|

市场调查报告书

商品编码

1630419

欧洲液化天然气燃料库-市场占有率分析、产业趋势与统计、成长预测(2025-2030)Europe LNG Bunkering - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

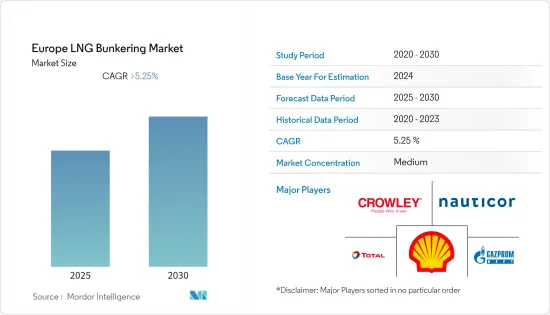

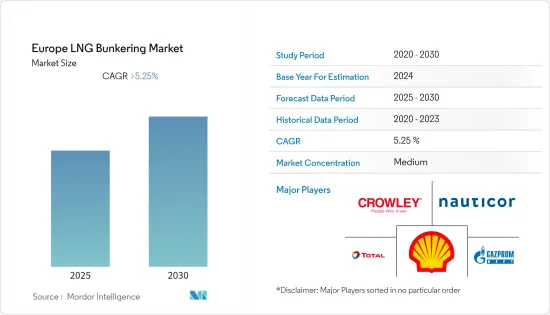

预计欧洲液化天然气燃料库市场在预测期内将维持超过5.25%的复合年增长率。

由于地区关闭,COVID-19 大流行对市场产生了负面影响。目前,市场已达到疫情前水准。

主要亮点

- 地方政府和国际海事组织为控制排放实施的严格环境法规,加上丰富的天然气供应,预计将刺激所研究市场的成长。

- 然而,一些国家没有发达的液化天然气燃料库基础设施,这可能会在预测期内阻碍市场。

- 液化天然气运输船的订单和交付量正在增加,而天然气价格的下降标誌着未来几年此类船舶机会扩大的开始。

- 预计挪威将在预测期内主导欧洲液化天然气燃料库市场。

欧洲液化天然气燃料库市场趋势

渡轮和 OSV 领域占据市场主导地位

- 渡轮是用于在水上运输货物的船隻。客运渡轮用作水上巴士或计程车,从一个地方前往另一个地方。不同的渡轮包括双头渡轮、水翼船、气垫船、双体船、滚装/滚装船、邮轮渡轮 (RoPax) 和高速 RoPax 渡轮。

- 这些船舶主要使用重油、石油和天然气。然而,政府有关硫、二氧化碳和其他污染物排放的法规鼓励使用液化天然气作为船舶燃料。

- 鑑于液化天然气动力渡轮和 OSV 的大量订单,未来五年,液化天然气动力渡轮和 OSV 的数量预计将增加。在预测期内,对液化天然气燃料库服务的需求可能会增加。

- 《欧洲绿色交易》由欧盟委员会于 2019 年制定,是旨在 2050 年实现欧洲碳中和的一系列措施倡议。它简洁地强调了液化天然气在实现这一目标方面的重要性,并强调了其作为卡车和船舶燃料的用途。

- 然而,有关燃料中硫含量的法规使得使用液化天然气对这些类型的船舶具有吸引力。原因是营运状况以及经济、监管和环境原因。

挪威主导市场

- 挪威一直是全球液化天然气燃料库市场的先驱。 2000年,世界上第一艘液化天然气燃料船Glutra汽车和客运渡轮在挪威投入营运。 17年后的2017年,挪威运作了欧洲最大的专用液化天然气燃料库站Hammer Festo,其储存容量为1250立方米,泵送能力为90吨/小时。

- 气候问题仍然是挪威高度关注的问题。挪威政府根据《巴黎协定》的温室气体排放目标和欧盟排放标准,制定了雄心勃勃且严格的排放标准。

- 为了回应全球对海上运输有害污染物排放日益增长的担忧,挪威在挪威氮氧化物基金的帮助下成为液化天然气运输船的早期投资者。它是由挪威政府主导的。

- 此外,挪威政府正致力于透过管道向其他欧洲国家出口液化天然气,并削弱俄罗斯对该地区的控制。 2020年初,管道系统营运商Gassco宣布核准其液化天然气管道,以加强北极巴伦支海的小规模液化天然气出口。

- 因此,在预测期内,挪威对液化天然气燃料库设施的需求大幅增加。

欧洲液化天然气燃料库产业概况

欧洲液化天然气燃料库市场适度整合。该市场的主要企业(排名不分先后)包括荷兰皇家壳牌公司、道达尔公司、克劳利海事公司、Nauticor GmbH &Co.KG 和 Gazpromneft Marine Bunker LLC。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第二章调查方法

第三章执行摘要

第四章市场概况

- 介绍

- 至2028年市场规模及需求预测(单位:十亿美元)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 抑制因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

第五章市场区隔

- 最终用户

- 油轮船队

- 货柜船队

- 散装杂货车队

- 渡轮和 OSV

- 其他的

- 地区

- 挪威

- 西班牙

- 荷兰

- 英国

- 欧洲其他地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- Shell Plc

- TotalEnergies SE

- Crowley Maritime Corporation

- Nauticor GmbH & Co. KG

- Harvey Gulf International Marine LLC

- ENN Energy Holdings Ltd

- Engie SA

- Gazpromneft Marine Bunker LLC

第七章 市场机会及未来趋势

简介目录

Product Code: 71257

The Europe LNG Bunkering Market is expected to register a CAGR of greater than 5.25% during the forecast period.

The COVID-19 outbreak negatively impacted the market due to regional lockdowns. Currently, the market reached pre-pandemic levels.

Key Highlights

- Stringent environmental regulations imposed by local government bodies and IMO to curb emissions, coupled with the abundant natural gas availability, are expected to stimulate the industry growth of the market studied.

- However, some countries lack of LNG bunkering infrastructure will likely hinder the market during the forecast period.

- The orders and deliveries of LNG-powered vessels are increasing, and the reduced natural gas prices marked the beginning of expanding opportunities for such vessels in the coming years.

- During the forecast period, Norway is expected to dominate the LNG bunkering market in Europe.

Europe LNG Bunkering Market Trends

Ferries & OSV Segment to Dominate the Market

- Ferries are vessels used to carry cargo across the water. A passenger ferry is used as a water bus or taxi to travel from one place to another. Various ferries include double-ended, hydrofoil, hovercraft, catamaran, roll-on/ roll-off, cruise ferry (RoPax), fast RoPax ferry, and others.

- These vessels majorly operate on heavy fuel oil and marine gas oil. However, government regulations regarding the emission of sulfur, carbon dioxide, and other pollutants encourage using LNG as fuel in vessels.

- In the next five years, the LNG-based ferries and OSVs are projected to increase, considering the large number of LNG-fueled ferries and OSVs on order. It is likely to increase the demand for LNG bunkering services in the forecast period.

- European Green Deal, formed in 2019 by the European Commission, is a set of policy initiatives to make Europe carbon neutral by 2050. It briefly underlines the importance of LNG for achieving this aim and emphasizes the usage of LNG as fuel for trucks and marine vessels.

- However, with the regulations related to sulfur content in the fuel, the option of using LNG is attractive to these types of vessels. It is because of the operating profile and economic, regulatory, and environmental reasons.

Norway to Dominate the Market

- Norway is always a pioneer country in the global LNG bunkering market. In 2000, the world's first LNG-fueled vessels, the Glutra car and passenger ferry, were made operational in Norway. Seventeen years later, in 2017, Hammerfest, Europe's largest dedicated LNG bunkering station with 1250 m3 storage and a pump capacity of 90 tons/hour, was operational in Norway.

- The focus on climate issues remains high in Norway. The Norwegian government is setting ambitious and stern emission norms to align itself with the greenhouse gas emissions targets of the Paris Agreement and within the EU emission standards.

- To counter the increasing global concerns regarding the harmful emission of pollutants from marine transportation, Norway invested early in LNG ships and was helped by the Norwegian NOx fund. The Norwegian government initiated it.

- Moreover, the country's government is focusing on exporting LNG through a pipeline to other European countries to reduce the domination of Russia in the region. In early 2020, the pipeline system operator, Gassco, announced that the company approved its LNG pipeline to boost its small-scale LNG exports from the Arctic Barents Sea.

- Hence, this significantly increased the demand for LNG bunkering facilities in Norway during the forecast period.

Europe LNG Bunkering Industry Overview

The Europe LNG bunkering market is moderately consolidated. Some of the major players in this market (in no particular order) include Royal Dutch Shell Plc, Total SA, Crowley Maritime Corporation, Nauticor GmbH & Co. KG, and Gazpromneft Marine Bunker LLC.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 End-User

- 5.1.1 Tanker Fleet

- 5.1.2 Container Fleet

- 5.1.3 Bulk and General Cargo Fleet

- 5.1.4 Ferries and OSV

- 5.1.5 Others

- 5.2 Geography

- 5.2.1 Norway

- 5.2.2 Spain

- 5.2.3 Netherlands

- 5.2.4 United Kingdom

- 5.2.5 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Shell Plc

- 6.3.2 TotalEnergies SE

- 6.3.3 Crowley Maritime Corporation

- 6.3.4 Nauticor GmbH & Co. KG

- 6.3.5 Harvey Gulf International Marine LLC

- 6.3.6 ENN Energy Holdings Ltd

- 6.3.7 Engie SA

- 6.3.8 Gazpromneft Marine Bunker LLC

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219