|

市场调查报告书

商品编码

1629766

中东和非洲的资料中心冷却:市场占有率分析、行业趋势和成长预测(2025-2030 年)MEA Data Center Cooling - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

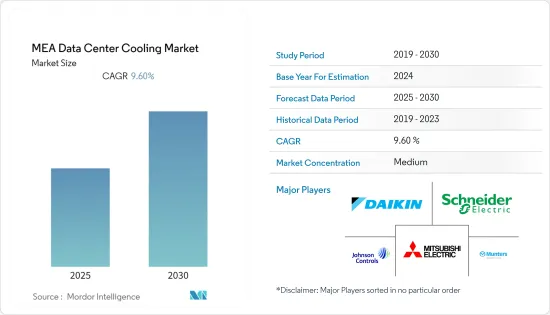

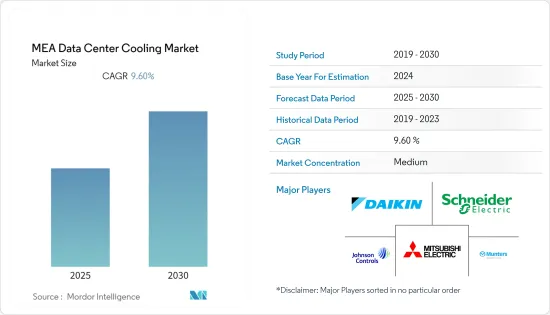

中东和非洲资料中心冷却市场预计在预测期内复合年增长率为 9.6%

主要亮点

- 该地区的市场受到政府和企业不断开发数位基础设施以支援金融服务、通讯零售和製造等各种最终用户垂直领域的自动化的推动。

- 许多主要的云端公司正在进入该地区,以抓住这个尚未开发的市场机会。因此,资料中心冷却的需求预计将会增加。此外,该地区的气候也使冷却解决方案成为资料中心的首要任务。

- 非洲正在成为资料中心的潜在市场。 Liquid Telecom 的子公司 Africa Data Centers 已安装另一层楼,为其位于肯亚内罗毕的设施增加 160 个机架空间。新开放的楼层是对非洲对託管和託管服务巨大需求的直接回应。

- COVID-19 和油价暴跌的双重影响对整个沿岸地区的经济产生了复杂的影响。儘管景气衰退,但网路服务供应商(ISP)、资讯科技 (IT) 基础设施供应商和资料中心等经济部门的需求却有所增加,这主要是由于人们转向在家工作和远端工作。这显示该地区资料中心冷却市场的需求不断增加。

中东和非洲资料中心冷却市场趋势

医疗保健呈现显着成长

- 透过电子健康记录(EMR) 实现的消费者健康记录数位化正在促进资料成长。医疗设备的最新创新和传统作业系统的现代化,包括劳动力管理和患者互动系统的改进,正在产生大量资料,进一步增加了对资料中心的需求。这些资料中心需求正在推动资料中心冷却的需求。

- 对医疗保健技术的投资被认为是重中之重,其中数位化的影响最大。根据 Omnia Health Insights 2020 年 6 月发布的一份报告,远端医疗对于诊所和医疗实践来说是一个关键的发展,尤其是营业额在500 万美元至1000 万美元之间的诊所和医疗实践,并且据说这种趋势比该地区更强。

- 例如,2020 年 7 月,TVM Capital Healthcare 筹集了第二隻成长资本基金,专注于海湾地区的投资。新基金将重点关注海湾合作委员会,特别是沙乌地阿拉伯。新的以海湾地区为重点的基金将寻求投资于除综合医院之外的所有医疗保健领域。这进一步增加了患者资料记录的创建,进而增加了该地区对资料中心冷却技术的需求。

沙乌地阿拉伯市场占有率最高

- 沙乌地阿拉伯最近已成为中东和非洲地区的技术中心之一。随着主要 IT 和医疗保健公司进入市场,该地区对资料中心的需求正在迅速增长。

- 此外,根据沙乌地阿拉伯的 2030 年愿景目标,Google、微软和 IBM 等科技巨头在该国设立了资料中心,并计划扩大其设施。

- 目前,该国六个地区有 22 个託管资料中心,为世界各地的私人和公共公司提供服务。此外,2021 年 1 月,中东领先的云端和託管 IT 服务供应商 BIOS Middle East 宣布在利雅德和吉达开设两个新的云端站点,为沙乌地阿拉伯王国的客户提供服务。此类案例预计将增加该国资料中心冷却解决方案的需求。

中东和非洲资料中心冷冻产业概况

中东和非洲资料中心冷却市场适度分散,由多家公司组成。从市场占有率来看,目前该市场由几家大型企业主导。然而,凭藉创新和永续的包装,许多公司正在透过赢得新契约和开发新市场来扩大其市场份额。

- 2021 年 5 月 - 全球科技公司 SAP 宣布与位于阿拉伯联合大公国的国际主要企业区域供冷开发商 The National Central Cooling Company PJSC (Tabreed) 建立合作伙伴关係。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 评估 COVID-19 对产业的影响

- 市场驱动因素

- 新兴国家IT基础设施发展

- 绿色资料中心的出现

- 市场限制因素

- 适应要求和停电

- 产业政策

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 按解决方案

- 空调/处理器

- 立柱/机架/门/天花板冷却系统

- 冷却器

- 液体冷却系统

- 节热器系统

- 按服务

- 安装部署

- 咨询、支援及维护服务

- 按行业分类

- 资讯科技

- BFSI

- 通讯

- 卫生保健

- 政府机构

- 其他行业

- 按国家/地区

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 南非

- 其他中东和北非国家

第六章 竞争状况

- 公司简介

- Vertiv Co.

- Schneider Electric SE

- STULZ GMBH

- Daikin Industries Ltd

- Trane Inc.

- Johnson Controls International Plc

- Mitsubishi Electric Corporation

- Rittal GmbH & Co. KG

- Nortek Air Solutions LLC

- Munters Group AB

- Asetek A/S

- Chilldyne Inc.

- CoolIT Systems Inc.

- Liquid Cool Solutions

- Green Revolution Cooling Inc.

第七章 投资分析

第八章市场的未来

简介目录

Product Code: 56285

The MEA Data Center Cooling Market is expected to register a CAGR of 9.6% during the forecast period.

Key Highlights

- The market in the region is driven by a consistent storm of government and enterprise, developing a digital infrastructure to support automation adoption across a variety of end-user verticals, including financial services, telecommunications retail, and manufacturing.

- Many major cloud players are entering the region to grab the opportunity of this untapped market. Hence this will also develop the demand for data center cooling. Additionally, the regional weather also makes cooling solutions a priority for data centers.

- Africa is emerging as a potential market for data centers. Africa Data Centers, a subsidiary of Liquid Telecom, has fitted out another floor for adding enough space for another 160 racks in its facility in Nairobi, Kenya. The newly-opened floor is a direct response to the massive demand for colocation and hosting services in Africa.

- The dual effects of COVID-19 and sharp oil price reduction have had manifold economic consequences across the Gulf region. Despite the downturn, one sector of the economy, namely internet service providers (ISPs), information technology (IT) infrastructure providers, and data centers, has seen demand increase primarily as a result of the shift towards home and remote working. This indicates the rising demand for the Data center cooling market in the region.

MEA Data Center Cooling Market Trends

Healthcare to Show Significant Growth

- Digitization of consumer health records in the form of electronic medical records (EMR) contributes to data increment. The latest innovations in the medical equipment and modernization of legacy operating systems, such as management of personnel, improvement in the patient response systems, etc., generate a multitude of data, further necessitating the need for data centers. This need for data centers, in turn, drives the demand for data center cooling.

- With digitization creating the most significant impact, investment in healthcare technology has been considered as a key priority. According to a report published by Omnia Health Insights in June 2020, telemedicine was also identified as a crucial development for clinics and medical practices, particularly those with a turnover of USD 5-10 million, and more so in the GCC and the Middle East than other regions.

- For instance, in July 2020, TVM Capital Healthcare raised a second growth capital fund focused on investment in the Gulf. The new fund will have a strong focus on the GCC, but also Saudi Arabia specifically. For its new Gulf-focused fund, the company will look to invest in all areas of health care, except for general hospitals. This has further increased the generation of data records of patients, and in turn, increased the demand for data center cooling technologies in the region.

Saudi Arabia to Hold the Highest Market Share

- Saudi Arabia has recently become one of the technology hubs of the Middle East and Africa region. With major IT and Healthcare firms gaining access to the market, there has been a steep increase in demand for data centers in the region such that the companies can keep their data within the boundaries of the country.

- Further, Saudi Arabia's Vision 2030 objectives have led to the technology giants, like Google, Microsoft, and IBM, setting up data centers in the country, with plans to extend the facilities as well.

- Currently, six areas of the country offer 22 colocation data centers for several private and public enterprises across the globe. Further, in January 2021, BIOS Middle East, a leading provider of cloud and managed IT services in the Middle East, announced it has established two new cloud footprints in Riyadh and Jeddah to serve customers in the Kingdom of Saudi Arabia. Such instances are expected to increase the demand for data center cooling solutions in the country.

MEA Data Center Cooling Industry Overview

The Middle East and Africa Data Center cooling market is moderately fragmented and consists of several players. In terms of market share, few of the major players currently dominate the market. However, with innovative and sustainable packaging, many of the companies are increasing their market presence by securing new contracts and by tapping new markets.

- May 2021 - Global technology company SAP has announced its partnership with The National Central Cooling Company PJSC (Tabreed), the leading UAE-based international district cooling developer, in a move that will contribute to the digital transformation of the district cooling industry.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Assessment of Impact of COVID-19 on the Industry

- 4.3 Market Drivers

- 4.3.1 Development in IT Infrastructure in the Emerging Countries

- 4.3.2 Emergence of Green Data Centers

- 4.4 Market Restraints

- 4.4.1 Adaptability Requirements and Power Outages

- 4.5 Industry Policies

- 4.6 Industry Value Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Force Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Solution

- 5.1.1 Air Conditioners/Handlers

- 5.1.2 Row/Rack/Door/Overhead Cooling Systems

- 5.1.3 Chillers

- 5.1.4 Liquid Cooling Systems

- 5.1.5 Economizer Systems

- 5.2 By Service

- 5.2.1 Installation and Deployment

- 5.2.2 Consulting, Support and Maintenance Services

- 5.3 By End-User Vertical

- 5.3.1 Information Technology

- 5.3.2 BFSI

- 5.3.3 Telecommunication

- 5.3.4 Healthcare

- 5.3.5 Government

- 5.3.6 Other End-User Verticals

- 5.4 By Country

- 5.4.1 United Arab Emirates

- 5.4.2 Saudi Arabia

- 5.4.3 South Africa

- 5.4.4 Rest of MENA

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Vertiv Co.

- 6.1.2 Schneider Electric SE

- 6.1.3 STULZ GMBH

- 6.1.4 Daikin Industries Ltd

- 6.1.5 Trane Inc.

- 6.1.6 Johnson Controls International Plc

- 6.1.7 Mitsubishi Electric Corporation

- 6.1.8 Rittal GmbH & Co. KG

- 6.1.9 Nortek Air Solutions LLC

- 6.1.10 Munters Group AB

- 6.1.11 Asetek A/S

- 6.1.12 Chilldyne Inc.

- 6.1.13 CoolIT Systems Inc.

- 6.1.14 Liquid Cool Solutions

- 6.1.15 Green Revolution Cooling Inc.

7 INVESTMENT ANALYSIS

8 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219