|

市场调查报告书

商品编码

1627133

亚太地区能源管理系统 (EMS) -市场占有率分析、产业趋势/统计、成长预测(2025-2030)APAC Energy Management Systems (EMS) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

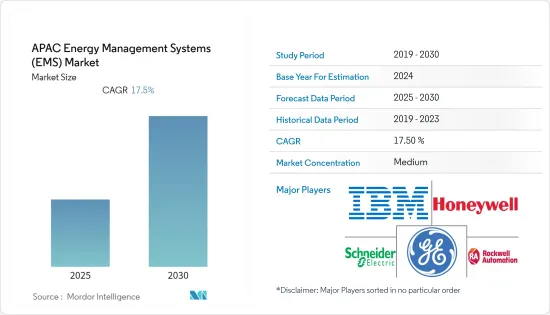

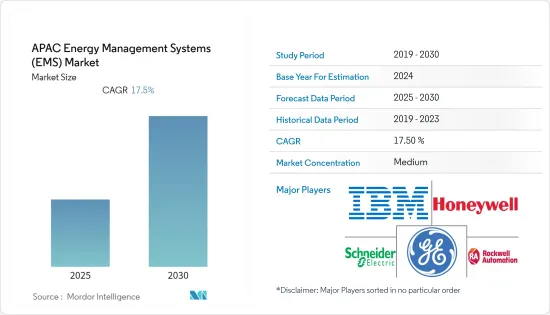

亚太能源管理系统市场预计在预测期内复合年增长率为 17.5%

主要亮点

- 该地区的政府机构正在积极采取措施,将 ISO 5,0001(能源管理系统标准)等标准引入建筑业,从而刺激 EMS 一体化。

- 因此,该地区中小型建筑的自动化机会越来越多。过去二十年来,亚洲的家庭数量急剧增加。联合国预测,2050年,亚洲都市化将达到64.1%,为该地区的建筑业创造更多商机。

- 各国政府一直积极参与制定能源消耗限制。例如,越南政府别无选择,将降低单位GDP消费量作为2011年至2020年永续发展策略的经济目标之一。

- 韩国高科技公司 NTELS 开发了一种 BEMS,可以从暖气、通风和空调 (HVAC) 系统收集能源资料。 ,识别建筑物的能源消耗模式,并根据其特征制定合适的能源消耗计划。它还具有预测功能和建筑运作监控功能,从而优化建筑能源效率。像这样的 BEMS 技术可以彻底改变建筑物的能源效率。

- 自从新型冠状病毒被宣布为大流行以来,大多数公司和工厂都已关闭或受到严格监管。同时,家庭和医院的能源消耗正在迅速增加。然而,电能消费量总体正在下降,这主要是由于中国、日本和印度的生产活动暂停。未来几个月,放鬆管制可能会变得明显。鑑于政府采取了减少能源消耗的倡议,该地区可能在预测期内提供机会。

亚太地区能源管理系统市场趋势

HEMS(家庭EMS)正在经历显着成长

- 随着网路通讯、智慧电网、双向通讯媒体、资讯基础设施、节能技术、各种技术等的快速完善,家庭区域网路(HAN)已成为改善能源等电力消耗领域的重要工具。使用模式在各个领域都发生了革命性的变化。

- 人们对有效利用能源的兴趣日益浓厚,引起了人们对家庭安装节能设备的关注。无论国家能源价格、使用情况和气候因素如何,能源管理系统对所有住宅来说都是具有成本效益的。因此,它越来越多地被引入家庭。

- 透过引入先进通讯技术增加对电网数位化的投资预计将推动住宅能源管理市场的成长。未来10年,作为都市化发展计画的一部分,中国将投资6兆美元用于基础建设。与中国签署「一带一路」合作协议的经济在全球经济中的份额正在增加。

- 最近的趋势是智慧家庭互联智慧型设备的发展迅速增加,例如智慧电錶、智慧感测器和智慧恆温器。这些设备具有先进的电源监控和显示技术。

- 例如,印度政府计划分阶段创造500个智慧城市,而智慧家庭是智慧城市最重要的元素。

预计中国将占较大份额

- 北京长期以来一直追求能源强度占国内生产毛额的目标,使中国能够以令人难以置信的速度成长。然而,与欧盟 (EU) 一样,中国已在 2020 年之前设定了能源使用上限。这些地区的政府正积极规划智慧电錶安装。

- 根据世界绿建筑委员会的数据,中国是全球最大的建筑市场,每年建成20亿平方公尺,未来十年将占全球新建建筑量的近一半。它也是世界上最大的温室气体排放,因此可以投资使用能源管理系统的绿色建筑。

- 尤其是中国本土厂商,将AI作为核心策略,资金筹措成功的却寥寥无几。例如,专门为商业和工业 (C&I) 建筑领域开发能源管理软体的 R&B Technology Holding 领主导了BP Ventures 的最新一轮投资,筹集了 360 万美元。 R&B 的能源管理系统专门用于预测、控制和改善建筑能源使用。该解决方案支援 BP Alternative Energy 专注于提供低碳电力、储存、数位能源价值炼和更全面的能源即服务 (EaaS)。

亚太地区能源管理系统产业概况

亚太地区能源管理系统市场适度细分,包括IBM、霍尼韦尔、施耐德电气、罗克韦尔自动化、通用电气公司等国际公司。该市场上的公司正在开发具有最新技术发展的产品,并与各国政府和组织合作以增加市场占有率。我想宣布一些最近的趋势。

- 2020 年 2 月 - 霍尼韦尔宣布推出 Forge 能源优化系统(闭合迴路、云端基础的机器学习),该系统能够持续监控建筑物能源消耗的变化,并在不影响居住者舒适度的情况下实现最佳节能设定的变化。

- 2020 年 1 月 - 施耐德电机宣布升级其能源中心产品中的传统保险丝盒,以满足寻求更好电源管理系统的住宅。该新产品是 Square D 向住宅提供的各种家庭能源管理设备的一部分。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 产业价值链分析

第五章市场动态

- 市场驱动因素

- 增加智慧电网和智慧电錶的使用

- 对绿建筑的日益关注和政府提高能源效率的努力

- 市场问题

- 缺乏技术一致性以及高昂的取得和实施成本

第六章 市场细分

- 按EMS(能源管理系统)类型

- BEMS(建筑物环境管理系统)

- IEMS(工业EMS)

- HEMS(家用EMS)

- 按最终用户产业

- 製造业

- 电力能源

- 资讯科技/通讯

- 医疗保健

- 其他的

- 按成分

- 硬体

- 软体

- 服务

- 按国家/地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

第七章 竞争格局

- 公司简介

- IBM Corporation

- Rockwell Automation Inc.

- General Electric Company

- Schneider Electric SE

- Cisco Systems Inc.

- Uplight Inc.

- Eaton Corporation

- Enel X Srl

- Elster Group SE(Elster Group)

第八章投资分析

第9章市场的未来

简介目录

Product Code: 49881

The APAC Energy Management Systems Market is expected to register a CAGR of 17.5% during the forecast period.

Key Highlights

- Proactive measures taken by government organizations in the region for the implementation of standards, such as ISO 50001 (energy-management-system standard) in the building sector, can stimulate the integration of EMS.

- Consequently, more opportunities for automation can now be found across small-to-medium buildings in the region. In the Asia Region, households have grown exponentially over the last two decades. The United Nations expects that urbanization in Asia will reach 64.1% by 2050, further opening up opportunities for the building and construction industry in the region.

- Governments across countries have been actively involved in setting the limits for energy consumption. For instance, structural shifts in the national economy compelled the Government of Vietnam to establish a reduction of energy consumption per unit of GDP ratio as one of the economic targets of the national Sustainable Development Strategy for 2011-2020; as the country remained the most energy-intensive economy in East Asia, behind China, Indonesia, Thailand, Malaysia, and the Philippines.

- NTELS, a Korean tech firm, developed a BEMS where energy data from heating, ventilation, and air conditioning (HVAC) systems were collected. Then, depending on their characteristics, the system identified energy consumption patterns of buildings and created proper energy consumption plans. It also has forecasting and building operations monitoring features, which leads to optimizing energy efficiency in buildings. Such BEMS technology can transform the energy efficiency of the buildings.

- Since the novel coronavirus has been declared a pandemic, most of the businesses and factories are closed or are under severe restrictions. On the other hand, energy consumption in homes, as well as hospitals, has increased drastically. However, the power and energy consumption has decreased overall, mainly due to the halt of manufacturing activity in China, Japan, and India. Nevertheless, relaxation on the restrictions may be apparent in the months ahead. Given the government initiatives to reduce energy consumption, the region will likely provide opportunities over the forecast period.

APAC Energy Management Systems Market Trends

HEMS (Home EMS) to Experience Significant Growth

- With the rapid improvements in technologies, like network communication, smart grid, bidirectional communication medium's, information infrastructures, energy conservation methodologies, and various techniques, home area networks (HANs) encountered a revolutionary change about multiple areas of power consumption domains, like energy conservation at consumption premises and electricity usage patterns.

- Due to the increasing concern about the efficient use of energy, there is an expanding focus on installing energy-saving devices in households. Energy management systems are cost-effective in all residential buildings, regardless of national energy prices, usage, and climatic factors. Thus they are increasingly being adopted in homes.

- Increasing investment in grid digitization by implementing advanced communications technologies will drive the growth of the residential energy management market. Over the next decade, China is investing USD 6 trillion in infrastructure as part of its urbanization development program. China and the economy, which have signed a cooperation agreement with China on the Belt and Road Initiative (BRI), are rising as a share of the world economy.

- In recent times, there has been a significant surge in the development of connected, intelligent devices, such as smart meters, smart sensors, and smart thermostats that are equipped in smart homes. These devices are experiencing advancements in power monitoring and display technologies.

- For instance, the Government of India planned to create 500 smart cities in a phased manner, with smart homes being the most critical entity of smart cities.

China is Expected to Hold Significant Share

- Over the years, Beijing has pursued an energy intensity target relative to GDP, allowing China to grow at a tremendous pace. However, just like the European Union, China has also put a cap on energy use by 2020. The Government in these regions is proactive in planning for smart meter installation.

- According to the World Green Building Council, China is the largest building construction market globally, with up to 2 billion square meters constructed annually, accounting for nearly half of new construction globally in the coming decade. It is also the world's largest emitter of greenhouse gas emissions, which allows the country to invest in green buildings using energy management systems.

- Local vendors, especially in China, have AI in their core strategy, and few of them have been successfully raising funds. For instance, R&B Technology Holding, which specializes in creating energy management software for commercial and industrial (C&I) building sectors, led BP Ventures in its latest series of investments, raising USD 3.6 million. R&B's energy management systems are specifically designed to predict, control, and improve building energy use. This solution supports BP Alternative Energy's focus on low-carbon power, storage, digital energy value chain, and more comprehensive Energy as a Service (EaaS) offers.

APAC Energy Management Systems Industry Overview

The Asia Pacific Energy Management Systems Market is moderately fragmented with the presence of various international players such as IBM, Honeywell, Schneider Electric, Rockwell Automation, General Electric Company, among others. The companies in the market are launching products with the latest technological developments and are collaborating with various governments and organizations to increase their market share. Some of the recent developments are:

- February 2020 - Honeywell introduced its Forge Energy Optimization systems (a closed-loop, cloud-based machine learning solution) to constantly monitor a building's energy consumption changes to optimal energy-saving settings without affecting occupant comfort levels.

- January 2020 - Schneider Electric unveiled its upgrade to the traditional fusebox to homeowners looking for a better power management system with the company's Energy Center product. The new product is part of a wide range of Square D home energy management devices that the company is aiming at homeowners.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Usage Of Smart Grids and Smart Meters

- 5.1.2 Increasing Focus on Green Buildings and Government Initiatives Towards Energy Efficiency

- 5.2 Market Challenges

- 5.2.1 Absence of Technology Alignment and High Acquisition and Implementation Costs

6 MARKET SEGMENTATION

- 6.1 By Type of EMS (Energy Management System)

- 6.1.1 BEMS (Building EMS)

- 6.1.2 IEMS (Industrial EMS)

- 6.1.3 HEMS (Home EMS)

- 6.2 By End-User Industry

- 6.2.1 Manufacturing

- 6.2.2 Power and Energy

- 6.2.3 IT and Telecommunication

- 6.2.4 Healthcare

- 6.2.5 Other End-user Industries

- 6.3 By Component

- 6.3.1 Hardware

- 6.3.2 Software

- 6.3.3 Services

- 6.4 By Country

- 6.4.1 China

- 6.4.2 India

- 6.4.3 Japan

- 6.4.4 South Korea

- 6.4.5 Rest of Asia Pacific

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 IBM Corporation

- 7.1.2 Rockwell Automation Inc.

- 7.1.3 General Electric Company

- 7.1.4 Schneider Electric SE

- 7.1.5 Cisco Systems Inc.

- 7.1.6 Uplight Inc.

- 7.1.7 Eaton Corporation

- 7.1.8 Enel X S.r.l.

- 7.1.9 Elster Group SE (Elster Group)

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219