|

市场调查报告书

商品编码

1630429

北美电子商务包装:市场占有率分析、行业趋势、统计和成长预测(2025-2030)North America E-Commerce Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

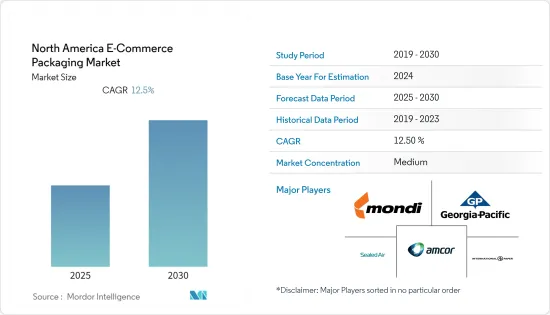

北美电子商务包装市场预计在预测期内复合年增长率为12.5%。

主要亮点

- 电子商务的快速成长,加上包装材料选择技术的进步,正在主要改变许多公司选择正确解决方案的方式。主要考虑因素是性能、透过改进材料的成本考虑、包装需求、创建按需包装的交付系统以及永续性。

- 在美国,电子商务持续快速成长,给传统零售带来压力。美国商务部数据显示,2019年消费者线上支出为6,017.5亿美元,较前一年的5,236.4亿美元成长14.9%。与 2018 年相比,这一增长率相对较高,商务部报告称, 与前一年同期比较增 13.6%。此外,长期局限于传统零售通路的消费品线上销售正在爆炸式增长,许多情况下与前一年同期比较增长率超过50%。

- 由于 COVID-19 疫情爆发,对药品、食品和其他必需品的需求增加,该地区对电子商务包装的需求大幅增加。对电子商务包装製造商的市场需求只会不断增长,因为人们越来越多地离开家只进行必需品购买,即购买食品杂货和药品,并且许多人都需要电子商务。

- Adobe数位经济指数的最新资料显示,与实施就地避难限制之前的3月初基准期相比,2020年4月美国电子商务成长了49%。线上杂货是成长背后的推动力,3 月至 4 月日销售额成长 110%。同时,电子产品销量成长了 58%,书籍销量翻了一番。

北美电商包装市场趋势

塑胶包装预计将显着成长

- 在高效包装方面,塑胶通常允许製造商用更少的包装材料运输更多的产品。这种轻量化製程在提高消费品包装的环境和经济效益方面发挥着重要作用。此外,泡壳包装是小型消费性电子产品的理想选择。这种塑胶包装使电子配件脱颖而出,并且还提供一定程度的防篡改功能,同时方便且易于打开。

- 许多公司正在开发新产品,以满足该地区的电子商务市场。例如,2020 年 1 月,美国Sealed Air 公司推出了新版 Bubble Wrap 品牌包装,该包装由至少 90% 的回收材料製成。 2020年1月,Coveris推出了100%PP结构的收缩膜。此外,Better Packaging 使用可在家中堆肥的可再生植物材料製作袋子和信封。

- 随着消费者越来越意识到包装和废弃物对环境的影响,品牌反映他们对此问题的担忧非常重要。千禧世代占该行业消费者群的很大一部分,并且更倾向于从重视永续性的公司购买产品。

- 因此,亚马逊等该地区的电子商务公司正在透过推出各种倡议来采用永续包装方法。亚马逊在过去十年中的倡议,包括无挫包装(FFP),透过推广易于打开、可回收的包装和运输产品,减少了超过81 万吨包装并交付了14 亿件产品,并取消了运输的使用。对 FPP 的日益重视可能会阻碍未来永续包装市场的发展。

消费性电子领域取得显着成长

- 根据消费者科技协会的数据,2019 年美国消费性电子与科技销售的零售收益为 4.06 亿美元,预计到 2020 年底将达到 4.22 亿美元。随着全球消费性电子产品需求的增加,预计在预测期内对保护性塑胶包装的需求将会增加。

- 在家用电子电器和媒体的特殊塑胶包装系统中,收缩包装、收缩包装和拉伸包装非常常见且广泛使用。与收缩膜和袋子相比,拉伸包装具有较大的节能效果,且不需要供应燃料。库存管理更容易,尤其是与收缩袋相比。此外,一些行动电话采用塑胶材料包装和运输。随着一些製造商转向永续包装选择,塑胶薄膜和包装盒发挥越来越大的作用。

- 例如,2020 年 4 月推出的 Mavic Air 2 无人机以及智慧型控制器和智慧型手机显示器均装在带有保护性塑胶收缩的纸箱中,以避免在运输过程中损坏。

- 此外,金士顿于 2019 年推出的 HyperX Savage EXO 采用多层透明泡壳包装,并插入盒子中。塑胶、无螺丝、石板灰色外壳可保护驱动器的内部。

北美电商包装产业概况

北美电子商务包装市场适度分散,有多家公司提供电子商务包装解决方案,许多公司正在製定扩大策略。该市场的供应商可以透过设计、技术和应用方面的创新获得永续的竞争优势。

- 2020 年 1 月,Bubble Wrap 的发明者 Sealed Air Corporation 推出了新版本的 Bubble Wrap 品牌包装材料,该材料由至少 90% 的回收材料製成。

- 2020 年 1 月,Amcor PLC 宣布与北美和拉丁美洲的 Moda 真空包装系统建立合作关係。透过将 Amcor 的肉类和起司收缩袋以及捲筒薄膜与 Moda 的系统相结合,生产商可以提高业务效率并节省整体成本。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 竞争公司之间的敌对关係

- 替代品的威胁

第五章市场动态

- 市场驱动因素

- 消费出货量持续成长

- 更加重视关键产品和材料创新,并透过包装获得竞争优势

- 优质包装的需求不断增长

- 市场挑战

- 关于塑胶使用的材料法规和良好生产规范相对缺乏

- 实施与电子商务包装创新相关的关键案例和使用案例

- COVID-19 对电子商务和包装产业的影响

第六章 市场细分

- 依材料类型

- 塑胶

- 纸板

- 纸

- 其他材料类型

- 依产品类型

- 盒子

- 保护性包装产品

- 其他产品类型

- 按最终用户产业

- 时尚/服饰

- 家电

- 饮食

- 个人保健产品

- 其他最终用户产业

- 按国家/地区

- 美国

- 加拿大

第七章 竞争格局

- 公司简介

- Amcor PLC

- Mondi PLC

- International Paper Company

- Smurfit Kappa Group PLC

- DS Smith PLC

- CCL Industries Inc.

- Georgia-Pacific LLC

- Sonoco Products Company

- Storopack Inc.

- Sealed Air Corporation

第八章投资分析

第9章 未来的机会

简介目录

Product Code: 71388

The North America E-Commerce Packaging Market is expected to register a CAGR of 12.5% during the forecast period.

Key Highlights

- The exponential growth of e-commerce, combined with the technological advancements in the packaging material options, is primarily changing the way most of the companies are choosing the right solution. The main consideration points are the performance, cost considerations driven by material improvements, packaging needs, delivery systems that create on-demand packaging, and sustainability.

- In the United States, e-commerce continues to grow at a dramatic pace, putting pressure on traditional retail. Consumers spent USD 601.75 billion online in 2019, up by 14.9% from USD 523.64 billion the prior year, according to the US Department of Commerce. That was a relatively higher growth rate than 2018 when online sales reported by the Commerce Department rose by 13.6% Y-o-Y. Additionally, sales of consumer-packaged goods, long confined to traditional retail channels, are exploding online, with growth rates, in many cases, in excess of 50% Y-o-Y.

- With the outbreak of COVID-19, the demand for e-commerce packaging in the region is witnessing a significant increase, due to the increasing demand for medicine, food, and other essential goods. The market demand for e-commerce packaging manufacturers will only grow, with people increasingly leaving the house only for essential purchases, i.e., groceries or medication, and many are turning to e-commerce for their retail needs.

- According to Adobe's Digital Economy Index's latest data, the US e-commerce increased by 49% in April, FY 2020, compared to the baseline period in early March before shelter-in-place restrictions came into effect. Online grocery helped drive the increase in revenues, with a 110% boost in daily sales between March and April. Meanwhile, electronic sales were up by 58%, and book sales have doubled.

North America E-Commerce Packaging Market Trends

Plastic Packaging is expected to Witness Significant Growth

- When it comes to efficient packaging, plastics often enable manufacturers to ship more products with less packaging material. This process of light-weighting can play an essential role in boosting the environmental and economic efficiency of consumer product packaging. Moreover, blister packaging is ideal for small consumer electronic goods. This type of plastic packaging highlights the electronic accessories and further provides a degree of tamper resistance, while still being convenient and easy to open.

- Many companies are developing new products to cater to the e-commerce market in the region. For instance, in January 2020, the US-based Sealed Air Corporation launched a new version of Bubble Wrap brand packaging material that is made with at least 90% recycled content. In January 2020, Coveris launched 100% PP structure shrink films that support the circular economy by minimizing material waste. Moreover, the Better Packaging Co. produces bags and envelopes made from renewable plant materials, which can be composted at home.

- As consumers are becoming more familiar with the environmental impacts of packaging and waste, it is becoming critical for brands to reflect their concern for this issue. Millennials make up a good portion of the industry's consumer base, and they are showing a preference for purchasing from companies that focus on sustainability.

- As a result, the e-commerce companies in the region, such as Amazon, are adopting sustainable way of packaging by introducing various initiatives. Over the past decade, Amazon's initiatives, including Frustration-Free Packaging (FFP), eliminated more than 810,000 metric ton of packaging material and eliminated the use of 1.4 billion shipping boxes, by promoting easy-to-open, recyclable packaging and shipping products. The increasing emphasis on FPP might hinder the market for lasting packaging in the future.

Consumer Electronics Segment to Witness Significant Growth

- According to the Consumer Technology Association, the retail revenue from consumer electronics/technology sales in the United States in 2019 was USD 406 million, and it is expected to reach USD 422 million by the end of FY 2020. With the increasing demand for consumer electronics worldwide, the demand for protective plastic packaging is expected to increase during the forecast period.

- Among the specialized plastic packaging systems for consumer electronics and media, shrink packaging or shrink wrapping and stretch wrapping are very common and widely used. Compared to shrink film and bags, stretch wrapping offers large energy-savings and does not require the availability of fuel. Compared to shrink bags, in particular, it simplifies inventory. Additionally, several mobile phones are packed and shipped using plastic material. Though several manufacturers are drifting toward sustainable packaging options, the role of plastic films and wraps on the boxes is ever-growing.

- For instance, the Mavic Air 2 drone that was launched in April 2020 is packaged with the smart controller and the smartphone display, in carton boxes that come with protective plastic shrink-wrap, to avoid damage during shipping.

- Moreover, Kingston's HyperX Savage EXO, which was launched in 2019, is packaged between layers of clear blister-pack inserted in the box. The plastic, screwless, slate-gray case protects the drive's internals.

North America E-Commerce Packaging Industry Overview

The North America e-commerce packaging market is moderately fragmented, owing to the availability of several players providing e-commerce packaging solutions with many companies developing expansion strategies. Vendors in the market can gain sustainable competitive advantage through innovation in design, technology, and application.

- In January 2020, Sealed Air Corporation, which is the inventor of Bubble Wrap, launched a new version of Bubble Wrap brand packaging material that is made with at least 90% recycled content.

- In January 2020, Amcor PLC announced its partnership with Moda vacuum packaging systems in North America and Latin America. By combining Amcor's shrink bag and roll stock film for meat and cheese with Moda's system, producers can gain operational efficiencies and drive total cost savings.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Intensity of Competitive Rivalry

- 4.3.5 Threat of Substitute Products

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Sustained Rise in Volume of Consumer Shipments

- 5.1.2 Key Product and Material Innovations, Coupled with Growing Emphasis on Gaining Competitive Advantage Through Packaging

- 5.1.3 Growing Demand for Luxury Packaging

- 5.2 Market Challenges

- 5.2.1 Material-specific Regulations on Use of Plastic, and Relative Lack of Exposure on Good Manufacturing Practices

- 5.3 Key Case Studies and Implementation of Use Cases Related to Innovations in E-commerce Packaging

- 5.4 Impact of COVID-19 on the E-commerce and Packaging Industries

6 MARKET SEGMENTATION

- 6.1 By Material Type

- 6.1.1 Plastic

- 6.1.2 Corrugated Board

- 6.1.3 Paper

- 6.1.4 Other Material Types

- 6.2 By Product Type

- 6.2.1 Boxes

- 6.2.2 Protective Packaging-based Products

- 6.2.3 Other Product Types

- 6.3 By End User Industry

- 6.3.1 Fashion and Apparel

- 6.3.2 Consumer Electronics

- 6.3.3 Food and Beverage

- 6.3.4 Personal Care Products

- 6.3.5 Other End User Industries

- 6.4 By Country

- 6.4.1 United States

- 6.4.2 Canada

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amcor PLC

- 7.1.2 Mondi PLC

- 7.1.3 International Paper Company

- 7.1.4 Smurfit Kappa Group PLC

- 7.1.5 DS Smith PLC

- 7.1.6 CCL Industries Inc.

- 7.1.7 Georgia-Pacific LLC

- 7.1.8 Sonoco Products Company

- 7.1.9 Storopack Inc.

- 7.1.10 Sealed Air Corporation

8 INVESTMENT ANALYSIS

9 FUTURE OPPORTUNITIES

02-2729-4219

+886-2-2729-4219