|

市场调查报告书

商品编码

1626318

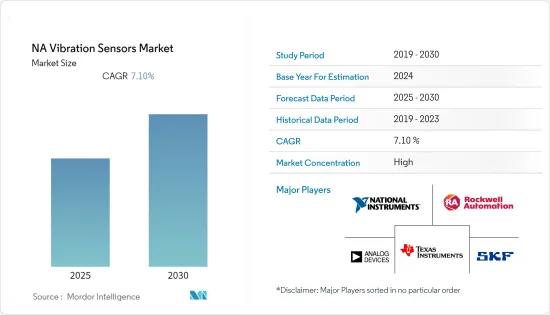

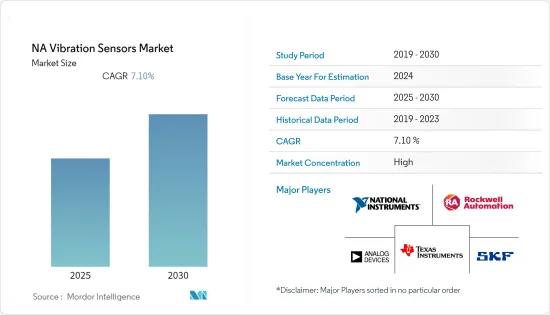

北美振动感测器:市场占有率分析、行业趋势、统计和成长预测(2025-2030)NA Vibration Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

北美振动感测器市场预计在预测期内复合年增长率为 7.1%

主要亮点

- 北美製造业竞争激烈。对先进製造机器人技术的需求正在推动该地区的市场成长。

- 汽车产业是推动市场成长的另一个产业。该地区汽车产量大幅成长,达到1,500万辆以上,仍是仅次于中国的世界第二大汽车生产国。

- 由于页岩气的发现不断增加以及老化基础设施的更新,振动感测器的需求量很大,促进了该地区整体市场的扩张。

- Covdid-19对该行业产生了负面影响,由于该地区原油和汽车需求下降,一些生产设施暂时停止或关闭。这减少了对振动感测器的需求。

北美振动感测器市场趋势

家用电子产品显着成长

- 对智慧电子产品的偏好增加、中阶的壮大、消费者可支配收入的增加、生活方式偏好的改变等是推动消费性电子产品需求的主要因素,其中振动感测器的成长对成长产生间接影响。

- 这些感测器用于家用电器中检测振动,以实现降噪和维护目的。振动和衝击感测器用于在笔记型电脑掉落时保护 HDD 上的资料。

- 此感测器用于检测姿势变化、萤幕旋转以及检测三个方向的移动。振动感测器越来越多地应用于家用电器中,因为它们用于校准位置、运动和加速度,并且可以了解行动电话方向和萤幕旋转、影像以及各种功能的变化以供用户使用。

- 例如,2021 年 6 月,Fluke Corporation 旗下公司 Fluke Reliability 发布了其最新产品 Fluke 3563 分析振动感测器系统。振动监控可协助维护团队减少非计划性停机并防止灾难性故障的发生。

美国占最高市场占有率

- 美国的国防应用预算拨款全球最高,据通报 2020 年支出超过 5,970 亿美元。

- F-35战斗机、俄亥俄级潜舰、KC-46空中加油机和拉斐尔战斗机等美国主要军事项目显示了美国对国防的重视。

- 新的研发倡议正在改变汽车产业,以更好地应对 21 世纪的机会。据 AutoAlliance 称,美国汽车业在研发上的支出超过 180 亿美元。

- 例如,2021年9月,Reality AI与Fujitsu Components Ltd.合作,将Fujitsu Components的非接触式振动感测器引入製造和工业应用。 RealityCheck ADTM(使用富士通组件基于多普勒雷达感测器的非接触式振动感测器进行工业异常检测的现实人工智慧)将于 9 月 21 日至 23 日在加州圣荷西举行的感测器融合博览会上进行现场演示。

北美振动感测器产业概况

北美振动感测器市场竞争激烈,由多家大公司组成。从市场占有率来看,目前该市场由几家大型企业占据主导地位。然而,凭藉创新和永续的包装,许多公司正在透过赢得新契约和开拓新市场来扩大其市场份额。

- 2021 年 11 月 - IMI 感测器专家推出了名为「水力发电厂振动监测解决方案」的免费网路直播。 IMI Sensors 为客户提供多种选项来正确监控水力发电机。这些选项还包括成本非常低的解决方案,几乎可以适应任何预算。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 评估 COVID-19 对产业的影响

- 市场驱动因素

- 机器状态监测和维护的需求不断增加

- 振动感测器寿命长,自发电功能,频率范围宽

- 市场限制因素

- 与旧机器的兼容性

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 副产品

- 加速计

- 速度感测器

- 非接触式位移计

- 其他的

- 按最终用户产业

- 车

- 卫生保健

- 航太/国防

- 家用电子产品

- 石油和天然气

- 其他的

- 按国家/地区

- 美国

- 加拿大

第六章 竞争状况

- 公司简介

- Rockwell Automation Inc.

- SKF AB

- National Instruments Corporation

- Texas Instruments Incorporated

- Analog Devices Inc.

- Emerson Electric Corp.

- Honeywell International Inc.

- NXP Semiconductors NV

- TE Connectivity Ltd

- Hansford Sensors Ltd

- Bosch Sensortec GmbH(Robert Bosch GmbH)

第七章 投资分析

第八章市场的未来

简介目录

Product Code: 47422

The NA Vibration Sensors Market is expected to register a CAGR of 7.1% during the forecast period.

Key Highlights

- North America has a competitive manufacturing sector. The demand for advanced manufacturing robotic technologies is likely to help the growth of the market in the region.

- The automobile industry is another sector aiding the growth of the market. The vehicle production in the region increased significantly to more than 15 million passenger vehicles, and the country remained the second-largest global vehicle producer after China.

- Due to the increasing shale gas discoveries and replacement of aging infrastructure, the demand for vibrating sensors is high, which thereby helps in increasing the overall market in the region.

- The covdid-19 had an adverse impact on the industry as several production facilities were discontinued or stopped momentarily due to a dip in demand for Crude Oil and automobile in the region. This, in turn, decreased the demand for vibration sensors in the market.

North America Vibration Sensors Market Trends

Consumer Electronics to Show Significant Growth

- The rise in preference toward using smart electronic devices, growing middle-class, rising disposable income of consumers, and changing lifestyle preferences are some of the major factors driving the demand for consumer electronics, which has an indirect impact on the growth of vibration sensors.

- These sensors are used in consumer electronics for vibration detection to reduce noise and maintenance. When a PC Notebook falls, vibration and shock sensors are used to protect the data of HDDs.

- The sensors are used to detect changes in orientation and screen rotation and detect motion in three directions. The application of vibration sensors in consumer electronics is increasing as the sensors are used to calibrate the position, motion, and acceleration, with which the orientation of the phone and the changes in the screen rotation, images, and various features can be known for user purposes.

- For instance, in June 2021, Fluke Reliability, an operating company of Fluke Corporation, is proud to announce its newest product, the Fluke 3563 Analysis Vibration Sensor system. Vibration monitoring helps maintenance teams reduce unplanned downtime and prevent potentially catastrophic failures from occurring, but it has been difficult or cost-prohibitive to monitor every tier of an asset.

United States to Hold the Highest Market Share

- The United States has allocated the highest budget for defense applications globally, with reported spending of more than USD 597 billion in 2020, which is roughly more than one-third of the overall global military expenditure.

- Key military programs in the United States, including F-35 Fighter Jet, Ohio Class Submarine, KC-46 AAerial Refueling Tanker, Rafael Fighter Programs, etc., elucidate the country's focus on the defense sector.

- New R&D initiatives are transforming the automobile industry to better respond to the opportunities of the 21st century. According to the Auto Alliance, the expenditure on R&D in the US automobile industry is more than USD 18 billion.

- For instance, in September 2021, Reality AI partnered with Fujitsu Component Limited to bring Fujitsu Component's contactless vibration sensor to manufacturing and industrial applications. Reality AI's RealityCheck ADTM for industrial anomaly detection with the Fujitsu Component's contactless vibration sensor based on Doppler Radar Sensor was demonstrated live at the Sensors Converge Expo in San Jose, CA, from September 21 to 23.

North America Vibration Sensors Industry Overview

The North America Vibration sensor market is highly competitive and consists of several major players. In terms of market share, few of the major players currently dominate the market. However, with innovative and sustainable packaging, many of the companies are increasing their market presence by securing new contracts and by tapping new markets.

- November 2021 - IMI Sensors experts will present a free webcast called Vibration Monitoring Solutions for Hydropower Plants. IMI Sensors provides customers with several different options for properly monitoring a hydro machine. These options include some very low-cost solutions that can fall within almost any budget.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Assessment of Impact of COVID-19 on the Industry

- 4.3 Market Drivers

- 4.3.1 Increasing need for machine condition monitoring and maintenance

- 4.3.2 Longer service life, self-generating capability, and wide range of frequency of vibration sensors

- 4.4 Market Restraints

- 4.4.1 Compatibility with old machinery

- 4.5 Industry Value Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Force Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Product

- 5.1.1 Accelerometer

- 5.1.2 Velocity Sensor

- 5.1.3 Non-Contact Displacement Transducer

- 5.1.4 Others

- 5.2 By End-User Industry

- 5.2.1 Automotive

- 5.2.2 Healthcare

- 5.2.3 Aerospace and Defense

- 5.2.4 Consumer Electronics

- 5.2.5 Oil & Gas

- 5.2.6 Others

- 5.3 By Country

- 5.3.1 United States

- 5.3.2 Canada

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Rockwell Automation Inc.

- 6.1.2 SKF AB

- 6.1.3 National Instruments Corporation

- 6.1.4 Texas Instruments Incorporated

- 6.1.5 Analog Devices Inc.

- 6.1.6 Emerson Electric Corp.

- 6.1.7 Honeywell International Inc.

- 6.1.8 NXP Semiconductors NV

- 6.1.9 TE Connectivity Ltd

- 6.1.10 Hansford Sensors Ltd

- 6.1.11 Bosch Sensortec GmbH (Robert Bosch GmbH)

7 INVESTMENT ANALYSIS

8 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219