|

市场调查报告书

商品编码

1630374

北非电池 -市场占有率分析、行业趋势、成长预测(2025-2030)North Africa Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

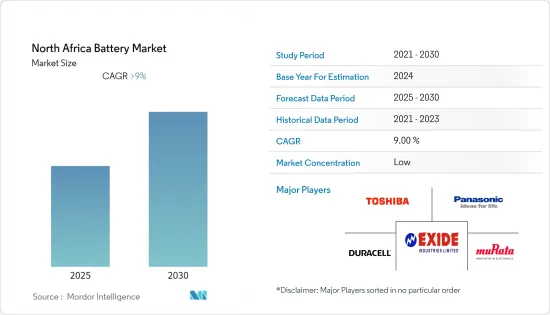

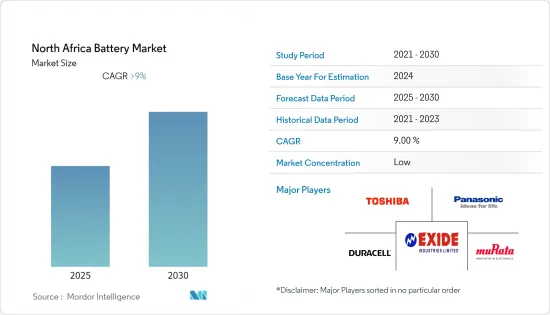

预计北非电池市场在预测期内的复合年增长率将超过 9%。

COVID-19 对 2020 年市场产生了负面影响。目前,市场已达到疫情前水准。

主要亮点

- 从长远来看,该地区越来越多地部署太阳能和风能等可再生能源,以及快速成长的通讯和资料库领域等因素预计将推动北非电池市场的发展。

- 同时,预计国内和外国投资较低将在预测期内抑制北非市场。

- 该地区国家越来越多地参与可再生能源和电动车(EV)领域,可能为北非电池市场创造一些未来机会。

北非电池市场趋势

锂离子电池主导市场成长

- 锂离子电池是一种常用于电子设备和能源汽车的可充电电池。这些电池也用于能源储存太阳能和风能等再生能源来源的能量。

- 这些电池的能量密度相当高,往返效率(能量输入/储存与能量输出/释放)为85%至95%。锂离子电池属于低维护电池,处理电池芯时对环境几乎没有危害。

- 此外,该地区各国政府正在努力在本国推广电动车(EV)并吸引海外投资。该地区多个国家的政府已推出有关电动车(EV)的区域倡议和政策。

- 2020年3月,阿尔及利亚总统呼吁广泛使用电动车,以减少该国二氧化碳排放。因此,政府发布了管理阿尔及利亚汽车产业活动的新规范。为了在该国普及电动车,政府采取了多项措施,包括限制进口三年以下的二手石化燃料汽车、禁止进口柴油车等。对二手石化燃料汽车的此类限制预计将推动该国使用锂离子电池发电的电动汽车产业的发展。

- 因此,鑑于上述情况,锂离子电池细分市场可能是预测期内北非电池市场成长最快的细分市场。

预计埃及将主导市场

- 埃及是北非最大的经济体,吸引世界各国投资开发电池製造设施。

- 此外,在太阳能和风能的快速部署的基础上,政府还制定了2035年可再生能源占该国电力结构42%的目标。这可能会推动电池市场,因为电池可用于储存可再生能源产生的多余电力。埃及太阳能发电装置容量将从2010年的15兆瓦(MW)增加到2021年的1,655.4兆瓦(MW)。

- 2021年8月,Azelio订单埃及Engazaat Development SAE的20台可再生能源储存设备TES.POD价值150万美元的有条件订单。 TES.POD 设备将由 Azerio 和 Engazaat Development SAE 共同拥有的计划合资公司提供资金筹措、实施和维护,并将用于埃及的 SAVE永续农业倡议。

- 在埃及的汽车产业,电动车市场正在快速成长,并正在推动该国的电池市场。此前,电动车使用的电池价格约为汽车价格的一半,对老百姓来说并不经济,但电池价格的降低,让老百姓也能负担得起。

- 鑑于上述情况,埃及预计将在预测期内主导北非电池市场。

北非电池产业概况

北非电池市场适度细分。该市场的主要企业(排名不分先后)包括东芝公司、村田製作所、Exide Industries Ltd、松下公司和金霸王公司。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 至2027年市场规模及需求预测(单位:十亿美元)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 抑制因素

- 供应链分析

- 波特五力分析

- 新进入者的威胁

- 消费者议价能力

- 供应商的议价能力

- 替代产品/服务的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 类型

- 一次电池

- 二次电池

- 科技

- 锂离子电池

- 铅酸电池

- 其他的

- 目的

- 汽车电池

- 工业电池

- 便携式电池

- 其他的

- 地区

- 埃及

- 阿尔及利亚

- 其他北非地区

第六章 竞争状况

- 合併、收购、联盟和合资企业

- 主要企业策略

- 公司简介

- Chloride Egypt SAE

- EL-Nisr Company

- NOUR Akkumulatoren GmbH

- Exide Industries Ltd

- United Batteries Co.

- Saft Groupe SA

- Toshiba Corp

- Murata Manufacturing Co., Ltd.

- Panasonic Corporation

- Duracell Inc

第七章 市场机会及未来趋势

简介目录

Product Code: 70277

The North Africa Battery Market is expected to register a CAGR of greater than 9% during the forecast period.

COVID-19 negatively impacted the market in 2020. Currently, the market has reached pre-pandemic levels.

Key Highlights

- Over the long term, factors such as increasing adoption of renewable energy such as solar and wind in the region and rapidly growing telecom and database sectors are likely to drive the North African battery market.

- On the other hand, low domestic and foreign investment is expected to restrain the North African market during the forecast period.

- The increasing involvement of the countries in the region towards its renewable and Electric Vehicle (EV) sector is likely to create several future opportunities for the North African battery market.

North Africa Battery Market Trends

Lithium-ion Batteries to Dominate the Market Growth

- Lithium-ion batteries are a rechargeable type of battery that is commonly used in electronic devices and energy vehicles. These batteries are also being used for the storage of energy from renewable energy sources such as solar and wind.

- The energy densities of these batteries are quite high and have a round trip efficiency of 85% to 95%, which means the ratio of energy output/released to energy input/stored. The lithium-ion battery is a low-maintenance battery, and the cells of the battery cause little harm to the environment when disposed of.

- Moreover, the governments of the countries in the region are promoting Electric Vehicles (EVs) in their countries and are reaching out to attract foreign investments. The governments of several countries in the region have launched regional initiatives and policies regarding Electric Vehicles (EVs).

- In March 2020, the President of Algeria called for the promotion of electric cars aiming to reduce the carbon footprint of the country. The government has therefore announced new specifications governing the activity of the automotive industry in Algeria. To promote electric vehicles in the country, the government took several measures, such as restricting the importation of second-handed fossil fuel cars with fewer than three years and prohibiting diesel-based cars for importation. These restrictions on second-handed fossil fuel-based cars are expected to drive the electric vehicles sector in the country, which uses lithium-ion batteries for generating power.

- Hence, owing to the above points, the lithium-ion segment is likely going to be the fastest-growing segment in the North Africa Battery Market during the forecast period.

Egypt Expected to Dominate the Market

- Egypt is the largest economy in North Africa and has been attracting investments from other countries across the globe for the development of the batteries manufacturing facilities.

- Moreover, the government has set targets for renewable to make up 42% of the country's electricity mix by 2035, based on rapid solar and wind deployment. This is likely going to drive the battery market as batteries can be used to store extra power generated from renewable. In 2021, Egypt's total installed solar capacity was 1655.4 megawatts (MW), compared to 15 megawatts (MW) in 2010.

- In August 2021, Azelio won a USD 1.5 million conditional order from Egypt's Engazaat Development SAE for 20 of its TES.POD renewable energy storage devices. The TES.POD devices will be financed, implemented, and maintained by a project business co-owned by Azelio and Engazaat Development SAE and will be utilized in Egypt's SAVE sustainable agricultural initiative.

- The automotive industry in Egypt is witnessing rapid growth in the electric vehicles market, thus driving the country's battery market. Previously the batteries used in electric vehicles used to cost approximately half the price of the car, which made it non-economical for the people, but with the reduction in battery prices, it is feasible for the common people in the country.

- Hence, owing to the above points, Egypt is expected to dominate the North African battery market during the forecast period.

North Africa Battery Industry Overview

The North Africa Battery Market is moderately fragmented. Some of the key players in this market (not in particular order) are Toshiba Corp, Murata Manufacturing Co., Ltd., Exide Industries Ltd, Panasonic Corporation, and Duracell Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Primary Battery

- 5.1.2 Secondary Battery

- 5.2 Technology

- 5.2.1 Lithium-ion Battery

- 5.2.2 Lead-acid Battery

- 5.2.3 Others

- 5.3 Application

- 5.3.1 Automotive Batteries

- 5.3.2 Industrial Batteries

- 5.3.3 Portable Batteries

- 5.3.4 Others

- 5.4 Geography

- 5.4.1 Egypt

- 5.4.2 Algeria

- 5.4.3 Rest of North Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers, Acquisitions, Collaboration and Joint Ventures

- 6.2 Strategies Adopted by Key Players

- 6.3 Company Profiles

- 6.3.1 Chloride Egypt S.A.E

- 6.3.2 EL-Nisr Company

- 6.3.3 NOUR Akkumulatoren GmbH

- 6.3.4 Exide Industries Ltd

- 6.3.5 United Batteries Co.

- 6.3.6 Saft Groupe S.A.

- 6.3.7 Toshiba Corp

- 6.3.8 Murata Manufacturing Co., Ltd.

- 6.3.9 Panasonic Corporation

- 6.3.10 Duracell Inc

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219