|

市场调查报告书

商品编码

1628748

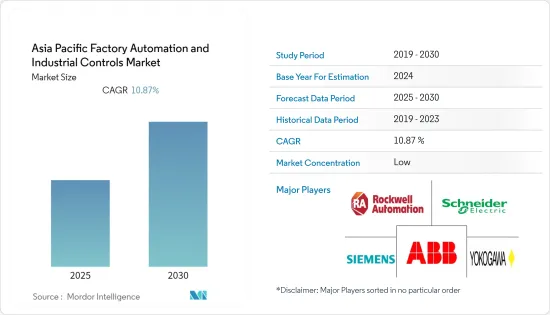

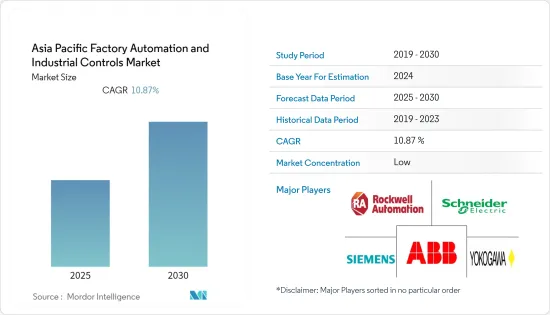

亚太地区工厂自动化和工业控制:市场占有率分析、产业趋势和成长预测(2025-2030)Asia Pacific Factory Automation and Industrial Controls - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

亚太工厂自动化和工业控制市场预计在预测期内复合年增长率为10.87%

主要亮点

- 此外,中国是受COVID-19大流行影响最严重的国家之一,大流行迫使其扩大劳动力,以解决技术纯熟劳工短缺的问题,并避免因前所未有的情况而导致工作流程中断,需要工厂自动化来取代。 ABB表示,在中国、美国和欧洲接受调查的1,900家建设公司中,81%有可能引进工业机器人。

- 此外,各行业对流程效率和降低生产成本的关注推动了亚太地区工厂自动化和工业控制系统市场的发展。製造业是亚太地区的重要产业,而在该产业中扮演重要角色的中国经济,由于人事费用飙升以及传统农民工缺乏永续性,正进入快速变革时期时期。这些趋势正在推动经济体采用自动化作为其製造流程的一部分。

- 此外,自动化流程的通讯支援使製造商更容易采用。感测器组件、更快的网路、高品质的诊断软体、具有高可靠性和安全分层存取的灵活介面以及纠错选项可提高生产率、持续高品质交货,并最大限度地降低该地区的製造成本。

- 例如,三菱电机和英特尔合作为英特尔在马来西亚的製造工厂开发下一代工厂自动化系统。这使我们能够分析半导体生产线产生的现场资料,提高营运绩效,并为节约能源做出贡献,从而降低社会永续发展的成本。

- 该地区工业自动化的采用正在进一步进展,物联网是跨越开发、生产和物流链的新技术方法的核心,现在被称为智慧工厂自动化。例如,日本政府核准了日本振兴计划,为进一步强化製造业提供了一条路径,发展目标为1.3兆美元。到 2023 年,在工业 4.0 的推动下,工业领域的企业收益预计将成长 4,900 亿美元。

亚太地区工厂自动化与工业控制市场趋势

汽车产业推动市场成长

- 汽车产业是占据自动化製造设施很大份额的重要产业之一。已经证实,各汽车製造商的生产设施都实现了自动化,以保持准确性和效率。此外,电动车取代传统汽车的趋势日益明显,预计将进一步扩大汽车产业的需求。

- 自动化对于该地区的汽车製造并不陌生。事实上,机器视觉正在透过执行基于影像的自动检查和分析来实现自动检查和製程控制,从而进入汽车製造领域。另一方面,自动化软体和控制系统支援从零件供应到新车交付的一切。

- 2020年11月,现代汽车宣布与印尼政府合作,在该国建造第一家製造工厂。 2020 年 5 月 1 日作为新公司成立的现代机器人公司提到,为新工厂订单了 370 台工业机械臂。现代汽车在东南亚的第一家製造工厂位于印尼首都雅加达附近,计划于 2022 年建成。工厂用地面积77.6万平方公尺,最大产能25万台。

- 2020 年 10 月,日本汽车零件供应商 DENSO 开发了独特的云端原生工厂物联网平台,透过云端连接其全球所有工厂。这使得工厂能够即时响应当地需求驱动的生产变化,并允许生产团队即时分析不同设施的工人移动和运作条件,从而增强了Denso的全球生产系统。

- 智慧先进製造和快速转型中心 (SAMARTH) Udyog Bharat 4.0倡议旨在提高印度製造业对工业 4.0 的认识,并使相关人员能够应对智慧製造挑战。

中国占较大市场占有率

- 引领工业机器人市场的中国在该地区的工厂自动化方面处于领先地位,不仅是亚太地区而且是全球领先的製造国。中国正在增加工业机器人的出货量,并采用各种工业控制系统软体,促进大规模工厂自动化。

- 製造业是中国经济的支柱之一,正经历快速转型。随着人口老化和人事费用上升,基于廉价移工的传统模式已不再永续。此外,全球70%的电脑、通讯设备和家用电子电器产品是中国製造的。

- 中国人口老化需要自动化。根据中国国家统计局的数据,中国劳动年龄人口(15岁至64岁人口)为9.98亿。人口下降始于 2014 年,预计到 2050 年将下降至 8 亿。

- 该国的工业控制系统在能源、交通、水利和市政等各个领域不断涌现。随着资讯科技与工业的深度融合以及物联网的快速发展,网路化控制系统正成为我国工业自动化的发展趋势。

- 与中国庞大的製造地规模及其僱用的工人数量相比,实施工厂自动化、製程自动化技术和机器人技术的公司数量很少。这一趋势为中国工业自动化领域的公司带来了巨大的机会。

亚太工厂自动化与工业控制产业概况

由于众多参与企业,亚太工厂自动化和工业控制市场竞争非常激烈。参与企业从事产品开发、伙伴关係、併购和收购等策略活动。市场的主要发展包括:

- 2021 年 4 月-工业机器人製造新兴企业Youibot 完成由软银亚洲资金筹措主导的 1,547 万美元融资。该公司80%的年收益来自中国,计划将筹集的资金用于研发。

- 2021 年 3 月 - 新加坡电信和现代汽车公司签署谅解备忘录,共同为现代汽车集团新加坡创新中心的製造平台开发支援 5G 的智慧工厂用例。

- 2021 年 2 月 - 三菱电机宣布将在名古屋工厂内建立工业机电一体化系统製造厂。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 评估 COVID-19 对产业的影响

第五章市场动态

- 市场驱动因素

- 启动严格的节能标准并促进本地生产

- 市场问题

- 贸易摩擦和金融措施收紧

第六章 市场细分

- 按类型

- 工业控制系统

- 集散控制系统(DCS)

- PLC(可程式逻辑控制器)

- SCADA(监控/资料采集)

- 产品生命週期管理 (PLM)

- 人机介面 (HMI)

- 製造执行系统(MES)

- 企业资源规划系统(ERP)

- 其他工业控制系统

- 现场设备

- 机器视觉系统

- 机器人(工业)

- 感测器和发射器

- 马达与驱动器

- 其他现场设备

- 工业控制系统

- 按最终用户产业

- 石油和天然气

- 化学/石化

- 电力/公共产业

- 饮食

- 车

- 製药

- 其他的

- 按国家/地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

第七章 竞争格局

- 公司简介

- Schneider Electric SE

- Rockwell Automation Inc.

- Emerson Electric Company

- Yokogawa Electric Corporation

- ABB Ltd.

- Siemens AG

- Mitsubishi Electric Corporation

- Honeywell International Inc.

- Omron Corporation

- Yaskawa Electric Corporation

第八章投资分析

第9章市场的未来

简介目录

Product Code: 53011

The Asia Pacific Factory Automation and Industrial Controls Market is expected to register a CAGR of 10.87% during the forecast period.

Key Highlights

- Moreover, with China being one of the worst-hit countries in the COVID 19 outbreak, the pandemic has also highlighted the need for factory automation to replace labor to deal with a skilled labor shortage and avoid disruption in the workflow due to the unprecedented nature of the situation. According to ABB, 81% of companies amongst 1,900 construction firms based in China, the United States, and Europe surveyed are likely to adopt industrial robots.

- Furthermore, the Asia-Pacific factory automation and industrial control systems market is primarily driven by the increased focus on enhancing process efficiencies and reducing the cost of production across various industry verticals. Manufacturing serves as a significant industry in Asia-Pacific and China's economy being a significant contributor is undergoing a rapid transformation as labor costs have risen and the conventional model of migrant workers has lost the sustainability. Such trends have pushed the economy to adopt automation as a part of their manufacturing processes.

- Moreover, the communications support for automated processes have facilitated easier adoption among the manufacturers. Sensor components, faster networks, quality diagnostic software, and flexible interfaces with high levels of reliability and secured hierarchical access, along with error-correction options have added productivity, continued quality deliveries, and minimized the cost of manufacturing in the region.

- For instance, the collaboration between Mitsubishi Electric and Intel on the next-generation factory automation system for Intel's manufacturing facility in Malaysia; This has enabled field data generation from semiconductor manufacturing lines to be analyzed for improving operational performance and contribute to energy savings, thereby, cost savings toward a sustainable society.

- With IoT at the center of new technological approaches for development, production, and the entire logistics chain, otherwise known as smart factory automation, has further driven the adoption of industrial automation in the region. For instance, the Japanese government approved a plan known as the 'Rebirth of Japan,' which outlines the route towards strengthening the manufacturing sector further by targeting the development of USD 1.3 trillion. It is expected that, by 2023, companies in the industrial sector could grow revenues by as much as USD 490 billion as a result of Industry 4.0.

APAC Factory Automation and Industrial Controls Market Trends

Automotive Industry to Drive the Market Growth

- The automotive industry is one of the prominent sectors that hold a significant share in automated manufacturing facilities. It is observed that the production facilities of various automakers are automated to maintain accuracy and efficiency. Further, the growing trend of replacing conventional vehicles with EVs is expected to further augment the automotive industry's demand.

- Automation, in the region, is currently no stranger to automotive shop floors. In fact, Machine Vision has found a way in the automotive making by carrying out imaging-based automatic inspection and analysis for automatic inspection and process control. Whereas automation software and control systems have been supporting everything from component supply to the delivery of new vehicles.

- In November 2020, Hyundai Motors announced a partnership with the Indonesian government to build its first manufacturing plant in the country. Hyundai Robotics launched as a new company on May 1st, 2020, mentioned that the order is for 370 industrial robotic arms for the new facility. Located near Jakarta, Indonesia's capital city, Hyundai Motors' first manufacturing plant in Southeast Asia is anticipated to be built by 2022. The plant is being constructed in an area of 776,000 sq m, with a manufacturing capacity of up to 250,000 cars.

- In October 2020, DENSO, a Japan based automotive supplier developed its own cloud-native Factory-IoT platform, to connect all its factories around the world via cloud, this has strengthened DENSO's global production system, by enabling factories to respond immediately to production changes based on local demand, and allow production teams to conduct real-time analysis of the movement of workers and operation statuses of different facilities.

- The Smart Advanced Manufacturing and Rapid Transformation Hub (SAMARTH) Udyog Bharat 4.0 initiative aims at enhancing awareness about Industry 4.0 within the Indian manufacturing industry and help stakeholders address challenges related to smart manufacturing.

China to Hold Significant Market Share

- China has led the industrial robot market, which has driven its way to factory automation in the region and is one of the leading manufacturing countries in the Asia-Pacific region and globally. The increase in shipment of industrial robots in the country and the adoption of various Industrial Control System software across the country facilitates factory automation at scale.

- Manufacturing is one of the pillars of China's economy and is undergoing a rapid transformation. As the population ages, along with rising labor costs, the legacy model based on inexpensive migrant workers is no longer sustainable. Moreover, 70% of the world's computers, communication equipment, and consumer electronics are made in China.

- The country's aging population necessitates automation. According to China's National Bureau of Statistics, the country's working-age population, people aged between 15 and 64 years, is 998 million. The decline in this population started in 2014, and is expected to drop as low as 800 million by 2050.

- The industrial control system in the country has emerged across various fields, like the energy, transportation, water, and municipal sectors. Due to the deep integration of information technology and industry and the rapid development of the Internet of Things, the networked control system is becoming the development trend of industrial automation in China.

- The number of companies deploying factory and process automation technologies and robotics in the country is less when compared to the enormous size of China's manufacturing base and the number of workers it employs. This trend presents a great opportunity for companies in the industrial automation sector in China.

APAC Factory Automation and Industrial Controls Industry Overview

The Asia Pacific factory automation and industrial controls market is competitive due to several players in the market. Players are involved in product development and strategic activities such as partnerships, mergers, and acquisitions. Some of the key developments in the market are:

- April 2021 - Youibot, a start-up company that makes industrial robots, closed an investment of USD 15.47 million in the funding round led by SoftBank Ventures Asia alongside others. The company generates 80% of its annual revenue in China and has plans to spend the raised funds on research and development.

- March 2021 - Singapore Telecommunications and Hyundai Motor Company entered into an MoU to collaborate and develop a 5G-enabled smart factory use case for the manufacturing platform of Hyundai Motor Group Innovation Centre Singapore.

- February 2021 - Mitsubishi Electric announced the establishment of Industrial Mechatronics Systems Works within the premises of the company's Nagoya Works in Nagoya, Japan.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Launch of Stringent Energy Conservation Standards and Drive for Local Manufacturing

- 5.2 Market Challenges

- 5.2.1 Trade Tensions and Monetary Policy Tightening

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Industrial Control Systems

- 6.1.1.1 Distributed Control System (DCS)

- 6.1.1.2 PLC (Programmable Logic Controller)

- 6.1.1.3 Supervisory Control and Data Acquisition (SCADA)

- 6.1.1.4 Product Lifecycle Management (PLM)

- 6.1.1.5 Human Machine Interface (HMI)

- 6.1.1.6 Manufacturing Execution System (MES)

- 6.1.1.7 Enterprise Resource Planning (ERP)

- 6.1.1.8 Other Industrial Control Systems

- 6.1.2 Field Devices

- 6.1.2.1 Machine Vision Systems

- 6.1.2.2 Robotics (Industrial)

- 6.1.2.3 Sensors and Transmitters

- 6.1.2.4 Motors and Drives

- 6.1.2.5 Other Field Devices

- 6.1.1 Industrial Control Systems

- 6.2 By End-user Industry

- 6.2.1 Oil and Gas

- 6.2.2 Chemical and Petrochemical

- 6.2.3 Power and Utilities

- 6.2.4 Food and Beverages

- 6.2.5 Automotive

- 6.2.6 Pharmaceutical

- 6.2.7 Other End-user Industries

- 6.3 By Country

- 6.3.1 China

- 6.3.2 India

- 6.3.3 Japan

- 6.3.4 South Korea

- 6.3.5 Rest of Asia pacific

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Schneider Electric SE

- 7.1.2 Rockwell Automation Inc.

- 7.1.3 Emerson Electric Company

- 7.1.4 Yokogawa Electric Corporation

- 7.1.5 ABB Ltd.

- 7.1.6 Siemens AG

- 7.1.7 Mitsubishi Electric Corporation

- 7.1.8 Honeywell International Inc.

- 7.1.9 Omron Corporation

- 7.1.10 Yaskawa Electric Corporation

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219