|

市场调查报告书

商品编码

1797693

电子商务耐热包装市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测E-Commerce Heat-Resistant Packaging Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

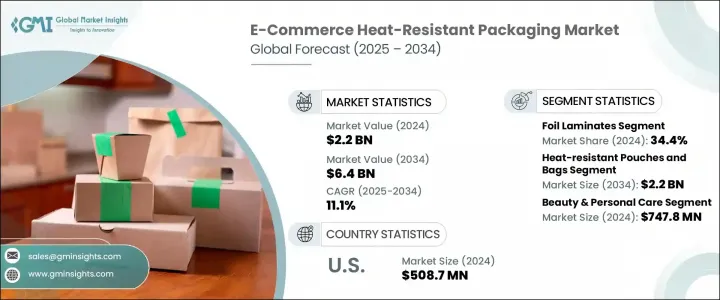

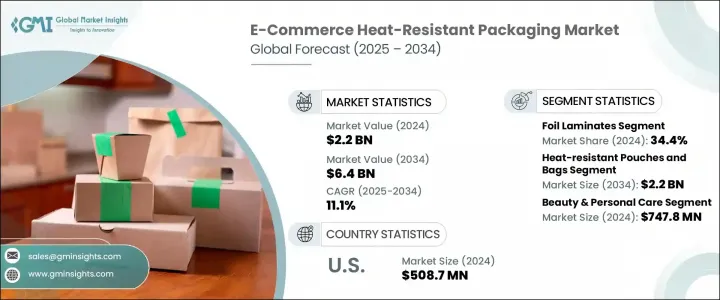

2024 年全球电子商务耐热包装市场价值为 22 亿美元,预计到 2034 年将以 11.1% 的复合年增长率成长,达到 64 亿美元。市场扩张主要得益于电子商务的持续成长以及製药业对热保护日益增长的需求。随着线上购物和国际配送的激增,对能够在不同温度条件下保持产品完整性的包装的需求显着增加。消费者追求可靠性和永续性,尤其是在安全运送食品、个人护理用品和对温度敏感的电子产品方面。现在的包装解决方案不仅必须提供隔热功能,还必须环保,符合现代客户的期望。医疗保健入户服务的增加和药品供应商数位化业务的不断增强,都加剧了对隔热包装的需求。

生物製剂和胰岛素等关键产品的合规性和温度控制也促使製造商采用先进的热包装技术,以确保运输过程中的安全交付。这些敏感药品需要在整个物流链中严格遵守温度范围,通常为 2°C 至 8°C,以保持功效并避免降解。随着全球监管机构加强对药品冷链完整性的指导,製造商面临越来越大的压力,需要实施能够提供精确且经过验证的温度性能的包装解决方案。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 22亿美元 |

| 预测值 | 64亿美元 |

| 复合年增长率 | 11.1% |

2024年,铝箔复合膜市场占最大份额,达34.4%。这些材料凭藉着卓越的隔热性能和轻量化,正成为包装产业的主流。它们在温度敏感领域的应用日益广泛,尤其是在国际运输领域。多层铝箔技术的新进展正在提升其保温性能和耐热性,从而在长期运输和多变的气候条件下提供更佳的保护。

预计到2034年,食品饮料产业的复合年增长率将达到12.3%。大都会居民生活方式的转变、对新鲜食品需求的不断增长以及美食的全球化,都加剧了对坚固耐热包装的需求。快速配送和当日送达服务的日益普及,使得整个供应链的持续温度控製成为该行业企业的首要任务。

2024年,美国电商耐热包装市场产值达5.087亿美元。其主导地位源自于永续物流策略和先进冷链系统的成功实施。包括製造业、食品饮料业和製药业在内的各行各业都在采用可回收隔热泡沫和环保包装,以实现环保目标。美国对节能包装方案的高度重视,持续巩固了在该领域的领导地位。

电子商务耐热包装市场的领先公司包括 LD Packaging、DS Smith、Insulated Products Corporation、Novolex、Amcor、Aspect Solutions、Nordic Cold Chain Solutions 和 DBS Packaging。该领域的公司正在积极投资研发,以开发将热效率与环境永续性结合的材料。各大品牌正在推出可回收和可重复使用的绝缘产品,以满足消费者对环保解决方案的偏好。许多公司还与电子商务和物流供应商建立策略合作伙伴关係,为极端天气条件下的最后一哩交付创建客製化的包装解决方案。扩大生产能力和全球分销网络是另一个主要重点,使公司能够更有效地满足区域需求。此外,企业也强调设计创新——提供可客製化、轻量化和多层包装,以满足温度控制规定,同时确保成本效益。

目录

第一章:方法论

- 市场范围和定义

- 研究设计

- 研究方法

- 资料收集方法

- 资料探勘来源

- 全球的

- 地区/国家

- 基础估算与计算

- 基准年计算

- 市场评估的主要趋势

- 初步研究和验证

- 主要来源

- 预测模型

- 研究假设和局限性

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率分析

- 成本结构

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 电子商务领域的成长

- 对可持续和可生物降解包装材料的需求不断增长

- 最后一哩配送的冷链合规性严格规定

- 需要热保护的製药业的扩张

- 线上食品配送和餐包服务的成长

- 产业陷阱与挑战

- 先进热封装材料成本高

- 回收能力有限和环境问题

- 市场机会

- 电子商务平台与包装创新者之间的合作

- 整合智慧感测器,实现即时温度监控

- 高端糖果和有机护肤品等细分市场的采用率不断提高

- 开发可客製化、品牌差异化的绝缘包装

- 成长动力

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL分析

- 科技与创新格局

- 当前的技术趋势

- 新兴技术

- 新兴商业模式

- 合规性要求

- 永续性措施

- 永续材料评估

- 碳足迹分析

- 循环经济实施

- 永续性认证和标准

- 永续性投资报酬率分析

- 全球消费者情绪分析

- 专利分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 按地区

- 关键参与者的竞争基准

- 财务绩效比较

- 收入

- 利润率

- 研发

- 产品组合比较

- 产品范围广度

- 科技

- 创新

- 地理位置比较

- 全球足迹分析

- 服务网路覆盖

- 各区域市场渗透率

- 竞争定位矩阵

- 领导者

- 挑战者

- 追踪者

- 利基市场参与者

- 战略展望矩阵

- 财务绩效比较

- 2021-2024 年关键发展

- 併购

- 伙伴关係和合作

- 技术进步

- 扩张和投资策略

- 永续发展倡议

- 数位转型倡议

- 新兴/新创企业竞争对手格局

第五章:市场估计与预测:按材料类型,2021 - 2034 年

- 主要趋势

- 箔层压板

- 耐高温塑料

- 绝缘纸基材料

- 隔热泡沫

- 其他的

第六章:市场估计与预测:依产品类型,2021 - 2034 年

- 主要趋势

- 耐热袋和包包

- 绝缘箱和容器

- 保护衬垫和内衬

- 热敏邮件和信封

- 其他的

第七章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 美容与个人护理

- 食品和饮料

- 电学

- 医疗保健和製药

- 其他的

第八章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

第九章:公司简介

- Amcor plc

- Aspect Solutions Ltd.

- Cryopak

- DBS Packaging

- DS Smith

- Insulated Products Corporation.

- LD PACKAGING CO .,LTD

- Nordic Cold Chain Solutions

- Novolex

- Perstorp

- Puropak (Foshan) Co., Ltd.

- Sealed Air

- Sonoco ThermoSafe

- Taghleef Industries

- Thermal Packaging Solutions Ltd.

- ZTJ Packaging Co., Ltd.

The Global E-Commerce Heat-Resistant Packaging Market was valued at USD 2.2 billion in 2024 and is estimated to grow at a CAGR of 11.1% to reach USD 6.4 billion by 2034. Market expansion is primarily driven by the ongoing growth of e-commerce and the increasing need for thermal protection in the pharmaceutical industry. With the surge in online purchases and international deliveries, the demand for packaging that can maintain product integrity under varied temperature conditions has significantly increased. Consumers are seeking reliability and sustainability, especially when it comes to the safe delivery of food, personal care items, and temperature-sensitive electronics. Packaging solutions must now not only provide thermal insulation but also be environmentally friendly, aligning with modern customer expectations. Rising healthcare delivery to homes and the growing digital presence of pharmaceutical suppliers have added momentum to the demand for insulated packaging.

Regulatory compliance and temperature control for critical products like biologics and insulin are also pushing manufacturers to adopt advanced thermal packaging technologies for secure delivery during transport. These sensitive pharmaceuticals require strict adherence to temperature ranges throughout the logistics chain, often between 2°C to 8°C, to preserve efficacy and avoid degradation. As global regulatory bodies tighten guidelines around pharmaceutical cold chain integrity, manufacturers are under increasing pressure to implement packaging solutions that offer precise, validated temperature performance.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.2 Billion |

| Forecast Value | $6.4 Billion |

| CAGR | 11.1% |

The foil laminates segment held the largest share in 2024, accounting for 34.4%. These materials are becoming a staple in the packaging industry due to their excellent insulation capabilities and minimal weight. Their application across temperature-sensitive sectors is growing, especially for international shipments. New developments in multi-layer foil technology are improving thermal retention and resistance, offering better protection during extended transit periods and under fluctuating climate conditions.

The food & beverage segment is projected to grow at a CAGR of 12.3% through 2034. Shifting lifestyles in metropolitan areas, rising demand for fresh meals, and the globalization of cuisine have all intensified the requirement for robust heat-resistant packaging. The rising adoption of fast and same-day delivery services has made consistent temperature control across the supply chain a top priority for businesses in this sector.

U.S. E-Commerce Heat-Resistant Packaging Market generated USD 508.7 million in 2024. Its dominance stems from the successful execution of sustainable logistics strategies and advanced cold chain systems. Various industries-including manufacturing, food and beverage, and pharmaceuticals-are embracing recyclable insulation foams and eco-conscious packaging to meet environmental goals. The country's strong focus on energy-efficient packaging options continues to shape its leadership position in this sector.

Leading companies in the E-Commerce Heat-Resistant Packaging Market include LD Packaging, DS Smith, Insulated Products Corporation, Novolex, Amcor, Aspect Solutions, Nordic Cold Chain Solutions, and DBS Packaging. Companies in this sector are actively investing in R&D to develop materials that combine thermal efficiency with environmental sustainability. Brands are introducing recyclable and reusable insulation products to align with consumer preferences for eco-friendly solutions. Many are also forming strategic partnerships with e-commerce and logistics providers to create tailored packaging solutions for last-mile delivery under extreme weather conditions. Expanding production capabilities and global distribution networks is another major focus, allowing firms to address regional demand more effectively. Additionally, businesses are emphasizing design innovation-offering customizable, lightweight, and multi-layer packaging that meets temperature control regulations while ensuring cost efficiency.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Material type trends

- 2.2.2 Product type trends

- 2.2.3 End use trends

- 2.2.4 Regional

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growth in e-commerce sector

- 3.2.1.2 Rising demand for sustainable and biodegradable packaging materials

- 3.2.1.3 Stringent regulations for cold chain compliance in last-mile delivery

- 3.2.1.4 Expansion of pharmaceutical sector requiring thermal protection

- 3.2.1.5 Growth of online food delivery and meal kit services

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of advanced thermal packaging materials

- 3.2.2.2 Limited recyclability and environmental concerns

- 3.2.3 Market opportunities

- 3.2.3.1 Partnerships between E-commerce platforms and packaging innovators

- 3.2.3.2 Integration of smart sensors for real-time temperature monitoring

- 3.2.3.3 Increased adoption in niche segments like premium confectionery and organic skincare

- 3.2.3.4 Development of customizable, brand-differentiated insulated packaging

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Emerging business models

- 3.9 Compliance requirements

- 3.10 Sustainability Measures

- 3.10.1 Sustainable Materials Assessment

- 3.10.2 Carbon Footprint Analysis

- 3.10.3 Circular Economy Implementation

- 3.10.4 Sustainability Certifications and Standards

- 3.10.5 Sustainability ROI Analysis

- 3.11 Global consumer sentiment analysis

- 3.12 Patent analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By region

- 4.3 Competitive benchmarking of key players

- 4.3.1 Financial performance comparison

- 4.3.1.1 Revenue

- 4.3.1.2 Profit margin

- 4.3.1.3 R&D

- 4.3.2 Product portfolio comparison

- 4.3.2.1 Product range breadth

- 4.3.2.2 Technology

- 4.3.2.3 Innovation

- 4.3.3 Geographic presence comparison

- 4.3.3.1 Global footprint analysis

- 4.3.3.2 Service network coverage

- 4.3.3.3 Market penetration by region

- 4.3.4 Competitive positioning matrix

- 4.3.4.1 Leaders

- 4.3.4.2 Challengers

- 4.3.4.3 Followers

- 4.3.4.4 Niche players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial performance comparison

- 4.4 Key developments, 2021-2024

- 4.4.1 Mergers and acquisitions

- 4.4.2 Partnerships and collaborations

- 4.4.3 Technological advancements

- 4.4.4 Expansion and investment strategies

- 4.4.5 Sustainability initiatives

- 4.4.6 Digital transformation initiatives

- 4.5 Emerging/ startup competitors landscape

Chapter 5 Market Estimates and Forecast, By Material Type, 2021 - 2034 (USD Million & Kilo Tons)

- 5.1 Key trends

- 5.2 Foil laminates

- 5.3 High-temperature resistant plastics

- 5.4 Insulated paper-based materials

- 5.5 Thermal insulating foams

- 5.6 Others

Chapter 6 Market Estimates and Forecast, By Product Type, 2021 - 2034 (USD Million & Kilo Tons)

- 6.1 Key trends

- 6.2 Heat-resistant pouches and bags

- 6.3 Insulated boxes and containers

- 6.4 Protective liners and inserts

- 6.5 Thermal mailers and envelopes

- 6.6 Others

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 (USD Million & Kilo Tons)

- 7.1 Key trends

- 7.2 Beauty & personal care

- 7.3 Food & beverages

- 7.4 Electronics & electrical

- 7.5 Healthcare & pharmaceuticals

- 7.6 Others

Chapter 8 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Million & Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Amcor plc

- 9.2 Aspect Solutions Ltd.

- 9.3 Cryopak

- 9.4 DBS Packaging

- 9.5 DS Smith

- 9.6 Insulated Products Corporation.

- 9.7 LD PACKAGING CO .,LTD

- 9.8 Nordic Cold Chain Solutions

- 9.9 Novolex

- 9.10 Perstorp

- 9.11 Puropak (Foshan) Co., Ltd.

- 9.12 Sealed Air

- 9.13 Sonoco ThermoSafe

- 9.14 Taghleef Industries

- 9.15 Thermal Packaging Solutions Ltd.

- 9.16 ZTJ Packaging Co., Ltd.