|

市场调查报告书

商品编码

1690115

电子商务塑胶包装:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)E-commerce Plastic Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

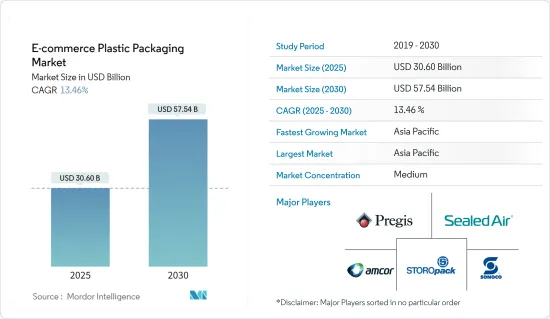

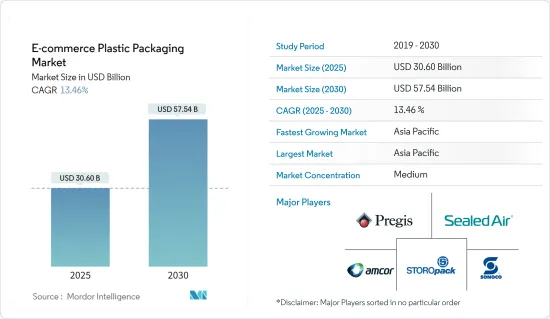

电子商务塑胶包装市场规模预计在 2025 年将达到 306 亿美元,预计到 2030 年将达到 575.4 亿美元,预测期内(2025-2030 年)的复合年增长率为 13.46%。

就出货量而言,市场预计将从 2025 年的 222 万吨增长到 2030 年的 381 万吨,预测期内(2025-2030 年)的复合年增长率为 11.42%。

包装和标籤直接影响您企业的销售和利润。电子商务包装包括由用于内容保护、产品密度控制、促销材料、产品识别以及处理和物流过程中的用户便利性的材料製成的各种包装解决方案。塑胶是电子商务包装使用的关键材料之一。

主要亮点

- 灵活的包装是电子商务的理想形式,因为它可以在整个运输过程中承受更多的接触点。此外,灵活的包装可防止溢出、抗破损并将产品保持在一起。根据《今日塑胶》报道,电子商务产品的处理量至少是传统零售的三倍。

- 灵活的包装还可以提高运输成本的效率,因为包裹的计费重量通常由其实际重量或体积重量中的较大者决定。因此,软塑胶包装等节省空间的包装形式正在降低运输价格,并且在电子商务领域越来越受欢迎。

- 此外,柔性塑胶包装通常由多层组成,难以回收。目前,许多市场先驱正致力于开发易于回收的更简单材料。塑胶包装产业参与者正在开发单一聚合物软包装层压板,以确保循环性,同时利用软塑胶包装形式的许多优势。

- 塑胶包装可能含有製造过程中使用的物质的残留物,例如溶剂,或非有意添加的物质(NIAS),例如寡聚物、杂质和分解产物。人们越来越担心,原生塑胶生产中使用的添加剂可能会使回收变得复杂或对人类和生态健康构成风险。

- 对于再生塑胶製造商来说,不确定性塑胶废弃物中是否存在这些添加剂可能会完全阻碍回收。因此,缺乏有关某些塑胶废弃物流中添加剂使用的资讯和透明度,成为促进这些产品回收和推进市场研究的重大障碍。

电子商务塑胶包装市场的趋势

消费性电子和媒体占据很大市场占有率

- 家用电子电器产品包装产品製造商越来越多地使用保护性包装物品,例如气泡膜、气枕和其他充气包装产品来保护他们的设备。未来,预计这些替代包装将满足所有电子产品类别的要求。对于小型消费品来说,泡壳包装非常有效。这种塑胶包装可以突出您的产品,易于打开,并提供防篡改证明。

- 环保电子包装越来越受欢迎。监管机构和政府机构正在大力推动使用环保包装。品牌和消费者都越来越认识到保护环境免受不可生物分解性包装废弃物污染的必要性。例如,2023 年 1 月,Flipkart 推出了一家以永续产品为特色的电子商店。透过推出该平台,Flipkart 希望带来改变,鼓励人们做出明智的购买决定,同时保持透明、以消费者为中心并具有环保意识。

- 说到高效包装,塑胶通常可以让生产商用更少的包装材料运送更多的产品。轻量化可以显着提高消费品包装的经济和环境性能。泡壳包装对于小型家电来说也是理想的选择。这种塑胶包装不仅实用且易于打开,还能突出您的电子配件并具有防篡改功能。这些属性将推动市场扩张。

- 行动电话通常采用塑胶材料包装和运输。然而,许多製造商正在转向永续包装选择。例如,在为 Apple 产品製作客製自订包装盒时,纸板是一种常见的选择。它的耐用性和抗压性使其成为保护上市后的 iPhone 的理想选择。然而,使用塑胶薄膜或包装纸的包装盒仍然是最受欢迎的包装方法。

- 爱立信预计,2028年,智慧型手机行动网路用户数量预计将超过77亿人。预计这将为市场带来显着的提振。由于对智慧型手机及其周边设备(如充电器、耳机和通用序列汇流排 (USB) 电缆)的安全包装的需求不断增加,市场正在成长。总体来看,全球家用电器中塑胶的使用量正在大幅增加,这将推动市场前景。消费性电子产品经常采用塑胶包装来保护各种电子产品免受恶劣天气等内部和外部危害。

亚太地区实现强劲成长

- 中国是全球最大的电子商务市场,占全球贸易额的50%左右。阿里巴巴旗下的淘宝天猫和京东是主导中国电子商务市场的国内平台。拼多多采用新的团购模式,击败数十家竞争对手,成为第三大平台。 《电子商务指南》显示,唯品会、蘑菇街、苏宁、国美、当当、1号店和聚美优等其他平台占据了剩余的市场占有率。

- 随着消费者对网路购物的偏好日益增长、付款方式日益多样化、一日宣传活动等网路购物活动的推广、诱人的折扣以及物流基础设施的不断完善,中国的电子商务行业正在经历快速增长。

- 印度的电子商务产业大大改变了商业运作方式。有许多类型的商业,包括企业对企业 (B2B)、消费者对消费者 (C2C)、直接面向消费者 (D2C) 和消费者对企业 (C2B)。过去几年,D2C 和 B2B 等一些关键领域都实现了显着成长。预计到 27 财年印度 D2C 市场规模将达到 600 亿美元左右。随着 D2C 公司越来越依赖塑胶包装解决方案来满足其线上客户的需求,这种成长从根本上重塑了包装格局。

- 根据印度品牌股权基金会 (IBEF) 估计,到 2030 年,全球电子商务产业的价值将达到 3,500 亿美元。预计到 2022 年,该产业的复合年增长率将达到 21.5%,到 2030 年将达到 748 亿美元。电子商务活动的激增直接导致对高效和永续塑胶包装解决方案的需求增加。

- 随着日本消费者从传统的实体店转向线上电子商务,日本的电子商务市场正在经历重大转型。日本电子商务公司正在利用该地区大量的城市人口、技术先进的消费者以及新兴经济体来扩大其在该地区电子商务市场的影响力。日本人口密集的都市区需要高效率、便利的电子商务体验。随着这些地区的人口不断转向网路购物,对可靠、环保的包装解决方案的需求日益增加,以便将商品安全送到他们家门口。

电子商务塑胶包装市场概况

电子商务塑胶包装市场正在变成半固体,Storopack Hans Reichenecker GmbH、Berry Global Inc.、Sealed Air Corporation、Pregis LLC、Sonoco Products Company 和 Amcor Group GmbH 等知名公司正在积极进入市场。这些公司透过推动设计、技术和应用的创新获得了永续的竞争优势。

- 2023 年 9 月,Sonoco Products Company 成功从合资伙伴 WestRock Corporation 手中收购 RTS Packaging LLC (RTS) 剩余股权。此次收购价值 3.3 亿美元,还包括收购 WestRock 位于田纳西州查塔努加的造纸厂。如今,Sonoco 的网路已扩展至美国、墨西哥和南美洲的 15 个地点。

- 2023 年 4 月,Amcor 宣布与全球领先的蛋白质和食品製造企业泰森食品 (Tyson Foods) 建立创新合作。合作的目的是为消费品引入永续的包装解决方案。此次合作将运用两家公司在永续性领域的专业知识,打造创新、环保的包装解决方案,为业界树立典范。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 购买者/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 产业价值链分析

第五章 市场动态

- 市场驱动因素

- 网路零售的兴起与全通路的出现

- 增加轻质软包装的使用

- 生物分解性塑胶包装在网路零售的兴起

- 市场挑战

- 缺乏良好的生产规范

- 限制使用塑料

- 电子商务中的永续包装方法

- 疫情过后对电子商务塑胶包装产业的影响

第六章 市场细分

- 依产品类型

- 袋子和包包

- 保护性包装

- 收缩膜

- 其他产品类型

- 按最终用户产业

- 家电及媒体

- 饮食

- 个人保健产品

- 服装与时尚

- 家庭护理和家具

- 其他最终用户产业

- 按地区

- 北美洲

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 西班牙

- 亚洲

- 中国

- 印度

- 日本

- 澳洲和纽西兰

- 拉丁美洲

- 巴西

- 墨西哥

- 美国

- 中东和非洲

- 北美洲

第七章 竞争格局

- 公司简介

- Amcor Group Gmbh

- Pregis LLC

- Sealed Air Corporation

- Sonoco Products Company

- Storopack Hans Reichenecker Gmbh

- Berry Global Group Inc.

- Huhtamaki OYJ

- CCL Industries Inc.

- Clondalkin Group

- Proampac LLC

第八章:亚马逊电子商务贡献

- 亚马逊对美国电商销售额贡献率(%)(金额)

- AMAZON使用的各种包装产品列表

- 包装产品供应商

- 各国永续包装倡议

- 无忧包装对亚马逊的影响和平均节省

- 塑胶包装材料回收趋势(塑胶袋、塑胶袋、塑胶包装纸的回收率)

第九章:市场的未来

The E-commerce Plastic Packaging Market size is estimated at USD 30.60 billion in 2025, and is expected to reach USD 57.54 billion by 2030, at a CAGR of 13.46% during the forecast period (2025-2030). In terms of shipment volume, the market is expected to grow from 2.22 million tons in 2025 to 3.81 million tons by 2030, at a CAGR of 11.42% during the forecast period (2025-2030).

Packaging and labeling directly impact the sales and profits of a business. E-commerce packaging consists of various packaging solutions made from materials used for content protection, product density management, promotional tools, product identification, and user convenience during handling and logistics. Plastic has been one of the critical materials used in e-commerce packaging.

Key Highlights

- Flexible packaging is an ideal format for e-commerce to withstand more touchpoints throughout the shipment process. Moreover, flexible packaging material can prevent spills, resist breakage, and hold products together. Compared to conventional retail, e-commerce products are handled at least three times, according to Plastics Today.

- Flexible packaging also drives shipping cost efficiencies as the billable weight for a package is usually determined by whichever value is the greater, actual, or dimensional weight. Therefore, more space-efficient formats like flexible plastic packaging drive lower shipping prices and are hence most prevalent in the e-commerce sector.

- Moreover, flexible plastic packaging has presented difficulties with recycling because it is generally comprised of various layers that require to be separated to become feasible. Many market players are now working to develop more simple materials that can be easily recycled. The players in the plastic packaging industry are developing mono-polymer flexible packaging laminates to ensure circularity while capitalizing on the many benefits of the flexible plastic packaging format.

- Plastic packaging can contain residues from substances used during the manufacturing process, such as solvents, along with non-intentionally added substances (NIAS), such as oligomers, impurities, or degradation products. There are increasing concerns over additives used to manufacture virgin plastics that complicate recycling or pose risks to human or ecological health.

- For manufacturers of recycled plastics, uncertainty about the presence of these additives in plastic waste can hinder recycling altogether. The lack of information and transparency regarding the use of additives in some plastic waste streams is thus a significant barrier to the increased recycling of those products and, in turn, to the market studied.

E-commerce Plastic Packaging Market Trends

Consumer Electronics and Media to Hold Significant Market Share

- Manufacturers of packaging products for consumer electronics are increasingly using protective packaging items, such as air bubble wraps, air pillows, and other inflated packaging products, to shield devices. It is anticipated that in the future, these packaging alternatives will satisfy the requirements of all electronic categories. The packaging of small consumer goods in blisters works effectively. This plastic packaging makes the items stand out and offers tamper protection while still being straightforward to open.

- Electronic product packaging that is environmentally friendly is growing in popularity. Regulators and government authorities have vigorously pushed for the use of green packaging. The necessity of protecting the environment from non-biodegradable packaging trash is being recognized by brands and consumers alike. For instance, in January 2023, Flipkart introduced an e-store for sustainable products. Flipkart hopes that the company will be able to make a difference and encourage informed buying decisions while being transparent, consumer-oriented, and eco-friendly through the implementation of this platform.

- Plastics frequently allow producers to send more products with less packaging material when it comes to efficient packaging. Light-weighting can significantly improve the packaging for consumer goods' economic and environmental performance. Blister packaging is also perfect for small consumer electronics products. While still practical and simple to open, this style of plastic packaging highlights electronic accessories and offers tamper resistance. These qualities promote market expansion.

- Cell phones are usually packed and shipped using plastic material. However, many manufacturers are shifting toward sustainable packaging options. For example, corrugated cardboard is often chosen when constructing custom boxes for Apple products. Their durability and resistance to crushing make it an ideal choice for protecting iPhones on the way to market. However, using plastic films and wraps to package boxes is still the most preferred packaging choice.

- According to Ericsson, by 2028, the number of smartphone mobile network subscriptions is expected to exceed 7.7 billion. This is expected to boost the market significantly. The market is growing due to the rising demand for safe packaging for smartphones and their peripherals, including chargers, earbuds, and universal serial bus (USB) cables. Overall, plastic use in consumer electronics is increasing significantly all around the world, which is enhancing the market outlook. Consumer electronics frequently employ plastic wrapping to shield various electronic gadgets from internal and external dangers like inclement weather.

Asia-Pacific to Register Major Growth

- China is the largest e-commerce market globally, generating approximately 50% of the world's transactions. Alibaba's Taobao Tmall and JD.com are the domestic platforms that dominate the country's e-commerce market. Pinduoduo overtook dozens of competitors to become the third-largest platform, using a new group purchasing model. Other platforms, including Vipshop, Mogujie, Suning, Gome, Dangdang, Yihaodian, and JuMei, comprise the remaining market share, according to The eCommerce Guide.

- The e-commerce sector in China is experiencing rapid growth due to the growing preferences of consumers to shop online, the increasing availability of payment methods, and the promotion of online shopping events, such as one-day offers, attractive discounts, and improved logistics infrastructure.

- The e-commerce industry in India has changed the way businesses work. It has opened different types of commerce, such as business-to-business (B2B), consumer-to-consumer (C2C), direct-to-consumer (D2C), and consumer-to-business (C2B). Some of the major segments, like D2C and B2B, have seen tremendous growth in the last few years. The Indian market for D2C is estimated to be around USD 60 billion in FY27. This growth is fundamentally reshaping the packaging landscape as D2C companies increasingly rely on plastic packaging solutions to meet the demands of their online customers.

- According to the India Brand Equity Foundation (IBEF), the global e-commerce industry is estimated to be worth USD 350 billion by 2030. It is expected to register a CAGR of 21.5 % in 2022 to reach USD 74.8 billion by 2030. This surge in e-commerce activity directly translates into an increased need for efficient and sustainable plastic packaging solutions.

- The Japanese e-commerce market is undergoing a major transformation as Japanese consumers transition from traditional physical stores to online e-commerce businesses. Japanese e-commerce companies are taking advantage of the region's high urban population, technologically advanced consumers, and developed economy further to expand their presence in the region's e-commerce market. The densely populated urban regions of Japan necessitate efficient and convenient e-commerce experiences. As the population of these areas continues to shift toward online shopping, there is an increasing demand for reliable and environmentally friendly packaging solutions to ensure the safe delivery of products to their doorstep.

E-commerce Plastic Packaging Market Overview

The e-commerce plastic packaging market is semi-consolidated, with notable players such as Storopack Hans Reichenecker GmbH, Berry Global Inc., Sealed Air Corporation, Pregis LLC, Sonoco Products Company, and Amcor Group GmbH actively participating in the market. These companies are achieving sustainable competitive advantages by fostering innovation in design, technology, and application.

- In September 2023, Sonoco Products Company successfully concluded the acquisition of the remaining portion of its equity stake in RTS Packaging LLC (RTS) from its joint venture partner, WestRock. This acquisition, totaling USD 330 million, also includes the acquisition of a WestRock paper mill located in Chattanooga, Tennessee. As a result, Sonoco has expanded its network, now encompassing 15 operations spread across the United States, Mexico, and South America.

- In April 2023, Amcor announced an innovative partnership with Tyson Foods, a global leader in protein and food production. The objective of this collaboration is to introduce more sustainable packaging solutions for consumer products. This alliance leverages the expertise of both companies in the realm of sustainability and aims to create a groundbreaking, environmentally friendly packaging solution, setting a precedent in the industry.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Proliferation of Online Retailing and Emergence of Omni-channel Presence

- 5.1.2 Rising Usage of Lightweight Flexible Packaging

- 5.1.3 Increasing Biodegradable Plastic Packaging for Online Retail

- 5.2 Market Challenges

- 5.2.1 Lack of Exposure to Good Manufacturing Practices

- 5.2.2 Regulation Pertaining to the Use of Plastic

- 5.2.3 Approach Toward Sustainable Packaging in E-commerce

- 5.3 Post-COVID-19 Impact on the E-commerce Plastic Packaging Industry

6 MARKET SEGMENTATION

- 6.1 By Product Type

- 6.1.1 Pouches and Bags

- 6.1.2 Protective Packaging

- 6.1.3 Shrink Films

- 6.1.4 Other Product Types

- 6.2 By End-user Industry

- 6.2.1 Consumer Electronics and Media

- 6.2.2 Food and Beverage

- 6.2.3 Personal Care Products

- 6.2.4 Fashion and Apparel

- 6.2.5 Home Care and Furnishing

- 6.2.6 Other End-user Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.2.4 Spain

- 6.3.3 Asia

- 6.3.3.1 China

- 6.3.3.2 India

- 6.3.3.3 Japan

- 6.3.3.4 Australia and New Zealand

- 6.3.4 Latin America

- 6.3.4.1 Brazil

- 6.3.4.2 Mexico

- 6.3.4.3 America

- 6.3.5 Middle East and Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amcor Group Gmbh

- 7.1.2 Pregis LLC

- 7.1.3 Sealed Air Corporation

- 7.1.4 Sonoco Products Company

- 7.1.5 Storopack Hans Reichenecker Gmbh

- 7.1.6 Berry Global Group Inc.

- 7.1.7 Huhtamaki OYJ

- 7.1.8 CCL Industries Inc.

- 7.1.9 Clondalkin Group

- 7.1.10 Proampac LLC

8 AMAZON E-COMMERCE CONTRIBUTION

- 8.1 Amazon Contribution (%) to E-commerce Sales In the United States (Value)

- 8.2 List of Various Packaging Products Used by Amazon

- 8.3 Suppliers of Packaging Products

- 8.4 Sustainable Packaging Initiatives across Various Countries

- 8.5 Impact of Frustration-free Packaging on Amazon and their Average Savings

- 8.6 Recycling Trends of Plastic Packaging Material (Percentage of Plastic Bags, Sacks, and Wraps Recycled)