|

市场调查报告书

商品编码

1630418

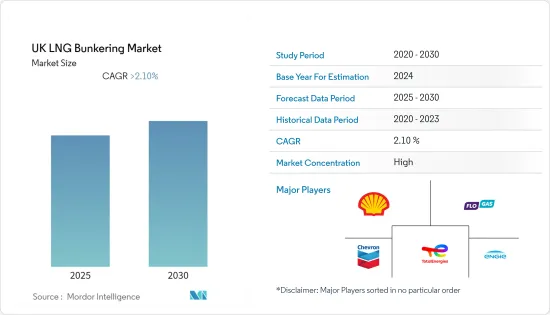

英国液化天然气燃料库:市场占有率分析、产业趋势、成长预测(2025-2030)UK LNG Bunkering - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

预计英国液化天然气燃料库市场在预测期内将维持超过2.1%的复合年增长率。

由于区域关闭和供应链中断,COVID-19 大流行对市场产生了负面影响。目前,市场已达到疫情前水准。

主要亮点

- IMO 于 2020 年 1 月 1 日实施的 0.50% 燃料硫含量限制将改变船用燃料供应和可用性格局,推动英国液化天然气燃料库市场的发展。

- 然而,液化天然气燃料库基础设施的缺乏可能会影响预测期内该国液化天然气燃料库活动的需求。

- 天然气价格的下降已开始扩大未来几年液化天然气燃料库活动的机会。

英国液化天然气燃料库市场趋势

渡轮和 OSV 领域占据市场主导地位

- 未来五年,使用LNG作为燃料的渡轮和OSV的数量预计将增加,因为使用LNG作为燃料的渡轮和OSV的订单很多。在预测期内,对液化天然气燃料库服务的需求可能会增加。

- 英国政府计划增加其在全球石油和天然气产量中的份额,预计将提振市场。英国大陆棚(UKCS)地区预计将成为海运最活跃的近海地区之一。

- 2022年,英国本土石油和天然气生产为英国GDP贡献了约284亿美元。英国政府预测,到2035年,该国能源结构的三分之二将是石油和天然气。

- 此外,预测期内安排的各种石油和天然气退役计划可能会增加对 OSV 的需求,并预计将推动市场。

- 由于大部分的贸易是透过船舶进行的,而且船舶营运商使用液化天然气燃料发动机,因此预计在预测期内,该国对液化天然气燃料库燃料需求将会增加。

石油和天然气活动的成长推动市场

- 为了提供永续且环保的运输网络,英国政府与各石油、天然气和航运业者合作,推广使用液化天然气驱动的海上运输。这将推动石油和天然气行业的液化天然气燃料库市场。

- 推动石油和天然气产业液化天然气燃料库市场的关键因素是航运业对液化天然气减少二氧化碳排放的需求增加以及国内天然气需求。此外,液化天然气是一种更好的替代燃料,政府正在采取倡议来适应液化天然气。

- 2021年天然气产量约327亿立方米,占该地区约16%的产量份额。由于国家价格下降,未来几年天然气产量预计将增加。

- 根据贝克休斯统计,2023年3月海上钻机数量为13座,超过2022年3月海上钻机数量。这表明该国的石油和天然气业务在海上比陆上更占主导地位。

- 这可能会激发石油和天然气勘探与生产相关活动对船舶的需求,从而在预测期内提振目标市场。

英国液化天然气燃料库产业概况

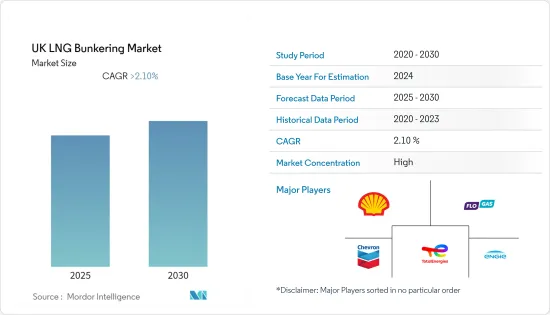

英国液化天然气燃料库市场正在整合。市场主要企业包括(排名不分先后)Flogas Britain Ltd、Chevron Corporation、Engie SA、TotalEnergies SE 和 Shell PLC。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 至2028年市场规模及需求预测(单位:百万美元)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 抑制因素

- 供应链分析

- PESTLE分析

第五章 依最终用户分類的市场区隔

- 油轮船队

- 货柜船队

- 散装杂货车队

- 渡轮和 OSV

- 其他的

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- Engie SA

- Chevron corporation

- TotalEngeries SE

- Flogas Britain Ltd

- Shell PLC

第七章 市场机会及未来趋势

简介目录

Product Code: 71256

The UK LNG Bunkering Market is expected to register a CAGR of greater than 2.1% during the forecast period.

The COVID-19 outbreak negatively impacted the market due to regional lockdowns and supply chain disruptions. Currently, the market reached pre-pandemic levels.

Key Highlights

- The bunker fuel supply and availability landscape changed when the IMO's regulation capping the global fuel Sulphur limit at 0.50% was enforced on 1 January 2020, likely driving the LNG bunkering market in the United Kingdom.

- However, the lack of LNG bunkering infrastructure will likely hurt the demand for LNG bunkering activities in the country during the forecast period.

- The reduced natural gas prices began expanding opportunities for LNG bunkering activities in the coming years.

UK LNG Bunkering Market Trends

Ferries and OSV Segment to Dominate the Market

- In the next five years, the LNG-based ferries and OSVs are projected to increase, considering the large number of LNG-fueled ferries and OSVs on order. It is likely to increase the demand for LNG bunkering services in the forecast period.

- The United Kingdom's government's plan to increase the country's global oil and gas production share is expected to boost the market. The United Kingdom Continental Shelf (UKCS) region is expected to become one of the most active offshore regions for maritime transport.

- Indigenous oil and gas production contributed around USD 28.4 billion to the United Kingdom's GDP in 2022. The UK government forecasts that two-thirds of the country's energy mix is expected to come from oil and gas by 2035.

- Additionally, various anticipated oil & gas decommissioning projects scheduled during the forecast period will likely increase the demand for OSVs, which is expected to drive the market.

- Since a major portion of the trade occurs through ships, and with the ship operators operating the LNG-fueled engines, the demand for LNG bunkering fuels is expected to increase in the country during the forecast period.

Growth in Oil & Gas Activities to Drive the Market

- To implement a sustainable and environmentally friendly transport network, the government of the United Kingdom, along with various oil and gas and shipping operators, promoted the use of LNG-powered marine transport. It will likely drive the LNG bunkering market in the oil & gas industry.

- The key factors driving the LNG bunkering market in the oil & gas industry are the increase in LNG demand to reduce carbon footprint in the shipping industry and the demand for natural gas in the country. Furthermore, LNG is a better alternative fuel, and the government is taking initiatives for LNG adaptation.

- The natural gas production in 2021 was about 32.7 billion cubic meters, providing around 16% production share to the region. Natural gas production is expected to rise in the coming years owing to the country's reduced price.

- According to Baker Hughes, the offshore rig count was 13 in March 2023, higher than the offshore rig count of March 2022. Thus indicating the dominancy of offshore oil and gas activities in the country over onshore.

- It calls for demand for ships in oil and gas E&P-related activities, likely to boost the target market over the forecast period.

UK LNG Bunkering Industry Overview

The United Kingdom LNG bunkering market is consolidated. Some of the key players in the market include (in no particular order) Flogas Britain Ltd, Chevron Corporation, Engie SA, TotalEnergies SE, and Shell PLC.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD million, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

5 MARKET SEGMENTATIONBY END-USER

- 5.1 Tanker Fleet

- 5.2 Container Fleet

- 5.3 Bulk and General Cargo Fleet

- 5.4 Ferries and OSV

- 5.5 Others

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Engie SA

- 6.3.2 Chevron corporation

- 6.3.3 TotalEngeries SE

- 6.3.4 Flogas Britain Ltd

- 6.3.5 Shell PLC

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219