|

市场调查报告书

商品编码

1851334

振动感测器:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Vibration Sensor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

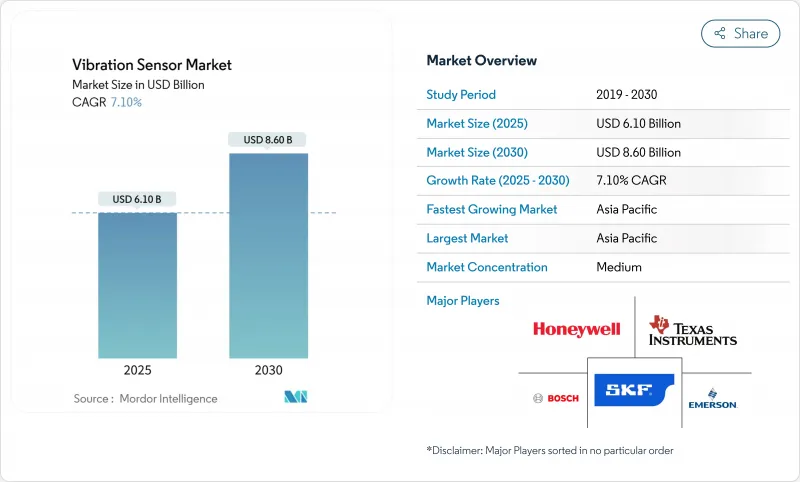

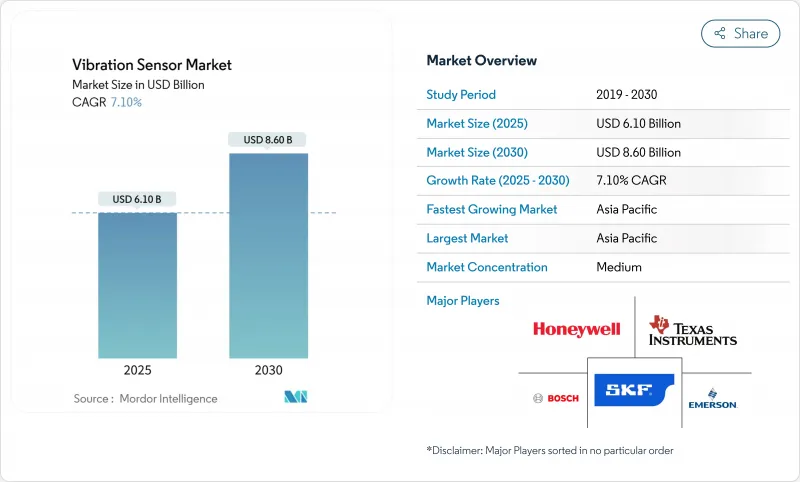

预计到 2025 年,振动感测器市场规模将达到 61 亿美元,到 2030 年将达到 86 亿美元,在此期间的复合年增长率为 7.10%。

对预测性维护项目的持续投入、MEMS设计的微型化以及更严格的机器健康法规正在加速工厂、风电场和汽车製造厂对MEMS技术的应用。亚太地区的製造商、风力发电机所有者和汽车组装投入了大部分资金,这得益于感测器价格的下降和该地区半导体製造能力的扩张。无线连接降低了安装成本,边缘AI韧体减少了数据流量,使得感测器能够在偏远和危险环境中使用。同时,中国将于2025年对用于陶瓷感测元件的稀土元素实施出口限制,使得供应链多元化变得迫切。

全球振动感测器市场趋势与洞察

预测性维护计划在连续製程工业的普及

亚太地区的工厂营运商利用预测性维护技术,将计划外停机成本降低了高达 50%。该技术依赖密集的感测器网络,将高频数据传输到分析引擎。早期计划,例如 Nordic Sugar 公司蒸气干燥机的维修,展示了 13 天的故障预测窗口,检验了该技术对大型化学和钢铁厂的投资回报。持续监测取代了定期检查,嵌入节点的边缘运算晶片将延迟降低到毫秒级。中国对工业 4.0 升级的奖励策略保持了这一势头,每个工厂都整合了数千个设备。因此,振动感测器市场获得了由维护预算而非资本支出週期驱动的长期重复性需求。

无线MEMS感测器在危险油气田的兴起

海上平台和炼油厂采用了经认证的无线节点,无需在ATEX区域铺设昂贵的电缆。压电能量采集器的电池寿命超过三年,进一步延长了维护週期。营运商评估了在不中断生产的情况下改装的能力,而中断生产每小时的成本可能高达5万美元。每个感测器内建的FFT处理功能可产生可操作的轴承磨损指标,从而减少了对现场振动分析师的需求。这些优势扩大了目标客户群,并重振了碳氢化合物经济体的振动感测器市场,这些经济体在数位化维护方面历来进展缓慢。

极端温度下压电感测器的校准漂移

压电元件在 110 度C以上会出现输出偏差,在中加热速率下误差可达 1.06%。在热循环频繁的涡轮发动机和航太发动机中,频繁的重新校准增加了生命週期成本。高温单晶压电元件虽然能在 600 °C 以上可靠运行,但价格昂贵。开发人员探索了补偿电路和双感测器配置,但复杂的设计限制了其在大众市场的吸引力。由此产生的性能-价格权衡阻碍了它们在振动感测器市场高要求细分领域的扩张。

细分市场分析

加速计的营收累计在2024年成长54.4%,其三轴感测器在汽车、智慧型手机和工厂马达等领域的广泛应用将推动价值61亿美元的振动感测器市场成长。无线速度感测器虽然价值较小,但到2030年将以9.1%的复合年增长率增长,因为炼油厂和管道工程师越来越意识到速度与轴承健康状况之间的直接关联。

小型化趋势推动了新一代加速计的发展,例如博世Sensortec公司的BMA580,它在满足穿戴式装置灵敏度要求的同时,将封装体积缩小了76%。这些晶片的边缘滤波功能仅传输异常值,从而节省网状网路的频宽。能源采集的同步进步延长了节点寿命,使远端设备的维护週期缩短至五年。这些改进将振动感测器市场拓展至穿戴式装置和基于状态的润滑系统等领域,这些领域先前一直受到功率和尺寸的限制。

由于压电元件具有低频灵敏度,预计到2024年其市占率将维持在46.3%;而随着半导体晶圆厂实现晶圆级经济效益,MEMS元件的出货量将以10.3%的复合年增长率成长。振动感测器市场受益于单晶粒整合技术,该技术将分立式模拟前端整合到紧凑的系统晶片封装中。

德克萨斯(TI) 的超音波镜头清洁演示突显了 MEMS 技术的多功能性,该技术利用可编程振动来清除汽车摄影机上的污垢。铸造技术的进步使得测量亚 G 级振动的多轴阵列成为可能,适用于结构健康监测;而压阻式和电容式设计则实现了具有低占空比的超低功耗穿戴式装置。这种多元化的产品组合使 OEM 厂商能够根据频宽、成本和功耗选择合适的架构,从而提高了振动感测器在市场上的普及率。

振动感测器市场按产品类型(加速计、速度感测器、位移感测器、其他)、技术(压电、压阻式、电容式、应变计、MEMS)、材料(石英、压电陶瓷、掺杂硅、其他)、终端用户产业(汽车、航太与国防、其他)和地区(北美、欧洲、亚太、南美、中东和非洲)进行细分。

区域分析

亚太地区将在2024年以34.2%的市场份额占据榜首,这主要得益于中国风力发电机部署和印度半导体设计中心的发展推动了区域需求。该地区将维持领先地位至2030年,年复合成长率将达到8.3%,超过全球平均。日本精密机械製造商正在订购用于机器人的高解析度感测器,这将进一步扩大该地区的振动感测器市场。

北美地区的需求主要源自于化工企业和航太专案对抗辐射设备的ISO合规性要求。美国国防部倾向空气间隙边缘处理单元,以降低网路安全风险。加拿大矿业公司在偏远矿区安装了强大的无线网状网络,这些矿区由于有线连接不切实际,从而为振动感测器市场开闢了新的领域。

欧洲展现出高度成熟的技术水平,例如宝马公司配备感测器的机器狗在引擎工厂巡逻。斯堪的纳维亚的近海离岸风力发电电场为15兆瓦的风力涡轮机配备了高通道数系统,用于监测偏航和叶片谐波。严格的职业安全指令确保了技术的稳定升级,儘管面临宏观经济逆风,振动感测器市场仍然保持韧性。

儘管南美洲和中东/非洲是新兴经济体,但其市场仍保持活力。巴西的矿业公司和农产品加工商开始采用状态监控套件,这得益于微机电系统(MEMS)成本的下降。沿岸地区的国家石油公司(NOC)在其火炬塔和压缩机上采用了经ATEX认证的无线感测器,迅速扩大了危险区域振动感测器的市场。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 商业流程工业中预测性维护计画的普及程度(亚太地区)

- 无线MEMS感测器在危险油气场所(中东)的兴起

- 边缘人工智慧在汽车组装中的诊断(欧洲)

- 欧盟和北美强制要求遵守 ISO 20816 标准

- 扩大风力发电机安装规模(北欧和中国)

- 穿戴式装置和可听设备推动了对小型化的需求。

- 市场限制

- 极端温度下压电感测器的校准漂移

- 基于云端基础的分析的资料安全问题(国防)

- 特种压电陶瓷材料短缺(中国出口配额)

- 价值链分析

- 技术展望

- 波特五力分析

- 新进入者的威胁

- 供应商的议价能力

- 买方的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- 投资分析

- 评估市场的宏观经济因素

第五章 市场规模与成长预测

- 依产品类型

- 加速计

- 速度感测器

- 位移感测器

- 陀螺仪(振动级)

- 透过技术

- 压电

- 压阻器

- 电容式

- 应变计

- MEMS

- 材料

- 石英

- 压电陶瓷

- 掺杂硅

- 其他的

- 按最终用途行业划分

- 车

- 航太/国防

- 石油和天然气

- 工业生产

- 发电(包括风力发电)

- 卫生保健

- 消费性电子产品和穿戴式装置

- 其他的

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他欧洲地区

- 亚太地区

- 中国

- 台湾

- 日本

- 韩国

- 印度

- ASEAN

- 亚太其他地区

- 南美洲

- 墨西哥

- 巴西

- 阿根廷

- 其他南美洲

- 中东和非洲

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 其他非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略性倡议(併购、伙伴关係、资金筹措)

- 市占率分析

- 公司简介

- Emerson Electric Co.

- SKF AB

- Honeywell International Inc.

- Analog Devices Inc.

- TE Connectivity Ltd

- Bosch Sensortec GmbH

- Texas Instruments Inc.

- National Instruments Corp.

- Rockwell Automation Inc.

- NXP Semiconductors NV

- Parker Hannifin Corp.

- Baker Hughes(Bently Nevada)

- Wilcoxon Sensing Technologies

- PCB Piezotronics Inc.

- Meggitt PLC(Sensing Systems)

- IMI Sensors

- ifm electronic GmbH

- Siemens AG

- Omron Corporation

- Hansford Sensors Ltd

第七章 市场机会与未来展望

The vibration sensor market size is valued at USD 6.10 billion in 2025 and is forecast to reach USD 8.60 billion by 2030, reflecting a 7.10% CAGR during the period.

Continued investment in predictive maintenance programs, miniaturized MEMS designs, and stricter machinery-health regulations accelerated adoption across factories, wind farms, and vehicle plants. Asia-Pacific manufacturers, wind turbine owners, and automotive assemblers directed much of this spending, aided by falling sensor prices and local semiconductor capacity expansions. Wireless connectivity reduced installation costs, and edge-AI firmware cut data traffic, making sensors viable for remote or hazardous sites. Meanwhile, supply-chain diversification gained urgency after China's 2025 export controls on rare-earth inputs used in ceramic sensing elements.

Global Vibration Sensor Market Trends and Insights

Proliferation of Predictive Maintenance Programs in Continuous Process Industries

Asia-Pacific plant operators used predictive maintenance to reduce unplanned downtime costs by up to 50%, relying on dense sensor grids that stream high-frequency data to analytics engines. Early projects such as the Nordic Sugar steam-dryer retrofit demonstrated 13-day fault-prediction windows, validating payback for large chemical and steel sites. Continuous monitoring displaced periodic walk-by inspections, and edge-computing chips embedded in nodes lowered latency to millisecond levels. Chinese stimulus for Industry 4.0 upgrades-maintained momentum, embedding thousands of devices per facility. Consequently, the vibration sensor market gained long-run recurring demand from maintenance budgets rather than capital expenditure cycles.

Rise of Wireless MEMS Sensors for Hazardous Oil and Gas Sites

Offshore platforms and refineries adopted certified wireless nodes that eliminated costly cable runs through ATEX zones. Battery lives exceeded three years, and piezoelectric energy harvesters further prolonged service intervals. Operators valued retrofit capability without shutting down throughput that could otherwise cost USD 50,000 per hour. Embedded FFT processing in each sensor produced actionable bearing-wear metrics, reducing the need for on-site vibration analysts. These benefits widened the addressable base and lifted the vibration sensor market in hydrocarbon economies that historically lagged digital-maintenance adoption.

Calibration Drift of Piezoelectric Sensors at Extreme Temperatures

Piezoelectric elements experienced output deviations above 110 °C, with errors hitting 1.06% at moderate heating rates. Frequent recalibration raised lifecycle costs in turbines and aerospace engines where thermal cycling was routine. High-temperature single-crystal alternatives operated reliably beyond 600 °C but commanded premium pricing. Developers explored compensation circuits and dual-sensor configurations, yet complex designs limited mass-market appeal. The resulting performance-price trade-off slowed deployments in harsh-duty niches of the vibration sensor market.

Other drivers and restraints analyzed in the detailed report include:

- Edge-AI Enabled Diagnostics in Automotive Assembly

- Mandatory ISO 20816 Compliance in EU and North America

- Data-Security Concerns in Cloud-based Analytics (Defense)

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Accelerometers generated 54.4% revenue in 2024, underpinning the vibration sensor market size of USD 6.10 billion through their tri-axial versatility in vehicles, smartphones, and factory motors. Wireless velocity devices, though smaller in value, led growth at 9.1% CAGR to 2030 as refinery and pipeline engineers valued velocity's direct correlation with bearing health.

The miniaturization push spurred next-generation accelerometers such as Bosch Sensortec's BMA580, which reduced package volume by 76% while meeting sensitivity targets for hearables. Edge filtering in these chips cuts outbound data by transmitting only anomalies, conserving bandwidth in mesh networks. Parallel advances in energy harvesting prolonged node life, enabling five-year maintenance intervals on remote assets. Together, these enhancements allowed the vibration sensor market to broaden into wearables and condition-based lubrication systems previously constrained by power or size limits.

Piezoelectric elements retained a 46.3% share in 2024 thanks to low-frequency sensitivity, but MEMS shipments expanded at a 10.3% CAGR as semiconductor fabs delivered wafer-level economies. The vibration sensor market benefited from single-die integration that collapsed discrete analog front-ends into compact system-on-chip packages.

Texas Instruments' ultrasonic lens-cleaning demo highlighted MEMS versatility, using programmable vibrations to remove contaminants from automotive cameras. Foundry advances enabled multi-axis arrays measuring sub-g vibrations suitable for structural-health monitoring. Meanwhile, piezoresistive and capacitive designs served ultra-low-power wearables where duty cycles were sparse. This diversified portfolio allowed OEMs to choose architectures based on bandwidth, cost, and power, expanding overall penetration of the vibration sensor market.

Vibration Sensor Market is Segmented by Product Type (Accelerometers, Velocity Sensors, Displacement Sensors, and More), Technology (Piezoelectric, Piezoresistive, Capacitive, Strain-Gauge, and MEMS), Material (Quartz, Piezoelectric Ceramics, Doped Silicon, and Others), End-Use Industry (Automotive, Aerospace and Defense, and More), and Geography (North America, Europe, Asia-Pacific, South America, and Middle East and Africa).

Geography Analysis

Asia-Pacific led with a 34.2% share in 2024 as China's wind-turbine roll-outs and India's semiconductor design centers lifted local demand. The region's 8.3% CAGR also out-paced global averages, preserving its leadership through 2030. Japanese precision-machinery firms ordered high-resolution sensors for robotics, further enlarging the vibration sensor market in the bloc.

North America followed, driven by ISO compliance in chemical plants and aerospace programs requiring radiation-tolerant devices. US defense retrofits favored edge-processed units that remained air-gapped, mitigating cybersecurity exposure. Canadian miners installed ruggedized wireless mesh networks across remote pits where wired runs were impractical, adding niche demand to the vibration sensor market.

Europe exhibited advanced maturity, exemplified by BMW's sensor-equipped robo-dogs patrolling engine plants. Nordic offshore wind farms fitted high-channel-count systems on 15 MW turbines to monitor yaw and blade harmonics. Strict worker-safety directives assured steady upgrades, keeping the vibration sensor market resilient despite macroeconomic headwinds.

South America and the Middle East/Africa remained emerging but dynamic. Brazilian miners and agribusiness processors began installing condition-monitoring kits, aided by falling MEMS costs. Gulf-region NOCs embraced ATEX-rated wireless sensors for flare stacks and compressors, quickly expanding the vibration sensor market footprint in hazardous-area deployments.

- Emerson Electric Co.

- SKF AB

- Honeywell International Inc.

- Analog Devices Inc.

- TE Connectivity Ltd

- Bosch Sensortec GmbH

- Texas Instruments Inc.

- National Instruments Corp.

- Rockwell Automation Inc.

- NXP Semiconductors N.V.

- Parker Hannifin Corp.

- Baker Hughes (Bently Nevada)

- Wilcoxon Sensing Technologies

- PCB Piezotronics Inc.

- Meggitt PLC (Sensing Systems)

- IMI Sensors

- ifm electronic GmbH

- Siemens AG

- Omron Corporation

- Hansford Sensors Ltd

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Proliferation of Predictive Maintenance Programs in Continuous Process Industries (Asia Pacific)

- 4.2.2 Rise of Wireless MEMS Sensors for Hazardous Oil and Gas Sites (Middle East)

- 4.2.3 Edge-AI Enabled Diagnostics in Automotive Assembly (Europe)

- 4.2.4 Mandatory ISO 20816 Compliance in EU and North America

- 4.2.5 Expansion of Wind Turbine Installations (Nordics and China)

- 4.2.6 Miniaturization Demand from Wearables and Hearables

- 4.3 Market Restraints

- 4.3.1 Calibration Drift of Piezoelectric Sensors at Extreme Temperatures

- 4.3.2 Data-Security Concerns in Cloud-based Analytics (Defense)

- 4.3.3 Shortage of Specialty Piezo-ceramic Materials (China Export Quotas)

- 4.4 Value Chain Analysis

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Suppliers

- 4.6.3 Bargaining Power of Buyers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Investment Analysis

- 4.8 Assessment of Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Accelerometers

- 5.1.2 Velocity Sensors

- 5.1.3 Displacement Sensors

- 5.1.4 Gyroscopes (Vibration-Grade)

- 5.2 By Technology

- 5.2.1 Piezoelectric

- 5.2.2 Piezoresistive

- 5.2.3 Capacitive

- 5.2.4 Strain-Gauge

- 5.2.5 MEMS

- 5.3 By Material

- 5.3.1 Quartz

- 5.3.2 Piezoelectric Ceramics

- 5.3.3 Doped Silicon

- 5.3.4 Others

- 5.4 By End-Use Industry

- 5.4.1 Automotive

- 5.4.2 Aerospace and Defense

- 5.4.3 Oil and Gas

- 5.4.4 Industrial Manufacturing

- 5.4.5 Power Generation (incl. Wind)

- 5.4.6 Healthcare

- 5.4.7 Consumer Electronics and Wearables

- 5.4.8 Others

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Taiwan

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 India

- 5.5.3.6 ASEAN

- 5.5.3.7 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Mexico

- 5.5.4.2 Brazil

- 5.5.4.3 Argentina

- 5.5.4.4 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, Partnerships, Funding)

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Emerson Electric Co.

- 6.4.2 SKF AB

- 6.4.3 Honeywell International Inc.

- 6.4.4 Analog Devices Inc.

- 6.4.5 TE Connectivity Ltd

- 6.4.6 Bosch Sensortec GmbH

- 6.4.7 Texas Instruments Inc.

- 6.4.8 National Instruments Corp.

- 6.4.9 Rockwell Automation Inc.

- 6.4.10 NXP Semiconductors N.V.

- 6.4.11 Parker Hannifin Corp.

- 6.4.12 Baker Hughes (Bently Nevada)

- 6.4.13 Wilcoxon Sensing Technologies

- 6.4.14 PCB Piezotronics Inc.

- 6.4.15 Meggitt PLC (Sensing Systems)

- 6.4.16 IMI Sensors

- 6.4.17 ifm electronic GmbH

- 6.4.18 Siemens AG

- 6.4.19 Omron Corporation

- 6.4.20 Hansford Sensors Ltd

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment