|

市场调查报告书

商品编码

1627126

拉丁美洲过程自动化:市场占有率分析、行业趋势和成长预测(2025-2030)Latin America Process Automation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

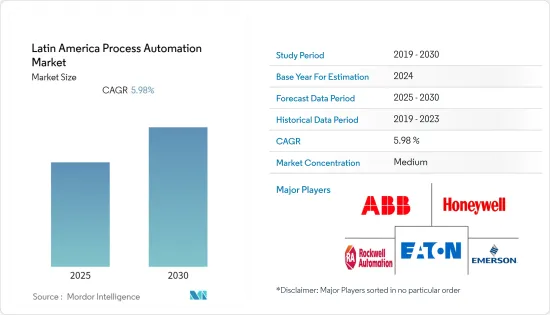

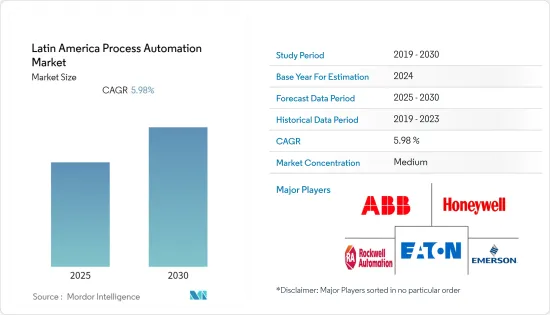

拉丁美洲过程自动化市场预计在预测期内复合年增长率为 5.98%

主要亮点

- 自动化已成为现代製造和工业流程的重要组成部分。它帮助企业实现上述优先事项。世界各地的公司借助 SCADA、DCS、MES 和 PLC 等各种技术实现业务自动化。对这些技术的需求正在迅速增加,许多供应商正在生产解决方案来帮助公司简化其製造流程。

- 物联网需求趋势预计在不久的将来将从消费者需求转向工业领域,主要由各种工业4.0应用推动。墨西哥和巴西等国家正处于工业革命的边缘,资料正在生产中大规模使用,并与整个供应链中的各种製造系统整合。

- 此外,巨量资料分析允许公司利用工厂自动化从反应性实践转向预测性实践。这项变更旨在提高流程效率和产品效能。

- 製造过程的自动化提供了许多好处,包括更容易监控、减少浪费和提高生产速度。该技术透过标准化和准时、低成本的可靠产品为客户提供了更高的品质。

- 此外,连接工业机械和设备并获取即时资料在 SCADA、HMI、PLC 系统和提供可视化的软体的采用中发挥关键作用。

拉丁美洲过程自动化市场趋势

医药产业预计将占据主要市场占有率

- 由于重视公共卫生安全,製药业受到严格监管。准确性、可重复性和控制是自动化系统的主要优势,有助于提高製药生产设施的生产力、安全性和清洁度。对流程优化、法规遵循和供应链增强的需求正在推动整个製药行业对自动化技术的投资。

- 自动化正在融入活性药物成分 (API) 等主要方面以及包装和分销等其他次要方面。数位转型为该地区的製药公司创造了新的业务效率、品质、流程自动化和员工生产力。

- 此外,製造、测试、药物开发、包装和分销等各种流程对流程自动化解决方案的需求不断增长,也是推动製药业在流程自动化和仪器市场成长的因素之一。

- 自动化描述了对流程的更好控制以及从远端位置监控流程的能力。它还可以帮助您自动建立报告、输入所需资料并即时共用资讯。自动化正在改变製药业的产品开发、商业生产和即时监控。采用感测器和系统可以推动卓越製造,并帮助公司以最低成本实现合规性。

- 此外,拉丁美洲的许多製药公司正在动员员工远距工作。在这种情况下,自动化可以帮助基本流程不受阻碍地继续进行。药物发现的自动化可最大限度地减少人为错误,提高通量并提高再现性,使整个过程更加可靠。

墨西哥占最大市场占有率

- 拉丁美洲(尤其是墨西哥)的物联网解决方案正在从服务供应链流程发展到提高医疗保健、政府和酒店业的可见度。 Wi-Fi、RFID、蓝牙和感测器的快速普及带来了物联网革命。

- 对连网型设备和穿戴式装置的需求不断增长也推动了国内市场的成长。随着连网型设备和感测器的高采用率以及 M2M通讯的可用性,製造中产生的资料点正在迅速增加。

- 物联网需求趋势预计在不久的将来将从消费者需求转向工业领域,主要由各种工业4.0应用推动。此外,化学品和石化、造纸和纸浆、水和污水处理、能源和公共产业、石油和天然气、製药以及食品和饮料等加工行业预计将推动成长。拉丁美洲市场也出现了类似的趋势。

- 墨西哥智慧工厂的网路攻击呈上升趋势,引发了人们对工业控制系统使用的担忧。政府已计划遏制此类犯罪的增加。这符合智慧工厂国产工业控制系统以避免网路安全漏洞风险的成长趋势。

- 此外,流程发现、流程最佳化、流程智慧和流程协作等技术和术语正在成为机器人流程自动化 (RPA) 的重要组成部分。未来,业务流程管理 (BPM) 和 RPA 之间的关係将持续发展。

拉丁美洲流程自动化产业概况

拉丁美洲过程自动化市场适度细分,新参与企业和主导参与企业都很少。公司不断创新并结成策略伙伴关係以维持市场占有率。近期市场发展趋势如下。

- 2021 年 7 月 - 罗克韦尔自动化公司宣布与云端基础的产品数位化和可追溯性平台 Kezzler AS 建立合作伙伴关係。

- 2020年5月-无线工业自动化与物联网解决方案供应商OleumTech宣布推出新型智慧压力感测器(HGPT智慧表压力感测器)。这些传送器是该公司快速成长的 H 系列硬连线製程仪器产品线的补充,使其成为石化、化学、电力、上游石油和天然气污水等製程工业的理想选择。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章 研究方法

第三章执行摘要

第四章市场动态

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 产业价值链分析

- 市场驱动因素(日益关注能源效率和降低成本|安全自动化系统的需求|工业物联网的出现)

- 市场挑战(成本和实施挑战)

- 行业标准和法规

- 对墨西哥、巴西和阿根廷主要工业自动化地点的分析 - 根据过去三年的投资和扩张活动来确定。

第 5 章:评估 COVID-19 对拉丁美洲流程自动化产业的影响

- 根据疫情中短期影响所确定的关键主题分析-V型復苏、中期復苏、低迷復苏

- 墨西哥流程自动化市场 - 具有最终用户效能的基础变数分析

- 巴西製程自动化市场 - 具有最终用户效能的基础变数分析

- 阿根廷过程自动化市场 - 具有最终用户性能的基础变数分析

- 供应相关挑战的影响以及市场监管在市场振兴中的作用

第六章 市场细分

- 按通讯协定

- 有线

- 无线的

- 依系统类型

- 按系统硬体

- 监控与资料采集系统(SCADA)

- 集散控制系统(DCS)

- 可程式逻辑控制器(PLC)

- 製造执行系统(MES)

- 阀门和致动器

- 马达

- 人机介面 (HMI)

- 製程安全系统

- 感测器和发射器

- 依软体类型

- APC(独立和客製化解决方案)

- 先进的监理控制

- 多变量模型

- 推理与连续式

- 资料分析和基于报告的软体

- 其他软体和服务

- 按系统硬体

- 按最终用户产业

- 石油和天然气

- 化学/石化

- 电力/公共产业

- 用水和污水

- 饮食

- 纸/纸浆

- 製药

- 其他的

- 按国家/地区

- 墨西哥

- 巴西

- 阿根廷

- 其他拉丁美洲国家

第七章 竞争格局

- 公司简介

- ABB Ltd

- Honeywell International Inc.

- Rockwell Automation

- Emerson Electric Co.

- Eaton Corporation

- Siemens AG

- Schneider Electric

- General Electric Co.

- Mitsubishi Electric

- Fuji Electric

- Delta Electronics Limited

- Yokogawa Electric

第8章过程自动化产业关键创新者与挑战分析

第九章投资分析及市场展望

简介目录

Product Code: 49570

The Latin America Process Automation Market is expected to register a CAGR of 5.98% during the forecast period.

Key Highlights

- Automation has become an essential part of modern manufacturing and industrial processes. It helps enterprises to realize the priorities above. Companies worldwide are automating their operations with the help of different technologies like SCADA, DCS, MES, and PLC. The demand for these technologies is escalating, and many vendors are manufacturing solutions to help enterprises achieve higher efficiency in their manufacturing processes.

- The IoT demand trend is expected to shift toward industrial space from consumer demand over the near future, primarily driven by various Industry 4.0 applications. Countries like Mexico and Brazil are on the verge of the industrial revolution, as data is being used on a large scale for production while integrating it with various manufacturing systems throughout the supply chain.

- Moreover, big data analytics allows an enterprise to use factory automation to shift from reactionary practices to predictive ones. This change targets to improve the efficiency of the process and performance of the product.

- Automation of manufacturing processes has offered various benefits, such as effortless monitoring, reduction of waste, and production speed. This technology offers customers an improved quality with standardization and dependable products within time and at a much lower cost.

- Further, connecting the industrial machinery and equipment and obtaining real-time data have played a vital role in the adoption of SCADA, HMI, PLC systems, and software that offer visualization; thus enables reducing the faults in the product, reducing downtime, scheduling maintenance, and switching from being in the reactive state to predictive and prescriptive stages for decision-making.

Latin America Process Automation Market Trends

Pharmaceutical Industry is Expected to Hold Significant Market Share

- The pharmaceutical industry is highly regulated due to the importance placed on public health safety. Accuracy, repeatability, and control are the key benefits of an automated system, helping to enhance productivity, safety, and cleanliness in pharmaceutical manufacturing facilities. The need for process optimization, regulatory compliance, and enhancements in the supply chain are driving investment in automation technologies across the pharmaceutical industry.

- Automation is embedded in primary aspects such as Active Pharma Ingredients (API) and other secondary aspects, including packaging and distribution. Digital transformation provides new operational efficiency, quality, process automation, and employee productivity to pharmaceutical companies in the region.

- Moreover, an increase in the need for process automation solutions to various processes such as manufacturing, testing, drug development, packaging, and distribution are among the factors that are likely to propel the growth in the pharmaceutical industry in the process automation and instrumentation market.

- Automation offers better control of processes and the ability to monitor processes from remote locations. It assists in automatically creating reports, entering essential data, and sharing real-time information. Automation is transforming pharma concerning product development, commercial production, and real-time monitoring. It can foster manufacturing excellence by adopting sensors and systems to help companies achieve compliance at the lowest costs.

- Further, many pharma companies in Latin America have mobilized their employees to remote working conditions. In such a scenario, automation helps them continue the essential processes unobstructed. Automation in drug discovery enhances the reliability of the entire process by minimizing manual errors, augments the throughput, and improves the ability to reproduce.

Mexico Accounts for the Largest Market Share

- IoT solutions in Latin America, specifically Mexico, have grown from servicing the supply chain process to adding visibility to healthcare, government offices, and hospitality industries. The rapidly growing implementation of Wi-Fi, RFID, Bluetooth, and sensors have brought on the IoT revolution, which is believed to be the most transformative technology for the next decade by 99% of respondents.

- The increasing demand for connected and wearables devices is also aiding the growth of the market in the country. With the high rate of adoption of connected devices and sensors and the enabling of M2M communication, there has been a surge in the data points generated in the manufacturing industry.

- The IoT demand trend is expected to shift toward industrial space from consumer demand over the near future, primarily driven by various Industry 4.0 applications. Furthermore, process industries, such as chemical and petrochemical, paper and pulp, water and wastewater treatment, energy and utilities, oil and gas, pharmaceutical, food, and beverages, are expected to fuel growth. Similar trends were observed in the Latin American market as well.

- With cyber-attacks increasing in smart factories in Mexico, there is growing concern about using Industrial Control Systems. The government has plans to curb the rise of such crimes. This aligns with the growing trend of industrial control systems manufactured in the country for smart factories to avoid the risk of cybersecurity breaches.

- Further, technologies and terminologies such as process discovery, process optimization, process intelligence, and process orchestration are becoming a more significant part of Robotic Process Automation (RPA). There is an ongoing trend of increasing a closer relationship between business process management (BPM) and RPA in the future.

Latin America Process Automation Industry Overview

The Latin American Process Automation Market is moderately fragmented, with few new entrants and few dominant players. The companies keep on innovating and entering into strategic partnerships to retain their market share. Some of the recent developments in the market are:

- July 2021 - Rockwell Automation, Inc announced a partnership with Kezzler AS, cloud-based product digitization and traceability platform, to help manufacturers capture the journey of their products from raw material sources to point-of-sale or beyond using cloud-based supply chain solutions that focus on product traceability.

- May 2020 - OleumTech, wireless industrial automation and IoT solutions provider announced the launch of new intelligent pressure transmitters (HGPT Smart Gauge Pressure Transmitters). These transmitters are an addition to its fast-growing H Series line of hardwired process instrumentation and claimed to deliver remarkable performance, accuracy, and reliability ideal for process industries, such as petrochemical, chemical, power, upstream oil, and gas wastewater.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHADOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Market Drivers (Growing emphasis on energy efficiency & cost reduction| Demand for Safety Automation Systems| Emergence of IIoT)

- 4.5 Market Challenges (Cost & Implementation Challenges)

- 4.6 Industry Standards & Regulations

- 4.7 Analysis of the major Industrial Automation hubs in the Mexico, Brazil, and Argentina - To be identified based on the investor activity & expansion activities undertaken over the last 3 years

5 ASSESSMENT OF THE IMPACT OF COVID-19 ON THE PROCESS AUTOMATION INDUSTRY IN LATIN AMERICA

- 5.1 Analysis of the key themes identified based on the near & medium-term effects of the pandemic - V-shaped recovery, Mid-range recovery & Slump recovery

- 5.2 Mexico Process Automation Market - Base variable analysis based on end-user performance

- 5.3 Brazil Process Automation Market - Base variable analysis based on end-user performance

- 5.4 Argentina Process Automation Market - Base variable analysis based on end-user performance

- 5.5 Impact of Supply-related challenges & the role of market regulations in spurring activity

6 MARKET SEGMENTATION

- 6.1 By Communication Protocol

- 6.1.1 Wired

- 6.1.2 Wireless

- 6.2 By System Type

- 6.2.1 By System Hardware

- 6.2.1.1 Supervisory Control and Data Acquisition System (SCADA)

- 6.2.1.2 Distributed Control System (DCS)

- 6.2.1.3 Programmable Logic Controller (PLC)

- 6.2.1.4 Manufacturing Execution System (MES)

- 6.2.1.5 Valves & Actuators

- 6.2.1.6 Electric Motors

- 6.2.1.7 Human Machine Interface (HMI)

- 6.2.1.8 Process Safety Systems

- 6.2.1.9 Sensors and Transmitters

- 6.2.2 By Software Type

- 6.2.2.1 APC (Standalone & Customized Solutions)

- 6.2.2.1.1 Advanced Regulatory Control

- 6.2.2.1.2 Multivariable Model

- 6.2.2.1.3 Inferential & Sequential

- 6.2.2.2 Data Analytics and Reporting-based Software

- 6.2.2.3 Other Software and Services

- 6.2.1 By System Hardware

- 6.3 By End-user Industry

- 6.3.1 Oil and Gas

- 6.3.2 Chemical and Petrochemical

- 6.3.3 Power and Utilities

- 6.3.4 Water and Wastewater

- 6.3.5 Food and Beverage

- 6.3.6 Paper and Pulp

- 6.3.7 Pharmaceutical

- 6.3.8 Other End-user Industries

- 6.4 By Country

- 6.4.1 Mexico

- 6.4.2 Brazil

- 6.4.3 Argentina

- 6.4.4 Rest of the Latin America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ABB Ltd

- 7.1.2 Honeywell International Inc.

- 7.1.3 Rockwell Automation

- 7.1.4 Emerson Electric Co.

- 7.1.5 Eaton Corporation

- 7.1.6 Siemens AG

- 7.1.7 Schneider Electric

- 7.1.8 General Electric Co.

- 7.1.9 Mitsubishi Electric

- 7.1.10 Fuji Electric

- 7.1.11 Delta Electronics Limited

- 7.1.12 Yokogawa Electric

8 ANALYSIS OF MAJOR INNOVATORS & CHALLENGERS IN THE PROCESS AUTOMATION INDUSTRY

9 INVESTMENT ANALYSIS & MARKET OUTLOOK

02-2729-4219

+886-2-2729-4219