|

市场调查报告书

商品编码

1639465

泰国石油和天然气下游市场 -市场占有率分析、行业趋势、成长预测(2025-2030)Thailand Oil and Gas Downstream - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

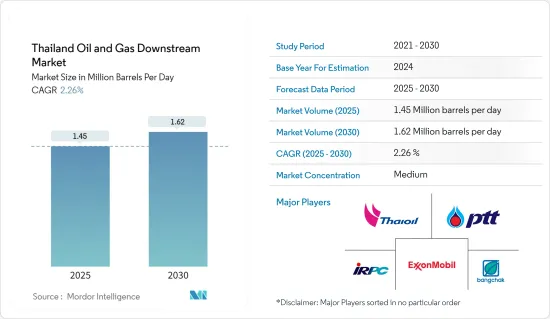

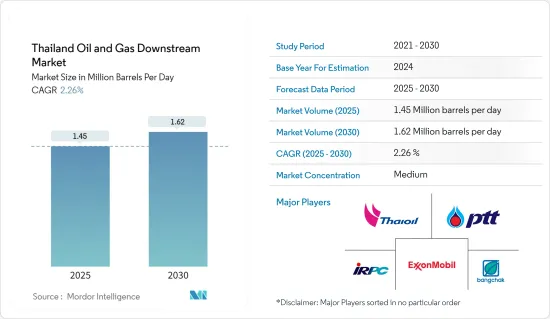

泰国石油和天然气下游市场规模预计2025年为145万桶/日,预计2030年将达到162万桶/日,预测期间(2025-2030年)复合年增长率为2.26%。

受访的市场在 2020 年受到了 COVID-19 的负面影响,但现在已恢復并达到疫情前的水平。随着各种精製产品的需求不断增长,该国正在重点发展炼油产能,预计这将在预测期内推动所研究市场的成长。然而,清洁替代能源的趋势,例如电动车的日益普及,预计将阻碍最终用户行业对精製油的需求并抑制市场成长。

安达曼海发现了天然气田,这让人们对减少对进口天然气的依赖和天然气运输成本的乐观增加。这一因素为这一领域的参与企业创造了机会。

泰国油气下游市场走势

炼油精製能确认成长

儘管泰国消耗的大部分石油都是自己生产的,但它仍然依赖进口来满足不断增长的需求。据泰国能源和工程部称,2020年汽油需求量每天超过3000万升,但2021年前10个月燃料(柴油和汽油)消费量下降4.4%,日均1.31亿升,同年与COVID-19 之前的水平相同。

就精製和加工能力而言,泰国的炼油业是东南亚第二大炼油业,仅次于新加坡。在泰国,2016年至2019年炼油产能保持相对稳定,从2016年的1,234,500桶/日增加到2021年的1,244,500桶/日。近年来,炼油厂加工能力不断增加。该国拥有六座炼油厂,其中大部分由该国国有石油和天然气集团 PTT 部分或全部拥有。该国正在积极提高精製能力,以满足不断增长的国内和地区需求。例如,泰国石油公司的是是拉差香甜辣椒酱炼油厂扩建计划是该公司无污染燃料计划(CFP)的一部分,预计到2023年终竣工后总产能将达到40万桶/日。

由于炼油厂扩建和精製油需求增加,泰国精製能力预计在预测期内略有增加。

石油和天然气产量下降抑制市场

泰国正在转型为“泰国4.0”,工业向技术进步和先进服务迈进。政府已将「下一代汽车」的发展指定为最重要的目标产业,并正在支持旨在从内燃机汽车(ICE)转向东南亚电动车生产中心的电动车相关企业。

在泰国政府为促进电动车市场成长而采取的有利措施的支持下,电动车 (EV) 产业正在引起人们的兴趣。例如,泰国政府制定了电动车奖励制度,包括税收减免和补贴,以促进该国电动车市场的发展。

2020 年国家电动车政策委员会推出了蓝图,制定了 2021 年至 2035 年泰国电动车发展框架,改造泰国现有的零排放车 (ZEV) 生产汽车供应链,建立现代化出行的技术能力。蓝图不仅涵盖了电动车的生产和使用,还包括电池製造和供应的发展、充电站和电网管理等配套基础设施以及相关安全标准和法规的规划,以实现全面、一体化的实施。总体规划中的电动车涵盖了各种车辆,包括摩托车、三轮车、巴士、卡车和渡轮。

泰国消费税部宣布,投资委员会(BOI)推广的10人座及以下电动乘用车将从2020年1月1日至2022年12月31日以及2023年1月1日至2025年享受0%的税收。

该国新登记的纯电动车从2019年的724辆增加到2021年的2079辆。随着电动车数量的增加,该国公共和私营部门的投资都在增加,充电站的数量也迅速增加。根据EVAT统计,2021年6月,全国10家开发商提供了2224个充电桩,安装充电站超过664个。泰国政府的目标是到2036年在全国拥有690个充电站和120万辆电动车。

交通运输业在泰国下游油气经济中扮演重要角色。因此,电动车的引入预计将阻碍泰国石油和天然气下游市场的成长。

泰国油气下游产业概况

泰国的石油和天然气下游市场本质上是部分一体化的。市场主要企业(排名不分先后)包括埃克森美孚公司、PTT Public Company Limited、Thai Oil PCL、IRPC PCL、Bangchak Petroleum Public Company 等。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第二章调查方法

第三章执行摘要

第四章市场概况

- 介绍

- 至2027年精製能力及预测(单位:千桶/日)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 抑制因素

- 供应链分析

- PESTLE分析

第五章市场区隔

- 透过炼油厂

- 概述

- 现有、兴建及规划计划

- 由石化厂

- 概述

- 现有、兴建及规划计划

- 燃料零售/销售

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- PTT Public Company Limited

- Esso Thailand PLC

- Bangchak Corporation PCL

- Royal Dutch Shell PLC

- Caltex(Chevron Corporation)

- SCG Chemicals Co. Ltd(Siam Cement Group)

- IRPC Public Company Limited

- Total SA

- ExxonMobil Corp.

- PTG Energy PCL

第七章 市场机会及未来趋势

The Thailand Oil and Gas Downstream Market size is estimated at 1.45 million barrels per day in 2025, and is expected to reach 1.62 million barrels per day by 2030, at a CAGR of 2.26% during the forecast period (2025-2030).

Although the market studied was negatively impacted by COVID-19 in 2020, it has recovered and reached pre-pandemic levels. With the growing demand for various refined products, the country is focused on developing its refinery capacity, which is expected to drive the growth of the market studied during the forecast period. However, the shifting trend toward cleaner alternatives, such as the increasing adoption of electric vehicles, is expected to hinder the demand for refined products from end-user industries, which is expected to restrain the market's growth.

Gas fields have been discovered in the Andaman Sea, increasing optimism about reducing the dependence on imported gas and the cost of natural gas transportation. This factor is creating an opportunity for the players in the sector.

Thailand Oil and Gas Downstream Market Trends

Oil Refining Capacity to Witness Growth

Thailand produces a large share of the petroleum it consumes but still relies on imports to meet the increasing demand. Demand for gasoline stood above 30 million liters a day in 2020, while fuel (diesel and gasoline) consumption took a plunge of 4.4% in the first ten months of 2021 to a daily average of 131 million liters, the same level as before COVID-19 level, according to Department of Energy Business, Thailand.

The refinery sector of Thailand is the second largest in Southeast Asia in refining capacity and throughput, just after Singapore. In Thailand, the refineries' capacity has remained relatively stable during 2016-2019, at 1,234,500 barrels per day in 2016, which increased to 1,244,500 barrels per day in 2021. The refinery throughput has been increasing in recent years. The country has six refinery complexes, the majority of which are owned partially or fully by the country's national oil and gas conglomerate PTT. The country has been actively increasing its refining capacity to meet its growing domestic and regional demand. For instance, the expansion project of Thai Oil's Sriracha refinery, a part of the company's Clean Fuel Project (CFP), is expected to have a total capacity of 400,000 b/d when completed at the end of 2023.

Thailand's oil refining capacity is expected to grow slightly during the forecast period due to the expansion of refineries and increased demand for refined oil.

Decreasing Oil and Gas Production to Restrain the Market

Thailand is trying to transform into 'Thailand 4.0,' whose industries transition to technological advances and high-level services. The government designated 'next-generation automotive' development among the top targeted industries and supported EV-related businesses to transform from internal combustion engine (ICE) vehicles to an EV production hub in Southeast Asia.

The electric vehicle (EV) industry is gaining interest in Thailand, supported by favorable government policies to push the EV market's growth. For example, the government of Thailand rolled out EV incentive schemes, i.e., tax benefits and subsidy systems, to propel the development of the EV market in the country.

The National Electric Vehicles Policy Committee 2020 introduced a roadmap that lays out a framework for Thailand's EV development from 2021-2035 to transform the country's well-established automotive supply chain for the production of zero-emission vehicles (ZEVs) and build the technological capacity for modern mobility. The roadmap covers not only EV production and usage but also developing plans for battery manufacturing and supplies, supporting infrastructure, including charging stations and power grid management, and the development of related safety standards and regulations to enable comprehensive and integrated implementation. EVs in the master plan covers various vehicles, including motorcycles, tricycles, buses, trucks, and ferry boats.

The Excise Department of Thailand has been applying an excise tax rate of 0% from 1 January 2020 to 31 December 2022 and 2% from 1 January 2023 to 31 December 2025 to electric-powered passenger vehicles with seating not exceeding ten seats which are promoted by the Board of Investment (BOI).

The country's newly registered battery electric vehicles grew from 724 in 2019 to 2,079 in 2021. With an increase in the number of EVs, the country is also witnessing a surge in the number of charging stations with rising investments from both the public and private sectors. According to EVAT, the country had over 664 charging stations with 2,224 chargers from 10 developers nationwide in June 2021. By 2036, the Thai government aims to have 690 charging stations and 1.2 million electric vehicles nationwide.

The transportation sector plays a vital role in Thailand's downstream oil and gas economy. Therefore, the adoption of EVs is expected to hamper the growth of the downstream oil and gas market in Thailand.

Thailand Oil and Gas Downstream Industry Overview

The Thailand oil and gas downstream market is partially consolidated in nature. Some of the major players in the market (in no particular order) include Exxon Mobil Corporation, PTT Public Company Limited, Thai Oil PCL, IRPC PCL, and Bangchak Petroleum Public Company, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Installed Refining Capacity and Forecast, in thousand barrels per day, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

5 MARKET SEGMENTATION

- 5.1 By Refineries

- 5.1.1 Overview

- 5.1.2 Existing, Under Construction, and Planned Projects

- 5.2 By Petrochemical Plants

- 5.2.1 Overview

- 5.2.2 Existing, Under Construction, and Planned Projects

- 5.3 By Fuel Retail and Marketing

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 PTT Public Company Limited

- 6.3.2 Esso Thailand PLC

- 6.3.3 Bangchak Corporation PCL

- 6.3.4 Royal Dutch Shell PLC

- 6.3.5 Caltex (Chevron Corporation)

- 6.3.6 SCG Chemicals Co. Ltd (Siam Cement Group)

- 6.3.7 IRPC Public Company Limited

- 6.3.8 Total SA

- 6.3.9 ExxonMobil Corp.

- 6.3.10 PTG Energy PCL