|

市场调查报告书

商品编码

1630371

西欧电池 -市场占有率分析、产业趋势与统计、成长预测(2025-2030)West Europe Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

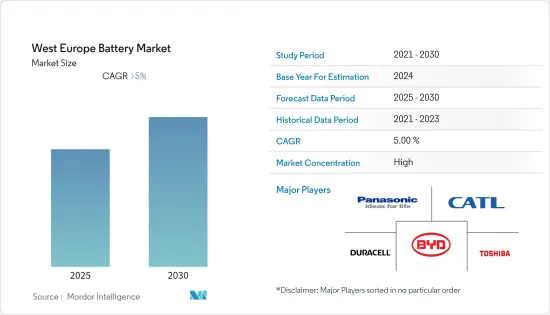

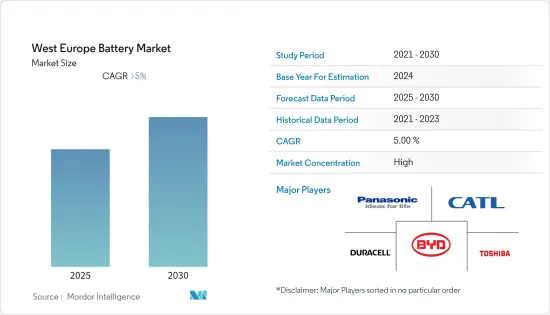

预计西欧电池市场在预测期内将维持5%以上的复合年增长率。

COVID-19 对 2020 年市场产生了负面影响。市场现在可能会达到大流行前的水平。

主要亮点

- 从中期来看,电动车在该地区的不断普及以及清洁能源来源的未来前景预计将推动市场成长。

- 同时,由于供需不匹配导致的电池原材料价格波动预计将阻碍预测期内西欧电池市场的成长。

- 西欧全部区域製造设施数量的增加可能会在预测期内为西欧电池市场创造有利的成长机会。

- 德国在市场上占据主导地位,并且可能在预测期内实现最高的复合年增长率。这一增长归因于可再生能源装置的增加以及从传统燃料到清洁能源来源的逐步过渡。

西欧电池市场趋势

锂离子电池可望主导市场

- 锂离子电池是一种常用于电子设备和能源汽车的可充电电池。该电池还储存来自太阳能和风能等再生能源来源的能量。

- 到2030年,欧洲电动车对锂离子电池的需求预计将达到325吉瓦时。这几乎代表了全球电动车锂离子电池需求的大部分。许多欧洲国家正在逐步淘汰内燃机,在此期间电池需求将大幅增加。

- 此外,该地区国家正在寻求国内投资和製造商。德国和法国等国家正计划减少亚太公司在欧洲的主导地位,影响当地公司在该地区的参与。

- 2022 年 8 月,Eurocell 透露,它正在洽谈在荷兰建设欧洲第一家超级工厂,并向泛欧能源储存和电动车生态系统供应电池。 Eurocell计画分两阶段兴建新的超级工厂,最快于2025年达到满载生产。第一阶段将涉及 2023 年初为欧洲现有客户大规模生产先进电池。到 2025 年,第二阶段预计在同一地点每年生产超过 4,000 万个电池。

- 综上所述,预计锂离子电池产业将在预测期内主导西欧电池市场。

德国可望主导市场

- 德国是欧盟最大的经济体,正在吸引世界各地的投资来开发电池製造设施。

- 此外,政府也计画增加可再生能源发电设施,计画到2025年可再生能源占能源消费量总量的40-45%。这可能会推动电池市场,因为电池可用于储存多余的可再生能源。 2021 年德国太阳能发电装置容量为 58.461 吉瓦 (GW),而 2020 年为 53.721 吉瓦 (GW)。

- 德国汽车工业见证了电动车市场的快速成长,这推动了德国电池市场的发展。此外,2020年2月,德国政府正式宣布增加电动车(EV)的环境奖金,并在《德国联邦公报》上公布。新的补贴率将适用于2019年11月4日之后註册的所有车辆,该指令将于2025年12月31日或预算劣化时到期。政府此举预计将吸引消费者,并可能吸引大公司的投资。

- 2022 年 3 月,电池製造新兴企业Northvolt 宣布计划在德国建造一座新的电池超级工厂。该厂计划于2025年开业,年产能将达到60吉瓦时,每年可供应约100万辆汽车。

- 鑑于上述情况,德国预计将在预测期内主导西欧电池市场。

西欧电池产业概况

西欧电池市场较为分散。该市场的主要企业包括(排名不分先后)东芝公司、宁德时代新能源科技有限公司、比亚迪有限公司、松下公司和金霸王公司。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 至2027年市场规模及需求预测(单位:十亿美元)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 抑制因素

- 供应链分析

- 波特五力分析

- 新进入者的威胁

- 消费者议价能力

- 供应商的议价能力

- 替代产品/服务的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 类型

- 一次电池

- 二次电池

- 科技

- 锂离子电池

- 铅酸电池

- 流动

- 其他的

- 目的

- 汽车电池

- 工业电池

- 便携式电池

- 其他的

- 地区

- 德国

- 法国

- 奥地利

- 其他的

第六章 竞争状况

- 合併、收购、联盟和合资企业

- 主要企业策略

- 公司简介

- VARTA Microbattery GmbH

- Clarios LLC

- Toshiba Corp

- INTILION GmbH

- Panasonic Corporation

- Tadiran Batteries GmbH

- EAS Batteries GmbH

- Saft Groupe SA

- E4V

- Duracell Inc

- Contemporary Amperex Technology Co Ltd

- BYD Company Ltd.

第七章 市场机会及未来趋势

简介目录

Product Code: 70249

The West Europe Battery Market is expected to register a CAGR of greater than 5% during the forecast period.

COVID-19 negatively impacted the market in 2020. Presently the market is likely to reach pre-pandemic levels.

Key Highlights

- Over the medium term, increasing the adoption of electric vehicles in the region and the future outlook toward cleaner energy sources are expected to drive the market's growth.

- On the other hand, variations in the prices of battery raw materials due to a mismatch in demand and supply are expected to hamper the West Europe Battery Market growth during the forecast period.

- Nevertheless, increasing manufacturing facilities across the West Europe region is likely to create lucrative growth opportunities for the West Europe Battery Market in the forecast period.

- Germany dominates the market and is likely to witness the highest CAGR during the forecast period. This growth is attributed to the increasing renewable energy installations and phasing from conventional fuel to cleaner energy sources.

West Europe Battery Market Trends

Lithium-ion Batteries are Expected to Dominate the Market

- Lithium-ion batteries are a rechargeable type of battery that is commonly used in electronic devices and energy vehicles. These batteries also store energy from renewable energy sources such as solar and wind.

- Europe's demand for lithium-ion batteries for electric vehicles is expected to amount to 325 gigawatt-hours in 2030. This represents almost the major of the global demand for electric vehicle lithium-ion batteries. Many European countries committed to combustion engine phase-out will substantially increase battery demand in this time frame.

- Moreover, the countries in the region are wanted domestic investment and manufacturers. Countries such as Germany and France have planned to decrease the dominance of Asia-Pacific companies in the European region, affecting local companies' involvement in the area.

- In August 2022, Eurocell confirmed that it is in advanced discussions to build its first European Gigafactory in the Netherlands, supplying battery cells to the energy storage and e-mobility ecosystem across the continent. Eurocell intends to construct its new Gigafactory in two phases reaching total capacity as early as 2025. The first phase will produce advanced battery cells at scale by early 2023 for existing European customers. The second phase, potentially on the same site, will produce more than 40 million cells annually by 2025.

- Hence, owing to the above points, the lithium-ion segment is expected to dominate in the West Europe Battery Market during the forecast period.

Germany Expected to Dominate the Market

- Germany being the largest economy in the European Union has been attracting investments from other countries across the globe for the development of the batteries manufacturing facilities.

- Moreover, the government has targeted increasing the installed renewable energy capacity and has planned to generate 40% to 45% of the total energy consumption from renewable energy by 2025. This will likely drive the battery market as batteries can be used to store extra renewable energy. In 2021, Germany's total installed solar capacity was 58.461 gigawatts (GW), compared to 53.721 gigawatts (GW) in 2020,

- The automotive industry in Germany is witnessing rapid growth in the electric vehicles market, thus driving the country's battery market. Moreover, in February 2020 government of Germany officially announced to increase in environmental bonuses on electric vehicles (EV) with its publication in the German Federal Gazette. The new subsidy rates apply to all vehicles registered after 4th November 2019, and the directive will expire on 31 December 2025 or when the budget is exhausted. This step by the government is expected to attract consumers and is likely to attract investment by major players.

- In March 2022, Battery manufacturing startup Northvolt announced plans to build a new battery cell gigafactory in Germany. The factory was expected to open in 2025 with an annual production capacity of 60 gigawatt-hours and enough to supply around one million cars annually.

- Hence, owing to the above points, Germany is expected to dominate the West Europe battery market during the forecast period.

West Europe Battery Industry Overview

The West Europe Battery Market is fragmented in nature. Some of the major players in the market (not in particular order) include Toshiba Corp, Contemporary Amperex Technology Co. Limited, BYD Company Ltd., Panasonic Corporation, and Duracell Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Primary Battery

- 5.1.2 Secondary Battery

- 5.2 Technology

- 5.2.1 Lithium-ion Battery

- 5.2.2 Lead-acid Battery

- 5.2.3 Flow

- 5.2.4 Others

- 5.3 Application

- 5.3.1 Automotive Batteries

- 5.3.2 Industrial Batteries

- 5.3.3 Portable Batteries

- 5.3.4 Others

- 5.4 Geography

- 5.4.1 Germany

- 5.4.2 France

- 5.4.3 Austria

- 5.4.4 Others

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers, Acquisitions, Collaboration and Joint Ventures

- 6.2 Strategies Adopted by Key Players

- 6.3 Company Profiles

- 6.3.1 VARTA Microbattery GmbH

- 6.3.2 Clarios LLC

- 6.3.3 Toshiba Corp

- 6.3.4 INTILION GmbH

- 6.3.5 Panasonic Corporation

- 6.3.6 Tadiran Batteries GmbH

- 6.3.7 EAS Batteries GmbH

- 6.3.8 Saft Groupe S.A.

- 6.3.9 E4V

- 6.3.10 Duracell Inc

- 6.3.11 Contemporary Amperex Technology Co Ltd

- 6.3.12 BYD Company Ltd.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219