|

市场调查报告书

商品编码

1640411

美国石油和天然气下游 -市场占有率分析、行业趋势、成长预测(2025-2030)United States Oil And Gas Downstream - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

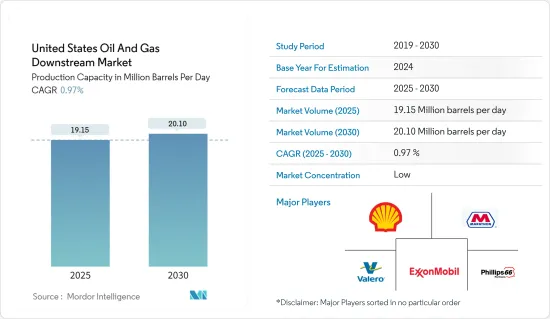

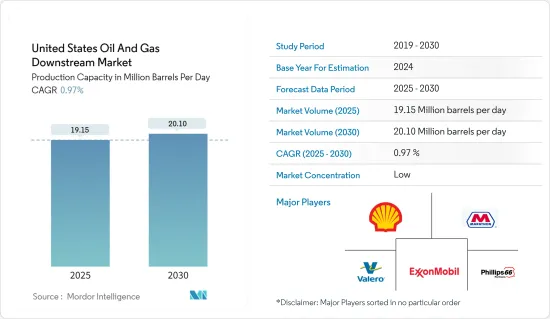

根据产能,美国下游油气市场预计将从2025年的1915万桶/日成长到2030年的2010万桶/日,预测期间(2025-2030年)复合年增长率为0.97%。

美国石油和天然气下游市场预计在预测期内复合年增长率为0.92%。

主要亮点

- 从中期来看,石油产品需求增加和炼油厂即将投资等因素预计将在预测期内推动美国石油和天然气下游市场的发展。

- 另一方面,可再生能源等清洁能源技术的采用预计将对电力产业产生重大影响,并在未来几年影响石油和天然气产业。

- 根据国际能源总署 (IEA) 预测,到 2050 年,石化产品预计将成为全球石油需求中唯一成长的部分。此外,美国的几个石化计划预计将在预测期内运作。因此,石化产业预计将成为该国下游企业的主要成长机会。

美国油气下游市场走势

精製业温和成长

- 美国的能源需求最近有所增加。这种需求的成长是由于已开发国家的人口成长和生活水准的提高。石油燃料仍然是全球主要能源来源,新能源和可再生能源在国内越来越受欢迎。这一趋势预计将持续数十年,使石油业的所有部门受益。

- 工业活动的活性化和经济成长预计将支持精製产业。预计马萨诸塞州、康乃狄克州和明尼苏达州等已开发国家未来几年对柴油和其他馏分油的需求将保持强劲。需求的成长得益于这些国家炼油工业的实力。

- 预计美国墨西哥湾沿岸地区在预测期内将出现新一波下游投资浪潮。此外,自页岩革命开始以来,美国页岩产量几乎翻了一番,并且预计将继续增加。

- 截至2023年,美国精製能力将达到1,842万桶/日。随着持续投资和激烈竞争,2023年美国精製能将以2%的速度成长。

- 截至2023年,美国有132家正在营运的精製。美国最新的炼油厂是位于德克萨斯州Channelview 的45,000 桶/CD 德克萨斯国际码头炼油厂,该炼油厂于2022 年1 月1 日开业,但实际上将于2022 年2 月开始运营。

- 2024年6月,Element Fuels Holdings提案兴建日产能50,000至55,000桶的炼油厂。该公司预计在早期开发阶段投资约12亿美元。

- 除此类计划外,国内石油需求也逐年增加。例如,2023年石油需求成长近1%,达到约20,360桶/日。同样,去年石油需求也有所增加。

- 因此,石油需求的增加以及精製业即将进行的投资预计将在预测期内温和成长。

石油产品需求增加

- 石油包括精製石油产品,如汽油、柴油、喷射机燃料和精製,以及液体,如燃料级乙醇、汽油混合成分和其他精製投入。

- 儘管美国消耗的大部分石油都是自己生产的,但它仍然依赖进口来满足不断增长的需求。从其他国家进口有助于满足国内石油需求。根据能源资讯署统计,2023年该国每天进口原油及产品852.6万桶,与前一年同期比较成长约2.3%。

- 其中,进口石油产品61,338,000桶。液化天然气367万桶,成品汽油329.4万桶,其余为煤油、重油、柴油等。

- 除了进口外,该国还在不断增加石油产品的产量。 2023年石油产品产量从2022年的1,939万桶/日增加到1,943万桶/日。此外,由于运输和工业等领域的消费增加,未来几年对石油产品的需求可能会增加。

- 2023年,美国乘用车销量将成长约9%。乘用车销量从2022年的285万辆增加到2023年的311万辆。随着人口和收入的成长,乘用车销售量可能会增加,导致该国对石油产品的需求增加。

- 此外,还有航空和铁路两个运输业,其扩张可能会进一步增加石油产品的消耗。

- 因此,这种情况预计将在未来几年推动美国石油和天然气下游市场的发展。

美国油气下游产业概况

美国下游油气市场呈现半碎片化,多家主要企业进入该市场,包括(排名不分先后)马拉松石油公司、雪佛龙公司、瓦莱罗能源公司、埃克森美孚公司、菲利普斯66公司和皇家石油公司荷兰壳牌公司已成为。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 市场定义

- 研究场所

- 研究成果

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 精製能力(100万桶/天)和预测到2029年

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 石油产品需求增加

- 精製业的未来投资

- 抑制因素

- 采用清洁能源技术

- 促进因素

- PESTLE分析

- 投资分析

第五章依行业区隔市场

- 精製

- 石化

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- Marathon Petroleum Corp.

- Phillips 66

- Valero Energy Corporation

- Exxon Mobil Corporation

- Shell Plc

- Hunt Refining Company

- US Oil & Refining Co.

- 其他知名公司名单

- 市场排名分析

第七章 市场机会及未来趋势

- 多个产业对石化产品的需求

The United States Oil And Gas Downstream Market size in terms of production capacity is expected to grow from 19.15 million barrels per day in 2025 to 20.10 million barrels per day by 2030, at a CAGR of 0.97% during the forecast period (2025-2030).

The United States oil and gas downstream market is expected to register a CAGR of 0.92% during the forecast period.

Key Highlights

- Over the medium term, factors such as increasing petroleum products demand, and upcoming investment in oil refineries are likely to drive the United States oil and gas downstream market during the forecast period.

- On the other hand, adopting clean energy technology, like renewables, is expected to significantly influence the power sector, thus impacting the oil and natural gas industry in the upcoming years.

- Nevertheless, according to the International Energy Agency, petrochemicals are expected to become the only growing segment of global oil demand by 2050. Moreover, several petrochemical projects are expected to come online in the United States during the forecast period. Hence, the petrochemical sector is expected to present a huge growth opportunity for the downstream players in the country.

US Downstream Oil and Gas Market Trends

Refining Sector to Register a Modest Growth

- The United States has been witnessing growing energy demand in recent days. This growth in demand can be attributed to the growing population and an improvement in living standards in the developed states. Even though new and renewable energy sources are gaining popularity around the country, petroleum fuel remains a major energy source globally. This trend is expected to continue for the next few decades and benefit all sectors of the petroleum industry.

- Increasing industrial activity and economic growth are likely to support the refining industry. In developed states such as Massachusetts, Connecticut, and Minnesota, the demand for diesel and other distillates is expected to be robust in the coming years. This demand growth can be attributed to the strong refinery industry in these countries.

- The United States Gulf Coast region is expected to witness a fresh wave of investment in the downstream business during the forecast period. In addition, the United States' shale production has almost doubled since the shale revolution started and is expected to increase further.

- As of 2023, the refining capacity of the United States stood at 18.42 million barrels per day. With continuous investments and high competition, the refining throughput of the United States increased at a rate of 2% in 2023.

- As of 2023, there were 132 operable petroleum refineries in the United States. The newest refinery in the United States is the Texas International Terminals 45,000 b/cd refinery in Channelview, Texas, which was operable on January 1, 2022, but actually started operating in February 2022.

- In the June 2024, Element Fuels Holdings proposed to build a refinery with a capacity of around 50,000 to 55,000 barrels per day. The company estimatewd to have an investment of around USD 1.2 billion in the initial phase of development.

- Apart from such projects, demand for oil in the country is increasing over the years. For instance, in 2023, the oil demand increased by nearly 1% to around 20.36 thousand barrels per day. Similarly, in the previous year, the country witnessed growth in oil demand.

- Hence, increased in oil demand, along with upcoming investment in the refining sector is expected to have a moderate growth in the forecast period.

Increasing Demand for Petroleum Products

- Petroleum includes refined petroleum products, such as gasoline, diesel fuel, jet fuel, unfinished oils, and other liquids, such as fuel ethanol, blending components for gasoline, and other refinery inputs.

- The United States produces a large share of the petroleum it consumes, but the country still relies on imports to meet the increasing demand. Imports from other countries help to meet the domestic demand for petroleum. According to the Energy Information Agency, in 2023, the country imported 8526 thousand barrels per day of crude oil and products, an increase of around 2.3% as compared to the previous year.

- Among all, 61338 thousand barrel of petrolume producst were imported. 3670 thousand barrels were natural gas liquids, 3294 thousand barrels were finished motor gasoline, and rest were kerosene, fuel oil, diesel fuel, etc.

- In addition to imports, the country is continously increasing its petroleum products output. In 2023, petroleum products output increased to 19.43 million barrels per day, from 19.39 million barrels per day in 2022. Further, in the upcoming years, the demand for petroleum products are likley to increase due to increasing consumption in sectors like transportation, and industries.

- In 2023, the United States witnessed increased in sales of passenger vahicles by around 9%. From 2.85 million in 2022, the passenger vehicle sales increased to 3.11 million in 2023. With increase in population, and income, sales of such vehicles are likley to increase, thus increasing demand for petroleum products in the country.

- In addition, aviation and railway are another two transportation industry, expantion of which is further likely to increase consumption of petrioleum products.

- Hence, such a scenario is expected to drive the United States oil and gas downstream market in the upcoming years.

US Downstream Oil and Gas Industry Overview

The market for United States oil and gas downstream market is semi-fragmented, with a number of key players, including (in no particular order) Marathon Petroleum Corp., Chevron Corporation, Valero Energy Corporation, Exxon Mobil Corporation, Phillips 66, and Royal Dutch Shell PLC.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Market Definition

- 1.2 Study Assumptions

- 1.3 Study Deliverables

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Refining Capacity and Forecast in million barrels per day, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Demand for Petroleum Products

- 4.5.1.2 Upcoming Investment in the Refining Sector

- 4.5.2 Restraints

- 4.5.2.1 Adoption of Clean Energy Technology

- 4.5.1 Drivers

- 4.6 PESTLE Analysis

- 4.7 Investment Analysis

5 MARKET SEGMENTATION BY SECTOR

- 5.1 Refining

- 5.2 Petrochemical

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Marathon Petroleum Corp.

- 6.3.2 Phillips 66

- 6.3.3 Valero Energy Corporation

- 6.3.4 Exxon Mobil Corporation

- 6.3.5 Shell Plc

- 6.3.6 Hunt Refining Company

- 6.3.7 U.S. Oil & Refining Co.

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Demand for Petrochemical in Several Industries