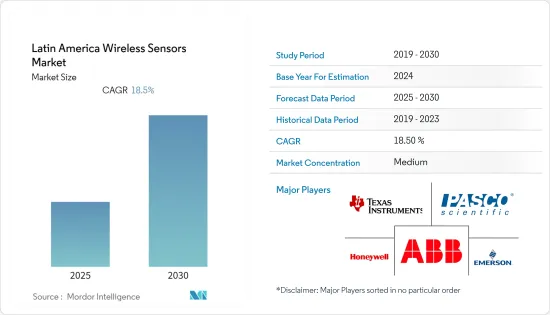

拉丁美洲无线感测器市场预计在预测期内复合年增长率为 18.5%

主要亮点

- 由于各国政府专注于通讯,而中国主要投资于新兴技术,拉丁美洲正经历技术繁荣。该地区经济预计将由巴西和阿根廷引领,消费者支出也有望进一步增加。

- 汽车和医疗保健生产支持该地区的无线感测器需求。该地区缺乏航太和军事设备以及其他工业控制系统的本地生产。

- 拉丁美洲的医疗设备製造以墨西哥为首,由美敦力(Medtronic)、金佰利(Kimberly Clark)、通用电气(GE)、波士顿科学(Boston Scientific)、强生(Johnson and Johnson)、泰科(Tyco)、西门子( Siemens、康德乐医疗(Cardinal Healthcare Becton Dickinson)等全球知名企业领衔。设备製造商和契约製造製造商的集中也为拉丁美洲的无线感测器市场做出了贡献。

- 此外,私立医院数量的增加以及外国公司对医疗保健产业投资的增加正在推动拉丁美洲IT医疗保健产业的发展。经济状况的波动推动了对低成本医疗设备的需求,并为该地区的无线感测器供应商创造了巨大的机会。

- 此外,无线感测器面临的主要挑战是频宽(因为它是一种无线技术)以及感测器与各种先前安装的设备的兼容性。

拉丁美洲无线感测器市场趋势

位置和接近感测器预计将占据主要市场占有率

- 位置感测器可以侦测物体的移动或计算其相对于已知参考点的位置。这种类型的感测器也可用于侦测物体是否存在。有许多感测器值得一提,它们的功能与位置感测器相当。动作感测器可用于侦测物体的运动并启动动作。此外,接近感测器可以识别物体何时进入感测器的范围。因此,这两种感测器都被归类为特殊位置感测器。

- 无线位置感测器在汽车中用于确定方向盘位置、踏板、座椅以及其他阀门、旋钮和致动器。位置感测器分为三类:角度感测器、旋转感测器和线性感测器。用于感测这些感测器位置的技术包括雨刷臂电位器、光学反射或影像处理以及霍尔效应感测器。

- 製造需要高精度才能满足产业需求。为了生产高品质的产品,製造商专注于两个重要参数:测量精度和彻底的检查。位置感测器监控多个重要特征,例如轮廓、宽度、高度、台阶、间隙、V 形间隙、边缘、角度、弯曲、凹槽和表面。

- HVAC 系统、运输系统、工业设备、移动油压设备、智慧建筑、重型齿轮和施工机械都可以受益于这些检测、测量和评估各种物体表面轮廓的感测器。当位置感测器与分析软体连接时,许多测量任务变得更加容易。因此,无线位置感测器非常适合需要检测位移、距离、长度和位置参数的自动化、测试和监控任务。

- 此外,位置感测器由来自多个供应商的各种组件组装,包括位置磁铁、感测桿、电子机壳、诊断发光二极体(LED) 和连接器。盈利主要取决于原材料和零件的可用性和成本,以及将成品推向市场所需的时间。该行业公司面临的主要挑战是扩大製造能力,生产更高品质的产品,并降低整体製造成本。

墨西哥拥有最大的市场占有率

- 墨西哥的食品、饮料和零售业是全球无线感测器成长最快的产业之一。无需实体连接即可传输资料的感测器可改善整个生产设施的卫生状况,并显着降低生产工具和机械污染的风险。

- 食品和饮料製造商越来越依赖自动化控制来实现更高的一致性和品质。因此,对无线感测器的需求不断增加。由于需要在工厂中保持理想的温度和湿度水平来生产麵包等各种食品,无线感测器的使用在墨西哥正在扩大。

- 零售业对无线感测器的需求不断增长正在推动所研究市场的成长。零售用户正在使用无线感测网路来确保产品的卫生生产、储存和分销。麵包店最近的一项应用是使用无线网路来监控烤箱气体消费量。

- Monnit 是一家知名的低成本远端监控解决方案和无线感测器供应商,它使用无线温度感测器来监控和记录步入式冰箱和冷冻库内的温度,提供符合 FDA 要求的资料,我们还设置了通知来通知工作人员。该公司使用无线感测器来确保食品安全和企业合规性。

- 此外,墨西哥的工业部门与汽车製造厂的增加有关。像英特尔这样专注于自动驾驶汽车领域的公司正在投资全球第六大汽车出口国墨西哥。该公司计划在2024年为自动驾驶乘用车市场做出重大贡献。 TPMS 在大多数地区都是强制性的,因此无线感测器的需求量很大。

拉丁美洲无线感测器产业概况

拉丁美洲的无线感测器市场竞争非常激烈,因为多家供应商向国内和国际市场提供无线感测器。该市场似乎适度分散,拥有较大市场份额的主要参与者专注于扩大其国际基本客群。此外,这些公司不断创新产品,以扩大市场占有率并提高盈利。以下是市场的一些最新发展:

- 2021 年 3 月 - Monnit 宣布推出 ALTA 土壤湿度感测器,以满足农业科技市场的需求。这种创新的土壤湿度感测器可帮助农民、商业种植者和温室管理者轻鬆地将其精准灌溉作业连接到物联网 (IoT)。

- 2021 年 1 月 - Everactive 是一家建立物联网 (IoT) 解决方案的科技公司,筹集了 3,500 万美元资金,用于开发无电池无线感测器。这笔资金将用于加速该公司工业无电池无线感测器的销售、行销和产品开发。此外,Everactive 的端到端监控解决方案也针对大量目前由于数量庞大而未受监控或监控不力的工业资产。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 技术简介

- COVID-19 对市场的影响

第五章市场动态

- 市场驱动因素

- 无线技术的采用增加(特别是在恶劣的环境中)

- 智慧工厂概念的出现(工业自动化)

- 市场挑战

- 与感测器产品相关的高安全需求和成本

- 网路安全问题和物联网领域的最新趋势

第六章 市场细分

- 按类型

- 压力感测器

- 温度感测器

- 化学/气体感测器

- 位置/接近感测器

- 其他类型

- 按最终用户产业

- 车

- 卫生保健

- 航太/国防

- 能源/电力

- 饮食

- 其他最终用户产业

- 按国家/地区

- 墨西哥

- 巴西

- 阿根廷

- 其他拉丁美洲国家

第七章 竞争格局

- 公司简介

- Honeywell International Inc.

- Emerson Electric Co.

- Texas Instruments Incorporated

- Pasco Scientific

- ABB Ltd.

- Monnit Corporation

- Schneider Electric

- Siemens AG

- Phoenix Sensors LLC

第八章投资分析

第九章 市场未来展望

The Latin America Wireless Sensors Market is expected to register a CAGR of 18.5% during the forecast period.

Key Highlights

- Latin America is undergoing a technology boom, owing to the government's emphasis on telecommunications and the Chinese investment in the region, especially in emerging technologies. With the region's economy expected to be driven by Brazil and Argentina, consumer spending is also expected to increase further.

- Automotive and healthcare production substantiates the region's demand for wireless sensors. The region lacks the local production of aerospace and military equipment and other industrial control systems.

- Medical device manufacturing in Latin America is driven by Mexico, which is led by well-known global companies, including Medtronic, Kimberly Clark, GE, Boston Scientific, Johnson and Johnson, Tyco, Siemens, and Cardinal Healthcare Becton Dickinson, among others. Such a concentration of device manufacturers and contract manufacturers also contributes to Latin America's market for wireless sensors.

- Moreover, the growing number of private hospitals and increasing investments in the healthcare sector by foreign players are helping in boosting the Latin American IT healthcare industry. Fluctuating economic condition has driven the demand for low-cost medical equipment, thus creating a massive opportunity for wireless sensor vendors in the region.

- Further, the major challenge for the wireless sensors is the bandwidth since it is a wireless technology, along with the compatibility of the sensor with the previously installed variety of devices.

Latin America Wireless Sensors Market Trends

Position and proximity sensor is Expected to Hold Significant Market Share

- Position sensors can detect an object's movement or calculate its relative position relative to a known reference point. Sensors of this type can also be used to detect the presence or absence of an object. Many sensor types perform comparable functions to position sensors that are worth mentioning. Motion sensors detect an object's movement and can be utilized to initiate an action. Proximity sensors can also identify when an object enters the sensor's range. As a result, both sensors could be classified as specialized position sensors.

- Wireless position sensors are used in automobiles to determine the steering wheel's position, pedals, seats, and other valves, knobs, and actuators. Position sensors are divided into three categories: angular, rotational, and linear. Wiper-arm potentiometers, optical reflection or imaging, and Hall-effect sensors are among the technologies used to sense position in these sensors.

- To meet industry requirements, the manufacturing business necessitates a high level of precision. To make high-quality products, manufacturers concentrate on two key parameters: measurement precision and thorough inspection. A position sensor monitors several essential properties, including profiling, width, height, step, gap, V-gap, edge, angle, bend, groove, and surface.

- HVAC systems, transportation systems, industrial equipment, mobile hydraulics, smart buildings, heavy-duty gear, and construction equipment can all benefit from these sensors, which detect, measure, and assess the profiles on various object surfaces. When the position sensor is connected with the analytics software, many measurement jobs become more accessible. As a result, the wireless position sensor is ideal for automating, testing, or monitoring operations where displacement, distance, length, or position parameters need to be detected.

- Further, position sensors are made/assembled with various components from several vendors, including position magnets, sensing rods, electronics housing fixtures, diagnostic light-emitting diodes (LEDs), and connectors. Profitability is primarily determined by the availability and cost of raw materials and components, as well as the length of time it takes to bring the finished product to market. The main challenge for enterprises in this area is expanding their manufacturing capabilities, producing higher-quality products, and lowering overall production costs.

Mexico Accounts for the Largest Market Share

- The food and beverage and retail industry in Mexico are one of the fastest-growing industries for wireless sensors globally. Sensors capable of transmitting data without any physical connections improve the hygiene of the overall production establishment and minimize the risk of contamination from production tools and machinery significantly.

- Food and beverage manufacturers increasingly depend upon automated controls to achieve higher consistency and quality. This, in turn, has fueled the demand for wireless sensors. The need to maintain plants' ideal temperature and humidity levels to manufacture various food items, such as bread, has led to the broader use of wireless sensors in Mexico.

- The rising demand for wireless sensors by the retail industry is fueling the growth of the market studied. Retail users use a wireless sensor network to ensure hygienic production, storage, and distribution of their products. A recent application in a bakery used a wireless network to monitor gas consumption in ovens.

- Monnit, a prominent low-cost remote monitoring solution and wireless sensors provider makes use of a wireless temperature sensor to monitor and record temperatures inside walk-in refrigerators and freezers, providing data for FDA requirements and notifications set to alert staff of temperature fluctuations, preventing product spoilage. The company helps to ensure food is safe, and companies are in compliance with its wireless sensors.

- Further, the Mexican industrial sector can be associated with the growing number of automotive manufacturing plants. Companies like Intel that focus on the autonomous vehicle space are investing in Mexico, the sixth global car exporter. The company is planning to contribute significantly to autonomous passenger vehicles in the market by the year 2024. As TPMS is mandated across most of the regions, the demand for wireless sensors is significant.

Latin America Wireless Sensors Industry Overview

The Latin American wireless sensor is highly competitive owing to multiple vendors providing wireless sensors to the domestic and international markets. The market appears to be moderately fragmented, and the major players with a prominent share in the market are focusing on expanding their customer base across international countries. Additionally, these companies are continuously innovating their products to increase their market share and increase their profitability. Some of the recent developments in the market are:

- March 2021 - Monnit announced the availability of its ALTA Soil Moisture Sensor to meet the AgriTech market's demands. The innovative Soil Moisture Sensor assists farmers, commercial growers, and greenhouse managers in easily connecting their precision irrigation operations to the Internet of Things (IoT).

- January 2021 - Everactive, a technology company that builds the Internet of Things (IoT) solutions, raised USD 35 million in funding to develop its battery-free wireless sensors. The funds will be used to accelerate sales, marketing, and product development of the company's battery-free wireless sensors for industrial applications. Moreover, Everactive's end-to-end monitoring solutions are aimed at high-volume industrial assets that are currently unmonitored or under-monitored due to the sheer volume.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Technology Snapshot

- 4.5 Impact of COVID-19 on the market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Adoption of Wireless Technologies (Especially in Harsh Environments)

- 5.1.2 Emergence of Smart Factory Concepts (Industrial Automation)

- 5.2 Market Challenges

- 5.2.1 Higher Security Needs and Cost associated with the Sensor Products

- 5.2.2 Concerns pertaining to cybersecurity in the IoT space and recent developments

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Pressure Sensor

- 6.1.2 Temperature Sensor

- 6.1.3 Chemical and Gas Sensor

- 6.1.4 Position and Proximity Sensor

- 6.1.5 Other Types

- 6.2 By End-user Industry

- 6.2.1 Automotive

- 6.2.2 Healthcare

- 6.2.3 Aerospace and Defense

- 6.2.4 Energy and Power

- 6.2.5 Food and Beverage

- 6.2.6 Other End-user Industries

- 6.3 By Country

- 6.3.1 Mexico

- 6.3.2 Brazil

- 6.3.3 Argentina

- 6.3.4 Rest of the Latin America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Honeywell International Inc.

- 7.1.2 Emerson Electric Co.

- 7.1.3 Texas Instruments Incorporated

- 7.1.4 Pasco Scientific

- 7.1.5 ABB Ltd.

- 7.1.6 Monnit Corporation

- 7.1.7 Schneider Electric

- 7.1.8 Siemens AG

- 7.1.9 Phoenix Sensors LLC