|

市场调查报告书

商品编码

1851370

美国振动感测器市场:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)US Vibration Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

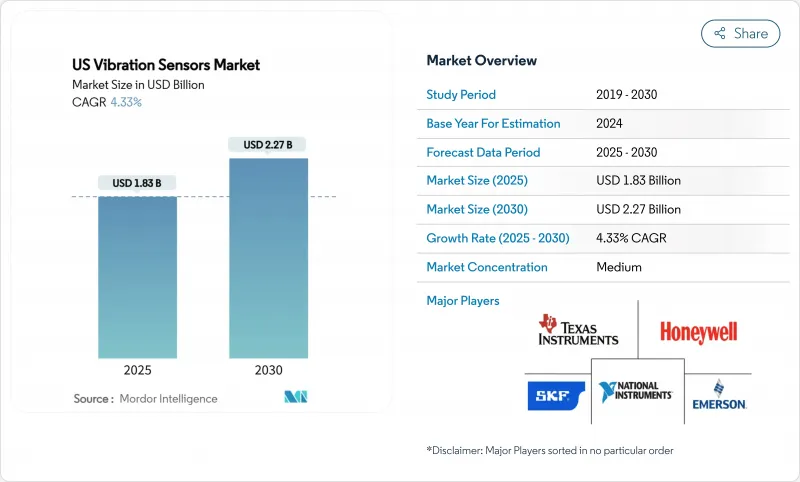

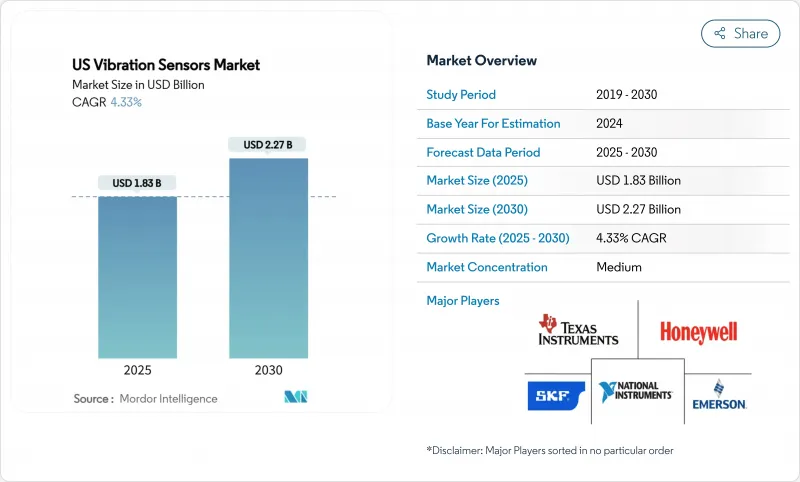

美国振动感测器市场规模预计到 2025 年将达到 18.3 亿美元,到 2030 年将达到 22.7 亿美元,复合年增长率为 4.33%。

随着终端用户采用边缘人工智慧、无线连接和工业4.0技术,美国振动感测器市场正从销售扩张转向技术主导的价值创造。预测分析的普及、来自美国职业安全与健康管理局 (OSHA) 和美国石油学会 (API) 标准的合规压力,以及减少非计划性停机时间的需求,都支撑着市场需求的稳定成长。无线节点、能源采集设计和基于微机电系统 (MEMS) 的加速计,为老旧工业设备提供了更多部署选择。供应商正透过提供将硬体与云端分析相结合的整合解决方案,并建立生态系统伙伴关係关係来应对网路安全和传统系统整合方面的挑战,从而实现差异化竞争。

美国振动感测器市场趋势与洞察

对预测性维护计划的需求日益增长

美国製造业每年因计画外停机造成的损失超过500亿美元,促使企业从基于时间的维护策略转向基于状态的维护策略。许多工厂现在采用连续振动监测来及早发现轴承磨损和不对中,从而将设备寿命延长多达30%,同时减少备件库存。将机器学习应用于频谱数据,可以识别出人工分析人员可能忽略的异常情况,尤其是在存在交互机械的工厂中。风电场营运商利用这些工具预测变速箱故障,避免了400万至500万欧元(430万至540万美元)的生产损失。早期应用的成功推动了该技术在汽车、金属和食品加工行业的广泛部署。

工业物联网(IIoT)赋能的无线振动节点日益普及

无线监测无需布线,并将覆盖范围扩展到以往难以触及的资产。 LoRaWAN 网路的资料传输距离超过 15 公里,已被证明适用于远端环境感测。动力来源环境振动和热量供电的能源采集装置无需更换电池,从而节省了传统电池成本。贝克休斯公司的 Ranger Pro 感测器已核准在全球危险区域使用,并为石油和天然气营运商提供企业级状态监测的典范。其部署週期短,可轻鬆纳入计画维护窗口,并支援快速计算投资报酬率。

与旧机器的整合问题

许多设施仍然依赖几十年前生产的设备,这些设备缺乏标准化的感测器安装座和通讯连接埠。改装是为新设备安装感测器的三到五倍。老旧机架的共振效应会影响讯号保真度,并且需要客製化夹具,从而增加工时。多代专有通讯协定需要网关,这会增加资本投入和网路安全风险。 Analog Devices 的 Voyager4 平台提供自适应安装座和节点上 AI,可以克服这些障碍,但价格敏感性正在减缓其普及速度。

细分市场分析

2024年,加速计货量将占总出货量的45.1%,这充分展现了其在各个频宽的通用性。速度感测器由于能够及早侦测大型旋转设备的低频故障,其复合年增长率将达到7.81%,成为市场成长最快的产品。多参数装置整合了加速度、速度和温度讯息,简化了安装流程并降低了整体拥有成本。 Analog Devices公司正在将边缘人工智慧整合到这些装置中,实现节点内故障分类,从而降低网路频宽。水力发电厂和纸浆造纸厂对速度感测技术的日益广泛应用,也推动了美国振动感测器市场的多元化发展。

第二个成长要素是轮胎和变速箱测试的扩展,其中三轴加速计用于追踪复杂的动态负荷。接近式探头虽然仍处于小众市场,但对于非接触式涡轮机应用至关重要。转速表作为变速驱动器阶次分析的参考仪器,仍具有重要价值。随着工厂数位化,资产健康平台正在整合所有产品类型的数据,这不仅扩大了美国振动感测器市场的硬体利润空间,还产生了服务费,从而加强了供应商与客户之间的联繫。

由于有线数位系统可靠性久经考验且现有电缆配线架可用,预计到 2024 年,有线数位系统将占总收入的 61.3%。然而,无线节点将因电池寿命的提升和无线稳定性的增强而以每年 9.23% 的速度增长。 LoRaWAN 将透过单一网关实现公里级覆盖范围,并支援分散式太阳能发电厂。混合电源加无线架构将在製药无尘室中应用,因为在这些场所,执行时间和污染控制至关重要。能源采集技术将消除维护难题,并拓展应用场景,例如在迴转窑中,滑环会增加成本和复杂性。

资料二极体功能和 AES-256 加密技术缓解了以往有线配置所面临的网路安全隐患。无线韧体更新允许操作人员在无需实体存取的情况下修復漏洞。 ISA100 和 IEC 62938 标准化促进了不同厂商之间的互通性,从而拓展了美国振动感测器市场的生态系统。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 对预测性维护计划的需求日益增长

- 相容于工业物联网的无线振动节点正变得越来越普及。

- 采用基于EMS的低成本加速感应器

- 危险产业面临的 OSHA 和 API 合规压力

- 边缘人工智慧分析释放新的价值池

- 汽车电气化推动高频振动感测技术的发展

- 市场限制

- 遗留整合问题

- I类/II区本质安全型感测器短缺

- 连网感测器带来的网路安全风险

- 压电陶瓷材料供应链的波动

- 价值链分析

- 监管现状和标准

- 技术展望

- 波特五力分析

- 新进入者的威胁

- 替代品的威胁

- 供应商的议价能力

- 买方的议价能力

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 依产品类型

- 加速计

- 近距离探针

- 转速表

- 速度感测器

- 其他的

- 透过感测器技术

- 有线(类比/数位)

- 无线(BLE、LoRa、Wi-Fi)

- 感测材料/原理

- 压电

- MEMS(电容式/压阻式)

- 磁致伸缩

- 光纤

- 按最终用户行业划分

- 车

- 航太/国防

- 石油和天然气

- 金属和采矿

- 发电

- 卫生保健

- 消费性电子产品

- 其他终端用户产业

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Analog Devices Inc.

- Texas Instruments Incorporated

- Honeywell International Inc.

- Emerson Electric Co.

- Rockwell Automation Inc.

- SKF USA Inc.

- PCB Piezotronics(MTS Systems)

- TE Connectivity Ltd.

- Wilcoxon Sensing Technologies(Amphenol)

- Siemens Digital Industries USA

- STMicroelectronics Inc.

- Bosch Sensortec GmbH

- KCF Technologies Inc.

- Banner Engineering Corp.

- Fluke Corporation

- Baker Hughes(Bently Nevada)

- Meggitt PLC(Endevco)

- Omron Corporation

- National Instruments Corp.

- Hansford Sensors Ltd.

第七章 市场机会与未来展望

The United States vibration sensors market size reached USD 1.83 billion in 2025 and is forecast to reach USD 2.27 billion by 2030, reflecting a 4.33% CAGR.

The United States vibration sensors market is moving from volume expansion toward technology-driven value creation as end users adopt edge AI, wireless connectivity, and Industry 4.0 practices. Uptake of predictive analytics, compliance pressures from OSHA and API standards, and the need to limit unplanned downtime underpin steady demand growth. Wireless nodes, energy-harvesting designs, and MEMS-based accelerometers broaden deployment options across aging industrial assets. Suppliers differentiate through integrated solutions that bundle hardware with cloud analytics while forming ecosystem partnerships to address cybersecurity and legacy-system integration challenges.

US Vibration Sensors Market Trends and Insights

Rising Demand for Predictive-Maintenance Programs

Unplanned downtime costs exceed USD 50 billion each year across U.S. manufacturing, prompting a shift from time-based to condition-based maintenance strategies. Many plants now deploy continuous vibration monitoring that detects bearing wear and misalignment early, extending asset life by as much as 30% while cutting spare-parts inventory. Machine learning applied to spectral data identifies anomalies that human analysts can miss, especially in facilities with interacting machines. Wind-farm operators using these tools have avoided lost production valued at EUR 4-5 million (USD 4.3-5.4 million) by predicting gearbox failures. Early adoption success is accelerating broader rollouts across automotive, metals, and food-processing sites.

IIoT-Enabled Wireless Vibration Nodes Gaining Traction

Wireless monitoring eliminates cable routing and allows coverage of assets once considered unreachable. LoRaWAN networks transmit data more than 15 kilometers, proven in remote environmental sensing. Energy-harvesting devices powered by ambient vibration or heat remove battery-change labor, addressing previous cost barriers. Baker Hughes' Ranger Pro sensor, approved for global hazardous areas, provides a template for oil and gas operators pursuing enterprise-wide condition monitoring. Short deployment times fit scheduled maintenance windows, supporting rapid ROI calculations.

Integration Issues with Legacy Machinery

Many facilities rely on equipment built decades ago without standardized sensor mounts or communication ports. Retrofitting can cost three to five times more than installing sensors on new assets. Resonance effects in older frames complicate signal fidelity and demand custom fixtures that add labor hours. Multiple generations of proprietary protocols require gateways that increase capex and cybersecurity exposure. Analog Devices' Voyager4 platform offers adaptive mounting and on-node AI to counter these hurdles, though price sensitivity slows adoption.

Other drivers and restraints analyzed in the detailed report include:

- Accelerating Adoption of MEMS-Based Low-Cost Accelerometers

- OSHA and API Compliance Pressures in Hazardous Industries

- Shortage of Intrinsically Safe Sensors for Class I/Div II Zones

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Accelerometers represented 45.1% of 2024 shipments, underlining their versatility across frequency ranges. Velocity sensors post the highest 7.81% CAGR as they capture low-frequency faults earlier in large rotating equipment. Multi-parameter devices combine acceleration, velocity, and temperature to simplify installation and reduce total cost of ownership. Analog Devices integrates edge AI in such packages, allowing on-node fault classification that trims network bandwidth. Growing use of velocity sensing in hydropower and pulp-and-paper plants supports revenue diversity within the United States vibration sensors market.

The second growth driver lies in expanding tire and gearbox testing where triaxial accelerometers track compound dynamic loads. Proximity probes, though niche, remain indispensable in non-contact turbine applications. Tachometers retain value as reference instruments for order analysis in variable-speed drives. As plants digitize, asset-health platforms ingest data from all product types, creating service fees that augment hardware margins and strengthen supplier-customer ties within the United States vibration sensors market.

Wired digital systems delivered 61.3% of 2024 revenue thanks to proven reliability and existing cable trays. However, wireless nodes grow 9.23% annually as battery life and radio resilience improve. LoRaWAN achieves kilometer-scale reach on single gateways, supporting distributed solar farms. Hybrid power-plus-wireless architectures appear in pharmaceutical cleanrooms where uptime and contamination control are paramount. Energy harvesting addresses maintenance pain points and expands use cases such as rotating kilns where slip rings add cost and complexity.

Data-diode features and AES-256 encryption mitigate cybersecurity concerns that once favored wired setups. Firmware-over-air updates let operators patch vulnerabilities without physical access. Standardization under ISA100 and IEC 62938 promotes interoperability across vendors, broadening the ecosystem for the United States vibration sensors market.

The United States Vibration Sensors Market Report is Segmented by Product Type (Accelerometers, Proximity Probes, Tachometers, Velocity Sensors, Others), Sensor Technology (Wired, Wireless), Sensing Material/Principle (Piezoelectric, MEMS, Magnetostrictive, Fiber-Optic), End-User Industry (Automotive, Aerospace and Defense, Oil and Gas, Metals and Mining, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Analog Devices Inc.

- Texas Instruments Incorporated

- Honeywell International Inc.

- Emerson Electric Co.

- Rockwell Automation Inc.

- SKF USA Inc.

- PCB Piezotronics (MTS Systems)

- TE Connectivity Ltd.

- Wilcoxon Sensing Technologies (Amphenol)

- Siemens Digital Industries USA

- STMicroelectronics Inc.

- Bosch Sensortec GmbH

- KCF Technologies Inc.

- Banner Engineering Corp.

- Fluke Corporation

- Baker Hughes (Bently Nevada)

- Meggitt PLC (Endevco)

- Omron Corporation

- National Instruments Corp.

- Hansford Sensors Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising demand for predictive-maintenance programs

- 4.2.2 IIoT-enabled wireless vibration nodes gaining traction

- 4.2.3 Accelerating adoption of MEMS-based low-cost accelerometers

- 4.2.4 OSHA and API compliance pressures in hazardous industries

- 4.2.5 Edge-AI analytics unlocking new value pools (under-reported)

- 4.2.6 Vehicle electrification driving high-frequency vibration sensing (under-reported)

- 4.3 Market Restraints

- 4.3.1 Integration issues with legacy machinery

- 4.3.2 Shortage of intrinsically safe sensors for Class I/Div II zones

- 4.3.3 Cyber-security risks from connected sensors (under-reported)

- 4.3.4 Supply-chain volatility in piezo-ceramic materials (under-reported)

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape and Standards

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Threat of Substitutes

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Bargaining Power of Buyers

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Product Type

- 5.1.1 Accelerometers

- 5.1.2 Proximity Probes

- 5.1.3 Tachometers

- 5.1.4 Velocity Sensors

- 5.1.5 Others

- 5.2 By Sensor Technology

- 5.2.1 Wired (Analog/Digital)

- 5.2.2 Wireless (BLE, LoRa, Wi-Fi)

- 5.3 By Sensing Material / Principle

- 5.3.1 Piezoelectric

- 5.3.2 MEMS (Capacitive/Piezoresistive)

- 5.3.3 Magnetostrictive

- 5.3.4 Fiber-Optic

- 5.4 By End-user Industry

- 5.4.1 Automotive

- 5.4.2 Aerospace and Defense

- 5.4.3 Oil and Gas

- 5.4.4 Metals and Mining

- 5.4.5 Power Generation

- 5.4.6 Healthcare

- 5.4.7 Consumer Electronics

- 5.4.8 Other End-user Industries

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Analog Devices Inc.

- 6.4.2 Texas Instruments Incorporated

- 6.4.3 Honeywell International Inc.

- 6.4.4 Emerson Electric Co.

- 6.4.5 Rockwell Automation Inc.

- 6.4.6 SKF USA Inc.

- 6.4.7 PCB Piezotronics (MTS Systems)

- 6.4.8 TE Connectivity Ltd.

- 6.4.9 Wilcoxon Sensing Technologies (Amphenol)

- 6.4.10 Siemens Digital Industries USA

- 6.4.11 STMicroelectronics Inc.

- 6.4.12 Bosch Sensortec GmbH

- 6.4.13 KCF Technologies Inc.

- 6.4.14 Banner Engineering Corp.

- 6.4.15 Fluke Corporation

- 6.4.16 Baker Hughes (Bently Nevada)

- 6.4.17 Meggitt PLC (Endevco)

- 6.4.18 Omron Corporation

- 6.4.19 National Instruments Corp.

- 6.4.20 Hansford Sensors Ltd.

7 MARKET OPPORTUNITIES and FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment