|

市场调查报告书

商品编码

1630372

南欧电池:市场占有率分析、产业趋势与统计、成长预测(2025-2030)South Europe Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

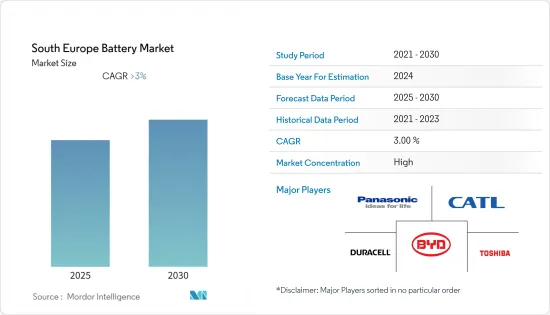

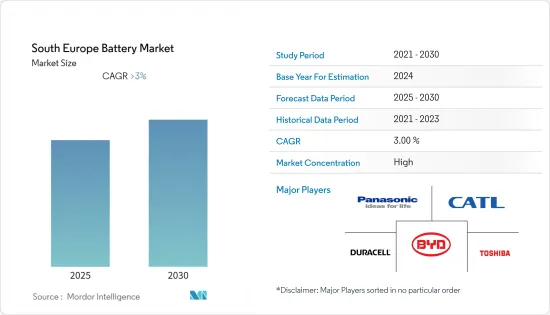

南欧电池市场预计在预测期内将维持3%以上的复合年增长率。

COVID-19 对 2020 年市场产生了负面影响。市场现在可能达到大流行前的水平。

主要亮点

- 从中期来看,锂离子电池成本的降低和能源储存系统的适应预计将推动市场成长。

- 同时,电池製造中使用的原材料和矿物价格上涨预计将阻碍预测期内南欧电池市场的成长。

- 锂硫电池和固态电池等新一代电池预计将在预测期内为南欧电池市场提供利润丰厚的成长机会。

- 义大利在市场上占据主导地位,并可能在预测期内实现最高的复合年增长率。这一增长是由对可再生能源发电的日益依赖所推动的。

南欧电池市场趋势

锂离子电池可望主导市场

- 锂离子电池是可充电电池,通常用于数位设备和动力车辆。该电池还储存来自太阳能和风能等可再生能源的能量。

- 到2030年,欧洲电动车对锂离子电池的需求预计将达到325吉瓦时。这几乎代表了全球电动车锂离子电池需求的大部分。许多正在逐步淘汰内燃机的欧洲国家可能会在此期间大幅增加电池需求。

- 包括义大利和希腊在内的许多国家的目标是到 2030年终分别安装 50 吉瓦 (GW) 和 5 吉瓦 (GW) 的太阳能。此类装置预计将成为南欧电池市场的驱动力,因为可再生能源产生的剩余能源可以储存在电池中以供以后使用。

- 葡萄牙已经是欧洲最大的锂生产国,但该国大部分锂用于製造陶瓷和玻璃产品。例如,2021年12月,瑞典电池製造商Northvolt宣布将与葡萄牙能源公司Garup组成50:50的合资企业。一家锂转化工厂将在合资企业 Aurora 的指导下在葡萄牙建造。该厂电池级氢氧化锂年产能将高达35,000吨,计划于2026年开始商业营运。

- 有鑑于上述情况,预计在预测期内南欧电池市场将由锂离子电池产业主导。

义大利可望主导市场

- 义大利的目标是到2025年终逐步淘汰煤炭发电,并依赖天然气、风能和太阳能等清洁能源来源。能源发电的这种转变预计将推动该国的电池市场,因为电池可用于储存可再生能源产生的多余能量以供以后使用。 2021 年可再生能源总装置容量为 56,987 兆瓦 (MW)。

- 此外,该国的通讯业正在快速成长,资料中心对电池的需求增加可能对该国的电池市场产生积极影响。

- 义大利汽车工业见证了电动车市场的快速成长,带动了该国电池市场的发展。在该国,政府已采取各种措施和措施来支持电动车(EV)的使用。大多数有关电动车展览的倡议可能会产生积极影响并推动该国的电池市场。

- 2022年8月,Italvolt宣布计画于2023年春季在义大利建造电动车电池工厂。该电动车电池工厂将在义大利西北部Piemonte建设一座45GWh电池工厂。该公司预计将于 2023 年春季获得建筑许可证。新厂将生产具有硅负极的MNC(镍、锰、钴)锂离子电池,供汽车製造商组装成电池组。

- 综上所述,预计义大利在预测期内将主导南欧电池市场。

南欧电池产业概况

南欧的电池市场较为分散。市场的主要企业包括(排名不分先后)东芝公司、宁德时代新能源科技有限公司、比亚迪有限公司、松下公司和金霸王公司。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 至2027年市场规模及需求预测(单位:十亿美元)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 抑制因素

- 供应链分析

- 波特五力分析

- 新进入者的威胁

- 消费者议价能力

- 供应商的议价能力

- 替代产品/服务的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 类型

- 一次电池

- 二次电池

- 科技

- 锂离子电池

- 铅酸电池

- 液流电池

- 其他的

- 目的

- 用于汽车

- 工业的

- 可携式的

- 其他的

- 地区

- 义大利

- 希腊

- 葡萄牙

- 西班牙

- 其他的

第六章 竞争状况

- 合併、收购、联盟和合资企业

- 主要企业策略

- 公司简介

- Sovema Group SpA

- SIA Industria Accumulatori SpA

- Toshiba Corp

- Posharp

- Manz Italy SRL

- Recor Batteries

- STEELMAXenergy

- MONBAT Group

- Panasonic Corporation

- Duracell Inc

- Hitachi Chemical Co Ltd

- BYD Company Ltd

- Contemporary Amperex Technology Co Ltd

第七章 市场机会及未来趋势

简介目录

Product Code: 70251

The South Europe Battery Market is expected to register a CAGR of greater than 3% during the forecast period.

COVID-19 negatively impacted the market in 2020. Presently the market is likely to reach pre-pandemic levels.

Key Highlights

- Over the medium term, the reduction in the cost of lithium-ion batteries and the adaptation of energy storage systems are expected to drive the market's growth.

- On the other hand, the increasing prices of raw materials and minerals used for manufacturing batteries are expected to hamper the South Europe Battery Market growth during the forecast period.

- Nevertheless, new-generation batteries such as lithium-sulfur and solid-state are likely to create lucrative growth opportunities for the South Europe battery market in the forecast period.

- Italy dominates the market and is likely to witness the highest CAGR during the forecast period. This growth is attributed to the increasing dependency on renewable energy power generation.

South Europe Battery Market Trends

Lithium-ion Batteries Expected to Dominate the Market

- Lithium-ion batteries are a rechargeable type of battery usually used in digital gadgets and power cars. These batteries also store energy from renewable energy resources, including solar and wind.

- Europe's demand for lithium-ion batteries for electric vehicles is expected to amount to 325 gigawatt-hours in 2030. This represents almost the major of the global demand for electric vehicle lithium-ion batteries. Many European countries committed to combustion engine phase-out will substantially increase battery demand in this time frame.

- Many countries, such as Italy and Greece, have targeted installing solar energy of 50 gigawatts (GW) and 5 gigawatts (GW), respectively, by the end of 2030. Such installation is expected to be a driver for the South Europe battery market, as the extra energy produced by renewable energy can be stored in batteries for later use.

- Portugal is already the largest lithium producer in Europe, though most of the country's lithium is used for making ceramics and glassware. For instance, in December 2021, the Swedish battery cell manufacturer Northvolt announced setting up a 50:50 joint venture with Portugal's energy company Galp. Under the direction of the joint venture Aurora, a lithium conversion plant is expected to be built in Portugal. The plant will have an annual production capacity of up to 35,000 tonnes of battery-grade lithium hydroxide and is expected to commence commercial operation in 2026.

- Hence, owing to the above points, the lithium-ion segment is expected to dominate in the South Europe Battery Market during the forecast period.

Italy Expected to Dominate the Market

- Italy has targeted to phase out coal power by the end of 2025 and rely more on cleaner energy sources such as gas, wind, solar, etc. Such a transition in energy generation is expected to drive the country's battery market as batteries can be used to store extra energy generated from renewable for later use. In 2021 the total renewable energy installation was 56,987 megawatts (MW).

- Moreover, the country is witnessing rapid growth in the telecommunication sector, and increasing demand for batteries in the data centers will likely positively impact the country's battery market.

- The automotive industry of Italy is witnessing rapid growth in the electric vehicles market, thus driving the country's battery market. Different types of initiatives and measures are taken by the government in the country to support electric vehicle (EV) usage in the country. Most of these initiatives regarding EV exhibits create a positive impact and are likely going to drive the country's battery market.

- In August 2022, Italvolt announced plans to build an Italian EV battery plant in spring 2023. The EV battery plant is a 45 GWh battery cell factory in the northwestern Italian region of Piedmont. The company expects to receive the building permit in spring 2023. The new factory will make MNC (nickel, manganese, cobalt) lithium-ion battery cells with silicon anodes for car makers to assemble into packs.

- Hence, owing to the above points, Italy is expected to dominate the South Europe battery market during the forecast period.

South Europe Battery Industry Overview

The South Europe Battery Market is fragmented in nature. Some of the major players in the market (not in particular order) include Toshiba Corp, Contemporary Amperex Technology Co. Limited, BYD Company Ltd, Panasonic Corporation, and Duracell Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Primary Battery

- 5.1.2 Secondary Battery

- 5.2 Technology

- 5.2.1 Lithium-ion Battery

- 5.2.2 Lead-acid Battery

- 5.2.3 Flow Battery

- 5.2.4 Others

- 5.3 Application

- 5.3.1 Automotive

- 5.3.2 Industrial

- 5.3.3 Portable

- 5.3.4 Others

- 5.4 Geography

- 5.4.1 Italy

- 5.4.2 Greece

- 5.4.3 Portugal

- 5.4.4 Spain

- 5.4.5 Others

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers, Acquisitions, Collaboration and Joint Ventures

- 6.2 Strategies Adopted by Key Players

- 6.3 Company Profiles

- 6.3.1 Sovema Group S.p.A.

- 6.3.2 SIA Industria Accumulatori SpA

- 6.3.3 Toshiba Corp

- 6.3.4 Posharp

- 6.3.5 Manz Italy S.R.L.

- 6.3.6 Recor Batteries

- 6.3.7 STEELMAXenergy

- 6.3.8 MONBAT Group

- 6.3.9 Panasonic Corporation

- 6.3.10 Duracell Inc

- 6.3.11 Hitachi Chemical Co Ltd

- 6.3.12 BYD Company Ltd

- 6.3.13 Contemporary Amperex Technology Co Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219