|

市场调查报告书

商品编码

1635506

南美石油天然气下游:市场占有率分析、产业趋势、统计、成长趋势预测(2025-2030)South America Oil and Gas Downstream - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

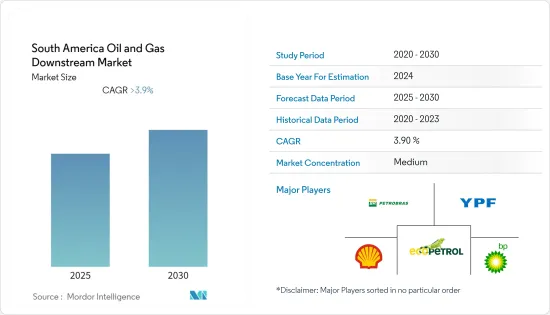

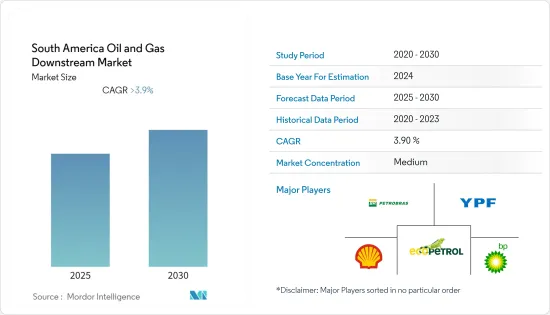

预计南美油气下游市场在预测期内将维持3.9%以上的复合年增长率。

2020 年,市场受到 COVID-19 大流行的负面影响。目前市场处于大流行前的水平。

主要亮点

- 从中期来看,天然气和精炼石油产品需求的增加预计将在预测期内提振南美石油和天然气下游市场的需求。

- 另一方面,生质乙醇和生物柴油等生质燃料的使用增加预计将对石油和天然气下游行业的成长产生负面影响。

- 精製和石化行业的数位化和现代化预计将降低精製成本和製程损失。预计这将在预测期内创造市场机会。

- 预计巴西在预测期内将主导南美石油和天然气下游市场。

南美洲油气下游市场走势

精製业实现大幅成长

- 由于巴西、阿根廷和哥伦比亚等国提案的多个扩建计划,预计南美精製业将在预测期内实现高速成长。根据 OPEC 2022 年年度统计公报,南美炼油厂产能从 2018 年的 6,618,000 桶/日 (kb/d) 增至 2021 年的 6,648 kb/d。

- 在巴西,炼油厂运转率大幅下降,从2008年至2016年的平均85%降至2017年至2019年的75%。由于即将开展的计划和炼油业投资的增加,预计未来几年运转率将会上升。

- 2021年1月,巴西Macro Desenvolvimento获得石油、天然气和生物燃料局(Agency for Petroleum, Natural Gas and 生质燃料)的许可,在甘乃迪总统市建设和运营价值4.8亿美元的天然气处理装置(UPGN)我在圣埃斯皮里图州申请了ANP)。预计 2023 年 12 月开始施工,并于 2025 年竣工。因此,政府向参与企业开放巴西下游产业的措施预计将在预测期内提振巴西下游产业对EPC服务的需求。

- 此外,在阿根廷,YPF(阿根廷领先的石油和天然气公司)持有Luján de Cuyo 炼油厂,名义产能为 114 mbbl/d。该炼油厂的乙基叔丁基醚工厂于 2021 年 8 月开始运作。该工厂是一家维修的前 MTBE 工厂,旨在优化乙醇与汽油的混合。 2021 年,Luján de Cuyo 炼油厂的加工也受到门多萨省盆地原油供应量减少的影响。

- 哥伦比亚的下游石油和天然气产业也显示出发展迹象,特别是炼油业。例如,2022年9月,哥伦比亚国家石油公司Ecopetrol完成了其位于卡塔赫纳的Reficar炼油厂的扩建,以满足国内不断增长的燃料需求。此次扩建加强了卡塔赫纳炼油厂作为保障哥伦比亚能源主权的战略资产的地位。该炼油厂还将生产硫含量分别低于 100 ppm 和 50 ppm 的柴油和汽油。这些发展可能对该地区的炼油业产生正面影响。

- 因此,基于上述因素,预计炼油业在预测期内将在南美石油和下游天然气市场出现显着成长。

巴西主导市场

- 截至2021年,巴西拥有17家炼油厂,其中国营石油天然气公司Petrobras营运该国总炼油能力的98%。大多数炼油厂位于巴西海岸的需求中心附近。作为其战略计划(2021-2025)的一部分,巴西国家石油公司宣布出售其 12 家现有炼油厂中的 8 家,併计划到 2022 年出售中游和燃料分销部门的剩余股权。此举由巴西矿业和能源部主导,旨在使该部能够有效过渡到开放和竞争的下游产业。

- 除了现有炼油厂外,预计私人公司也将在未来几年进入巴西炼油厂市场。例如,2020年5月,美国石油集团宣布计画斥资3亿美元在巴西里约热内卢阿库港兴建炼油厂,产能2万桶/日。该工厂预计将于 2024 年投入运作,并可在未来几年内扩大至 50,000 桶/日。该公司也考虑在巴西再建五家小型炼油厂。

- 只有在国有企业开始销售衍生性商品以符合国际价格后,私人企业才能进入市场。此前,低于市场价格销售产品导致了巨大损失,并阻碍了市场参与企业进入市场。

- 根据欧佩克年度统计快报(2022年),该国2021年炼油厂吞吐能力为178.5万桶/日,比前一年(171.7万桶)增加约4%。

- 因此,由于上述因素,预计巴西在预测期内将主导南美洲地区的油气下游领域。

南美洲油气下游产业概况

南美下游油气市场本质上是适度一体化的。市场主要企业包括(排名不分先后)Petrobras、YPF SA、Ecopetrol SA、壳牌 PLC 和 BP PLC。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 至2027年精製能力及预测(单位:百万桶/日)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 抑制因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

第五章市场区隔

- 按行业分类

- 炼油厂

- 市场概况

- 主要计划资讯

- 石化厂

- 市场概况

- 主要计划资讯

- 炼油厂

- 按地区

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- Petrobras

- YPF SA

- Ecopetrol SA

- Shell PLC

- BP PLC

- Exxon Mobil Corporation

第七章 市场机会及未来趋势

简介目录

Product Code: 92923

The South America Oil and Gas Downstream Market is expected to register a CAGR of greater than 3.9% during the forecast period.

The market was negatively impacted by the COVID-19 pandemic in 2020. Presently, the market has reached pre-pandemic levels.

Key Highlights

- Over the medium term, factors such as the increasing demand for natural gas and refined petroleum products are expected to boost the demand for the oil and gas downstream market in South America during the forecast period.

- On the flip side, increased use of biofuels such as bioethanol and biodiesel is expected to negatively impact growth in the downstream oil and gas sector.

- Nevertheless, the digitalization and modernization of the refining and petrochemical sector are expected to reduce refining costs and process losses. This, in turn, is expected to create an opportunity for the market during the forecast period.

- During the forecast period, Brazil is expected to dominate South America's oil and gas downstream market.

South America Oil & Gas Downstream Market Trends

Refinery Sector to Witness Significant Growth

- South America's refining sector is expected to register high growth during the forecast period, owing to the several expansion projects proposed by countries like Brazil, Argentina, Colombia, etc. According to OPEC Annual Statistical Bulletin 2022, in South America, the capacity of refineries had increased from 6,618 thousand barrels per day (kb/d) in 2018 to 6,648 kb/d in 2021.

- The refinery utilization rate dropped sharply in Brazil, from an average of 85% in 2008-2016 to 75% in 2017-2019. This rate is expected to be increased in the coming years, owing to upcoming projects and increasing investments in the refinery sector.

- In January 2021, Brazilian company Macro Desenvolvimento requested authorization from the National Agency of Petroleum, Natural Gas and Biofuels (ANP) to build and operate a USD 480 million natural gas processing unit (UPGN) in Presidente Kennedy municipality, Espirito Santo. The construction work is planned to start in December 2023 and is expected to be completed by 2025. Therefore, the government's move to open the country's downstream sector to private players is expected to boost the demand for EPC services in the downstream segment in Brazil during the forecast period.

- Moreover, In Argentina, the YPF (Argentina's major oil and gas company) has the Lujan de Cuyo refinery, which has a nominal capacity of 114 mbbl/d. In August 2021, this refinery started the operation of the ethyl tertiary-butyl ether plant. This plant is a revamp of a former plant of MTBE, and its goal is to optimize the blending of ethanol in motor gasoline. In 2021, the processing of the Lujan de Cuyo refinery was also affected by the lower availability of crude oil from the basins of the Mendoza Province.

- Furthermore, Colombia is also showing signs of development in the country's downstream oil and gas sector, particularly in the refineries segment. For instance, in September 2022, Colombian state oil company Ecopetrol completed expansion works at its Reficar oil refinery in Cartagena as it seeks to meet rising domestic fuel demand. This expansion consolidates the Cartagena refinery as a strategic asset to guarantee Colombia's energy sovereignty. Also, this refinery would now produce diesel and gasoline with sulfur content levels below 100 parts per million (ppm) and 50 ppm, respectively. Such developments are likely to create a positive impact on the refinery sector in the region.

- Therefore, based on the above factors, the refinery sector is expected to witness significant growth in South America's oil and downstream gas market during the forecast period.

Brazil to Dominate the Market

- As of 2021, Brazil has 17 refineries, of which 98% of the country's total refining capacity is operated by the state-owned oil and gas company Petrobras. Most of the refineries are located near demand centers on the country's coast. As part of its Strategic Plan (2021-2025), Petrobras announced the divestment of eight of its 12 existing refineries and plans to sell its remaining stakes in the midstream and fuels distribution sectors by 2022. This move, initiated by Brazil's Mines and Energy Ministry, is aimed at facilitating the sector's ability to achieve an effective transition to an open and competitive downstream sector.

- In addition to the existing refineries, private firms are planning to enter Brazil's refining market in the coming years. For instance, in May 2020, the US-based firm Oil Group announced its plans to build a USD 300 million refinery with a capacity to deliver 20,000 b/d of oil derivatives in Brazil's Acu port, Rio de Janeiro. The plant is expected to come online by 2024, with the possibility of being expanded to 50,000 b/d in the coming years. The company is also studying the implementation of five more small refineries in Brazil.

- The entrance of private players in the market only became possible after the state firm started following international prices for derivatives sales. Before that, the sale of products below market prices generated big losses for the firm and prevented competitors from participating.

- According to the OPEC Annual Statistical Bulletin 2022, the country's refinery throughput totaled 1,785 thousand barrels per day in 2021, i.e., an increase of about 4% when compared to the previous year's value (1,717 thousand barrels per day).

- Therefore, based on the above-mentioned factors, Brazil is expected to dominate the oil and gas downstream sector in the South American region during the forecast period.

South America Oil & Gas Downstream Industry Overview

The South American oil and gas downstream market is moderately consolidated in nature. Some of the major players in the market (in no particular order) include Petrobras, YPF SA, Ecopetrol SA, Shell PLC, and BP PLC.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Refining Capacity and Forecast in million barrels per day, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Sector

- 5.1.1 Refineries

- 5.1.1.1 Market Overview

- 5.1.1.2 Key Project Information

- 5.1.2 Petrochemical Plants

- 5.1.2.1 Market Overview

- 5.1.2.2 Key Project Information

- 5.1.1 Refineries

- 5.2 By Geography

- 5.2.1 Brazil

- 5.2.2 Argentina

- 5.2.3 Colombia

- 5.2.4 Rest of South America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Petrobras

- 6.3.2 YPF SA

- 6.3.3 Ecopetrol SA

- 6.3.4 Shell PLC

- 6.3.5 BP PLC

- 6.3.6 Exxon Mobil Corporation

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219