|

市场调查报告书

商品编码

1630327

石油和天然气下游 -市场占有率分析、行业趋势、统计、成长预测(2025-2030)Oil & Gas Downstream - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

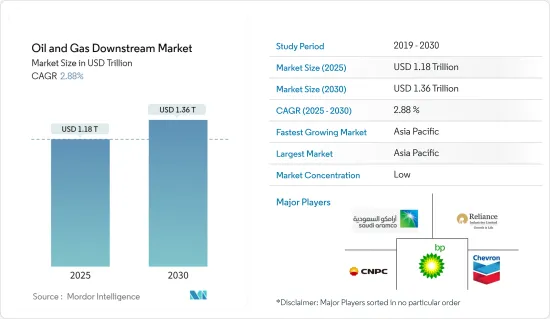

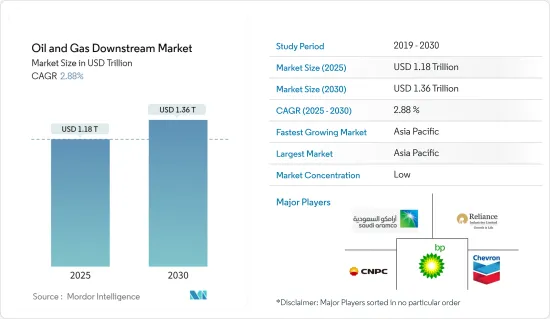

预计2025年石油和天然气下游市场规模为1.18兆美元,预计2030年将达1.36兆美元,预测期内(2025-2030年)复合年增长率为2.88%。

主要亮点

- 从中期来看,亚太和中东地区精製能力的增加以及新兴国家工业化程度的提高等因素预计将在预测期内推动石油和天然气下游市场的发展。

- 在已开发经济体和新兴经济体中,省油车的份额不断增加以及电动车的普及率不断提高,预计将在预测期内阻碍市场发展。

- 精製和石化行业的数位化和现代化预计将降低精製成本和製程损失。预计这将在预测期内创造市场机会。

- 下游油气市场以亚太地区为主,需求大多来自中国、东南亚和印度。

油气下游市场趋势

炼油厂预计主导市场

- 炼油厂是加工原油并将其转化为汽油、柴油、喷射机燃料、暖气油和石化产品等精製产品的工业设施。炼油厂在石油和天然气产业的下游部门发挥重要作用,提供精製以满足能源和化学需求。

- 炼油厂地理位置优越,靠近石油生产区、主要航线和主要需求区。北美、欧洲、亚太地区和中东/非洲等地区有重要的精製地点。

- 此外,各国正专注于加强炼油厂以提高加工能力。例如,根据能源研究所《世界能源统计评论》的数据,到 2023 年,亚太地区将占全球精製能力的近 36.2%,而北美这一比例为 21.2%。

- 多家公司正在投资现有炼油厂,以提高精製能力。例如,2023年3月,泰国国家石油公司宣布计划将其是拉差香甜辣椒酱炼油厂的精製能力从目前的280kb/d增加400kb/d。该计划预计2025年完工,耗资约5亿美元。

- 此外,一些公司正在世界各地投资兴建炼油厂。例如,2023年4月,印度大使最近宣布,在印度援助下正在兴建的蒙古第一座精製预计2025年完工。该计划由印度 12 亿美元软贷款资助,蒙古炼油厂第一期工程预计将于 2023年终完工。该炼油厂的加工量约为每年150万吨。

- 此外,2023 年 3 月,泰国石油公司宣布计划在 2023 年至 2025 年间投资 10 亿美元用于发展业务。其中包括 5 亿美元用于扩大炼油厂产能并转向更高附加价值的燃料产品,作为无污染燃料计划(CFP) 策略的一部分。该专案计画将是是拉差香甜辣椒酱(泰国)炼油厂产能从280 kb/d扩大至400 kb/d,将燃料油提质为柴油、喷射机燃料等高附加价值产品。

- 许多国家的政府也采取了多项倡议来建造新的炼油厂。例如,印度政府于2023年2月宣布HPCL拉贾斯坦炼油厂(HRRL)计划于2024年1月完工,并于2024年全面运作。据能源部长称,政府将要求总理莫迪于 2024 年 1 月开放炼油厂。

- 因此,增加现有炼油厂的精製能力和建立新的炼油厂预计将见证全球石油和天然气下游产业的成长。

亚太地区预计将主导市场

- 在该地区新兴经济体能源需求不断增长的推动下,亚太地区石油和天然气下游市场正经历强劲成长。随着人口成长和工业化,中国和印度等国家的能源消耗迅速增加,导致下游领域的投资增加,例如扩大精製能力、对现有精製进行现代化改造以及开发石化联合体。

- 根据世界能源统计,2023年亚太地区精製能力将达3,740万桶/日。截至2023年,印度精製能力几乎占全球的4.9%。对精製石油产品的需求不断增长正促使下游公司投资新计画并扩大现有设施。

- 例如,2023年9月,印度总理为巴拉特石油公司(BPCL)位于比纳的炼油厂扩建和待开发区石化计划奠基。该扩建计划预计将使BPCL的精製能力从780万吨/年增加到1,100万吨/年。也将兴建一座石化产品年产量超过220万吨的生产基地。该计划耗资59亿美元。

- 截至2023年,中国精製能力将占全球的17.9%。该国的石化和精製业预计在预测期内将转好。

- 2023年3月,沙乌地阿美公司及其中国合作伙伴宣布,计画于2026年将位于中国东北部的石化炼油计划全面投产,以满足中国日益增长的石化产品和燃料需求。计划位于辽宁省岩津市,预计耗资100亿美元,将是阿美公司在中国的第二个重大精製和石化投资。

- 此外,2023年3月,韩国乐天集团子公司乐天化学印尼公司成功资金筹措,在印尼万丹省建立石化联合企业。该计划名为 LINE,是 PT Lotte Chemical Indonesia 的一项重大投资,总价值达 39 亿美元。 2025年完工后,LINE石化联合体将具备年产100万吨乙烯及52万吨丙烯的生产能力。

- 由于精製和石化行业的投资增加以及各国现有下游基础设施的扩建,预计在预测期内,石油和天然气下游市场将由该地区主导。

石油天然气下游产业概况

油气下游市场适度细分。该市场的主要企业包括信实工业有限公司、英国石油公司、沙乌地阿美公司、中国石油天然气集团公司和雪佛龙公司。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 2029年之前的市场规模与需求预测(单位:美元)

- 石油和天然气生产情境(2013-2029)

- 油气消费情境(2013-2029)

- 炼油厂产能(2013-2029)

- 主要计划资讯

- 现有计划

- 正在进行的计划

- 即将进行的计划

- 原油价格走势分析(2013-2023)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 司机

- 提高亚太和中东精製能力

- 新兴国家工业化进展

- 抑制因素

- 电动车的扩张

- 司机

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

第五章市场区隔

- 类型

- 炼油厂

- 石化厂

- 市场分析:按地区(2029 年之前的市场规模和需求预测)

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 法国

- 义大利

- 德国

- 英国

- 西班牙

- 北欧国家

- 土耳其

- 俄罗斯

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 印尼

- 日本

- 韩国

- 马来西亚

- 泰国

- 越南

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 南非

- 奈及利亚

- 卡达

- 埃及

- 其他中东/非洲

- 北美洲

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- Reliance Industries Ltd

- Royal Dutch Shell PLC

- The Dow Chemical Company

- BP PLC

- Saudi Aramco

- Indian Oil Corporation Limited

- China National Petroleum Corporation

- Total SA

- Chevron Corporation

- List of Other Prominent Companies

- 市场排名/份额(%)分析

第七章 市场机会及未来趋势

- 精製石化产业数位化、现代化

简介目录

Product Code: 68192

The Oil & Gas Downstream Market size is estimated at USD 1.18 trillion in 2025, and is expected to reach USD 1.36 trillion by 2030, at a CAGR of 2.88% during the forecast period (2025-2030).

Key Highlights

- In the medium term, factors such as increasing refining capacity across Asia-Pacific and the Middle East and rising industrialization in developing countries are expected to drive the oil and gas downstream market during the forecast period.

- The growing share of fuel-efficient vehicles and increasing penetration of electric vehicles in developed and emerging economies are expected to hinder the market's growth during the forecast period.

- Nevertheless, digitalization and modernization of the refining and petrochemical sectors are expected to reduce refining costs and process losses. This, in turn, is expected to create an opportunity for the market during the forecast period.

- Asia-Pacific has dominated the oil and gas downstream market, with the majority of the demand coming from China, Southeast Asia, and India.

Oil & Gas Downstream Market Trends

The Refineries Segment is Expected to Dominate the Market

- Refineries are industrial facilities where crude oil is processed and converted into refined products such as gasoline, diesel, jet fuel, heating oil, and petrochemicals. Refineries play a critical role in the downstream sector of the oil and gas industry by supplying refined products to meet energy and chemical demands.

- Refineries are located strategically near oil production regions, major shipping routes, and key demand centers. Significant refining hubs exist in regions such as North America, Europe, Asia-Pacific, and the Middle East and Africa.

- Further, countries are focused on enhancing their refineries to increase the throughput. For instance, according to the Energy Institute Statistical Review of World Energy, in 2023, Asia-Pacific holds nearly 36.2% of the global refining capacity, whereas North America has 21.2%.

- Several companies are investing in the existing refineries to increase their refining capacity. For instance, in March 2023, Thai Oil Public Company Limited announced that it plans to increase the refining capacity in the Sriracha refinery by 400 kb/d from the current 280 kb/d. The project is expected to be completed by 2025 at approximately USD 500 million.

- Several companies are also investing in the construction of refineries in many regions across the world. For instance, in April 2023, the Indian Ambassador recently announced that Mongolia's first oil refinery, which is being built with Indian assistance, is expected to be completed by 2025. The project is being funded through a USD 1.2 billion Indian soft loan, and the first stage of the Mongol Oil Refinery is set to be completed by the end of 2023. The refinery will have approximately 1.5 million metric tons of processing capacity annually.

- Further, in March 2023, Thai Oil announced plans to invest USD 1 billion in the capital between 2023 and 2025 to grow its business, including USD 500 million to expand its refinery capacity and transition to higher added-value fuel products as part of its Clean Fuel Project (CFP) strategy. The business intends to expand its oil refinery capacity in Sriracha (Thailand) to 400 kb/d, up from 280 kb/d, and upgrade fuel oil to higher-value products such as diesel and jet fuel.

- Governments in many countries also took several initiatives to establish new refineries. For instance, in February 2023, the Government of India announced that the HPPCL Rajasthan Refinery (HRRL) project is anticipated to be completed by January 2024 and be completely operational by 2024. According to the energy minister, the government will ask Prime Minister Narendra Modi to open the refinery in January 2024.

- Hence, increasing the refining capacity of the existing refineries and establishing new refineries are expected to witness the growth of the oil and gas downstream sector globally.

Asia-Pacific is Expected to Dominate the Market

- The Asia-Pacific oil and gas downstream market is witnessing robust growth driven by increasing energy demand in the region's emerging economies. With a growing population and industrialization, countries like China and India are experiencing a surge in energy consumption, boosting investments in downstream activities, including refining capacity expansion, modernization of existing refineries, and the development of petrochemical complexes are key trends in this market.

- According to a Statistical Review of World Energy data, in 2023, Asia-Pacific's oil refining capacity reached 37.4 million barrels per day. As of 2023, India accounted for almost 4.9% of global oil refinery capacity. The increasing demand for refined petroleum products has driven downstream companies to invest in new projects and expand existing facilities.

- For instance, in September 2023, the prime minister of India laid the foundation stone for Bharat Petroleum Corp Ltd's (BPCL) refinery expansion and greenfield petrochemical project in Bina. The expansion project is expected to increase BPCL's refinery capacity to 11m tonnes/year from 7.8m tonnes/year. A manufacturing complex will also be built to produce more than 2.2m tonnes/year of petrochemical products. The cost of this project is USD 5.9 billion.

- As of 2023, China accounted for 17.9% of global oil refining capacity. The country's petrochemical and refinery sector is expected to be positive during the forecast period.

- In March 2023, Saudi Aramco and its Chinese partners announced that they aim to start entire operations at a petrochemical and refinery project in northeast China in 2026 to meet the country's increasing demand for petrochemicals and fuel. The project in Liaoning province's city of Panjin, expected to cost USD 10 billion, will be Aramco's second significant refining-petrochemical investment in China.

- Further, in March 2023, Lotte Chemical Indonesia, a South Korea-based Lotte Group subsidiary, successfully secured financing for constructing a petrochemical complex in Banten Province, Indonesia. The project, known as the LINE, is a significant investment for PT Lotte Chemical Indonesia, with a total cost of USD 3.9 billion. Upon completion in 2025, the LINE petrochemical complex will have the capacity to manufacture 1 million tons of Ethylene and 520,000 tons of Propylene annually.

- Hence, the region is expected to dominate the oil and gas downstream market during the forecast period owing to the increasing investment in the refining and petrochemical sector and the expansion of existing downstream infrastructure in respective countries.

Oil & Gas Downstream Industry Overview

The oil and gas downstream market is moderately fragmented. Some of the key players in the market are Reliance Industry Limited, BP PLC, Saudi Aramco, China National Petroleum Corporation, and Chevron Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Oil and Gas Production Scenario (2013 - 2029)

- 4.4 Oil and Gas Consumption Scenario (2013 - 2029)

- 4.5 Refinery Throughput Capacity (2013 - 2029)

- 4.6 Key Projects Information

- 4.6.1 Existing Projects

- 4.6.2 Projects in Pipeline

- 4.6.3 Upcoming Projects

- 4.7 Crude Oil Price Trend Analysis (2013 - 2023)

- 4.8 Recent Trends and Developments

- 4.9 Government Policies and Regulations

- 4.10 Market Dynamics

- 4.10.1 Drivers

- 4.10.1.1 Increasing Refining Capacity across Asia-Pacific and the Middle East

- 4.10.1.2 Rising Industrialization in Developing Countries

- 4.10.2 Restraints

- 4.10.2.1 Increasing Penetration of Electric Vehicles

- 4.10.1 Drivers

- 4.11 Supply Chain Analysis

- 4.12 Porter's Five Forces Analysis

- 4.12.1 Bargaining Power of Suppliers

- 4.12.2 Bargaining Power of Consumers

- 4.12.3 Threat of New Entrants

- 4.12.4 Threat of Substitutes Products and Services

- 4.12.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Refineries

- 5.1.2 Petrochemical Plants

- 5.2 Geography (Regional Market Analysis {Market Size and Demand Forecast till 2029 (for regions only)})

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.1.3 Rest of North America

- 5.2.2 Europe

- 5.2.2.1 France

- 5.2.2.2 Italy

- 5.2.2.3 Germany

- 5.2.2.4 United Kingdom

- 5.2.2.5 Spain

- 5.2.2.6 Nordic Countries

- 5.2.2.7 Turkey

- 5.2.2.8 Russia

- 5.2.2.9 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 China

- 5.2.3.2 India

- 5.2.3.3 Indonesia

- 5.2.3.4 Japan

- 5.2.3.5 South Korea

- 5.2.3.6 Malaysia

- 5.2.3.7 Thailand

- 5.2.3.8 Vietnam

- 5.2.3.9 Rest of Asia-Pacific

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Colombia

- 5.2.4.4 Rest of South America

- 5.2.5 Middle East and Africa

- 5.2.5.1 Saudi Arabia

- 5.2.5.2 United Arab Emirates

- 5.2.5.3 South Africa

- 5.2.5.4 Nigeria

- 5.2.5.5 Qatar

- 5.2.5.6 Egypt

- 5.2.5.7 Rest of Middle East and Africa

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Reliance Industries Ltd

- 6.3.2 Royal Dutch Shell PLC

- 6.3.3 The Dow Chemical Company

- 6.3.4 BP PLC

- 6.3.5 Saudi Aramco

- 6.3.6 Indian Oil Corporation Limited

- 6.3.7 China National Petroleum Corporation

- 6.3.8 Total SA

- 6.3.9 Chevron Corporation

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking/Share (%) Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Digitalization and Modernization of the Refining and Petrochemical Sector

02-2729-4219

+886-2-2729-4219