|

市场调查报告书

商品编码

1627122

振动感测器 -市场占有率分析、行业趋势/统计、成长预测 (2025-2030)Vibration Sensor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

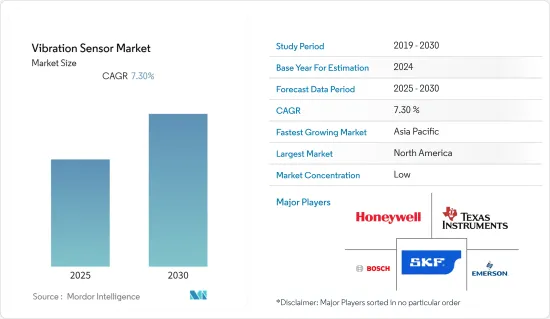

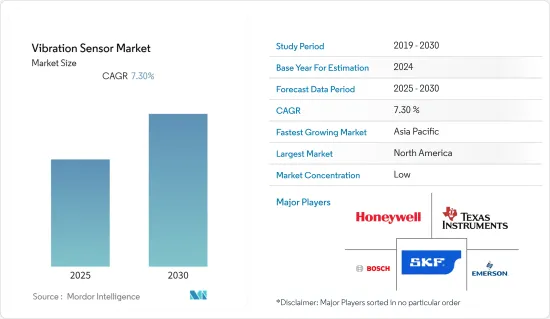

振动感测器市场预计在预测期内复合年增长率为 7.3%

主要亮点

- 在竞争日益激烈的工业市场中,需要新的能力来生产「智慧」工具,而监控各种组件的状况是一项基本需求。因此,预计在预测期内对振动感测器的需求将会增加。

- 随着工业 4.0 的出现,组织开始专注于自动化和预测性维护,以便及早检测机械和设备的磨损。因此,预计在预测期内此类感测器的采用将会增加。

- 2022 年 3 月,Flusso 发布了世界上最小的风速感测器。 FLS122 的占地面积仅 3.5 x 3.5 毫米,比当今最小的竞争设备小 80%。 Fursuso 的 FLS122 感测器专为基板装式风速测量而设计,用于空间受限和要求苛刻的环境中的温度控管和过滤器监控。

- 此外,近年来振动感测器的需求不断增加,与旧设备的兼容性被指出是影响市场的主要问题。

- 此外,2022 年 3 月,高科技精密仪器供应商 Spectris plc 宣布收购 Dytran Instruments,这是一家领先的压电和 MEMS加速计和感测器设计商和製造商。此次 8,200 万美元的收购将使两家公司能够利用互补的能力来改善客户服务并加速产品开发。

- 智慧型手机、穿戴式装置、智慧家用电子电器产品以及使用加速计的植入式或摄取式医疗设备等智慧型装置的日益普及预计将在预测期内推动振动感测器市场的成长。

- 例如,2022年3月,三星推出了新款智慧型手机Galaxy A系列。三星 Galaxy A53 5G 搭载八核心处理器。它拥有6.50吋触控显示屏,更新率为120Hz,解析度为10802400像素,像素密度为407像素/英吋。此外,三星 Galaxy A53 5G 的连接选项包括 Wi-Fi 802.11 a/b/g/n/ac、GPS、蓝牙 v5.10、NFC、USB Type-C、3G、4G 和 5G。它包括加速计、环境光感应器、指南针/地磁感应器、陀螺仪、接近感应器和显示器指纹感应器。

- 振动陀螺仪感测器也广泛应用于汽车电子稳定控制系统、汽车导航系统、手机游戏中的运动感测、数位相机抖动侦测系统、机器人系统、无线电遥控直升机等。近年来,MEMS陀螺仪凭藉着成本低、体积小、重量轻等特点,在智慧型手机的推动下取得了巨大成功。

- 此外,COVID-19 的爆发扰乱了全球供应链和多种产品的需求。此外,中国的停产导致许多行业的各种产品供不应求。然而,市场供应商正在努力为企业提供服务并帮助收益。

振动感测器市场趋势

航太及国防终端用户占比较大

- 提高情境察觉、提高维护成本效益以及推动营运的资产利用是推动飞机健康监测系统需求的一些关键因素。

- 此外,2021 年 3 月,美国国家技术美国(NIST) 的研究人员开发了一种采用机械和雷射原理的新型加速计。该感测器由一对硅晶片组成,可用于太空船、飞机、自动驾驶汽车、平板电脑、智慧型手机等,进一步推动市场成长。

- 亚洲以及英国、欧洲和德国等主要航空市场的客运量和飞机起降架次均出现成长,预计将在预测期内推动市场发展。

- 例如,据波音公司称,到2040年,印度民航服务业的市场规模预计将达到3.7兆美元,从而在未来20年内新增2,200架新民航机的需求。因此,航空业的扩张预计将增加对振动感测器的需求,并在预测期内推动市场发展。

- 涡轮发动机故障是机械故障的主要原因并增加成本。因此,越来越多的用户转向预测健康管理(PGM)系统来防止这些损失并降低维护成本。由于振动是航太发动机行业最常见的健康监测参数,因此 PHM 系统的发展可能会直接影响振动感测器的成长。

亚太地区在欧洲占有很大份额

- 亚太地区拥有最大的航太业。 IBEF 预计,到 2030 年,印度航太与国防 (A&D) 市场规模预计将达到 700 亿美元。

- 先进的振动感测器用于恶劣的应用,例如飞机旋翼轨道和平衡 (RT&B)。它也用于飞机设计和检查,提供直流响应(静态)和交流响应(动态)类型的加速计。

- 印度家用电子电器产品的成长导致越来越多的振动感测器整合到家用电子电器产品中。此外,根据印度品牌资产基金会(IBEF)的数据,印度家用电子电器(ACE)市场的复合年增长率将达到9%,预计到2022年将达到3.15兆印度卢比(约483.7亿美元)。预计这将在预测期内推动振动感测器市场的成长。

- 此外,国内石油需求的增加预计将导致现场精製和探勘场所的增加以满足需求,从而推动石油和天然气行业对振动感测器的需求。

- 製造业已成为该国高速成长的领域之一。印度总理雄心勃勃地推动的「印度製造」计划,旨在将印度定位为主要的製造地,让印度经济获得全球认可,旨在推动製造业的自动化和智慧技术。

- 此外,印度中央政府旗下的印度石油公司宣布计画投资7,000亿卢比,到2030年将精製能力提高25%。因此,其他参与企业(私人)的此类潜在投资将推动该国对振动感测器的需求。

振动感测器产业概况

振动感测器市场是细分的。随着全球感测器製造商进入市场并建立了品牌身份验证,新参与企业将在接触消费者方面面临挑战,并对竞争对手之间的竞争强度产生重大影响。品牌 ID 验证在确定购买行为方面发挥着重要作用。因此,知名度高的公司比同一市场的其他参与企业有显着的优势。主要参与企业包括德州仪器 (TI)、霍尼韦尔 (Honeywell) 和艾默生 (Emerson)。

- 2021 年 10 月 - TE Connectivity 推出三款针对混合动力和电动商务传输市场的新产品。新型 IPT-HD Powervolt 连接器的工作温度范围为 -40 至 +125°C,并可透过低接触电阻设计承受过度的引擎级振动。

- 2021年5月-意法半导体宣布发布下一代MEMS三轴线性加速度感测器AIS2IH。此加速计具有提高远端资讯处理资讯娱乐等汽车应用中的热稳定性、解析度和机械稳健性的潜力。人工智慧 (AI) 和物联网 (IoT) 等先进技术日益融入振动感测器,正在创造新的市场机会。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 产业价值链分析

- 评估 COVID-19 对产业的影响

第五章市场动态

- 市场驱动因素

- 机器状态监测和维护的需求不断增加

- 扩大智慧製造和工业IoT的采用

- 市场问题

- 需求波动

第六章 市场细分

- 副产品

- 加速计

- 速度感测器

- 非接触式位移计

- 其他的

- 按最终用户产业

- 车

- 医疗保健

- 航太/国防

- 消费性电子产品

- 石油和天然气

- 其他的

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 其他亚太地区

- 拉丁美洲

- 巴西

- 阿根廷

- 墨西哥

- 其他拉丁美洲

- 中东/非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 南非

- 其他中东/非洲

- 北美洲

第七章 竞争格局

- 公司简介

- SKF GmbH

- Bosch Sensortec GmbH(Robert Bosch GmbH)

- Honeywell International Inc.

- Emerson Electric Corporation

- Texas Instruments Incorporated

- National Instruments Corporation

- Rockwell Automation Inc.

- NXP Semiconductors NV

- TE Connectivity Ltd

- Hansford Sensors Ltd

- Analog Devices Inc.

第八章投资分析

第9章市场的未来

The Vibration Sensor Market is expected to register a CAGR of 7.3% during the forecast period.

Key Highlights

- In an increasingly competitive industrial market, where new features are required to produce ''smarter'' tools, monitoring the condition of various components has become a fundamental need. This is expected to boost the demand for vibration sensors over the forecast period.

- With the advent of industry 4.0, organizations have started being more bent on automation and predictive maintenance that allows them to prematurely detect the wear and tear in the machines and equipment. This is expected to boost the adoption of such sensors over the forecast period.

- In March 2022, Flusso announced the world's smallest air velocity sensor. The FLS122 has a footprint of only 3.5 by 3.5 mm, making it 80% smaller than today's smallest competitive device. Flusso's FLS122 sensor was designed specifically for board-mounted air velocity measurements for thermal management and filter monitoring in some of the most space-constrained and challenging environments.

- In addition, the demand for vibration sensors has been rising for the last few years, and compatibility concerns, especially with old equipment, have been identified as major challenges affecting the market.

- Furthermore, in March 2022, Spectris plc, a supplier of high-tech precision instruments, announced the acquisition of Dytran Instruments, a leading designer and manufacturer of piezo-electric and MEMS-based accelerometers and sensors. The USD 82 million deal will enable both companies to leverage complementary capabilities to improve customer offerings and accelerate product development.

- The increasing adoption of smart devices, such as smartphones, wearables, smart appliances, and implantable or ingestible medical devices, among others that use accelerometers, is expected to drive the growth of the vibration sensors market over the forecast period.

- For instance, in March 2022, Samsung launched the new Galaxy A-series Smartphone. An octa-core processor powers Samsung Galaxy A53 5G. It has a 120 Hz refresh rate and 6.50-inch touchscreen display, offering a resolution of 10802400 pixels at a pixel density of 407 pixels per inch. In Addition, Connectivity options on the Samsung Galaxy A53 5G include Wi-Fi 802.11 a/b/g/n/ac, GPS, Bluetooth v5.10, NFC, USB Type-C, 3G, 4G, and 5G. Sensors on the phone include an accelerometer, ambient light sensor, compass/ magnetometer, gyroscope, proximity sensor, and in-display fingerprint sensor.

- Vibration gyroscope sensors are also widely adopted for electronic stability control systems of vehicles, car navigation systems, motion-sensing for mobile games, camera-shake detection systems in digital cameras, robotic systems, radio-controlled helicopters, etc. In the last few years, smartphones have witnessed MEMS gyroscopes' great success, owing to their low-cost, miniature size, and lightweight.

- Furthermore, owing to the COVID-19 outbreak, the global supply chain and demand for multiple products have experienced disruption. Moreover, due to the production shutdown in China, numerous industries have observed a supply shortage of various products. However, market vendors are trying to provide services to enterprises, which is helping them get revenues.

Vibration Sensor Market Trends

Aerospace & Defense End User to Hold Significant Share

- Increased situational awareness to drive operations, cost-effective maintenance, and asset utilization are some of the key factors driving the demand for aircraft health monitoring systems.

- Moreover, in March 2021, the National Institute of Technology (NIST) researchers developed a new type of accelerometer based on opting mechanical and lasers principles. This sensor consists of a pair of silicon chips and could find use in spacecraft and aircraft, self-driving cars, tablets, and smartphones, which will further drive the market growth.

- The passenger traffic in Asia and other major aviation markets, such as the United Kingdom, Europe, and Germany, has witnessed growth in terms of the number of passengers and aircraft movements, which is expected to drive the market during the forecast period.

- For instance, according to Boeing, the market size of India's commercial aviation services industry is expected to witness 3.7 trillion U.S. dollars by 2040, creating demand for an additional 2,200 new commercial aircraft in the next 20 years. As a result, the expanding airline industry is expected to increase the demand for vibration sensors, driving the market during the forecast period.

- Turbine engine failures are the primary cause of mechanical failures, increasing costs; hence, users are increasingly turning to prognostic health management (PHM) systems to prevent these losses and reduce maintenance costs. As vibration is the most common health monitoring parameter in the aerospace engine industry, the development of PHM systems is likely to directly impact the growth of vibration sensors.

Asia Pacific to Hold Significant Share in Europe Region

- The Asia Pacific is home to the largest aerospace industry. According to IBEF, The Indian aerospace & defense (A&D) market is projected to reach USD 70 billion by 2030.

- Advanced vibration sensors are used for harsh applications, like aircraft rotor track and balance (RT&B). They also serve applications in aircraft design and testing, offering DC-response (static) and AC-response (dynamic) types of accelerometers.

- The growth of consumer electronics in the country has led to a rise in vibration sensors being integrated into appliances. Furthermore, according to the India Brand Equity Foundation (IBEF), the Indian appliances and consumer electronics (ACE) market is expected to register a 9% CAGR to reach INR 3.15 trillion (USD 48.37 billion) in 2022. This is expected to boost the vibration sensors market growth over the forecast period.

- In addition, the increase in demand for oil in the country is expected to lead to a rise in local refineries and exploration sites to fulfill the need, thus driving the demand for vibration sensors in the oil and gas industry.

- Manufacturing has emerged as one of the sectors showing high growth in the country. The country's Prime Minister's ambitious 'Make in India' program, meant to position India as a leading manufacturing hub and give global recognition to the Indian economy, is expected to drive the adoption of automation and smart technologies in the manufacturing sector.

- Furthermore, The Indian Oil Corporation, owned by the Central Government of India, announced its plans to invest INR 70,000 crore to further increase its oil refining capacity by 25% by 2030, as it takes the lead in meeting the rising energy needs of the country. Thus, such potential investments by other players (private) are poised to drive the vibration sensors demand in the country.

Vibration Sensor Industry Overview

The vibration sensor market is fragmented. The presence of global sensor manufacturers with established brand identities in the market is expected to profoundly influence the intensity of competitive rivalry as new entrants face challenges in reaching out to consumers. Brand identity plays a strong role in determining buyer behavior. Therefore, well-known companies have a considerable advantage over other players in the market. Some of the key players are Texas Instruments, Honeywell, and Emerson.

- October 2021 - TE Connectivity has launched three new products for the hybrid and electric commercial transportation market. The new IPT-HD power bolt connector performs in temperatures ranging from -40 to +125 degrees Celsius, and its low-contact-resistance design can withstand excessively high engine-level vibrations.

- May 2021 - STMicroelectronics has announced the release of the AIS2IH, a next-generation MEMS three-axis linear accelerometer. This accelerometer has the potential to improve temperature stability, resolution, and mechanical robustness in automotive applications such as telematics infotainment. The increasing integration of advanced technologies such as Artificial Intelligence (AI) and the Internet of Things (IoT) in vibration sensors opens up new market opportunities.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porters Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Need for Machine Condition Monitoring and Maintenance

- 5.1.2 Growing Adoption of Smart Manufacturing and Industrial IoT

- 5.2 Market Challenges

- 5.2.1 Volatility in Demand

6 MARKET SEGMENTATION

- 6.1 By Product

- 6.1.1 Accelerometers

- 6.1.2 Velocity Sensors

- 6.1.3 Non-contact Displacement Transducers

- 6.1.4 Other Products

- 6.2 End User Industry

- 6.2.1 Automotive

- 6.2.2 Healthcare

- 6.2.3 Aerospace and Defence

- 6.2.4 Consumer Electronics

- 6.2.5 Oil and Gas

- 6.2.6 Other End User Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 Germany

- 6.3.2.2 United Kingdom

- 6.3.2.3 France

- 6.3.2.4 Rest of Europe

- 6.3.3 Asia Pacific

- 6.3.3.1 China

- 6.3.3.2 India

- 6.3.3.3 Japan

- 6.3.3.4 Rest of the Asia Pacific

- 6.3.4 Latin America

- 6.3.4.1 Brazil

- 6.3.4.2 Argentina

- 6.3.4.3 Mexico

- 6.3.4.4 Rest of the Latin America

- 6.3.5 Middle East & Africa

- 6.3.5.1 United Arab Emirates

- 6.3.5.2 Saudi Arabia

- 6.3.5.3 South Africa

- 6.3.5.4 Rest of the Middle East & Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 SKF GmbH

- 7.1.2 Bosch Sensortec GmbH (Robert Bosch GmbH)

- 7.1.3 Honeywell International Inc.

- 7.1.4 Emerson Electric Corporation

- 7.1.5 Texas Instruments Incorporated

- 7.1.6 National Instruments Corporation

- 7.1.7 Rockwell Automation Inc.

- 7.1.8 NXP Semiconductors NV

- 7.1.9 TE Connectivity Ltd

- 7.1.10 Hansford Sensors Ltd

- 7.1.11 Analog Devices Inc.